Answered step by step

Verified Expert Solution

Question

1 Approved Answer

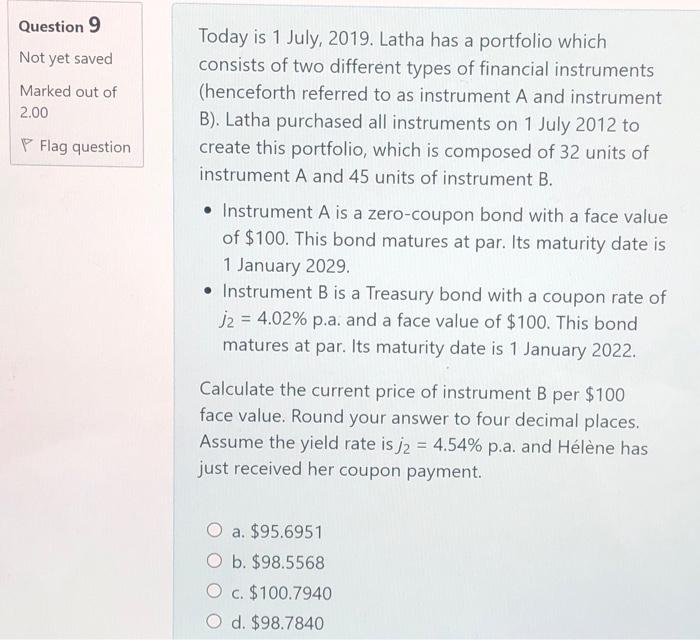

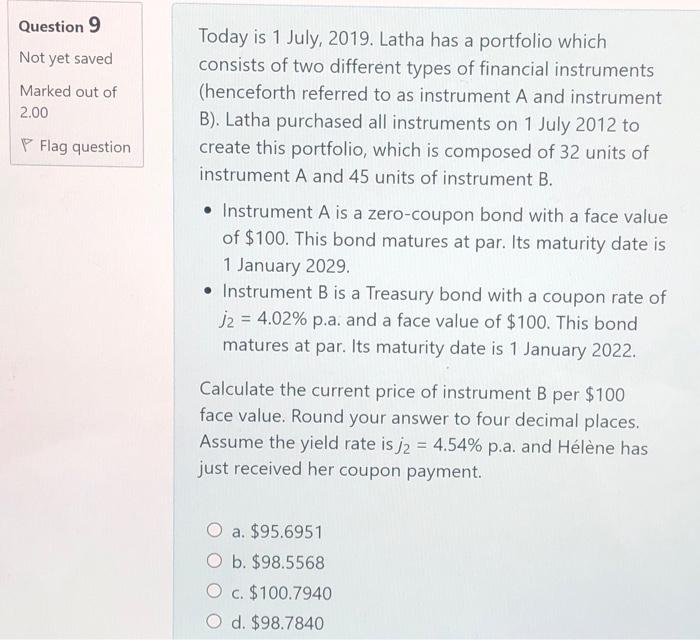

please help me with this question. Question 9 Today is 1 July, 2019. Latha has a portfolio which Not yet saved consists of two different

please help me with this question.

Question 9 Today is 1 July, 2019. Latha has a portfolio which Not yet saved consists of two different types of financial instruments Marked out of (henceforth referred to as instrument A and instrument B). Latha purchased all instruments on 1 July 2012 to create this portfolio, which is composed of 32 units of instrument A and 45 units of instrument B. - Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. - Instrument B is a Treasury bond with a coupon rate of j2=4.02% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January 2022. Calculate the current price of instrument B per $100 face value. Round your answer to four decimal places. Assume the yield rate is j2=4.54% p.a. and Hlne has just received her coupon payment. a. $95.6951 b. $98.5568 c. $100.7940 d. $98.7840

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started