please help me with this question. also put the drop down boxes so you know my options. thank you in advance

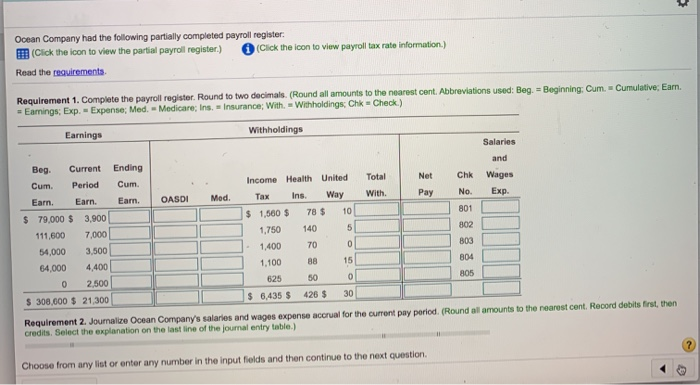

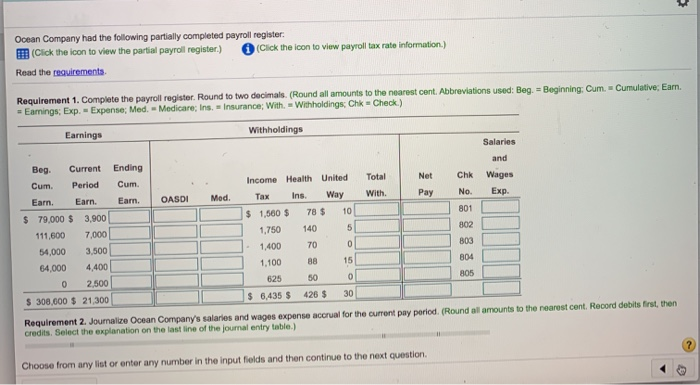

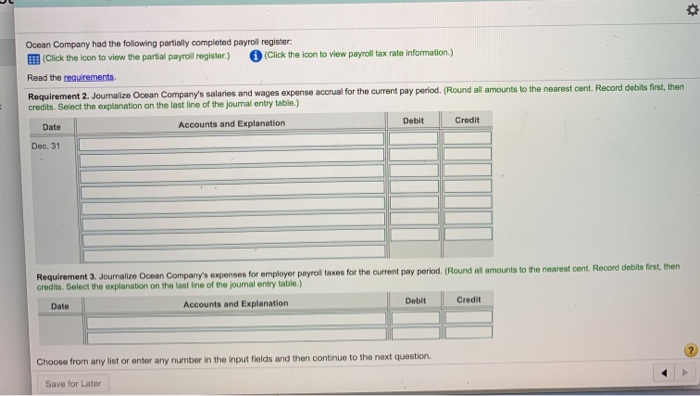

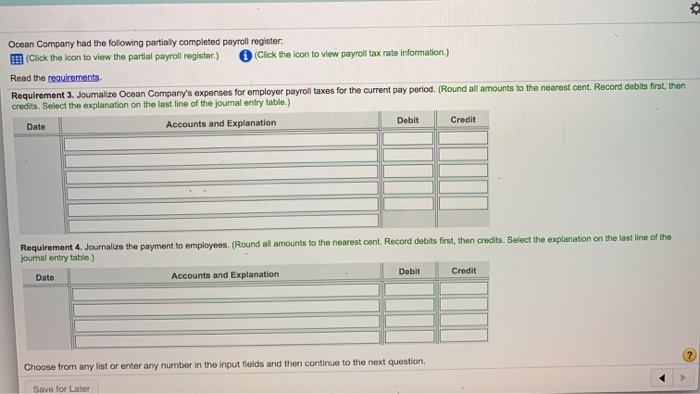

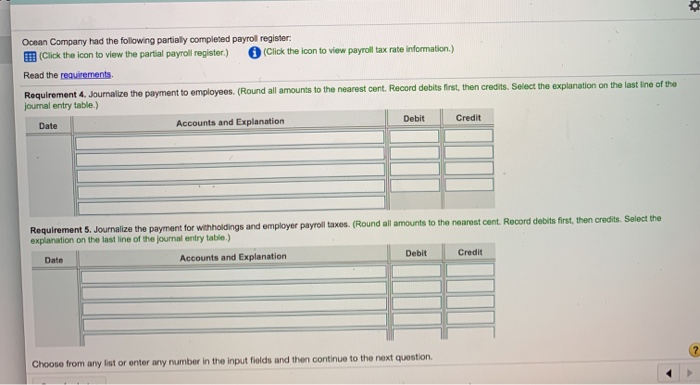

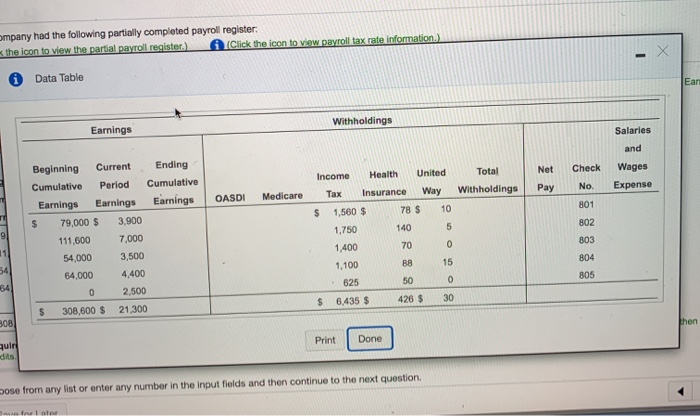

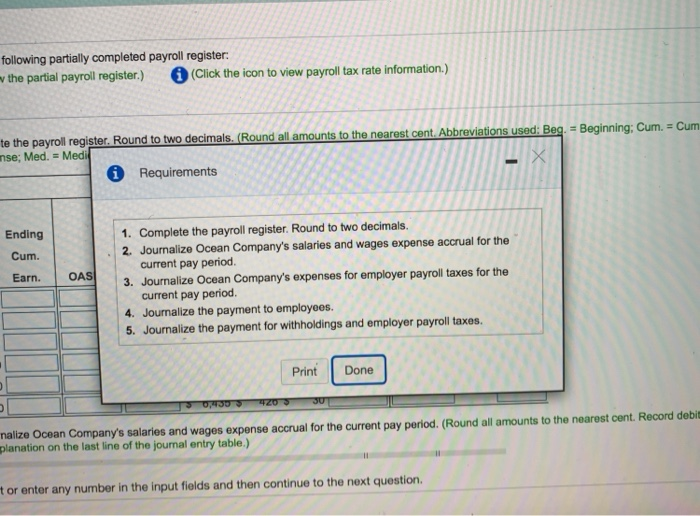

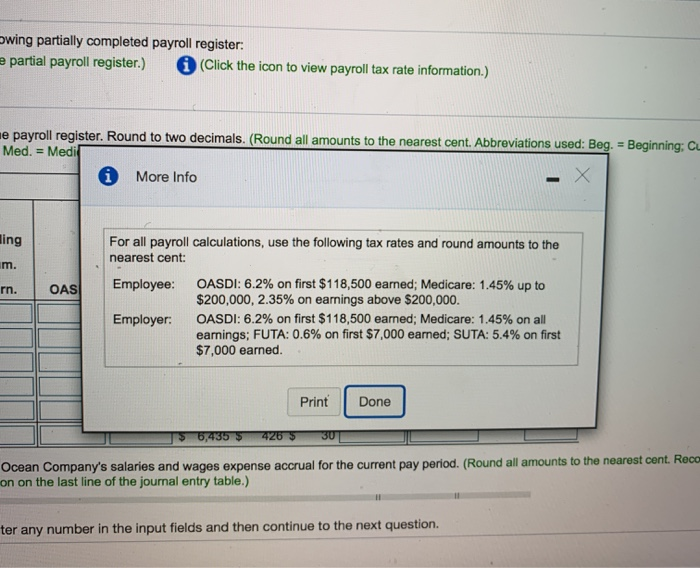

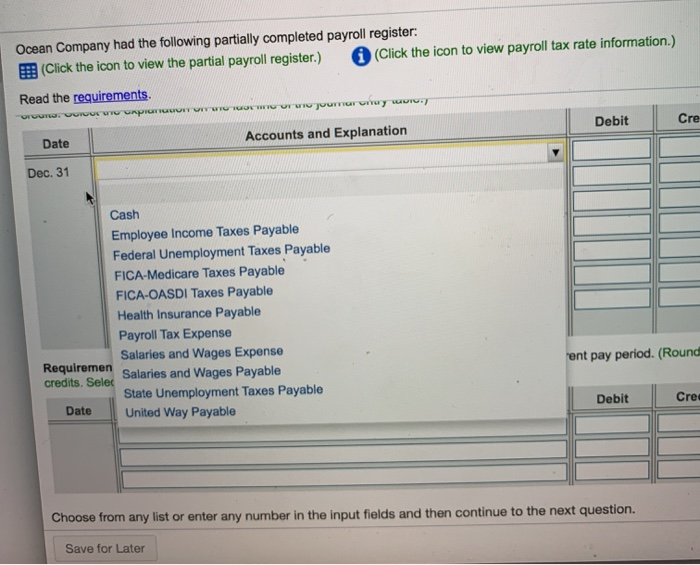

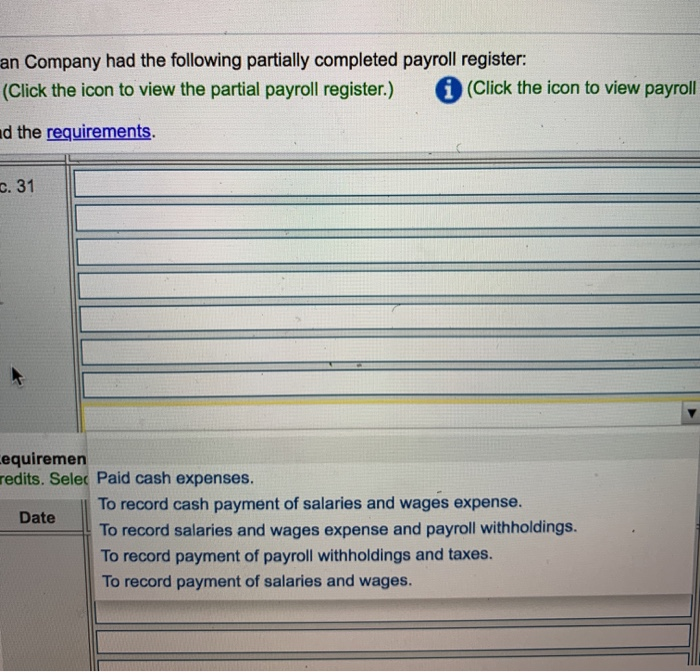

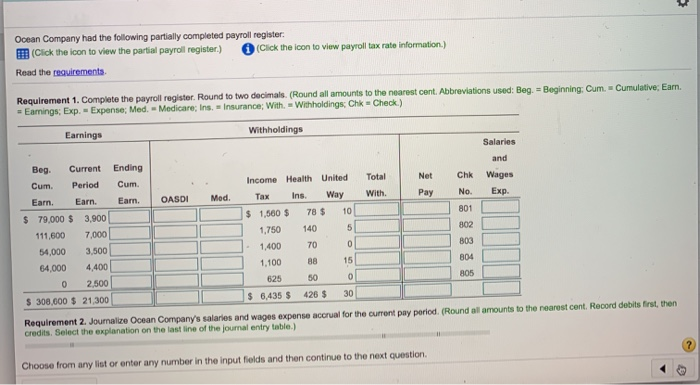

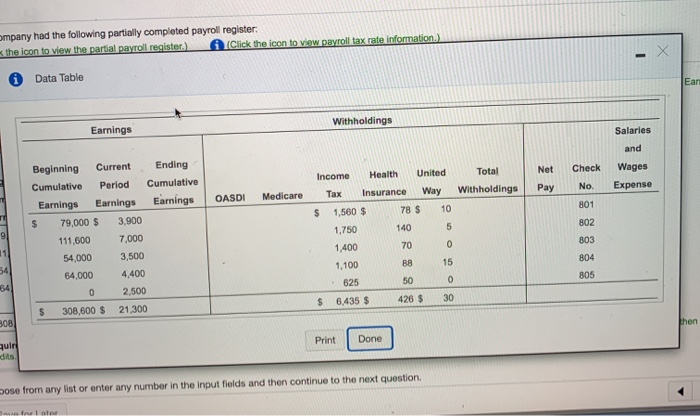

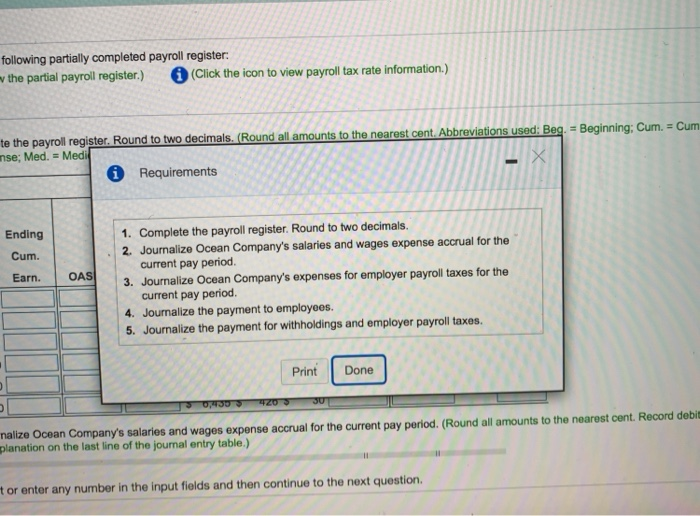

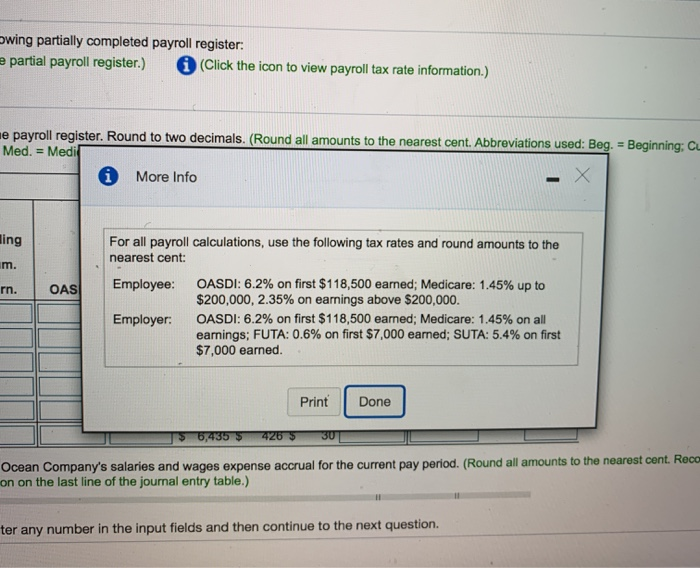

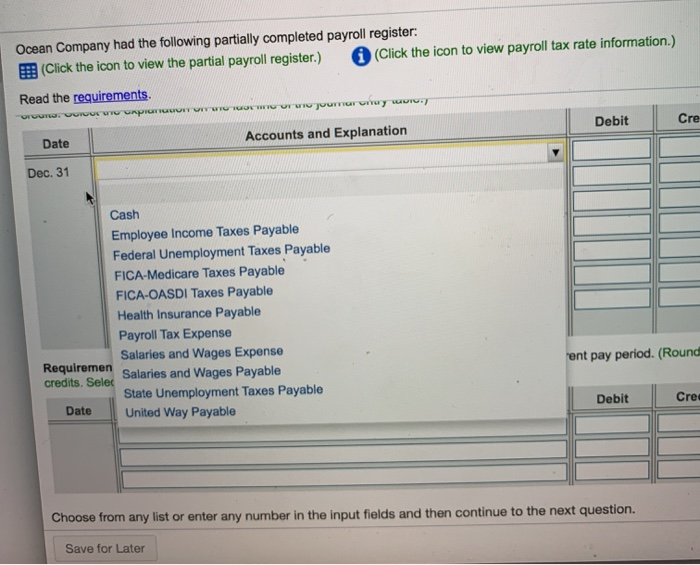

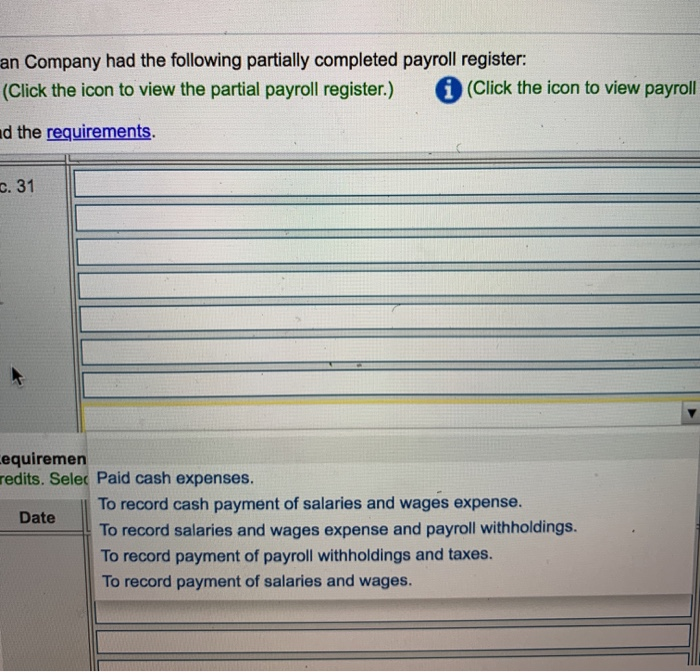

Ocean Company had the following partially completed payroll register (Click the icon to view the partial payroll register) Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Complete the payrollregister. Round to two decimals (Round all amounts to the nearest cent. Abbreviations used: Beg Earnings, Exp. - Expense, Med. - Medicare Ins. Insurance: With. Withholdings: Chk Check.) Beginning: Cum Cumulative, Eam. Earnings Withholdings Salaries Ending Cum. Eam. Total With Chk Wages No. OASDI OASE Med. Pay Exp 801 Beg. Current Cum. Period Earn Earn. $ 79.000 $ 3.900 111,600 7,000 54,000 3.500 64,000 4,400 0 2.500 $ 300,000 $ 21,300 Income Health United Tax Ins. Way 1,560 $ 78 $ 10 1,750 1405 1,400 700 1,100 88 15 625 500 l $ 6,435 $ 426 $ 30 802 803 804 805 Requirement 2. Journalize Ocean Company's salaries and wages expense accrual for the current pay period. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table) Choose from any list or enter any number in the input fields and then continue to the next question. Ocean Company had the following partially completed payroil register (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information) Read the requirements Requirement 2. Journalize Ocean Company's salaries and wages expense accrual for the current pay period. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 Requirement 3. Journalize Ocean Company's expenses for employer payroll taxes for the current pay period. (Round al amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Ocean Company had the following partially completed payroll register. (Click the loon to view the partial payroll register.) (Click the icon to view payroll tax rate information) Read the requirements Requirement 3. Journalize Ocean Company's expenses for employer payroll taxes for the current pay period. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Requirement 4. Journalize the payment to employees. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Ocean Company had the following partially completed payroll register (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements Requirement 4. Journalize the payment to employees (Round all amounts to the nearest cont. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Requirement 5. Journalize the payment for withholdings and employer payroll taxes. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table) Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question mpany had the following partially completed payroll register the icon to view the partial payroll register.) Click the icon to view payroll tax rate information) Data Table Earnings Withholdings Salaries and Wages Total Withholdings Net Pay Check No OASDI Medicare Expense 801 Beginning Current Ending Cumulative Period Cumulative Earnings Earnings Earnings $ 79,000 $ 3,900 111,600 7,000 54,000 3,500 64.000 4,400 0 2,500 $ 308,600 $ 21,300 Income Health United Tax Insurance Way $ 1,560 $ 78 $ 10 1,750 1,400 1,100 802 803 804 805 625 $ 6,435 $ 426 $ Print Done ose from any list or enter any number in the input fields and then continue to the next question following partially completed payroll register: the partial payroll register.) (Click the icon to view payroll tax rate information.) te the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. Beginning; Cum. Cum nse; Med. = Medi * Requirements Ending Cum. Earn. OAS 1. Complete the payroll register. Round to two decimals. 2. Journalize Ocean Company's salaries and wages expense accrual for the current pay period. 3. Journalize Ocean Company's expenses for employer payroll taxes for the current pay period 4. Journalize the payment to employees. 5. Journalize the payment for withholdings and employer payroll taxes. Print Done 0,430 20 30 malize Ocean Company's salaries and wages expense accrual for the current pay period. (Round all amounts to the nearest cent. Record debil lanation on the last line of the journal entry table.) or enter any number in the input fields and then continue to the next question. wing partially completed payroll register: partial payroll register.) (Click the icon to view payroll tax rate information.) ne payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning: C Med. = Medi * More Info ing im. rn. OAS For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Print Done] J$ 6,435 $ 426 5 Ocean Company's salaries and wages expense accrual for the current pay period. (Round all amounts to the nearest cont. Reco on on the last line of the journal entry table.) ter any number in the input fields and then continue to the next question. Ocean Company had the following partially completed payroll register: (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements. OUR WUWU UPOTR YOU OFW juurrurerry W . Accounts and Explanation Debit Date Dec. 31 Cash Employee Income Taxes Payable Federal Unemployment Taxes Payable FICA-Medicare Taxes Payable FICA-OASDI Taxes Payable Health Insurance Payable Payroll Tax Expense Salaries and Wages Expense Requiremen credits. Selec Salaries and Wages Payable State Unemployment Taxes Payable Date United Way Payable rent pay period. (Round Debit Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later an Company had the following partially completed payroll register: (Click the icon to view the partial payroll register.) (Click the icon to view payroll id the requirements . 31 Lequiremen redits. Selec Paid cash expenses. To record cash payment of salaries and wages expense. Date To record salaries and wages expense and payroll withholdings. To record payment of payroll withholdings and taxes. To record payment of salaries and wages