please help!

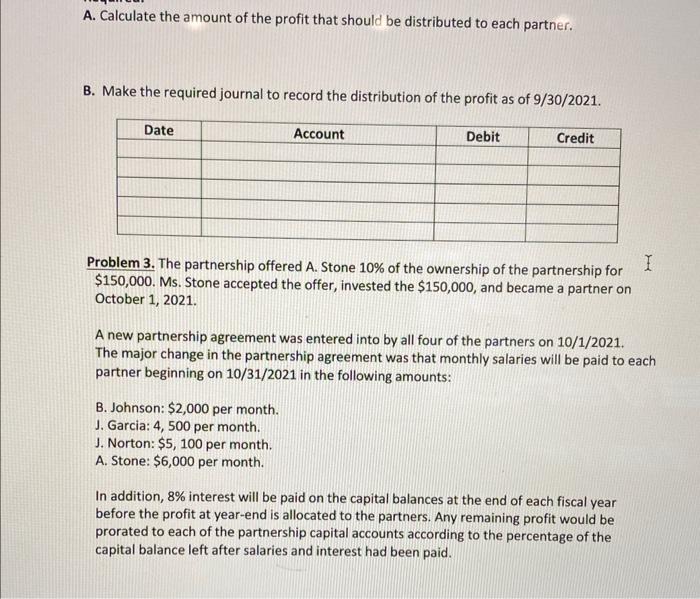

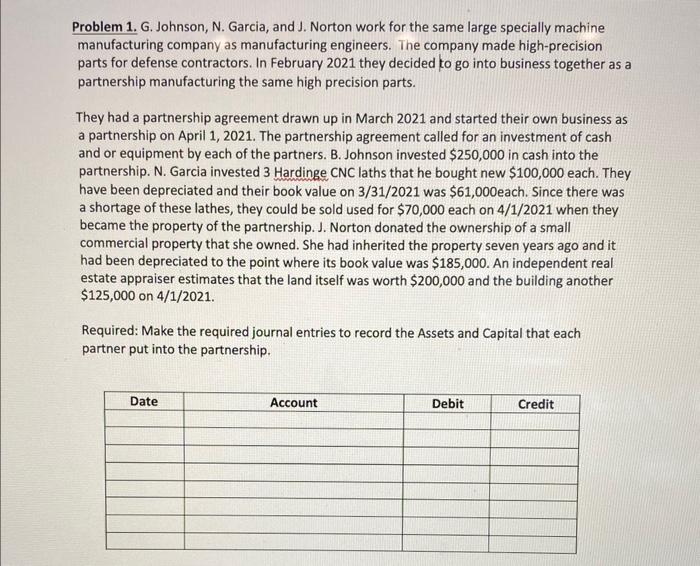

Problem 1. G. Johnson, N. Garcia, and J. Norton work for the same large specially machine manufacturing company as manufacturing engineers. The company made high-precision parts for defense contractors. In February 2021 they decided to go into business together as a partnership manufacturing the same high precision parts. They had a partnership agreement drawn up in March 2021 and started their own business as a partnership on April 1, 2021. The partnership agreement called for an investment of cash and or equipment by each of the partners. B. Johnson invested $250,000 in cash into the partnership. N. Garcia invested 3 Hardinge CNC laths that he bought new $100,000 each. They have been depreciated and their book value on 3/31/2021 was $61,000 each. Since there was a shortage of these lathes, they could be sold used for $70,000 each on 4/1/2021 when they became the property of the partnership. J. Norton donated the ownership of a small commercial property that she owned. She had inherited the property seven years ago and it had been depreciated to the point where its book value was $185,000. An independent real estate appraiser estimates that the land itself was worth $200,000 and the building another $125,000 on 4/1/2021. Required: Make the required journal entries to record the Assets and Capital that each partner put into the partnership. Problem 2. The partnership hired 2 highly skilled machinists to set up and maintain production runs on the three Hardinge CNC lathes. In September 2021 the partners decided they needed to hire another manufacturing engineer to keep up with the workload. They found it very difficult to find a suitable engineer for the job and decided to offer one of their colleagues from the company that they had worked for a percentage of the partnership to become a partner and join the company. The partnership's CPA recommended that before a new partner is brought into the partnership, that the partnership's capital accounts be brought up to date to reflect the profits the company had made through September 30, 2021. In addition, she recommended that after that had been accomplished, distribute the profit to each partner under the existing partnership agreement. The original partnership agreement called for a distribution of profits to each partner based on the percentage of ownership that each partner had in the partnership. As of 9/30/2021 revenue generated by the business was $1,360,000 and the expenses were $1,025,000. A. Calculate the amount of the profit that should be distributed to each partner. B. Make the required journal to record the distribution of the profit as of 9/30/2021. Problem 3. The partnership offered A. Stone 10% of the ownership of the partnership for $150,000. Ms. Stone accepted the offer, invested the $150,000, and became a partner on October 1, 2021. A new partnership agreement was entered into by all four of the partners on 10/1/2021. The major change in the partnership agreement was that monthly salaries will be paid to each partner beginning on 10/31/2021 in the following amounts: B. Johnson: $2,000 per month. J. Garcia: 4, 500 per month. J. Norton: $5,100 per month. A. Stone: $6,000 per month. In addition, 8% interest will be paid on the capital balances at the end of each fiscal year before the profit at year-end is allocated to the partners. Any remaining profit would be prorated to each of the partnership capital accounts according to the percentage of the capital balance left after salaries and interest had been paid