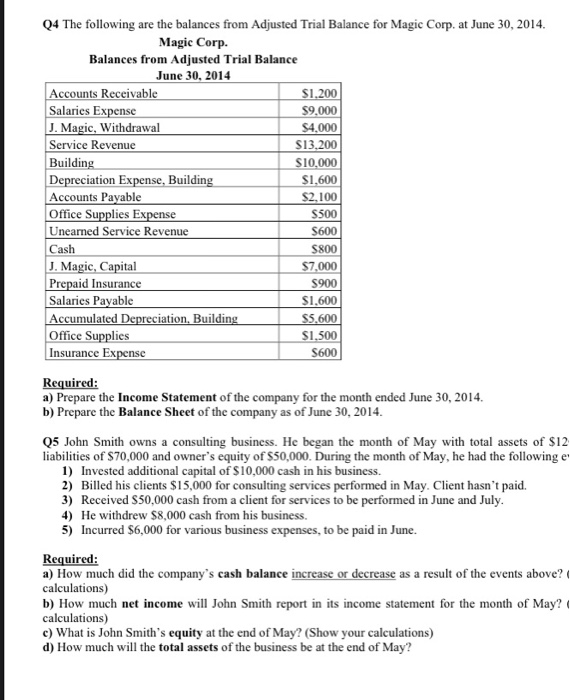

Q4 The following are the balances from Adjusted Trial Balance for Magic Corp. at June 30, 2014 Magic Corp. Balances from Adjusted Trial Balance June 30, 2014 Accounts Receivable $1,200 Salaries Expense $9.000 J. Magic, Withdrawal $4,000 Service Revenue $13,200 Building S10.000 Depreciation Expense, Building $1,600 Accounts Payable $2,100 Office Supplies Expense $500 Unearned Service Revenue $600 Cash 5800 J. Magic, Capital $7,000 Prepaid Insurance 900 Salaries Payable $1,600 Accumulated Depreciation, Building 55.600 Office Supplies $1,500 Insurance Expense S600 Required: a) Prepare the Income Statement of the company for the month ended June 30, 2014. b) Prepare the Balance Sheet of the company as of June 30, 2014. Q5 John Smith owns a consulting business. He began the month of May with total assets of $12 liabilities of $70,000 and owner's equity of $50,000. During the month of May, he had the following e 1) Invested additional capital of $10,000 cash in his business. 2) Billed his clients $15,000 for consulting services performed in May. Client hasn't paid. 3) Received $50,000 cash from a client for services to be performed in June and July. 4) He withdrew $8,000 cash from his business 5) Incurred $6,000 for various business expenses, to be paid in June. Required: a) How much did the company's cash balance increase or decrease as a result of the events above? calculations) b) How much net income will John Smith report in its income statement for the month of May? calculations) c) What is John Smith's equity at the end of May? (Show your calculations) d) How much will the total assets of the business be at the end of May? Q4 The following are the balances from Adjusted Trial Balance for Magic Corp. at June 30, 2014 Magic Corp. Balances from Adjusted Trial Balance June 30, 2014 Accounts Receivable $1,200 Salaries Expense $9.000 J. Magic, Withdrawal $4,000 Service Revenue $13,200 Building S10.000 Depreciation Expense, Building $1,600 Accounts Payable $2,100 Office Supplies Expense $500 Unearned Service Revenue $600 Cash 5800 J. Magic, Capital $7,000 Prepaid Insurance 900 Salaries Payable $1,600 Accumulated Depreciation, Building 55.600 Office Supplies $1,500 Insurance Expense S600 Required: a) Prepare the Income Statement of the company for the month ended June 30, 2014. b) Prepare the Balance Sheet of the company as of June 30, 2014. Q5 John Smith owns a consulting business. He began the month of May with total assets of $12 liabilities of $70,000 and owner's equity of $50,000. During the month of May, he had the following e 1) Invested additional capital of $10,000 cash in his business. 2) Billed his clients $15,000 for consulting services performed in May. Client hasn't paid. 3) Received $50,000 cash from a client for services to be performed in June and July. 4) He withdrew $8,000 cash from his business 5) Incurred $6,000 for various business expenses, to be paid in June. Required: a) How much did the company's cash balance increase or decrease as a result of the events above? calculations) b) How much net income will John Smith report in its income statement for the month of May? calculations) c) What is John Smith's equity at the end of May? (Show your calculations) d) How much will the total assets of the business be at the end of May