Please help produce AEC eq and ans for parts f-k given info.

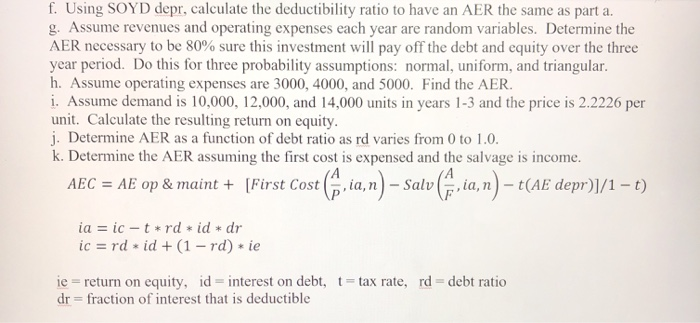

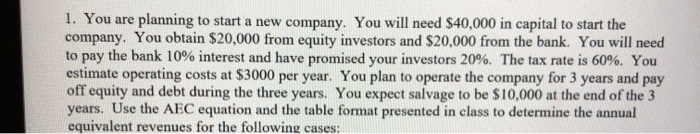

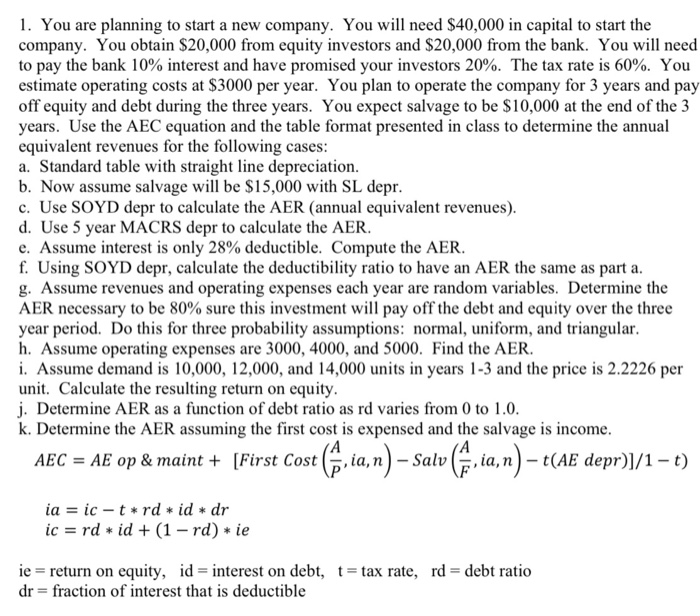

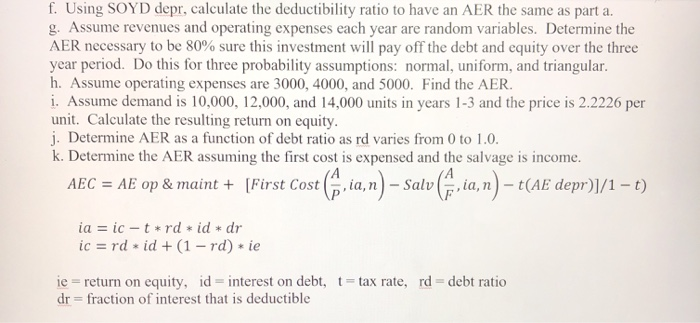

f. Using SOYD depr, calculate the deductibility ratio to have an AER the same as part a. g. Assume revenues and operating expenses each year are random variables. Determine the AER necessary to be 80% sure this investment will pay off the debt and equity over the three year period. Do this for three probability assumptions: normal, uniform, and triangular. h. Assume operating expenses are 3000, 4000, and 5000. Find the AER i. Assume demand is 10,000, 12,000, and 14,000 units in years 1-3 and the price is 2.2226 per unit. Calculate the resulting return on equity. j. Determine AER as a function of debt ratio as rd varies from 0 to 1.0. k. Determine the AER assuming the first cost is expensed and the salvage is income. AEC = AE op & maint+ [First Cos ) - (AE depr)]/1 - t) ia = ic-t*rd* id * dr ic =rdid + (1 - rd) .ie ie = return on equity, id interest on debt, t=tax rate, rd - debt ratio dr = fraction of interest that is deductible 1. You are planning to start a new company. You will need $40,000 in capital to start the company. You obtain $20,000 from equity investors and $20,000 from the bank. You will need to pay the bank 10% interest and have promised your investors 20%. The tax rate is 60%. You estimate operating costs at $3000 per year. You plan to operate the company for 3 years and pay off equity and debt during the three years. You expect salvage to be $10,000 at the end of the 3 years. Use the AEC equation and the table format presented in class to determine the annual equivalent revenues for the following cases: 1. You are planning to start a new company. You will need $40,000 in capital to start the company. You obtain $20,000 from equity investors and $20,000 from the bank. You will need to pay the bank 10% interest and have promised your investors 20%. The tax rate is 60%. You estimate operating costs at $3000 per year. You plan to operate the company for 3 years and pay off equity and debt during the three years. You expect salvage to be $10,000 at the end of the 3 years. Use the AEC equation and the table format presented in class to determine the annual equivalent revenues for the following cases: a. Standard table with straight line depreciation. b. Now assume salvage will be $15,000 with SL depr. c. Use SOYD depr to calculate the AER (annual equivalent revenues). d. Use 5 year MACRS depr to calculate the AER e. Assume interest is only 28% deductible. Compute the AER. f. Using SOYD depr, calculate the deductibility ratio to have an AER the same as part a. g. Assume revenues and operating expenses each year are random variables. Determine the AER necessary to be 80% sure this investment will pay off the debt and equity over the three year period. Do this for three probability assumptions: normal, uniform, and triangular. h. Assume operating expenses are 3000, 4000, and 5000. Find the AER. i. Assume demand is 10,000, 12,000, and 14,000 units in years 1-3 and the price is 2.2226 per unit. Calculate the resulting return on equity. j. Determine AER as a function of debt ratio as rd varies from 0 to 1.0. k. Determine the AER assuming the first cost is expensed and the salvage is income. AEC = AE op & maint+ [First Cost ne) - (AE depr)]/1-t) ia = ic - t*rd* id * dr ic = rd * id + (1 - rd) * ie debt ratio ie = return on equity, id = interest on debt, t = tax rate, rd dr = fraction of interest that is deductible f. Using SOYD depr, calculate the deductibility ratio to have an AER the same as part a. g. Assume revenues and operating expenses each year are random variables. Determine the AER necessary to be 80% sure this investment will pay off the debt and equity over the three year period. Do this for three probability assumptions: normal, uniform, and triangular. h. Assume operating expenses are 3000, 4000, and 5000. Find the AER i. Assume demand is 10,000, 12,000, and 14,000 units in years 1-3 and the price is 2.2226 per unit. Calculate the resulting return on equity. j. Determine AER as a function of debt ratio as rd varies from 0 to 1.0. k. Determine the AER assuming the first cost is expensed and the salvage is income. AEC = AE op & maint+ [First Cos ) - (AE depr)]/1 - t) ia = ic-t*rd* id * dr ic =rdid + (1 - rd) .ie ie = return on equity, id interest on debt, t=tax rate, rd - debt ratio dr = fraction of interest that is deductible 1. You are planning to start a new company. You will need $40,000 in capital to start the company. You obtain $20,000 from equity investors and $20,000 from the bank. You will need to pay the bank 10% interest and have promised your investors 20%. The tax rate is 60%. You estimate operating costs at $3000 per year. You plan to operate the company for 3 years and pay off equity and debt during the three years. You expect salvage to be $10,000 at the end of the 3 years. Use the AEC equation and the table format presented in class to determine the annual equivalent revenues for the following cases: 1. You are planning to start a new company. You will need $40,000 in capital to start the company. You obtain $20,000 from equity investors and $20,000 from the bank. You will need to pay the bank 10% interest and have promised your investors 20%. The tax rate is 60%. You estimate operating costs at $3000 per year. You plan to operate the company for 3 years and pay off equity and debt during the three years. You expect salvage to be $10,000 at the end of the 3 years. Use the AEC equation and the table format presented in class to determine the annual equivalent revenues for the following cases: a. Standard table with straight line depreciation. b. Now assume salvage will be $15,000 with SL depr. c. Use SOYD depr to calculate the AER (annual equivalent revenues). d. Use 5 year MACRS depr to calculate the AER e. Assume interest is only 28% deductible. Compute the AER. f. Using SOYD depr, calculate the deductibility ratio to have an AER the same as part a. g. Assume revenues and operating expenses each year are random variables. Determine the AER necessary to be 80% sure this investment will pay off the debt and equity over the three year period. Do this for three probability assumptions: normal, uniform, and triangular. h. Assume operating expenses are 3000, 4000, and 5000. Find the AER. i. Assume demand is 10,000, 12,000, and 14,000 units in years 1-3 and the price is 2.2226 per unit. Calculate the resulting return on equity. j. Determine AER as a function of debt ratio as rd varies from 0 to 1.0. k. Determine the AER assuming the first cost is expensed and the salvage is income. AEC = AE op & maint+ [First Cost ne) - (AE depr)]/1-t) ia = ic - t*rd* id * dr ic = rd * id + (1 - rd) * ie debt ratio ie = return on equity, id = interest on debt, t = tax rate, rd dr = fraction of interest that is deductible