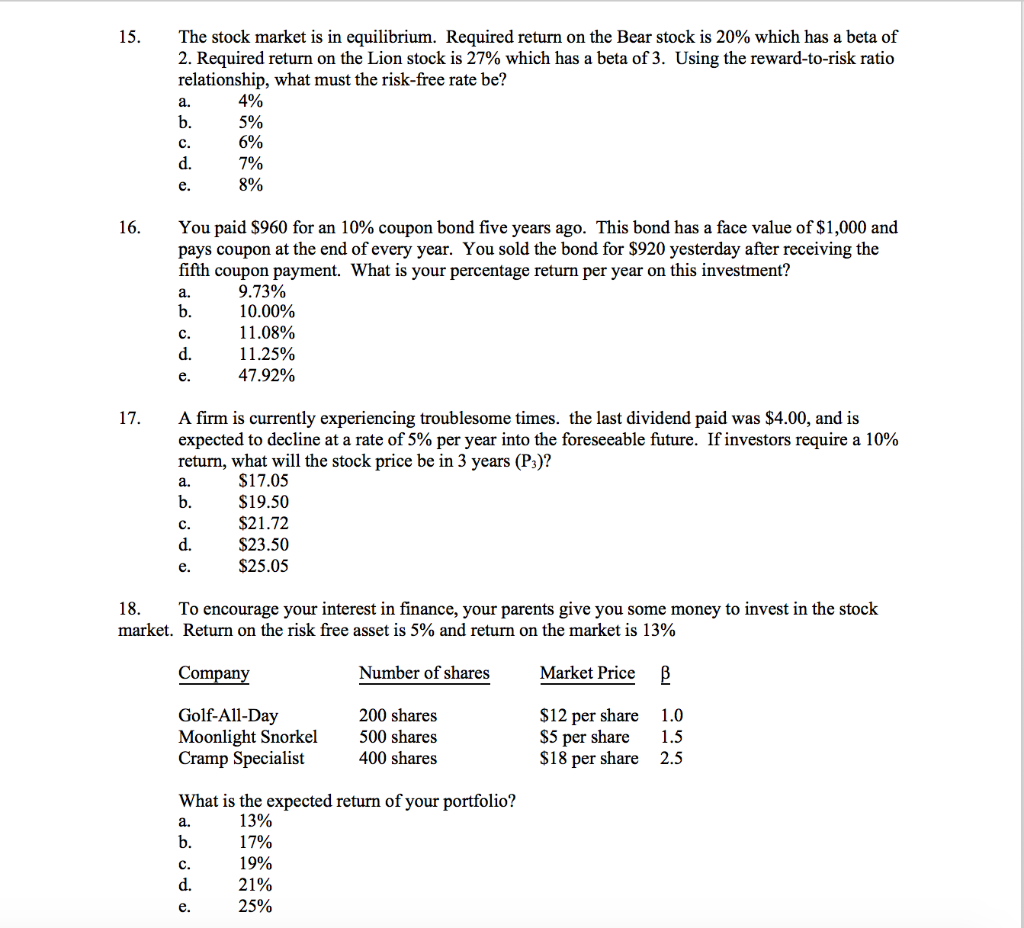

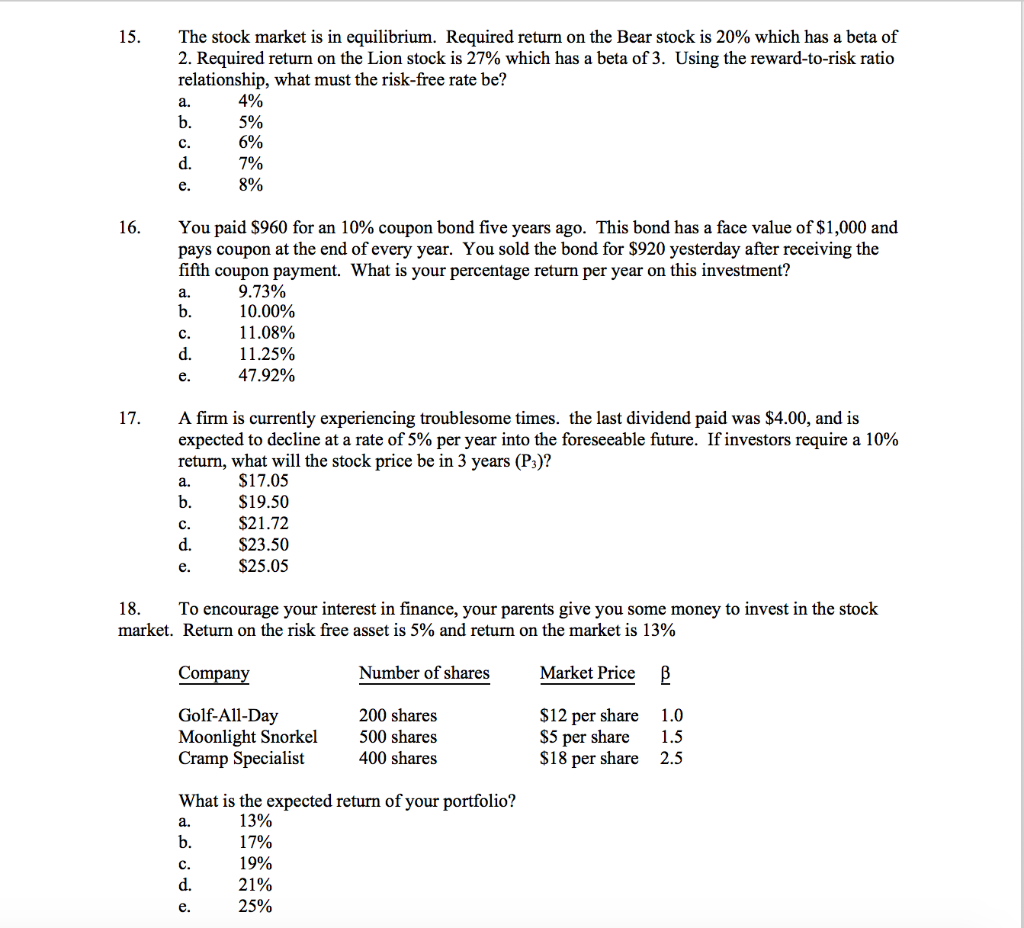

Please Help! Please show work if possible! If there's any quick short cuts that can be done on the BA II calculator to solve some of them please let me know!

The answers for each problem are given! Thank you as always!

15. C

16. A

17. C

18. D

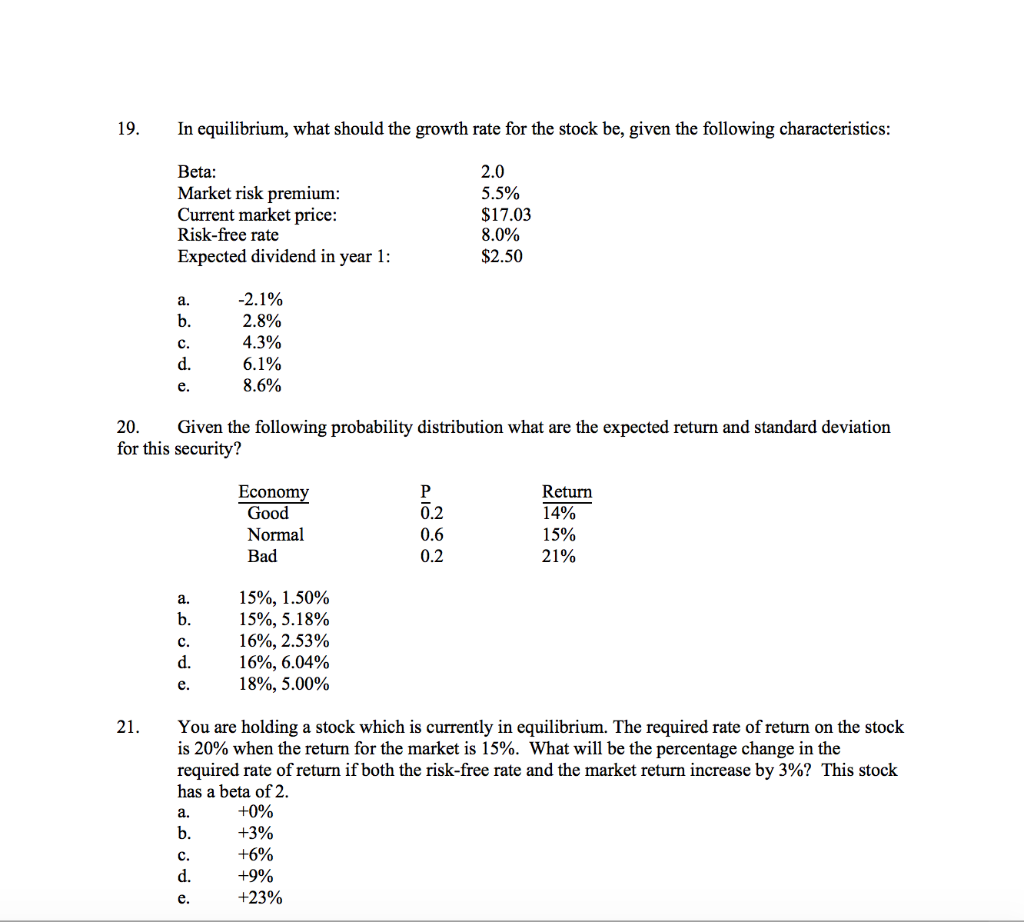

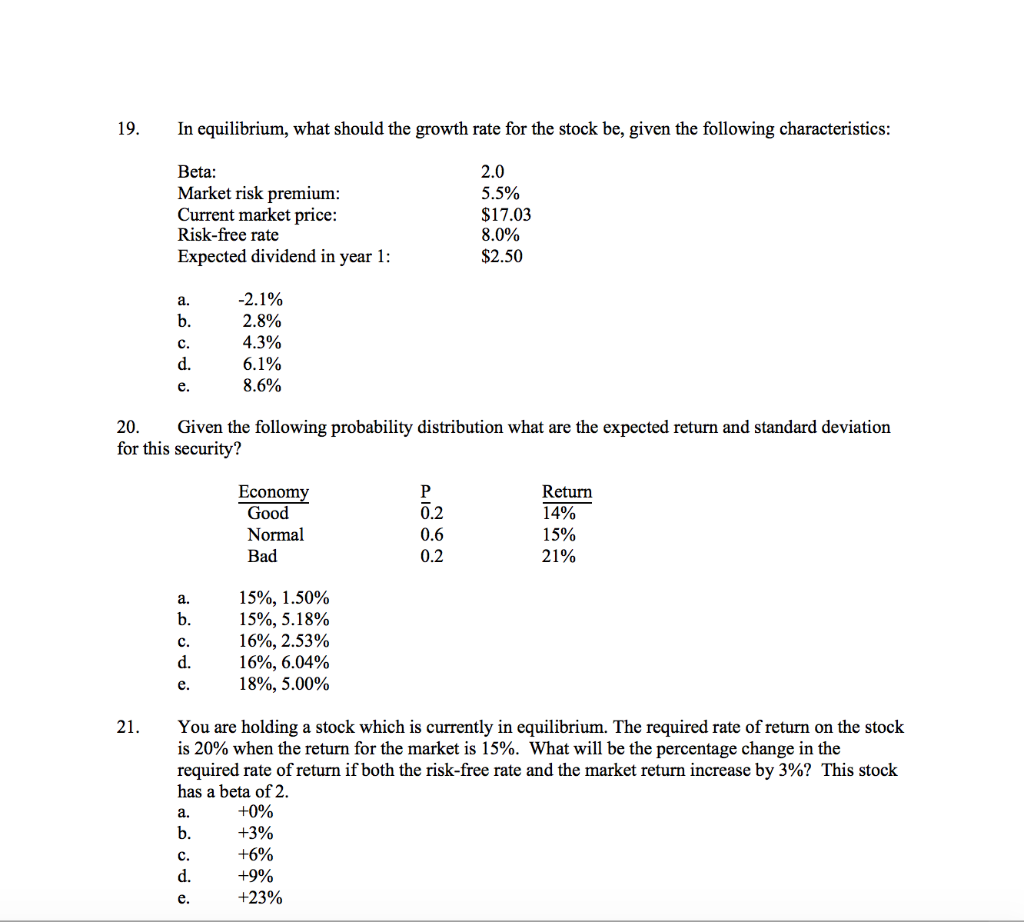

19. C

20. C

21. B

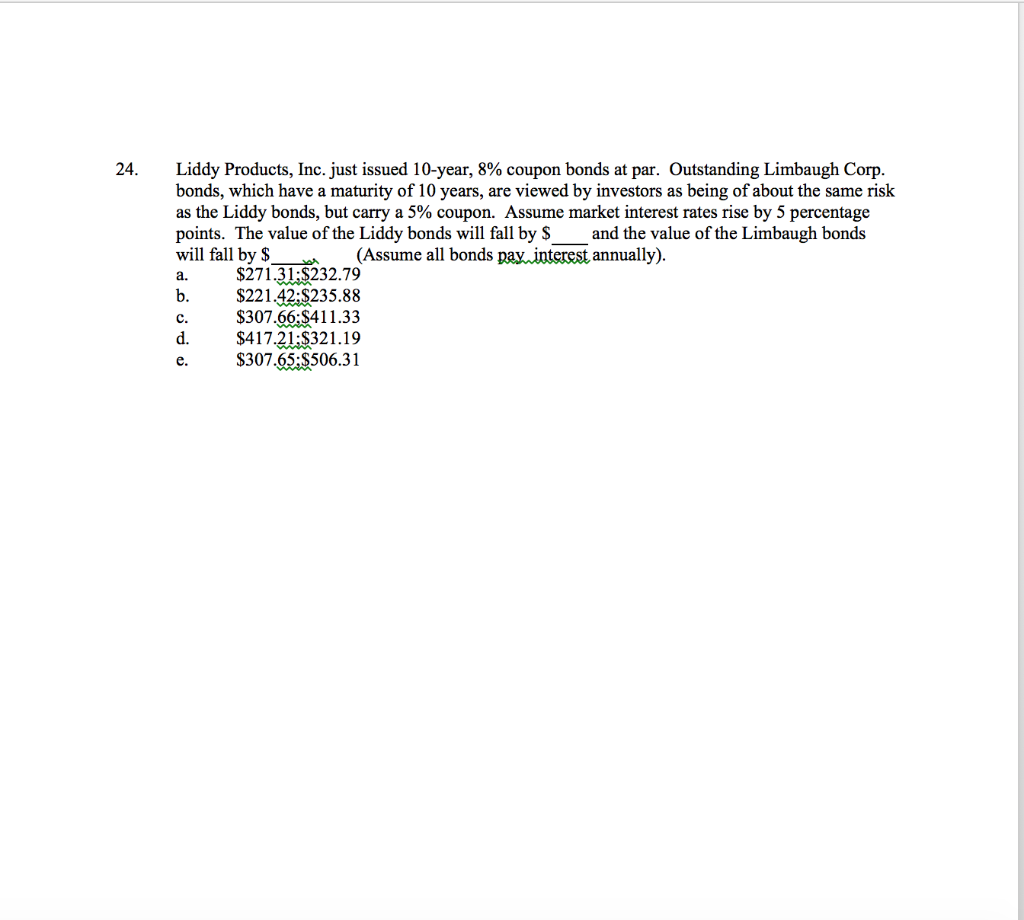

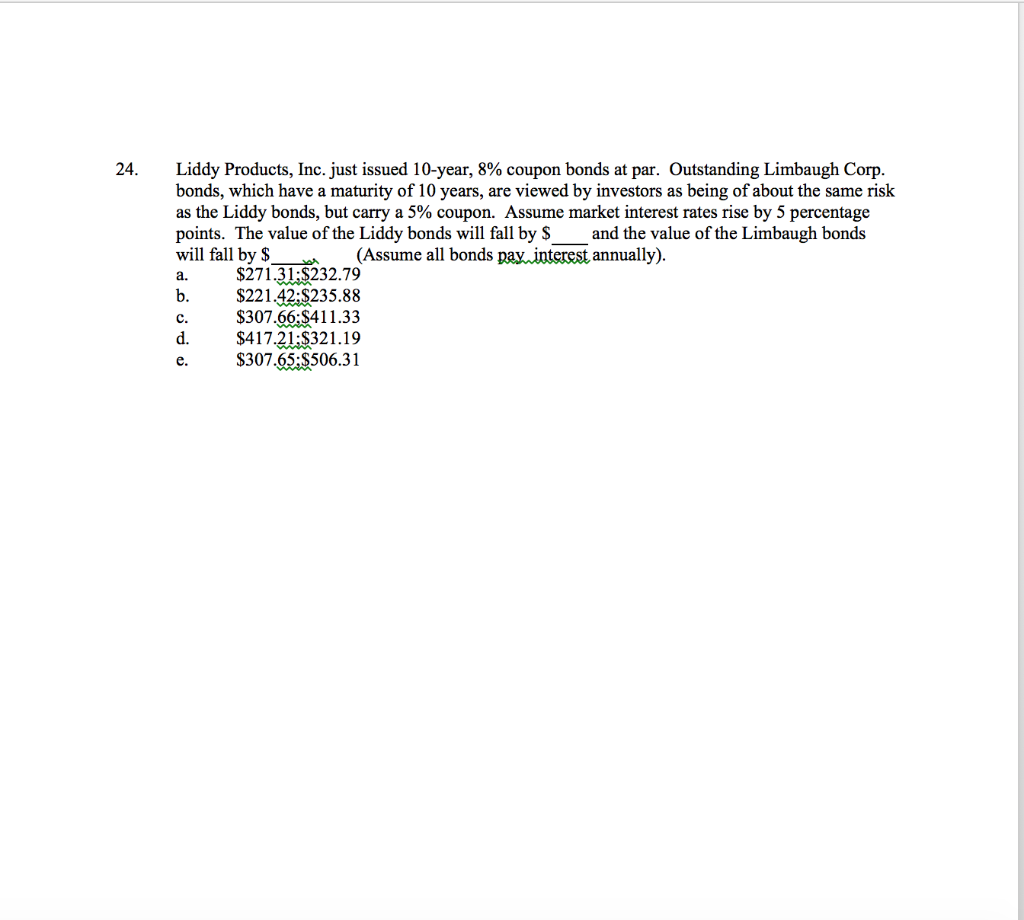

24. A

15. 2 Sodo The stock market is in equilibrium. Required return on the Bear stock is 20% which has a beta of 2. Required return on the Lion stock is 27% which has a beta of 3. Using the reward-to-risk ratio relationship, what must the risk-free rate be? 4% 5% 6% 7% 8% 16. dodo You paid $960 for an 10% coupon bond five years ago. This bond has a face value of $1,000 and pays coupon at the end of every year. You sold the bond for $920 yesterday after receiving the fifth coupon payment. What is your percentage return per year on this investment? 9.73% 10.00% 11.08% 11.25% e. 47.92% doooo A firm is currently experiencing troublesome times, the last dividend paid was $4.00, and is expected to decline at a rate of 5% per year into the foreseeable future. If investors require a 10% return, what will the stock price be in 3 years (P3)? $17.05 $19.50 $21.72 $23.50 $25.05 18. To encourage your interest in finance, your parents give you some money to invest in the stock market. Return on the risk free asset is 5% and return on the market is 13% Company Number of shares Market Price B Golf-All-Day Moonlight Snorkel Cramp Specialist 200 shares 500 shares 400 shares $12 per share $5 per share $18 per share 1.0 1.5 2.5 3 Sodo What is the expected return of your portfolio? 13% 17% 19% 21% 25% 19. In equilibrium, what should the growth rate for the stock be, given the following characteristics: 2.0 Beta: Market risk premium: Current market price: Risk-free rate Expected dividend in year 1: 5.5% $17.03 8.0% $2.50 doooo -2.1% 2.8% 4.3% 6.1% 8.6% 20. Given the following probability distribution what are the expected return and standard deviation for this security? Economy Good Normal Bad 0.2 0.6 Return 14% 15% 21% 0.2 Sodo 15%, 1.50% 15%, 5.18% 16%, 2.53% 16%, 6.04% 18%, 5.00% doooo You are holding a stock which is currently in equilibrium. The required rate of return on the stock is 20% when the return for the market is 15%. What will be the percentage change in the required rate of return if both the risk-free rate and the market return increase by 3%? This stock has a beta of 2. +0% +3% +6% +9% +23% Bodeodo Liddy Products, Inc. just issued 10-year, 8% coupon bonds at par. Outstanding Limbaugh Corp. bonds, which have a maturity of 10 years, are viewed by investors as being of about the same risk as the Liddy bonds, but carry a 5% coupon. Assume market interest rates rise by 5 percentage points. The value of the Liddy bonds will fall by $ and the value of the Limbaugh bonds will fall by $ we (Assume all bonds par interest annually). $271.31:$232.79 $221.42:$235.88 $307.66:$411.33 $417.21:$321.19 $307.65:$506.31