Answered step by step

Verified Expert Solution

Question

1 Approved Answer

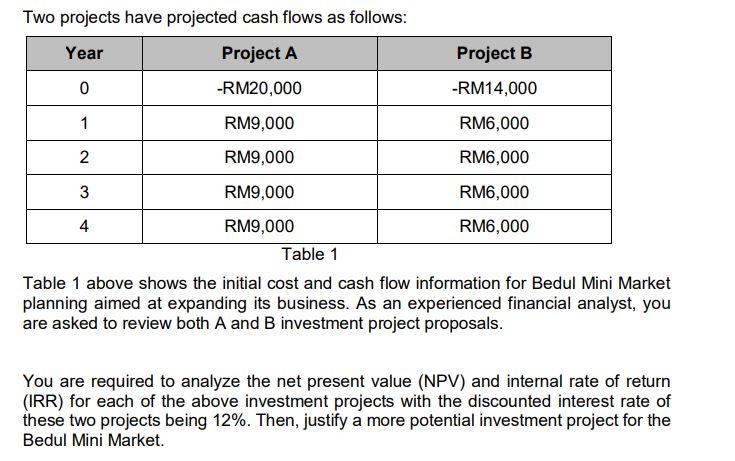

Please help me ya. Pleaseee........ N Two projects have projected cash flows as follows: Year Project A Project B 0 -RM20,000 -RM14,000 1 RM9,000 RM6,000

Please help me ya. Pleaseee........

N Two projects have projected cash flows as follows: Year Project A Project B 0 -RM20,000 -RM14,000 1 RM9,000 RM6,000 RM9,000 RM6,000 3 RM9,000 RM6,000 4 RM9,000 RM6,000 Table 1 Table 1 above shows the initial cost and cash flow information for Bedul Mini Market planning aimed at expanding its business. As an experienced financial analyst, you are asked to review both A and B investment project proposals. You are required to analyze the net present value (NPV) and internal rate of return (IRR) for each of the above investment projects with the discounted interest rate of these two projects being 12%. Then, justify a more potential investment project for the Bedul Mini Market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started