Answered step by step

Verified Expert Solution

Question

1 Approved Answer

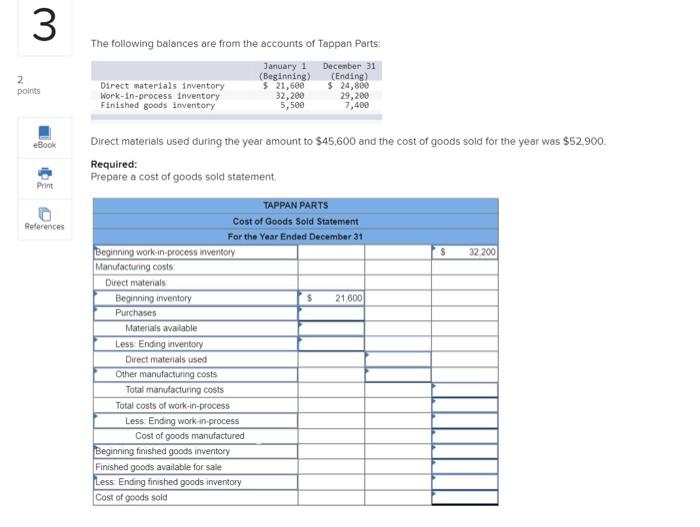

Please help me with this question. Thank you so much! 3 2 points The following balances are from the accounts of Tappan Parts: January 1

Please help me with this question. Thank you so much!

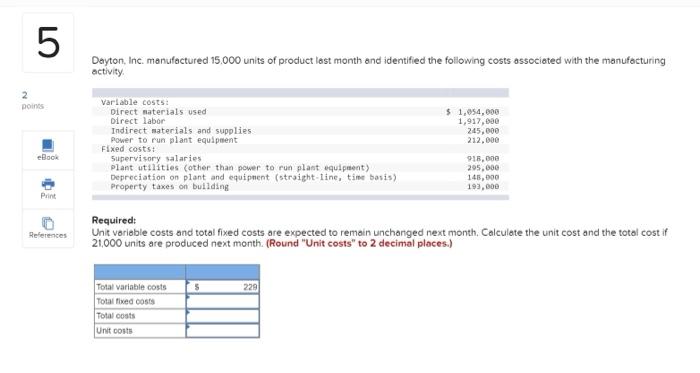

3 2 points The following balances are from the accounts of Tappan Parts: January 1 December 31 (Beginning) (Ending) Direct materials inventory 5 21,600 $ 24,880 Work-in-process Inventory 29,200 Finished goods Inventory 5,589 32,200 7,400 eBook Direct materials used during the year amount to $45,600 and the cost of goods sold for the year was $52.900. Required: Prepare a cost of goods sold statement Print References $ 32.200 TAPPAN PARTS Cost of Goods Sold Statement For the Year Ended December 31 Beginning work in process inventory Manufacturing costs Direct materials Beginning inventory 21,600 Purchases Materials available Less Ending inventory Direct materials used Other manufacturing costs Total manufacturing costs Total costs of work-in-process Less Ending work in process Cost of goods manufactured Beginning finished goods inventory Finished goods available for sale Less Ending finished goods inventory Cost of goods sold 07 5 Dayton, Inc. manufactured 15.000 units of product last month and identified the following costs associated with the manufacturing activity 2 points Variable costs: Direct materials used Direct labor Indirect materials and supplies Power to run plant equipment Fixed costs: Supervisory salaries Plant utilities other than power to run plant equipment) Depreciation on plant and equipment (straight-line, time basis) Property taxes on building $ 1,054,000 1,917,000 245,000 212,000 915.000 295,000 145,000 193,000 eBook Print References Required: Unit variable costs and total fixed costs are expected to remain unchanged next month. Calculate the unit cost and the total cost if 21,000 units are produced next month. (Round "Unit costs" to 2 decimal places.) 229 Total variable costs Totalfixed costs Total costs Unit costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started