Please help quick

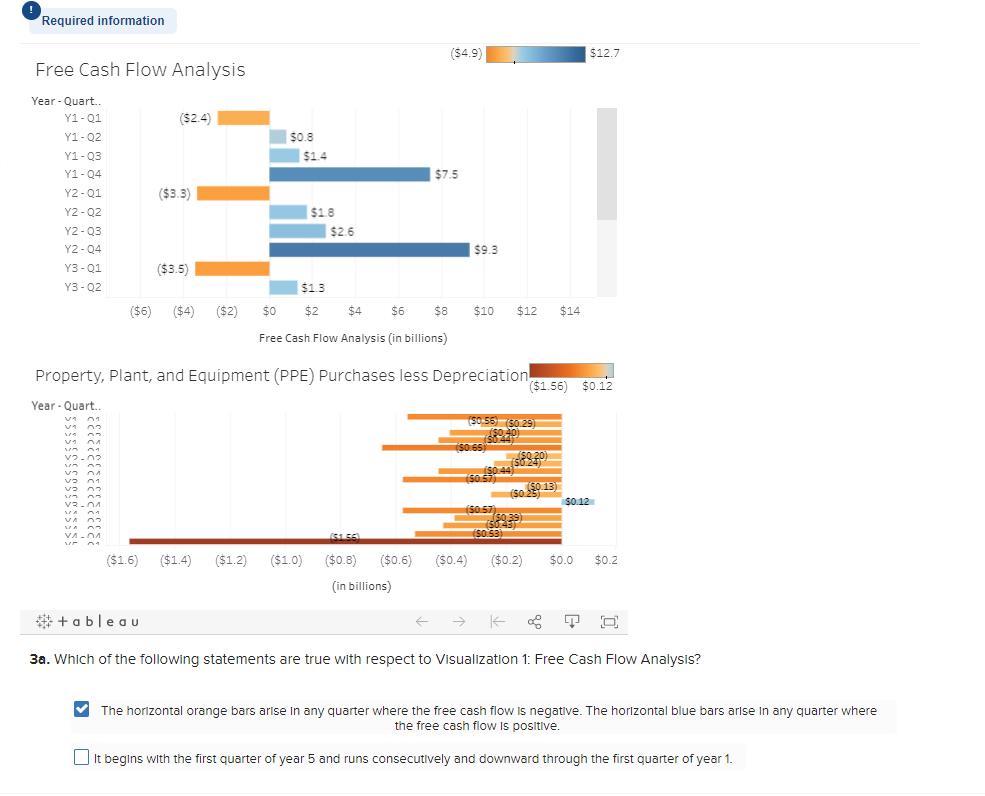

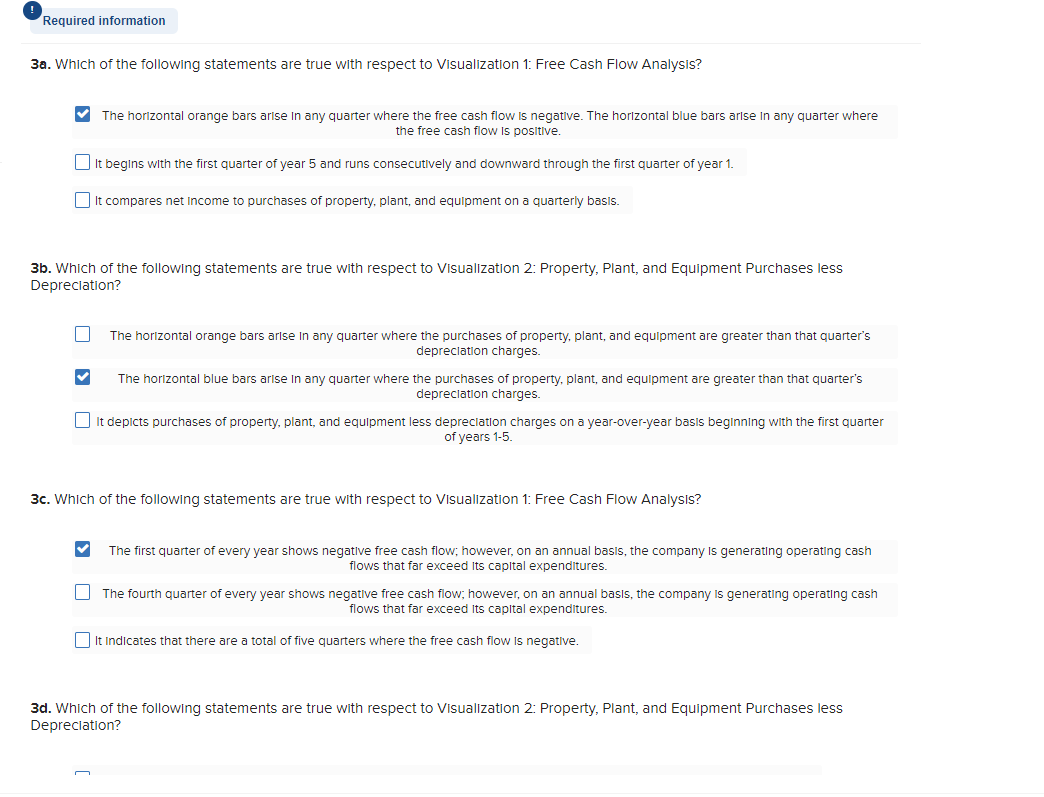

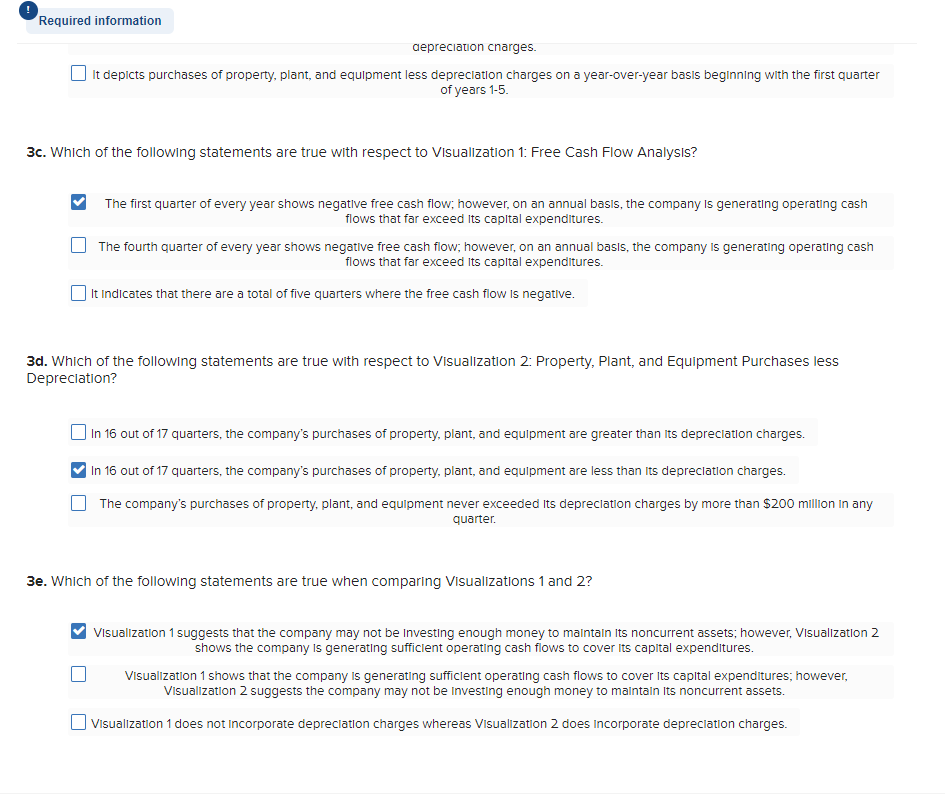

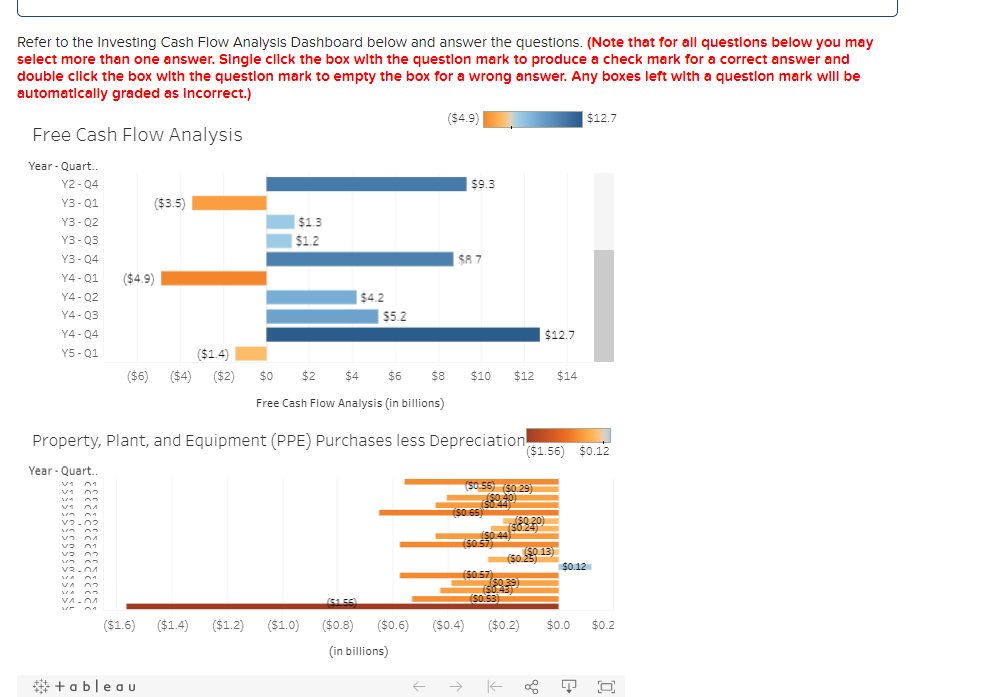

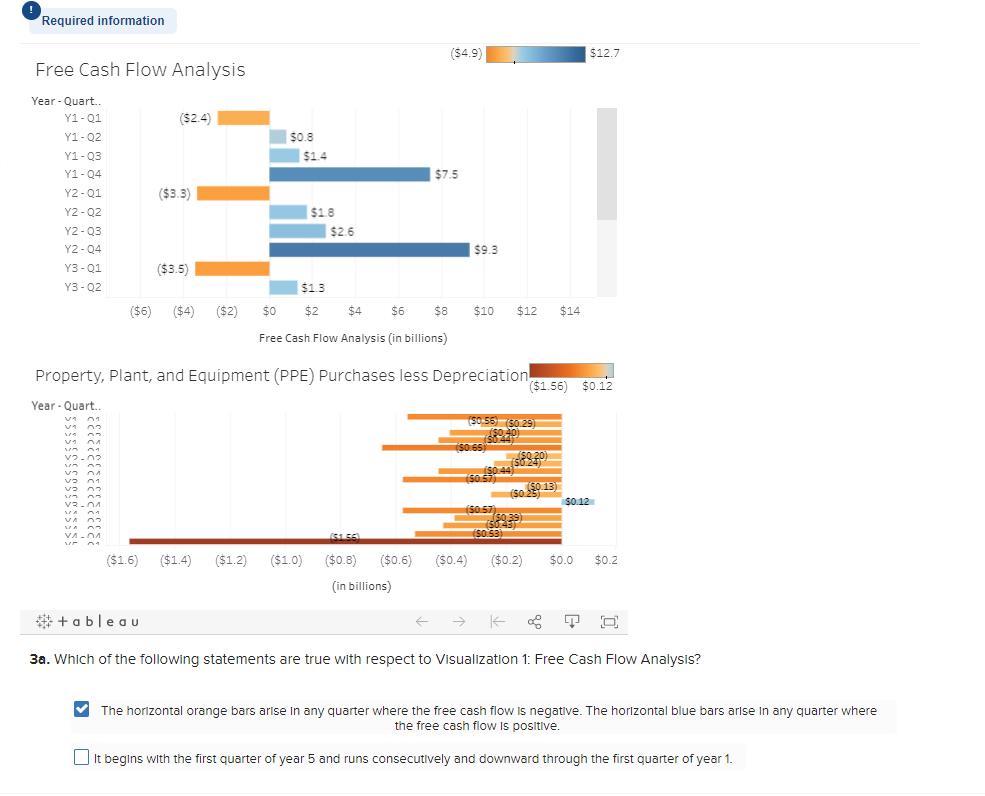

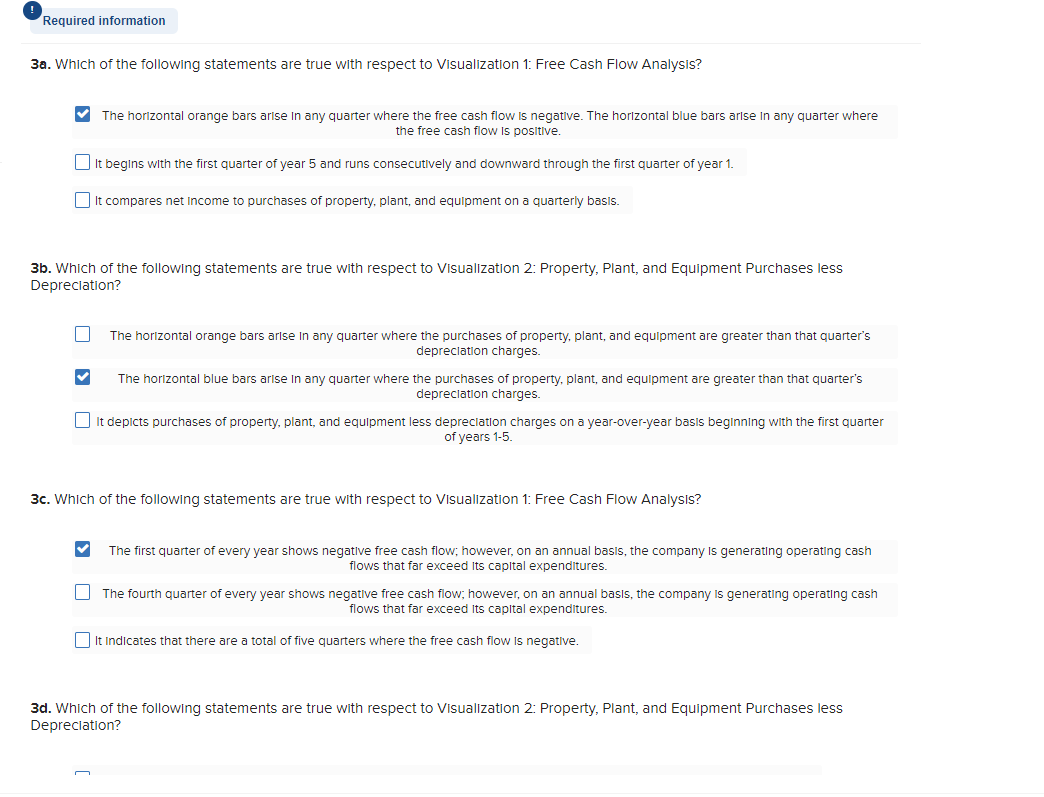

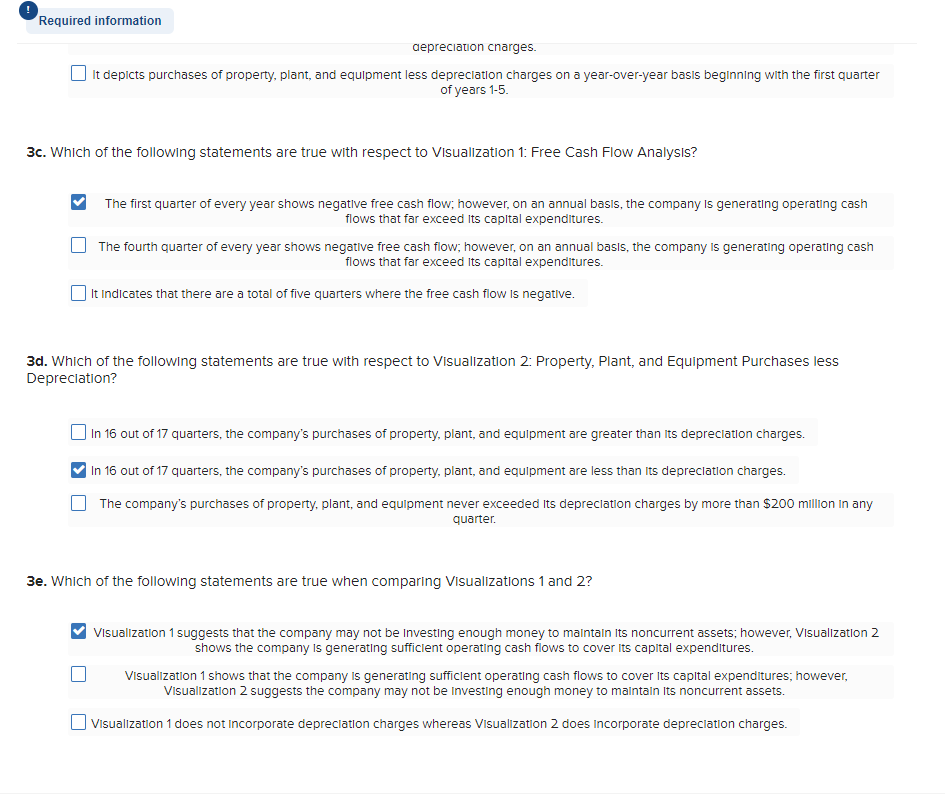

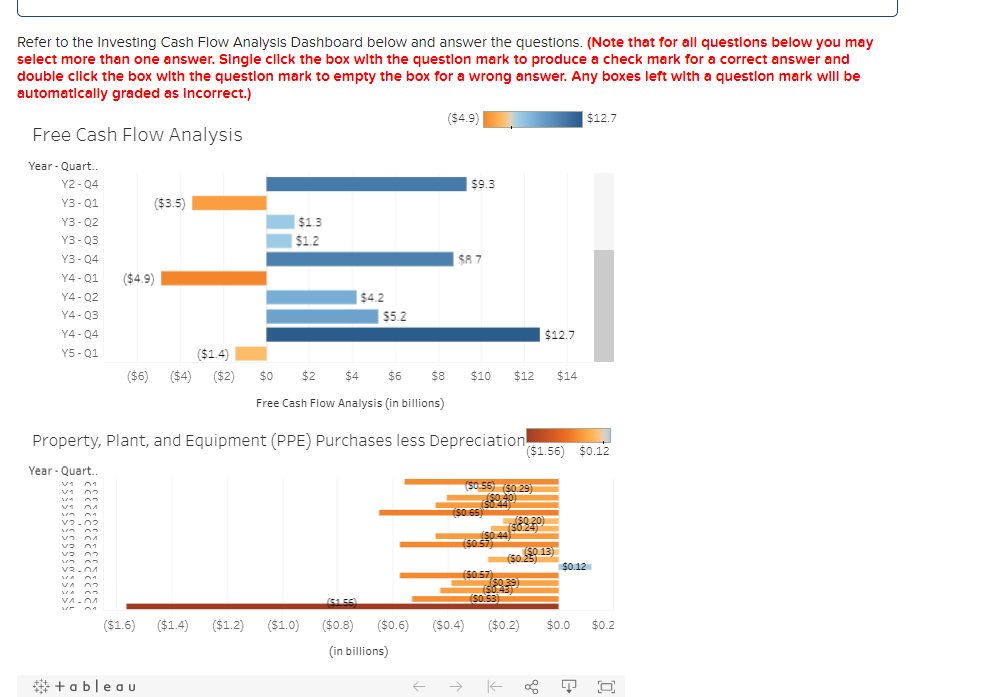

! Required information ($4.9) $12.7 Free Cash Flow Analysis Year - Quart.. Y1-01 ($2.4) Y1-02 Y1-03 $0.8 $1.4 $7.5 ($3.3) Y1-04 Y2-01 Y2-02 Y2-03 Y2-04 Y3-01 Y3-02 $1.8 $2.6 $9.3 ($3.5) $1.3 $2 ($6) ($4) ($2) $0 $4 $6 $8 $10 $12 $14 Free Cash Flow Analysis (in billions) Property, Plant, and Equipment (PPE) Purchases less Depreciation Year - Quart.. ($1.56) $0.12 V2-n (S0.56) (50 291 $0.40) S0.65 158940) (S0.44 $057 S0.13) ($0.257 $0.12 (S0:57 V NA v901 V90 V3. VA. 155 (S0.53) ($1.6) ($1.4) ($1.2) ($1.0) ($0.4) ($0.2) $0.0 $0.2 ($0.8) ($0.6) (in billions) #*+ableau C o 3a. Which of the following statements are true with respect to Visualization 1: Free Cash Flow Analysis? The horizontal orange bars arise in any quarter where the free cash flow is negative. The horizontal blue bars arise in any quarter where the free cash flow is positive. It begins with the first quarter of year 5 and runs consecutively and downward through the first quarter of year 1. Required information 3a. Which of the following statements are true with respect to Visualization 1: Free Cash Flow Analysis? The horizontal orange bars arise in any quarter where the free cash flow is negative. The horizontal blue bars arise in any quarter where the free cash flow is positive. It begins with the first quarter of year and runs consecutively and downward through the first quarter of year 1. It compares net Income to purchases of property, plant, and equipment on a quarterly basis. 3b. Which of the following statements are true with respect to Visualization 2: Property, Plant, and Equipment Purchases less Depreciation? The horizontal orange bars arise in any quarter where the purchases of property, plant, and equipment are greater than that quarter's depreciation charges. The horizontal blue bars arise in any quarter where the purchases of property, plant, and equipment are greater than that quarter's depreciation charges. It depicts purchases of property, plant, and equipment less depreciation charges on a year-over-year basis beginning with the first quarter of years 1-5. 3c. Which of the following statements are true with respect to Visualization 1: Free Cash Flow Analysis? The first quarter of every year shows negative free cash flow, however, on an annual basis, the company is generating operating cash flows that far exceed Its capital expenditures. The fourth quarter of every year shows negative free cash flow; however, on an annual basis, the company is generating operating cash flows that far exceed Its capital expenditures. It Indicates that there are a total of five quarters where the free cash flow is negative. 3d. Which of the following statements are true with respect to Visualization 2: Property, Plant, and Equipment Purchases less Depreciation? Required information depreciation charges. It depicts purchases of property, plant, and equipment less depreciation charges on a year-over-year basis beginning with the first quarter of years 1-5. 3c. Which of the following statements are true with respect to Visualization 1: Free Cash Flow Analysis? The first quarter of every year shows negative free cash flow, however, on an annual basis, the company is generating operating cash flows that far exceed its capital expenditures. The fourth quarter of every year shows negative free cash flow, however, on an annual basis, the company is generating operating cash flows that far exceed Its capital expenditures. It Indicates that there are a total of five quarters where the free cash flow is negative. 3d. Which of the following statements are true with respect to Visualization 2: Property, Plant, and Equipment Purchases less Depreciation? In 16 out of 17 quarters, the company's purchases of property, plant, and equipment are greater than its depreciation charges. In 16 out of 17 quarters, the company's purchases of property, plant, and equipment are less than its depreciation charges. The company's purchases of property, plant, and equipment never exceeded its depreciation charges by more than $200 million in any quarter 3e. Which of the following statements are true when comparing Visualizations 1 and 2? Visualization 1 suggests that the company may not be Investing enough money to maintain its noncurrent assets; however, Visualization 2 shows the company is generating sufficient operating cash flows to cover its capital expenditures. Visualization 1 shows that the company is generating sufficient operating cash flows to cover its capital expenditures; however, Visualization 2 suggests the company may not be Investing enough money to maintain its noncurrent assets. Visualization 1 does not incorporate depreciation charges whereas Visualization 2 does Incorporate depreciation charges. Refer to the Investing Cash Flow Analysis Dashboard below and answer the questions. (Note that for all questions below you may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) ($4.9) $12.7 Free Cash Flow Analysis $9.3 ($3.5) $1.3 $12 Year - Quart Y2-04 Y3-01 Y3-02 Y3-03 Y3-04 Y4-01 Y4-02 Y4-03 Y4-04 Y5-01 SA 7 ($4.9) $42 $52 $12.7 ($1.4) ($4) ($2) ($6) $10 $12 $14 $0 $2 $4 $6 $8 Free Cash Flow Analysis (in billions) Property, Plant, and Equipment (PPE) Purchases less Depreciation ($1.56 $0.12 Year - Quart.. (50.56 $0.291 VA V2.02 VA V9 01 VO $0.65) $0.20) (501220 S0.44 SOS ($0.13) (S0.25) (S0.57 V. $0.12 VA 02 stes VA. 15 (S0.53) ($1.6) ($1.4) ($1.2) ($0.4) ($0.2) $0.0 $0.2 ($1.0) ($0.8) ($0.6) (in billions) # + ableau TO