Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help on this with detailed explaination 2. (40) Consider modifying the Glosten-Milgrom (1985) model to allow for informed traders to mistakenly inter- pret their

please help on this with detailed explaination

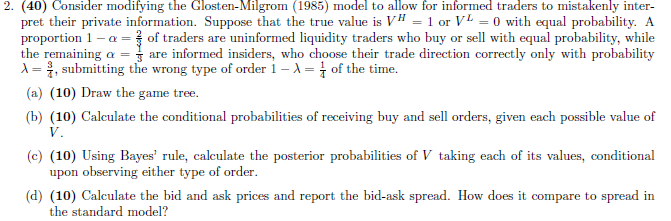

2. (40) Consider modifying the Glosten-Milgrom (1985) model to allow for informed traders to mistakenly inter- pret their private information. Suppose that the true value is VH = 1 or VI = 0 with equal probability. A proportion 1 -a = of traders are uninformed liquidity traders who buy or sell with equal probability, while the remaining a = are informed insiders, who choose their trade direction correctly only with probability X = X, submitting the wrong type of order 1 - 1 = 1 of the time. (a) (10) Draw the game tree. (b) (10) Calculate the conditional probabilities of receiving buy and sell orders, given each possible value of V. (C) (10) Using Bayes' rule, calculate the posterior probabilities of V taking each of its values, conditional upon observing either type of order. (d) (10) Calculate the bid and ask prices and report the bid-ask spread. How does it compare to spread in the standard model? 2. (40) Consider modifying the Glosten-Milgrom (1985) model to allow for informed traders to mistakenly inter- pret their private information. Suppose that the true value is VH = 1 or VI = 0 with equal probability. A proportion 1 -a = of traders are uninformed liquidity traders who buy or sell with equal probability, while the remaining a = are informed insiders, who choose their trade direction correctly only with probability X = X, submitting the wrong type of order 1 - 1 = 1 of the time. (a) (10) Draw the game tree. (b) (10) Calculate the conditional probabilities of receiving buy and sell orders, given each possible value of V. (C) (10) Using Bayes' rule, calculate the posterior probabilities of V taking each of its values, conditional upon observing either type of order. (d) (10) Calculate the bid and ask prices and report the bid-ask spread. How does it compare to spread in the standard modelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started