please help

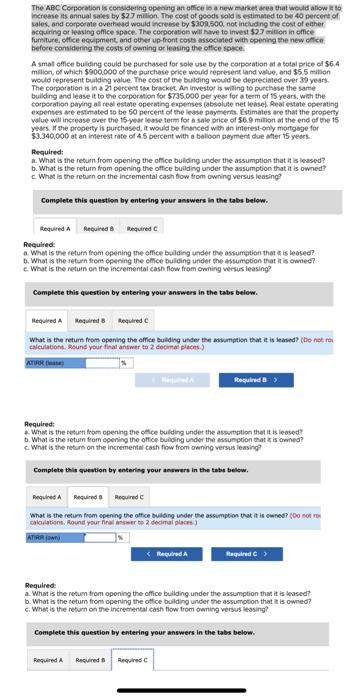

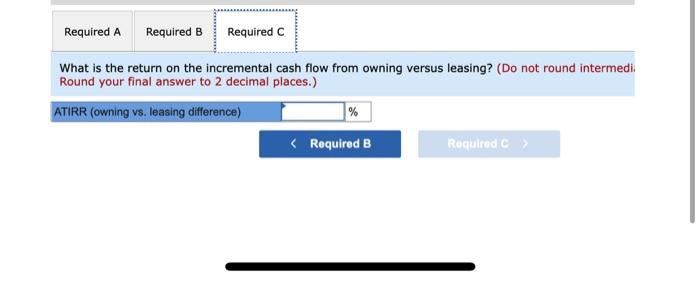

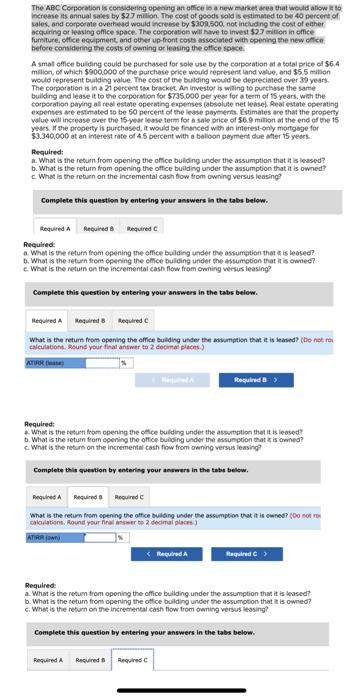

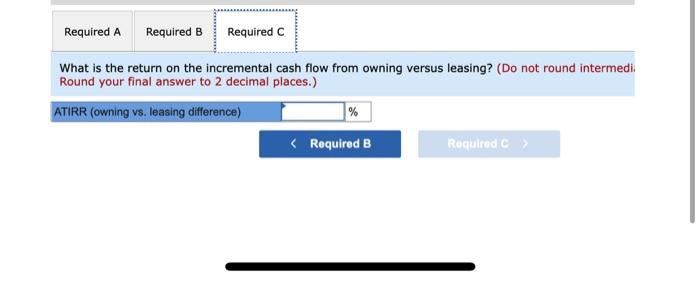

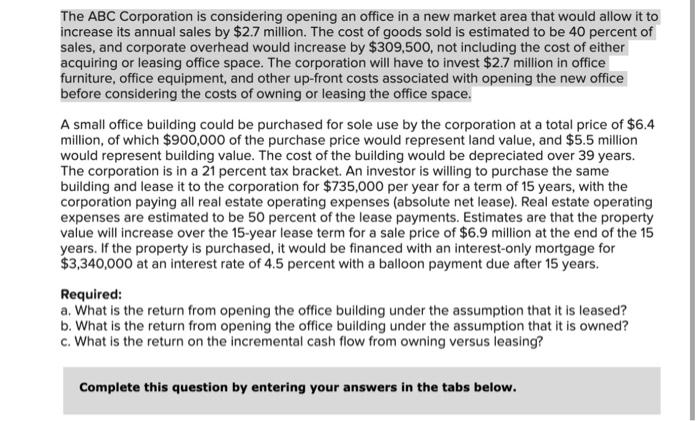

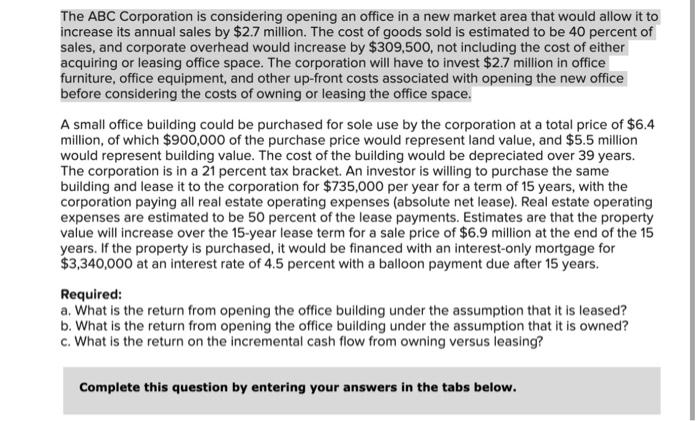

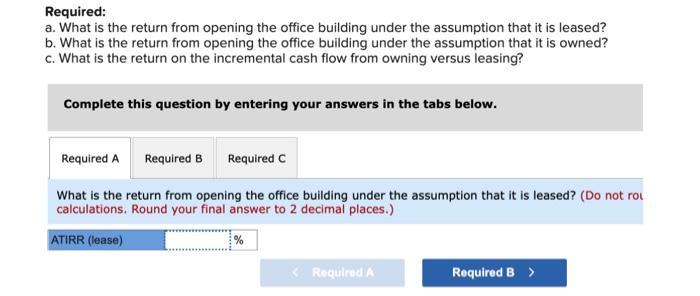

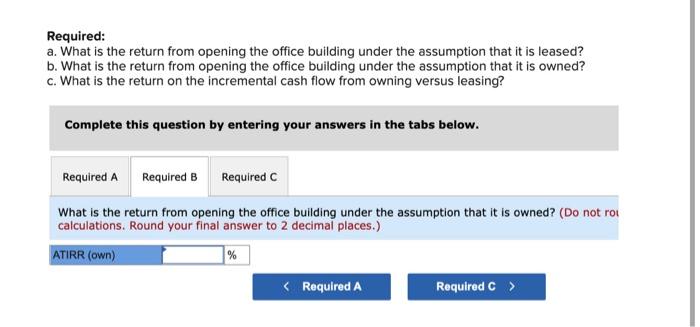

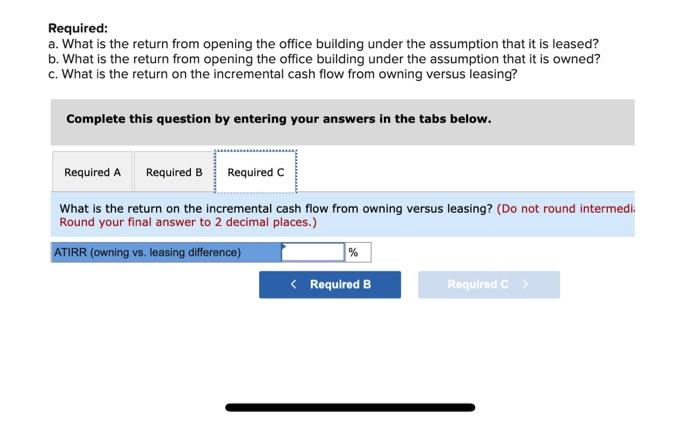

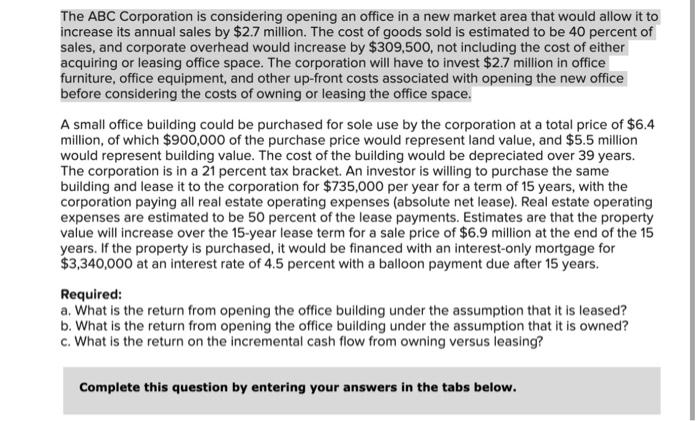

The aBC Comoration is considering opecing art effice in a new market area that would atiow is so ncrecse its annual saves by $2.7 milion. The cost of goods sold is estimeted to be 40 percert of sales. and corporate overhedd would incresse by 5309.500 not inciuding the cost of eaher aceicining or lessing office spoce. The corporasion will have to irvest 527 mition in office fumiture, office ecuipment, and ofhed up-front cost associeted with coening the new offce. before considening the costs of owning or leasing the office ssace. A small offce buicting could be purchased for sole use by the corpotation at a total price of 56.4 milion, of which 5900.000 of the purchase prise wosid represert land value, and $5.5 mition woeld represent bulding value. The cost of the bulding would be depreciated over 39 years. The corporation is in a 21 percent Alor bracket. An investor is wiling to purthase the same building and lease it to the coeporation lot 5735.000 per yeee for a term of 15 years, with the corpecetion paying afl redi estate opeceting expectses (absolute net lease). Redi estate operating expenses are estimated to be 50 persent of the lesse paytrents. Estimates are that the property walue will increase crer the 15 -year besse termi for a sale price of 36.9 mition at the end of the 15 years. If the property is purchased, it would be financed with an imterest-only mortgoge for $3.340.000 at an inferest rate of 4.5 percent with a baloon peyment due ater 15 years. Required: 1. What is the retum from opening the office bulding under the assumption that it is leased? b. What is the retum from opering the office building under the assumption that it is owned? c. What is the reburn on the incremental cash fow from owning versus leasing? Complete this question by entering your answers lin the tabs below. Required: a. What is the tetum from opening the effice bulding under the assumption thet is is leased? b. Whet is the feburn frem opecing the cefce buliding under the assumption that if is ownech c. What is the retum on the incremental cash flow fram owning wersus leasing? Complete this question by entering your answers in the tabs below. What is the retum from opening the emice tueding under the dodumptisn that it is leased) (bo not rui calculationt, hound your final answer to 2 cecirtal places.) Pequired: 4. What is the retuen from opening the oflce bulding under the assumption thet it is leased? b. What is the retuin from coening the office buiding under the assumption that is is crened? c. What is the return on the incremental cash fow from owning versus leasing? Complete this quewtion by enteriag your answers in the tabs belew. What is the return focm epening the office bulding inder the assumption that it is owned? (D0 sot ro. calculationt. Round rour frewl ansoer to 2 decimal places. Required: a. What is the resum from opening the office buliding under the assumption that it is leased? b. What is the setum from opening the oflice buiding under the assumption that it is owned? c. Whet is the refurn on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return on the incremental cash flow from owning versus leasing? (Do not round intermed Round your final answer to 2 decimal places.) The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.7 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $309,500, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.7 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $6.4 million, of which $900,000 of the purchase price would represent land value, and $5.5 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $735,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $6.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $3,340,000 at an interest rate of 4.5 percent with a balloon payment due after 15 years. Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return from opening the office building under the assumption that it is leased? (Do not r calculations. Round your final answer to 2 decimal places.) Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return from opening the office building under the assumption that it is owned? (Do not calculations. Round your final answer to 2 decimal places.) Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return on the incremental cash flow from owning versus leasing? (Do not round interme Round your final answer to 2 decimal places.) The aBC Comoration is considering opecing art effice in a new market area that would atiow is so ncrecse its annual saves by $2.7 milion. The cost of goods sold is estimeted to be 40 percert of sales. and corporate overhedd would incresse by 5309.500 not inciuding the cost of eaher aceicining or lessing office spoce. The corporasion will have to irvest 527 mition in office fumiture, office ecuipment, and ofhed up-front cost associeted with coening the new offce. before considening the costs of owning or leasing the office ssace. A small offce buicting could be purchased for sole use by the corpotation at a total price of 56.4 milion, of which 5900.000 of the purchase prise wosid represert land value, and $5.5 mition woeld represent bulding value. The cost of the bulding would be depreciated over 39 years. The corporation is in a 21 percent Alor bracket. An investor is wiling to purthase the same building and lease it to the coeporation lot 5735.000 per yeee for a term of 15 years, with the corpecetion paying afl redi estate opeceting expectses (absolute net lease). Redi estate operating expenses are estimated to be 50 persent of the lesse paytrents. Estimates are that the property walue will increase crer the 15 -year besse termi for a sale price of 36.9 mition at the end of the 15 years. If the property is purchased, it would be financed with an imterest-only mortgoge for $3.340.000 at an inferest rate of 4.5 percent with a baloon peyment due ater 15 years. Required: 1. What is the retum from opening the office bulding under the assumption that it is leased? b. What is the retum from opering the office building under the assumption that it is owned? c. What is the reburn on the incremental cash fow from owning versus leasing? Complete this question by entering your answers lin the tabs below. Required: a. What is the tetum from opening the effice bulding under the assumption thet is is leased? b. Whet is the feburn frem opecing the cefce buliding under the assumption that if is ownech c. What is the retum on the incremental cash flow fram owning wersus leasing? Complete this question by entering your answers in the tabs below. What is the retum from opening the emice tueding under the dodumptisn that it is leased) (bo not rui calculationt, hound your final answer to 2 cecirtal places.) Pequired: 4. What is the retuen from opening the oflce bulding under the assumption thet it is leased? b. What is the retuin from coening the office buiding under the assumption that is is crened? c. What is the return on the incremental cash fow from owning versus leasing? Complete this quewtion by enteriag your answers in the tabs belew. What is the return focm epening the office bulding inder the assumption that it is owned? (D0 sot ro. calculationt. Round rour frewl ansoer to 2 decimal places. Required: a. What is the resum from opening the office buliding under the assumption that it is leased? b. What is the setum from opening the oflice buiding under the assumption that it is owned? c. Whet is the refurn on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return on the incremental cash flow from owning versus leasing? (Do not round intermed Round your final answer to 2 decimal places.) The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.7 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $309,500, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.7 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $6.4 million, of which $900,000 of the purchase price would represent land value, and $5.5 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $735,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $6.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $3,340,000 at an interest rate of 4.5 percent with a balloon payment due after 15 years. Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return from opening the office building under the assumption that it is leased? (Do not r calculations. Round your final answer to 2 decimal places.) Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return from opening the office building under the assumption that it is owned? (Do not calculations. Round your final answer to 2 decimal places.) Required: a. What is the return from opening the office building under the assumption that it is leased? b. What is the return from opening the office building under the assumption that it is owned? c. What is the return on the incremental cash flow from owning versus leasing? Complete this question by entering your answers in the tabs below. What is the return on the incremental cash flow from owning versus leasing? (Do not round interme Round your final answer to 2 decimal places.)