Please help me with this example. The tables are for calulation and note down the answer

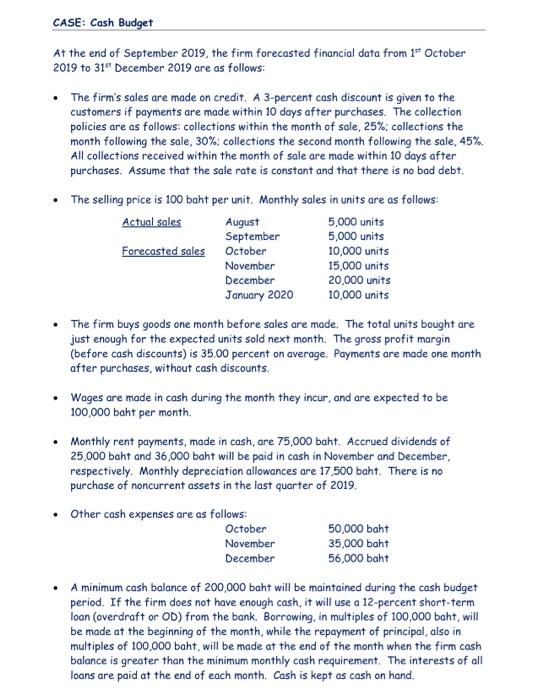

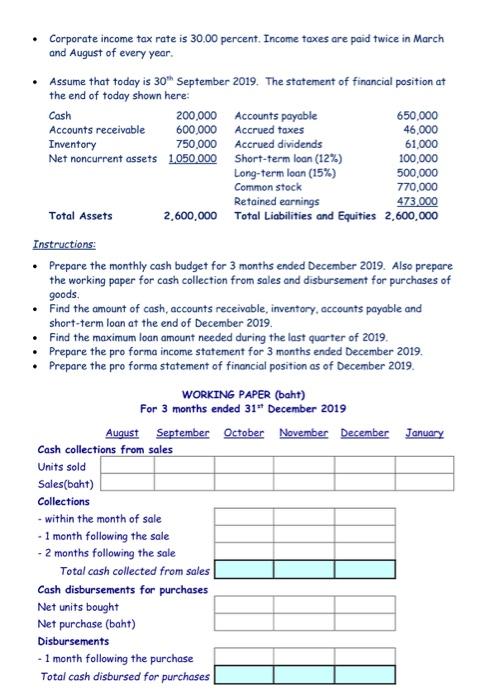

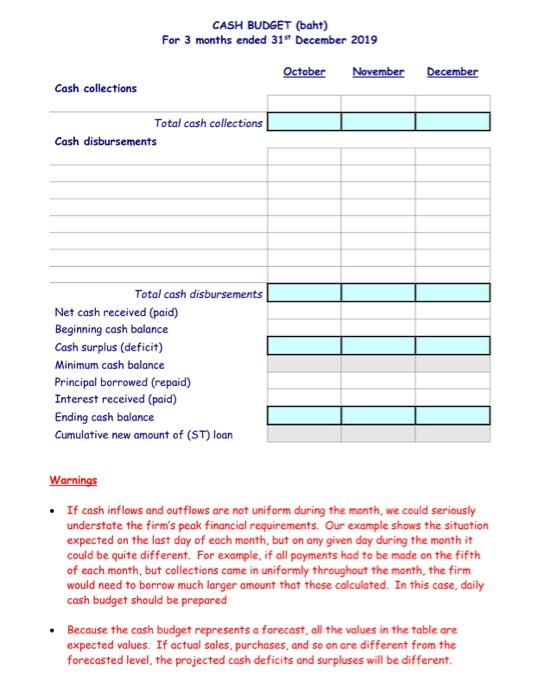

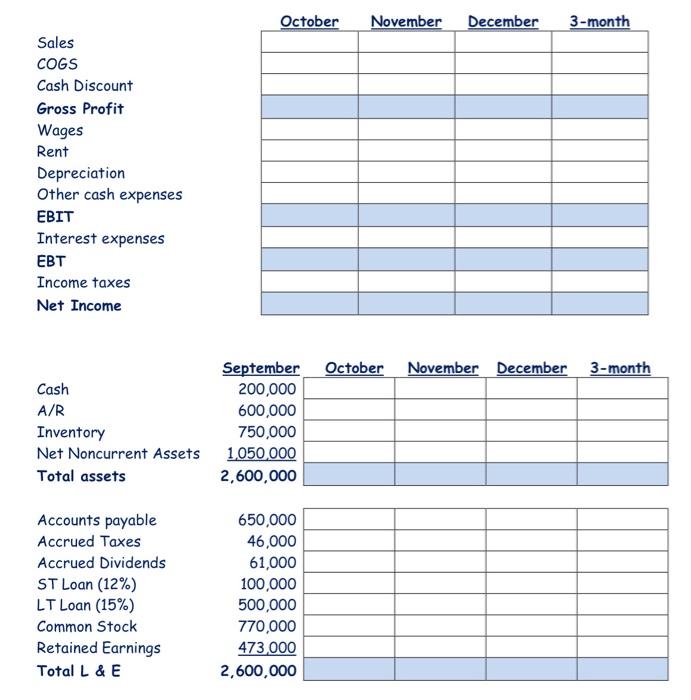

CASE: Cash Budget At the end of September 2019, the firm forecasted financial data from 19 October 2019 to 31" December 2019 are as follows: The firm's sales are made on credit. A 3-percent cash discount is given to the customers if payments are made within 10 days after purchases. The collection policies are as follows: collections within the month of sale, 25%, collections the month following the sale, 30%: collections the second month following the sale, 45%. All collections received within the month of sale are made within 10 days after purchases. Assume that the sale rate is constant and that there is no bad debt. The selling price is 100 baht per unit. Monthly sales in units are as follows: Actual sales August 5,000 units September 5,000 units Forecasted sales October 10,000 units November 15,000 units December 20,000 units January 2020 10,000 units The firm buys goods one month before sales are made. The total units bought are just enough for the expected units sold next month. The gross profit margin (before cash discounts) is 35.00 percent on average. Payments are made one month after purchases, without cash discounts. Wages are made in cash during the month they incur, and are expected to be 100,000 baht per month Monthly rent payments made in cash, are 75,000 baht. Accrued dividends of 25,000 baht and 36,000 baht will be paid in cash in November and December, respectively. Monthly depreciation allowances are 17,500 baht. There is no purchase of noncurrent assets in the last quarter of 2019. Other cash expenses are as follows: October November December 50,000 baht 35,000 baht 56,000 baht A minimum cash balance of 200,000 baht will be maintained during the cash budget period. If the firm does not have enough cash, it will use a 12-percent short-term loan (overdraft or OD) from the bank. Borrowing, in multiples of 100,000 baht, will be made at the beginning of the month, while the repayment of principal, also in multiples of 100,000 baht, will be made at the end of the month when the firm cash balance is greater than the minimum monthly cash requirement. The interests of all loans are paid at the end of each month. Cash is kept as cash on hand. Corporate income tax rate is 30.00 percent. Income taxes are paid twice in March and August of every year. Assume that today is 30 September 2019. The statement of financial position at the end of today shown here: Cash 200,000 Accounts payable 650,000 Accounts receivable 600,000 Accrued taxes 46,000 Inventory 750,000 Accrued dividends 61,000 Net noncurrent assets 1.050.000 Short-term loan (12%) 100,000 Long-term loan (15%) 500,000 Common stock 770,000 Retained earnings 473.000 Total Assets 2.600.000 Total Liabilities and Equities 2,600,000 Instructions: Prepare the monthly cash budget for 3 months ended December 2019. Also prepare the working paper for cash collection from sales and disbursement for purchases of goods Find the amount of cash, accounts receivable, inventory, accounts payable and short-term loan at the end of December 2019. Find the maximum loan amount needed during the last quarter of 2019. Prepare the pro forma income statement for 3 months ended December 2019. Prepare the pro forma statement of financial position as of December 2019. WORKING PAPER (baht) For 3 months ended 31" December 2019 August September October November December January Cash collections from sales Units sold Sales(baht) Collections - within the month of sale - 1 month following the sale - 2 months following the sale Total cash collected from sales Cash disbursements for purchases Net units bought Net purchase (baht) Disbursements - 1 month following the purchase Total cash disbursed for purchases CASH BUDGET (baht) For 3 months ended 31 December 2019 October November December Cash collections Total cash collections Cash disbursements Total cash disbursements Net cash received (paid) Beginning cash balance Cash surplus (deficit) Minimum cash balance Principal borrowed (repaid) Interest received (paid) Ending cash balance Cumulative new amount of (ST) loan Warnings If cash inflows and outflows are not uniform during the month, we could seriously understate the firm's peak financial requirements. Our example shows the situation expected on the last day of each month, but on any given day during the month it could be quite different . For example, if all payments had to be made on the fifth of each month, but collections came in uniformly throughout the month, the firm would need to borrow much larger amount that those calculated. In this case, daily cash budget should be prepared Because the cash budget represents a forecast, all the values in the table are expected values. If actual sales, purchases, and so on are different from the forecasted level, the projected cash deficits end surpluses will be different. October November December 3-month Sales COGS Cash Discount Gross Profit Wages Rent Depreciation Other cash expenses EBIT Interest expenses EBT Income taxes Net Income November December 3-month Cash A/R September October 200,000 600,000 750,000 1,050,000 2,600,000 Inventory Net Noncurrent Assets Total assets Accounts payable Accrued Taxes Accrued Dividends ST Loan (12%) LT Loan (15%) Common Stock Retained Earnings Total L & E 650,000 46,000 61,000 100,000 500,000 770,000 473,000 2,600,000 CASE: Cash Budget At the end of September 2019, the firm forecasted financial data from 19 October 2019 to 31" December 2019 are as follows: The firm's sales are made on credit. A 3-percent cash discount is given to the customers if payments are made within 10 days after purchases. The collection policies are as follows: collections within the month of sale, 25%, collections the month following the sale, 30%: collections the second month following the sale, 45%. All collections received within the month of sale are made within 10 days after purchases. Assume that the sale rate is constant and that there is no bad debt. The selling price is 100 baht per unit. Monthly sales in units are as follows: Actual sales August 5,000 units September 5,000 units Forecasted sales October 10,000 units November 15,000 units December 20,000 units January 2020 10,000 units The firm buys goods one month before sales are made. The total units bought are just enough for the expected units sold next month. The gross profit margin (before cash discounts) is 35.00 percent on average. Payments are made one month after purchases, without cash discounts. Wages are made in cash during the month they incur, and are expected to be 100,000 baht per month Monthly rent payments made in cash, are 75,000 baht. Accrued dividends of 25,000 baht and 36,000 baht will be paid in cash in November and December, respectively. Monthly depreciation allowances are 17,500 baht. There is no purchase of noncurrent assets in the last quarter of 2019. Other cash expenses are as follows: October November December 50,000 baht 35,000 baht 56,000 baht A minimum cash balance of 200,000 baht will be maintained during the cash budget period. If the firm does not have enough cash, it will use a 12-percent short-term loan (overdraft or OD) from the bank. Borrowing, in multiples of 100,000 baht, will be made at the beginning of the month, while the repayment of principal, also in multiples of 100,000 baht, will be made at the end of the month when the firm cash balance is greater than the minimum monthly cash requirement. The interests of all loans are paid at the end of each month. Cash is kept as cash on hand. Corporate income tax rate is 30.00 percent. Income taxes are paid twice in March and August of every year. Assume that today is 30 September 2019. The statement of financial position at the end of today shown here: Cash 200,000 Accounts payable 650,000 Accounts receivable 600,000 Accrued taxes 46,000 Inventory 750,000 Accrued dividends 61,000 Net noncurrent assets 1.050.000 Short-term loan (12%) 100,000 Long-term loan (15%) 500,000 Common stock 770,000 Retained earnings 473.000 Total Assets 2.600.000 Total Liabilities and Equities 2,600,000 Instructions: Prepare the monthly cash budget for 3 months ended December 2019. Also prepare the working paper for cash collection from sales and disbursement for purchases of goods Find the amount of cash, accounts receivable, inventory, accounts payable and short-term loan at the end of December 2019. Find the maximum loan amount needed during the last quarter of 2019. Prepare the pro forma income statement for 3 months ended December 2019. Prepare the pro forma statement of financial position as of December 2019. WORKING PAPER (baht) For 3 months ended 31" December 2019 August September October November December January Cash collections from sales Units sold Sales(baht) Collections - within the month of sale - 1 month following the sale - 2 months following the sale Total cash collected from sales Cash disbursements for purchases Net units bought Net purchase (baht) Disbursements - 1 month following the purchase Total cash disbursed for purchases CASH BUDGET (baht) For 3 months ended 31 December 2019 October November December Cash collections Total cash collections Cash disbursements Total cash disbursements Net cash received (paid) Beginning cash balance Cash surplus (deficit) Minimum cash balance Principal borrowed (repaid) Interest received (paid) Ending cash balance Cumulative new amount of (ST) loan Warnings If cash inflows and outflows are not uniform during the month, we could seriously understate the firm's peak financial requirements. Our example shows the situation expected on the last day of each month, but on any given day during the month it could be quite different . For example, if all payments had to be made on the fifth of each month, but collections came in uniformly throughout the month, the firm would need to borrow much larger amount that those calculated. In this case, daily cash budget should be prepared Because the cash budget represents a forecast, all the values in the table are expected values. If actual sales, purchases, and so on are different from the forecasted level, the projected cash deficits end surpluses will be different. October November December 3-month Sales COGS Cash Discount Gross Profit Wages Rent Depreciation Other cash expenses EBIT Interest expenses EBT Income taxes Net Income November December 3-month Cash A/R September October 200,000 600,000 750,000 1,050,000 2,600,000 Inventory Net Noncurrent Assets Total assets Accounts payable Accrued Taxes Accrued Dividends ST Loan (12%) LT Loan (15%) Common Stock Retained Earnings Total L & E 650,000 46,000 61,000 100,000 500,000 770,000 473,000 2,600,000