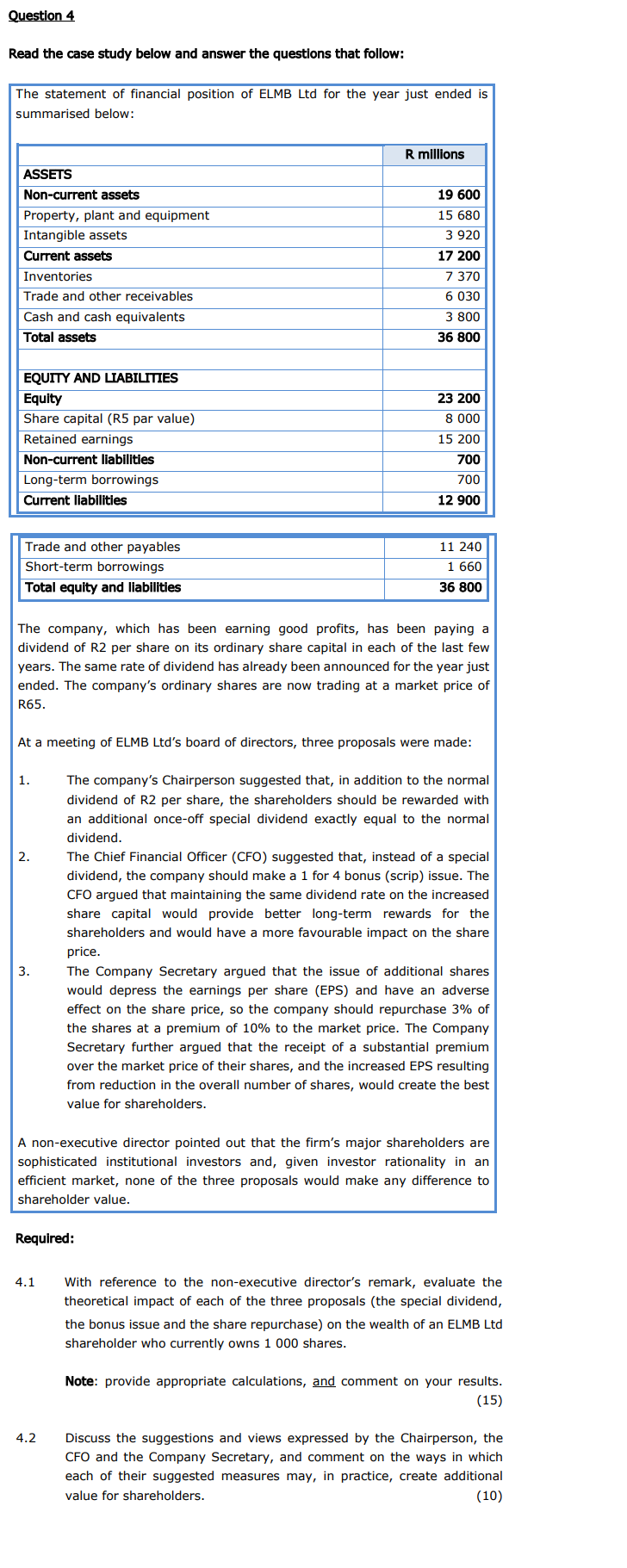

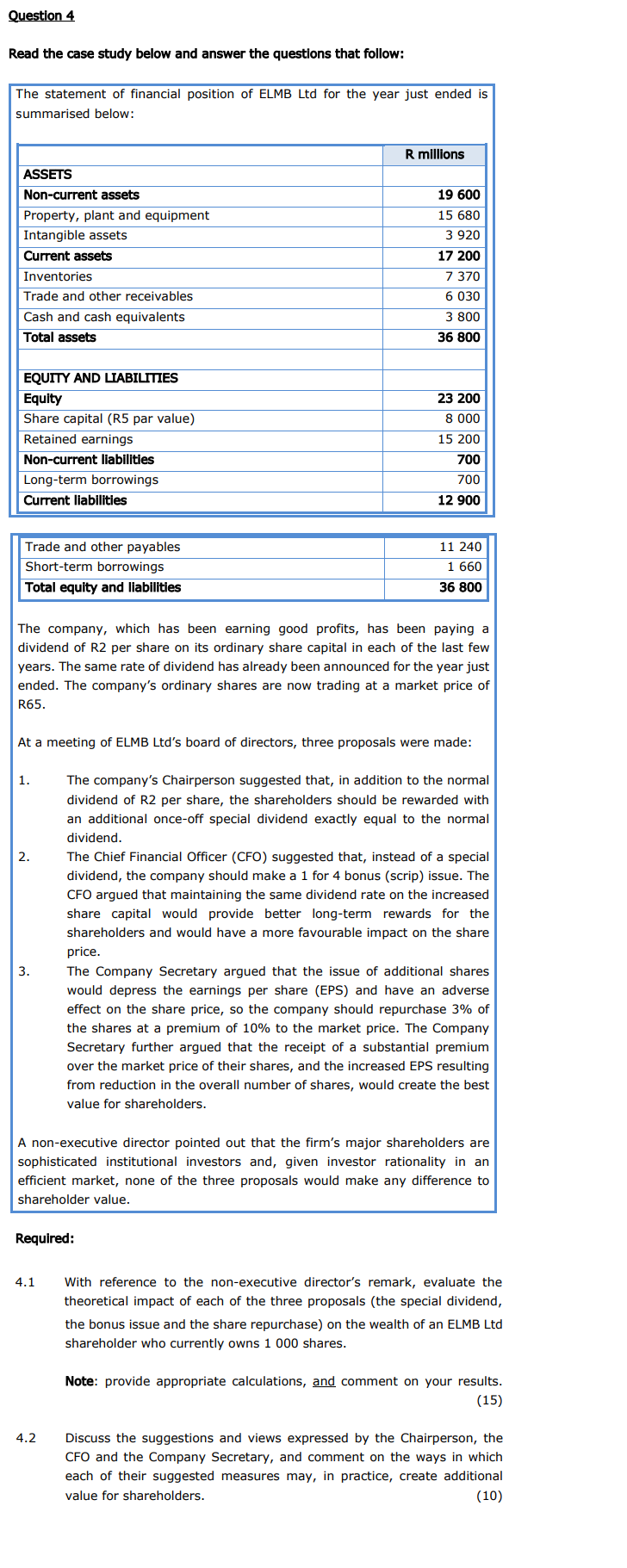

Question 4 Read the case study below and answer the questions that follow: The statement of financial position of ELMB Ltd for the year just ended is summarised below: R millions ASSETS Non-current assets Property, plant and equipment Intangible assets Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets 19 600 15 680 3 920 17 200 7 370 6 030 3 800 36 800 EQUITY AND LIABILITIES Equity Share capital (R5 par value) Retained earnings Non-current liabilities Long-term borrowings Current liabilities 23 200 8 000 15 200 700 700 12 900 Trade and other payables Short-term borrowings Total equity and liabilities 11 240 1 660 36 800 The company, which has been earning good profits, has been paying a dividend of R2 per share on its ordinary share capital in each of the last few years. The same rate of dividend has already been announced for the year just ended. The company's ordinary shares are now trading at a market price of R65. At a meeting of ELMB Ltd's board of directors, three proposals were made: 1. 2. 2 The company's Chairperson suggested that, in addition to the normal dividend of R2 per share, the shareholders should be rewarded with an additional once-off special dividend exactly equal to the normal dividend. The Chief Financial Officer (CFO) suggested that, instead of a special dividend, the company should make a 1 for 4 bonus (scrip) issue. The CFO argued that maintaining the same dividend rate on the increased share capital would provide better long-term rewards for the shareholders and would have a more favourable impact on the share price. The Company Secretary argued that the issue of additional shares would depress the earnings per share (EPS) and have an adverse effect on the share price, so the company should repurchase 3% of the shares at a premium of 10% to the market price. The Company Secretary further argued that the receipt of a substantial premium over the market price of their shares, and the increased EPS resulting from reduction in the overall number of shares, would create the best value for shareholders. 3. A non-executive director pointed out that the firm's major shareholders are sophisticated institutional investors and, given investor rationality in an efficient market, none of the three proposals would make any difference to shareholder value. Required: 4.1 With reference to the non-executive director's remark, evaluate the theoretical impact of each of the three proposals (the special dividend, the bonus issue and the share repurchase) on the wealth of an ELMB Ltd shareholder who currently owns 1 000 shares. Note: provide appropriate calculations, and comment on your results. (15) 4.2 Discuss the suggestions and views expressed by the Chairperson, the CFO and the Company Secretary, and comment on the ways in which each of their suggested measures may, in practice, create additional value for shareholders. (10) Question 4 Read the case study below and answer the questions that follow: The statement of financial position of ELMB Ltd for the year just ended is summarised below: R millions ASSETS Non-current assets Property, plant and equipment Intangible assets Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets 19 600 15 680 3 920 17 200 7 370 6 030 3 800 36 800 EQUITY AND LIABILITIES Equity Share capital (R5 par value) Retained earnings Non-current liabilities Long-term borrowings Current liabilities 23 200 8 000 15 200 700 700 12 900 Trade and other payables Short-term borrowings Total equity and liabilities 11 240 1 660 36 800 The company, which has been earning good profits, has been paying a dividend of R2 per share on its ordinary share capital in each of the last few years. The same rate of dividend has already been announced for the year just ended. The company's ordinary shares are now trading at a market price of R65. At a meeting of ELMB Ltd's board of directors, three proposals were made: 1. 2. 2 The company's Chairperson suggested that, in addition to the normal dividend of R2 per share, the shareholders should be rewarded with an additional once-off special dividend exactly equal to the normal dividend. The Chief Financial Officer (CFO) suggested that, instead of a special dividend, the company should make a 1 for 4 bonus (scrip) issue. The CFO argued that maintaining the same dividend rate on the increased share capital would provide better long-term rewards for the shareholders and would have a more favourable impact on the share price. The Company Secretary argued that the issue of additional shares would depress the earnings per share (EPS) and have an adverse effect on the share price, so the company should repurchase 3% of the shares at a premium of 10% to the market price. The Company Secretary further argued that the receipt of a substantial premium over the market price of their shares, and the increased EPS resulting from reduction in the overall number of shares, would create the best value for shareholders. 3. A non-executive director pointed out that the firm's major shareholders are sophisticated institutional investors and, given investor rationality in an efficient market, none of the three proposals would make any difference to shareholder value. Required: 4.1 With reference to the non-executive director's remark, evaluate the theoretical impact of each of the three proposals (the special dividend, the bonus issue and the share repurchase) on the wealth of an ELMB Ltd shareholder who currently owns 1 000 shares. Note: provide appropriate calculations, and comment on your results. (15) 4.2 Discuss the suggestions and views expressed by the Chairperson, the CFO and the Company Secretary, and comment on the ways in which each of their suggested measures may, in practice, create additional value for shareholders