Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with this problem, there are two parts to fill in. I will make sure to upvote. Thank you so much Seaforth International

Please help me with this problem, there are two parts to fill in. I will make sure to upvote. Thank you so much

Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31:

| Customer | Amount |

| Kim Abel | $24,500 |

| Lee Drake | 31,000 |

| Jenny Green | 29,700 |

| Mike Lamb | 17,900 |

| Total | $103,100 |

The company prepared the following aging schedule for its accounts receivable on December 31:

| Aging Class (Number of Days Past Due) | Receivables Balance on December 31 | Estimated Percent of Uncollectible Accounts |

| 030 days | $740,000 | 1% |

| 3160 days | 300,000 | 2 |

| 6190 days | 110,000 | 15 |

| 91120 days | 70,000 | 30 |

| More than 120 days | 94,000 | 60 |

| Total receivables | $1,314,000 |

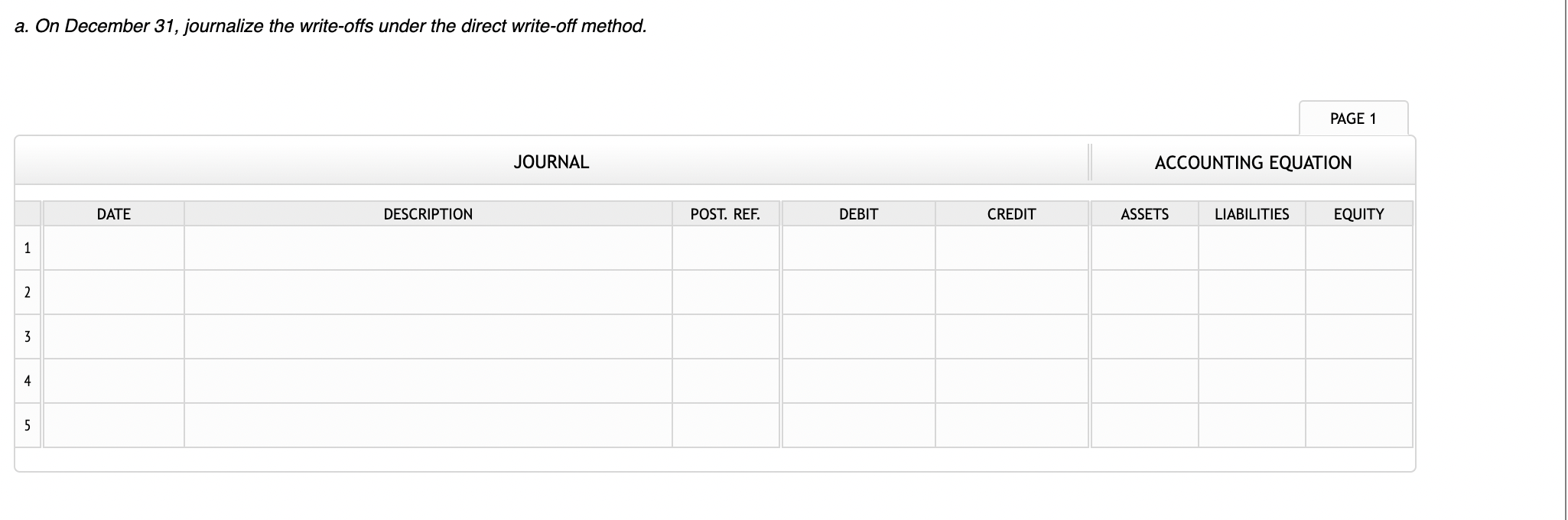

| a. Journalize the write-offs under the direct write-off method. | |

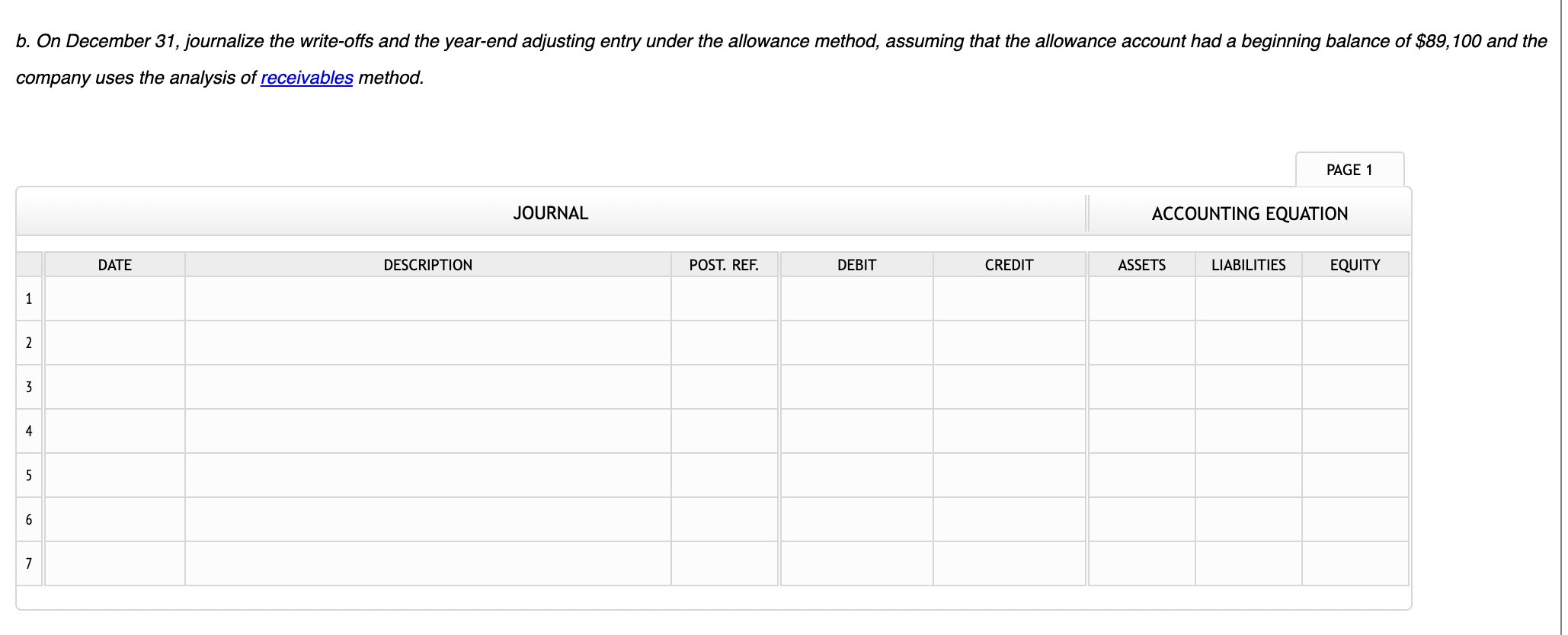

| b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $89,100 and the company uses the analysis of receivables method. | |

| c. How much higher (lower) would Seaforth Internationals net income have been under the allowance method than under the direct write-off method? |

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seaforth International | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fill in the blanks

a. On December 31, journalize the write-offs under the direct write-off method. b. On December 31, journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $89,100 and company uses the analysis of receivables method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started