Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! On January 1, 20X4, Parent Company purchased 90% of the common stock of arent Company purchased 90% of the common stock of Subsidiary

please help!

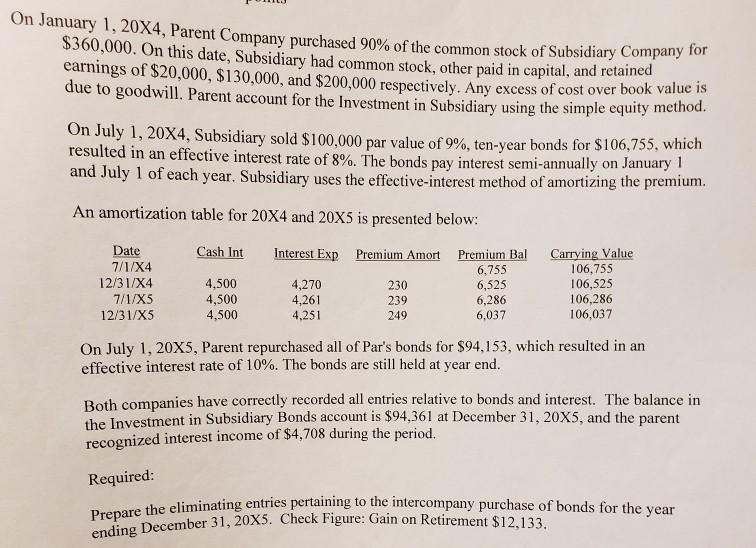

On January 1, 20X4, Parent Company purchased 90% of the common stock of arent Company purchased 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had common stock, other paid in capital, and earnings of $20,000, $130,000, and $200,000 respectively. Any excess of cost over Dog due to goodwill. Parent account for the Investment in Subsidiary using the simple equity met On July 1, 20X4, Subsidiary sold $100.000 par value of 9% ten-year bonds for $106,75), which resulted in an effective interest rate of 8%. The bonds pay interest semi-annually on January and July 1 of each year. Subsidiary uses the effective interest method of amortizing the premium. An amortization table for 20X4 and 20X5 is presented below: Date Cash Int Interest Exp Premium Amort 7/1/X4 12/31/X4 7/1/X5 12/31/15 4,500 4,500 4,500 4,270 4,261 4,251 230 239 Premium Bal 6,755 6,525 6,286 6,037 Carrying Value 106,755 106,525 106,286 106,037 249 On July 1, 20X5, Parent repurchased all of Par's bonds for $94,153, which resulted in an effective interest rate of 10%. The bonds are still held at year end. Both companies have correctly recorded all entries relative to bonds and interest. The balance in Investment in Subsidiary Bonds account is $94,361 at December 31, 20X5, and the parent recognized interest income of $4,708 during the period. Required: Prepare the eliminating entries per ending December 31, 20X5. Check Fie liminating entries pertaining to the intercompany purchase of bonds for the year ember 31, 20X5. Check Figure: Gain on Retirement $12,133Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started