Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with this question as soon as possible please.it should have these answers i am sending you below repair expense amount. 4. Details

please help me with this question as soon as possible please.it should have these answers i am sending you below

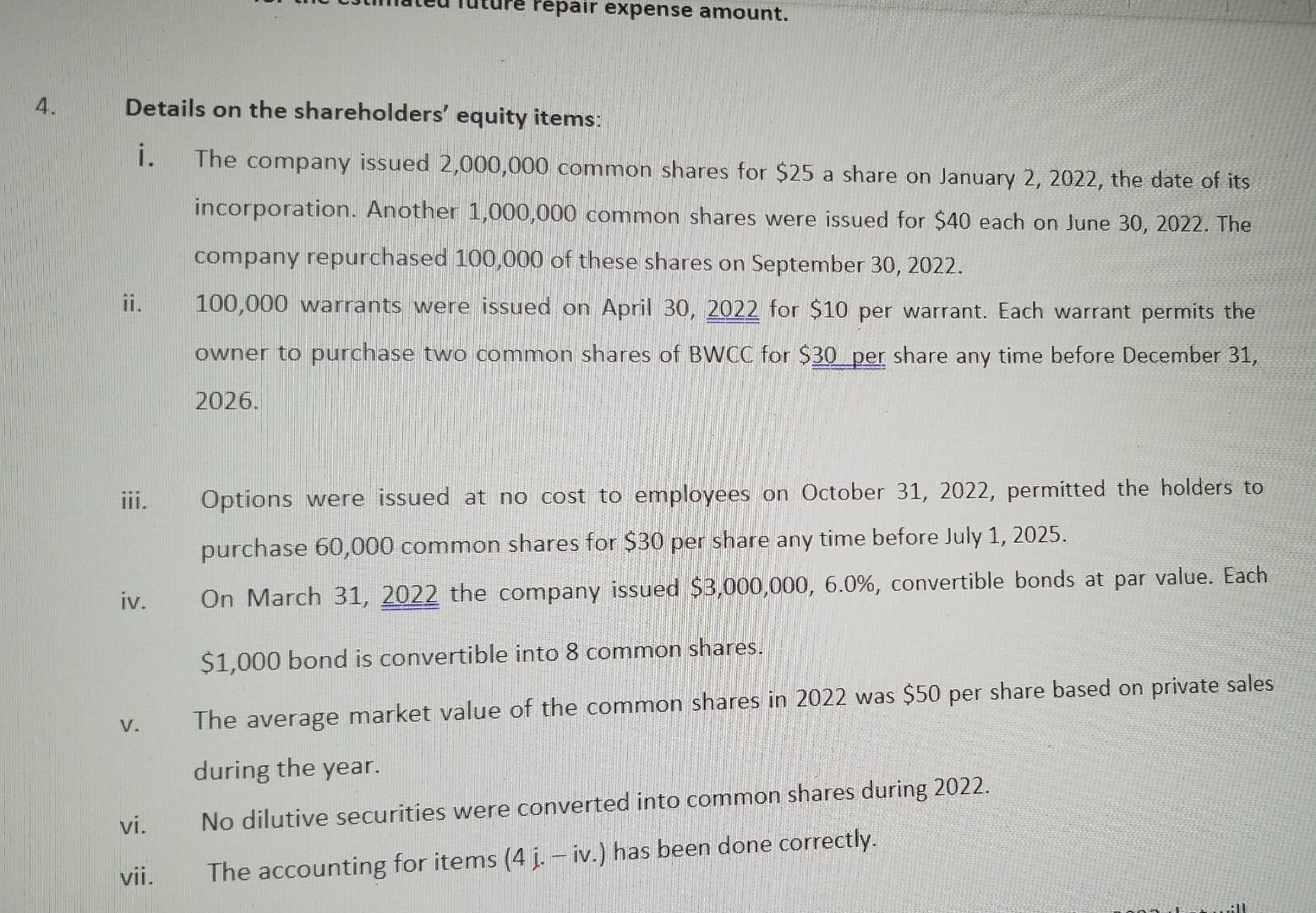

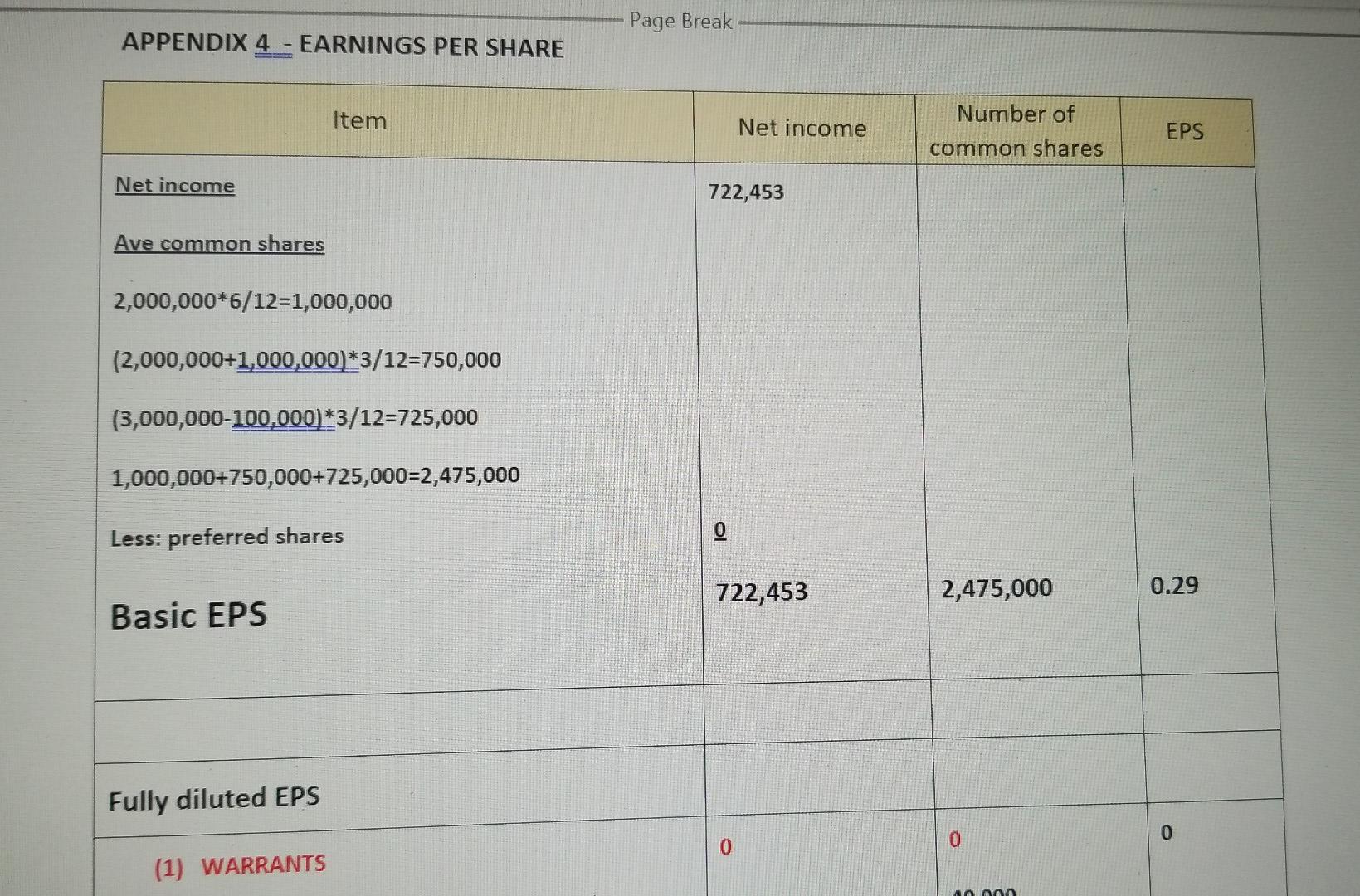

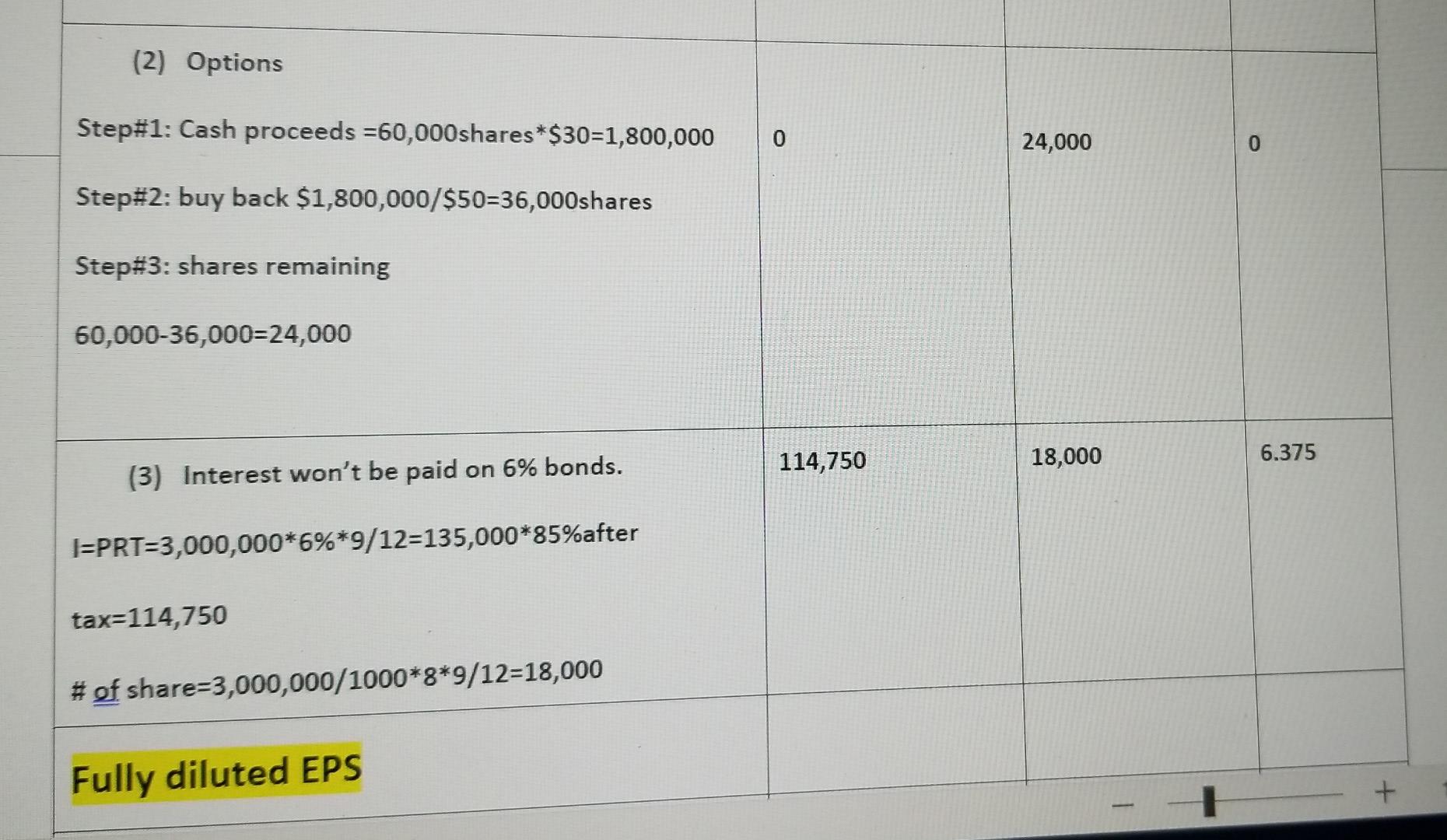

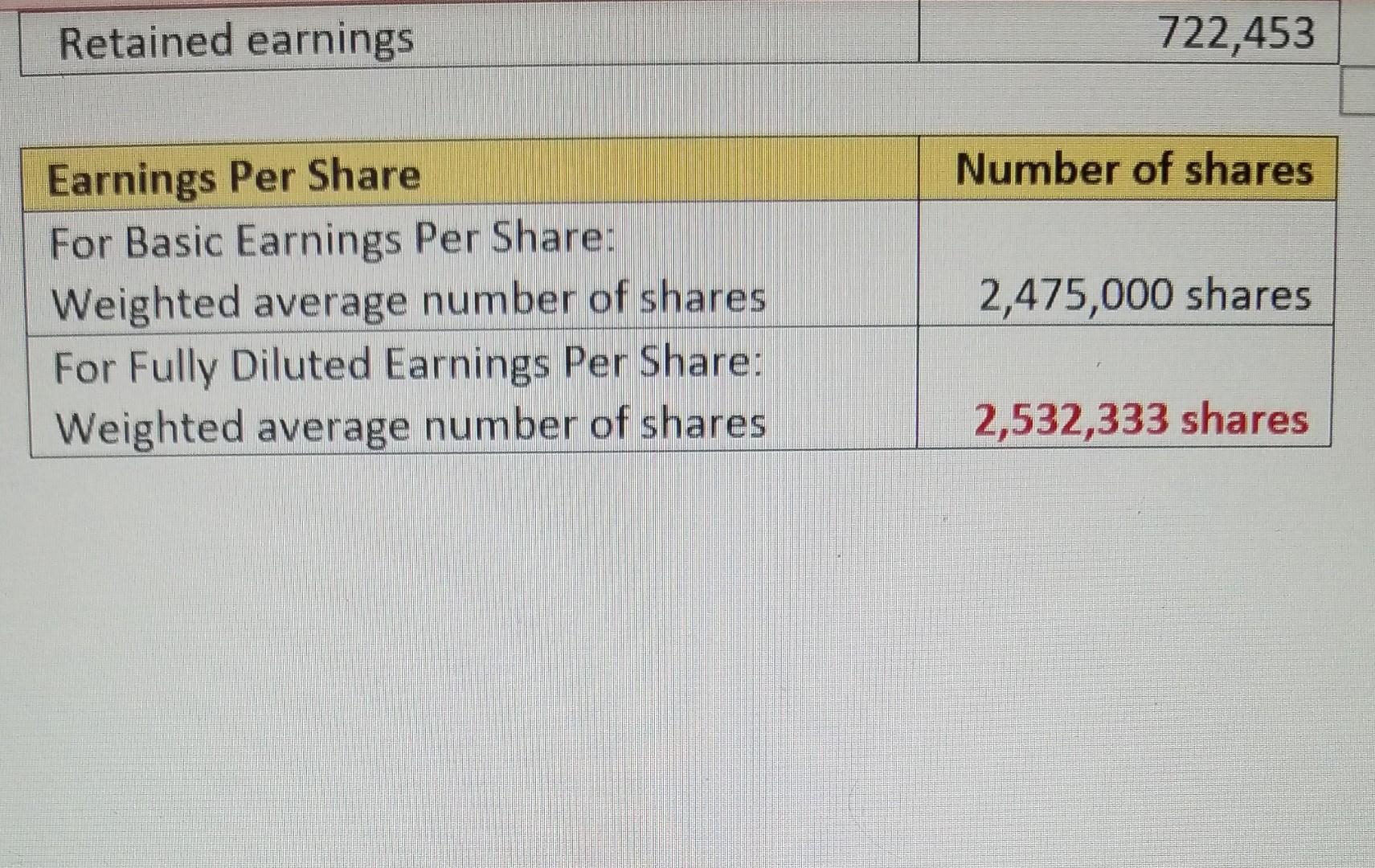

repair expense amount. 4. Details on the shareholders' equity items: i. The company issued 2,000,000 common shares for $25 a share on January 2, 2022, the date of its incorporation. Another 1,000,000 common shares were issued for $40 each on June 30, 2022. The company repurchased 100,000 of these shares on September 30, 2022. ii. 100,000 warrants were issued on April 30, 2022 for $10 per warrant. Each warrant permits the owner to purchase two common shares of BWCC for $30 per share any time before December 31, 2026. III. Options were issued at no cost to employees on October 31, 2022, permitted the holders to purchase 60,000 common shares for $30 per share any time before July 1, 2025. On March 31, 2022 the company issued $3,000,000, 6.0%, convertible bonds at par value. Each iv. $1,000 bond is convertible into 8 common shares. V. The average market value of the common shares in 2022 was $50 per share based on private sales during the year. vi. No dilutive securities were converted into common shares during 2022. vii. The accounting for items (4 1.- iv.) has been done correctly. Page Break APPENDIX 4 - EARNINGS PER SHARE Item Net income Number of common shares EPS Net income 722,453 Ave common shares 2,000,000*6/12=1,000,000 (2,000,000+1,000,000) *3/12=750,000 (3,000,000-100.000)*3/12=725,000 1,000,000+750,000+725,000=2,475,000 0 Less: preferred shares 722,453 2,475,000 0.29 Basic EPS Fully diluted EPS 0 0 0 (1) WARRANTS Ann Fully diluted EPS (1) WARRANTS 0 0 Step#1: Cash proceeds 40,000 =100,000shares *$30*2=$6,000,000 100.000 shares * $15*2=$3,000,000 Step#2: buy back =$6,000,000/$50=120,000 $3,000,000/$50=60,000 p#3: shares remaining 100,000-120,000={20,000) ??? Does not make sense 100,000-60,000=40,000 (2) Options 0 0 24,000 Step#1: Cash proceeds =60,000shares*$30=1,800,000 Step#2: buy back $1,800,000/$50=36,000shares (2) Options Step#1: Cash proceeds =60,000shares*$30=1,800,000 24,000 Step#2: buy back $1,800,000/$50=36,000shares Step#3: shares remaining 60,000-36,000=24,000 114,750 18,000 6.375 (3) Interest won't be paid on 6% bonds. I=PRT=3,000,000*6%*9/12=135,000*85%after tax=114,750 # of share=3,000,000/1000*8*9/12=18,000 Fully diluted EPS + Retained earnings 722,453 Number of shares Earnings Per Share For Basic Earnings Per Share: Weighted average number of shares For Fully Diluted Earnings Per Share: Weighted average number of shares 2,475,000 shares 2,532,333 shares repair expense amount. 4. Details on the shareholders' equity items: i. The company issued 2,000,000 common shares for $25 a share on January 2, 2022, the date of its incorporation. Another 1,000,000 common shares were issued for $40 each on June 30, 2022. The company repurchased 100,000 of these shares on September 30, 2022. ii. 100,000 warrants were issued on April 30, 2022 for $10 per warrant. Each warrant permits the owner to purchase two common shares of BWCC for $30 per share any time before December 31, 2026. III. Options were issued at no cost to employees on October 31, 2022, permitted the holders to purchase 60,000 common shares for $30 per share any time before July 1, 2025. On March 31, 2022 the company issued $3,000,000, 6.0%, convertible bonds at par value. Each iv. $1,000 bond is convertible into 8 common shares. V. The average market value of the common shares in 2022 was $50 per share based on private sales during the year. vi. No dilutive securities were converted into common shares during 2022. vii. The accounting for items (4 1.- iv.) has been done correctly. Page Break APPENDIX 4 - EARNINGS PER SHARE Item Net income Number of common shares EPS Net income 722,453 Ave common shares 2,000,000*6/12=1,000,000 (2,000,000+1,000,000) *3/12=750,000 (3,000,000-100.000)*3/12=725,000 1,000,000+750,000+725,000=2,475,000 0 Less: preferred shares 722,453 2,475,000 0.29 Basic EPS Fully diluted EPS 0 0 0 (1) WARRANTS Ann Fully diluted EPS (1) WARRANTS 0 0 Step#1: Cash proceeds 40,000 =100,000shares *$30*2=$6,000,000 100.000 shares * $15*2=$3,000,000 Step#2: buy back =$6,000,000/$50=120,000 $3,000,000/$50=60,000 p#3: shares remaining 100,000-120,000={20,000) ??? Does not make sense 100,000-60,000=40,000 (2) Options 0 0 24,000 Step#1: Cash proceeds =60,000shares*$30=1,800,000 Step#2: buy back $1,800,000/$50=36,000shares (2) Options Step#1: Cash proceeds =60,000shares*$30=1,800,000 24,000 Step#2: buy back $1,800,000/$50=36,000shares Step#3: shares remaining 60,000-36,000=24,000 114,750 18,000 6.375 (3) Interest won't be paid on 6% bonds. I=PRT=3,000,000*6%*9/12=135,000*85%after tax=114,750 # of share=3,000,000/1000*8*9/12=18,000 Fully diluted EPS + Retained earnings 722,453 Number of shares Earnings Per Share For Basic Earnings Per Share: Weighted average number of shares For Fully Diluted Earnings Per Share: Weighted average number of shares 2,475,000 shares 2,532,333 shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started