Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with this i tried really hard to do it myself but I couldnt thank you On 1 January 20X4 an entity, JASPERS,

please help me with this

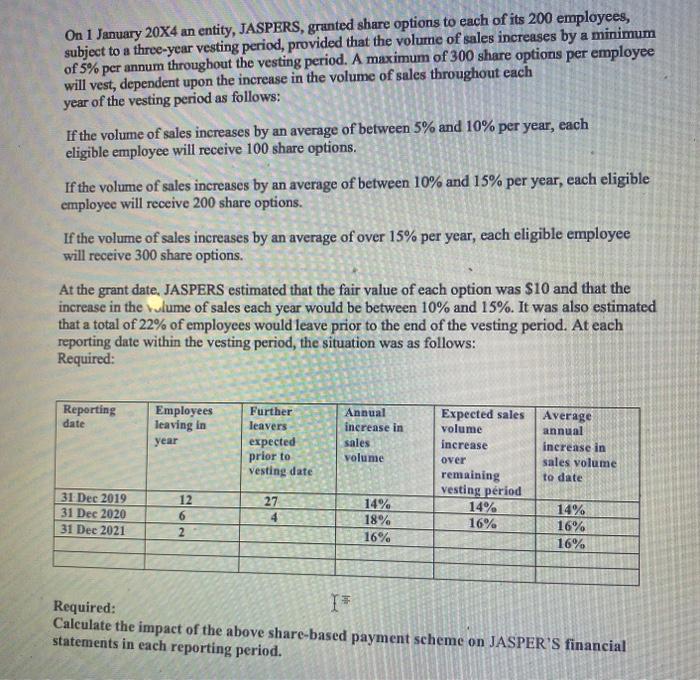

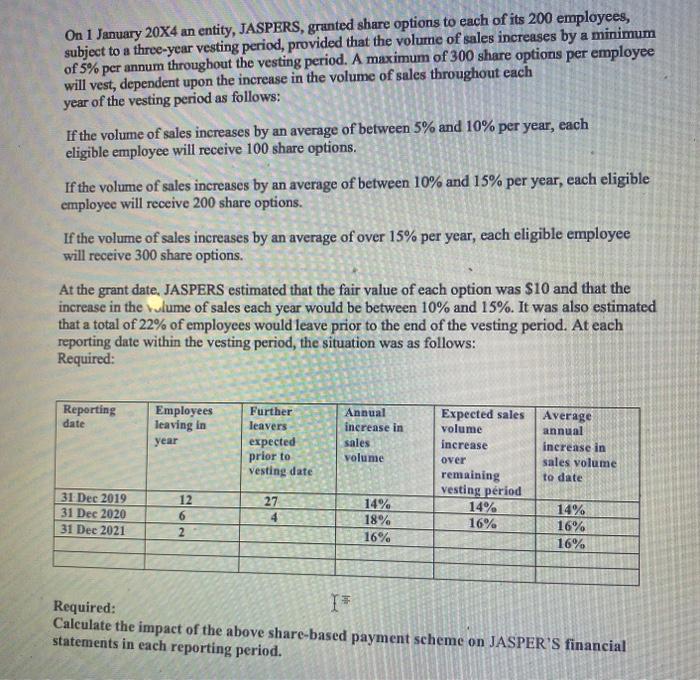

On 1 January 20X4 an entity, JASPERS, granted share options to each of its 200 employees, subject to a three-year vesting period, provided that the volume of sales increases by a minimum of 5% per annum throughout the vesting period. A maximum of 300 share options per employee will vest, dependent upon the increase in the volume of sales throughout each year of the vesting period as follows: If the volume of sales increases by an average of between 5% and 10% per year, each eligible employee will receive 100 share options. If the volume of sales increases by an average of between 10% and 15% per year, each eligible employee will receive 200 share options. If the volume of sales increases by an average of over 15% per year, each eligible employee will receive 300 share options. At the grant date. JASPERS estimated that the fair value of each option was $10 and that the increase in the tulume of sales each year would be between 10% and 15%. It was also estimated that a total of 22% of employees would leave prior to the end of the vesting period. At each reporting date within the vesting period, the situation was as follows: Required: Required: Calculate the impact of the above share-based payment scheme on JASPER'S financial statements in each reporting period i tried really hard to do it myself but I couldnt

thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started