Answered step by step

Verified Expert Solution

Question

1 Approved Answer

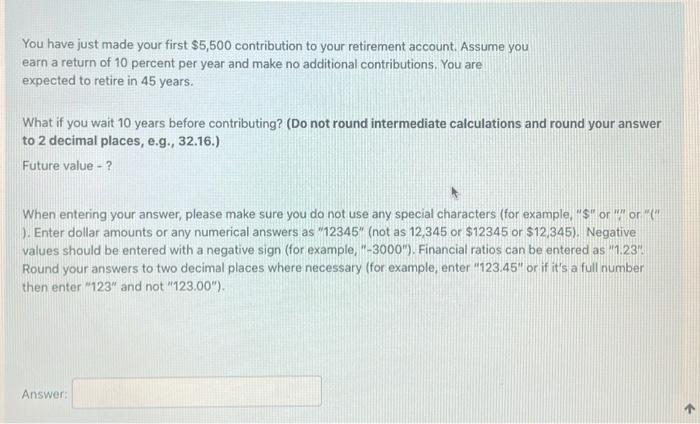

please help me You have just made your first $5,500 contribution to your retirement account. Assume you earn a return of 10 percent per year

please help me

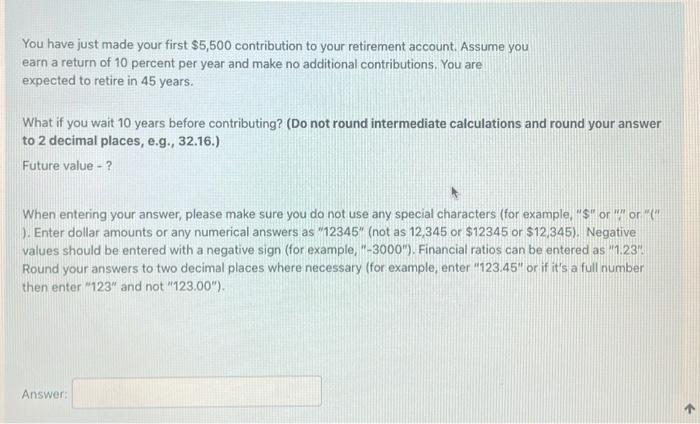

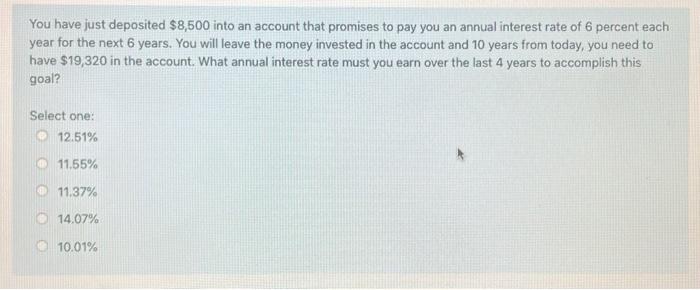

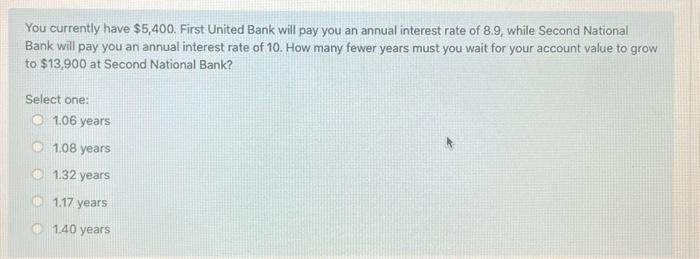

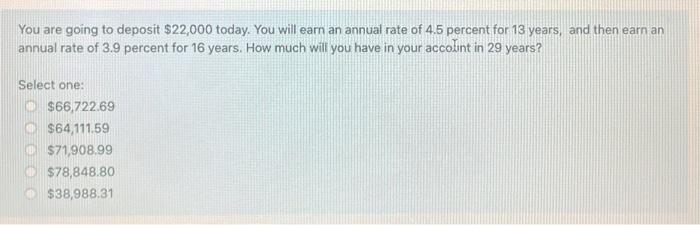

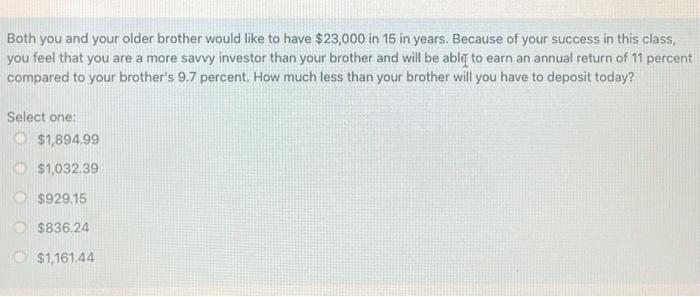

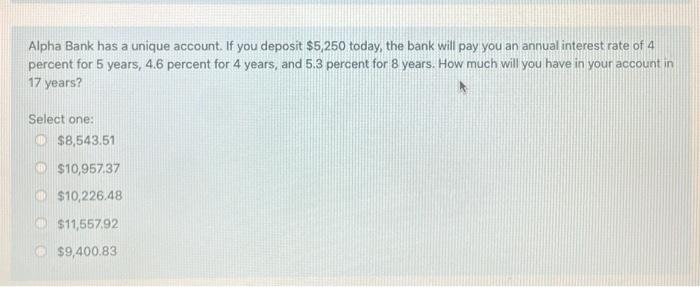

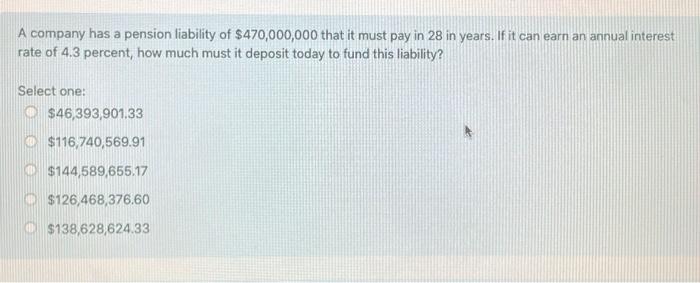

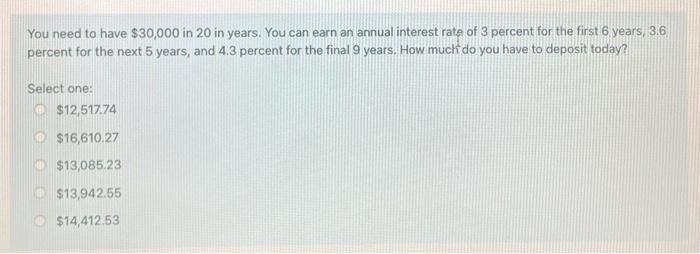

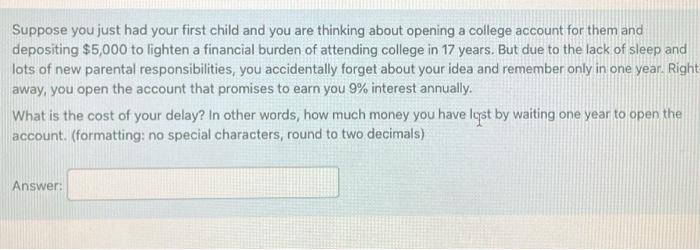

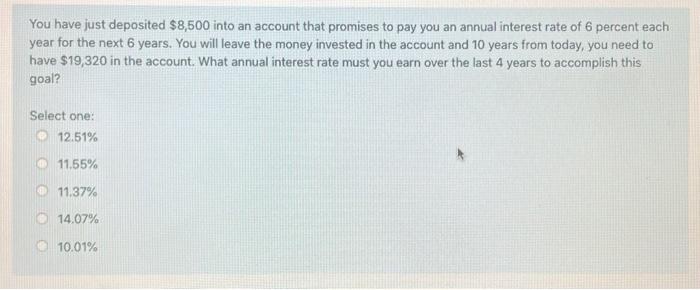

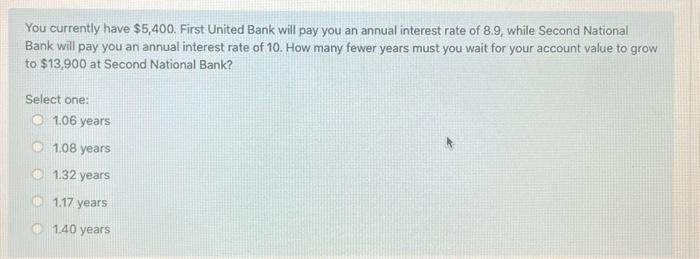

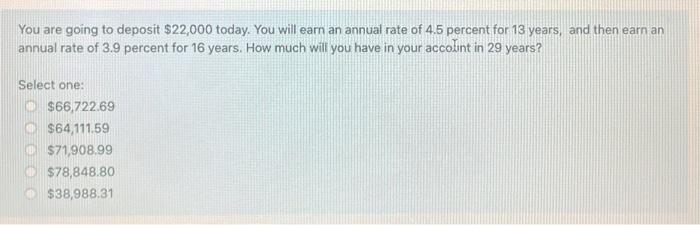

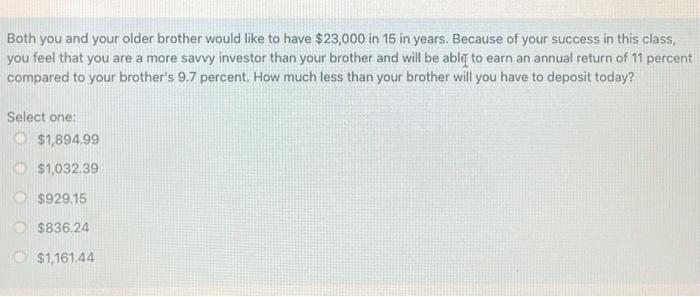

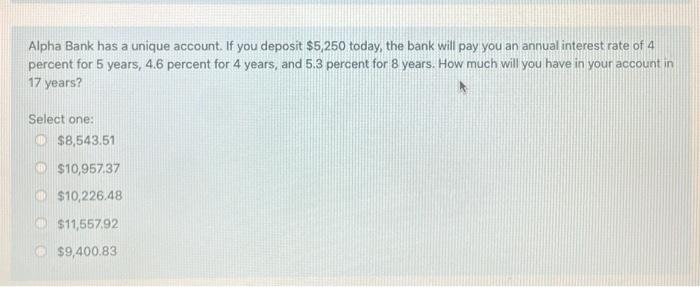

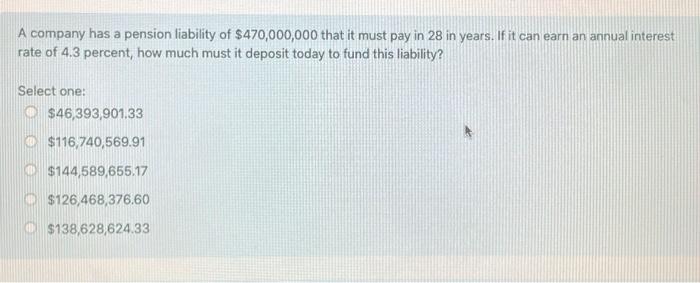

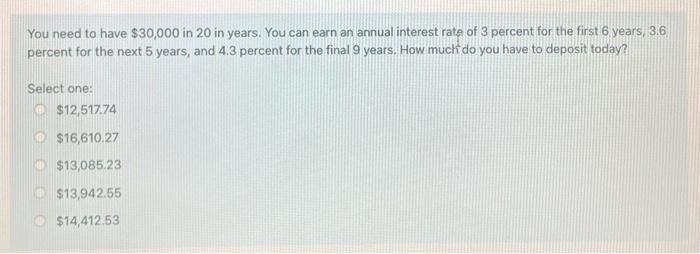

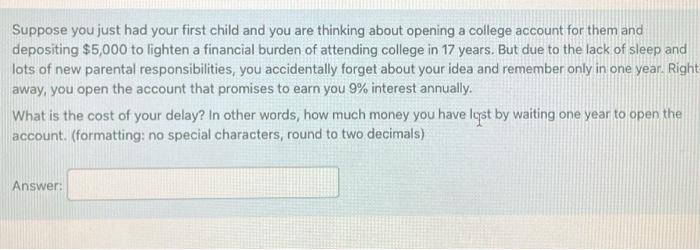

You have just made your first $5,500 contribution to your retirement account. Assume you earn a return of 10 percent per year and make no additional contributions. You are expected to retire in 45 years. What if you wait 10 years before contributing? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Future value - ? When entering your answer, please make sure you do not use any special characters (for example, "S" or mor" ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, -3000"). Financial ratios can be entered as "1.23 Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter 123" and not "123.00") Answer: You have just deposited $8,500 into an account that promises to pay you an annual interest rate of 6 percent each year for the next 6 years. You will leave the money invested in the account and 10 years from today, you need to have $19,320 in the account. What annual interest rate must you earn over the last 4 years to accomplish this goal? Select one: 12.51% @ 11.55% 11.37% le 14.07% 10.01% You currently have $5,400. First United Bank will pay you an annual interest rate of 8.9, while Second National Bank will pay you an annual interest rate of 10. How many fewer years must you wait for your account value to grow to $13,900 at Second National Bank? Select one: 1.06 years 1.08 years 1.32 years 1.17 years 1.40 years You are going to deposit $22,000 today. You will earn an annual rate of 4.5 percent for 13 years, and then earn an annual rate of 3.9 percent for 16 years. How much will you have in your accolint in 29 years? Select one: $66,722.69 @ $64, 111,59 $71,908.99 $78,848.80 $38,988.31 Both you and your older brother would like to have $23,000 in 15 in years. Because of your success in this class, you feel that you are a more savvy investor than your brother and will be able to earn an annual return of 11 percent compared to your brother's 9.7 percent. How much less than your brother will you have to deposit today? m Select one: $1,894.99 $1,032.39 $929.15 0 $836.24 $1,161.44 Alpha Bank has a unique account. If you deposit $5,250 today, the bank will pay you an annual interest rate of 4 percent for 5 years, 4.6 percent for 4 years, and 5.3 percent for 8 years. How much will you have in your account in 17 years? Select one: 0 $8,543.51 $10,957.37 $10,226.48 S11,557,92 $9,400.83 A company has a pension liability of $470,000,000 that it must pay in 28 in years. If it can earn an annual interest rate of 4.3 percent, how much must it deposit today to fund this liability? Select one: @ $46,393,901.33 $116,740,569.91 $144,589,655.17 $126,468,376.60 $138,628,624.33 You need to have $30,000 in 20 in years. You can earn an annual interest rate of 3 percent for the first 6 years 3.6 percent for the next 5 years, and 4.3 percent for the final 9 years. How much do you have to deposit today? Select one: $12,517.74 $16,610.27 $13,085.23 $13,942.55 $14,412.53 Suppose you just had your first child and you are thinking about opening a college account for them and depositing $5,000 to lighten a financial burden of attending college in 17 years. But due to the lack of sleep and lots of new parental responsibilities, you accidentally forget about your idea and remember only in one year. Right away, you open the account that promises to earn you 9% interest annually. What is the cost of your delay? In other words, how much money you have lost by waiting one year to open the account. (formatting: no special characters, round to two decimals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started