Answered step by step

Verified Expert Solution

Question

1 Approved Answer

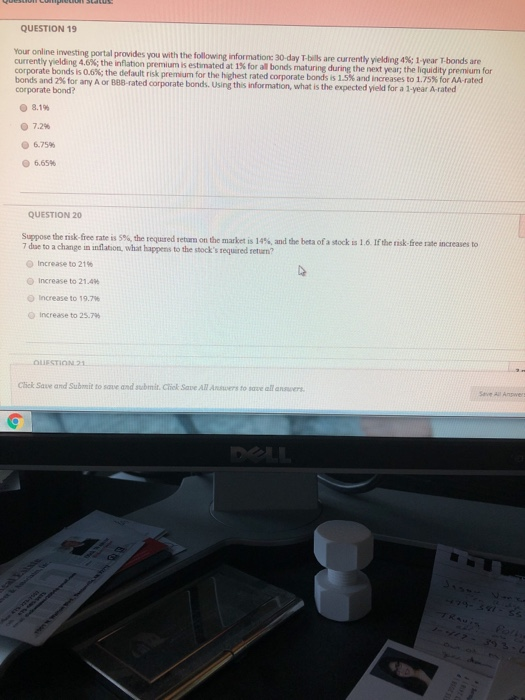

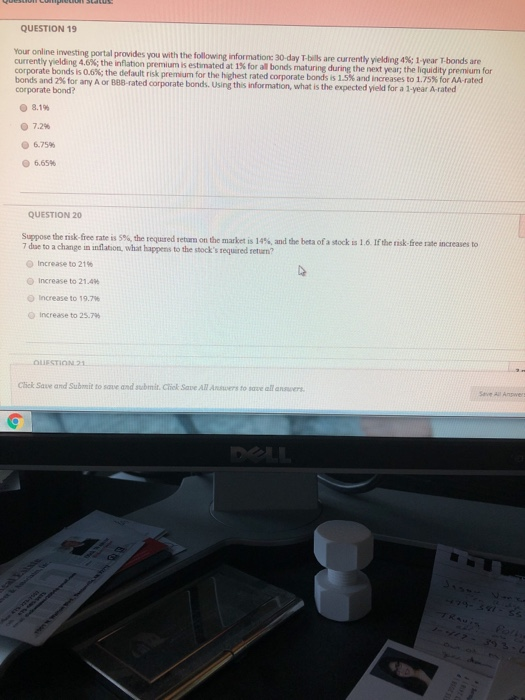

please help QUESTION 19 Your online investing portal provides you with the following information 30-day T-bills are currently yielding 4%; 1 year T-bonds are currently

please help

QUESTION 19 Your online investing portal provides you with the following information 30-day T-bills are currently yielding 4%; 1 year T-bonds are currently yielding 4.6%; the inflation premium is estimated at 1% for all bonds maturing during the next year; the liquidity premium for corporate bonds is 0.6%; the default risk premium for the highest rated corporate bonds is 1.5 and increases to 1.75% for AA rated bonds and for any A B B-rated corporate bonds. Ung this formation, what is the expected yield for a 1-year A-rated corporate bond? 7.2 6.75 6.65 QUESTION 20 Suppose the risk-free rate is 5%, the required return on the market is 14%and the beta of a stock is 16. If the risk free rate increases to 7 dae to a change in n o what happens to the stock's requeretur increto 215 Increase to 21.0 increase to 19.7 Increase to 2.7 UTION Chat Sanand Saba B o sella

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started