please help quickly for hw

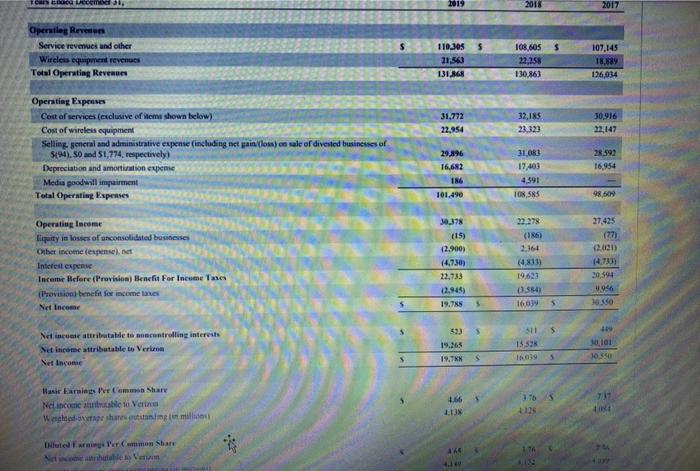

7. current ratio

8. debt equity ratio

9. Times interest ratio

10. inventory turmover ratio

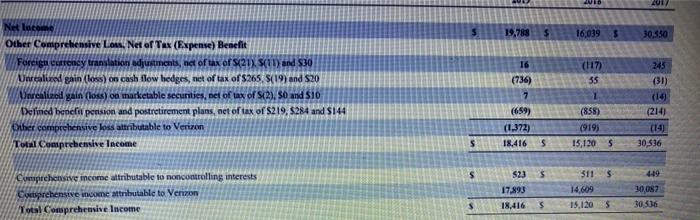

11. return on equity

please answer all It will really help me out

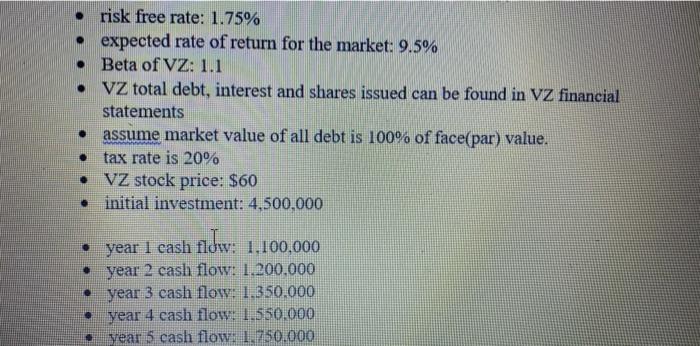

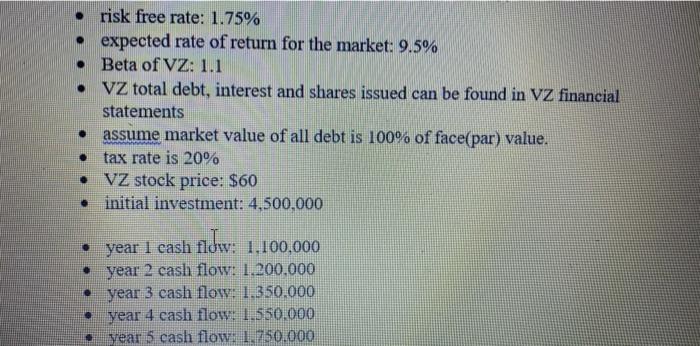

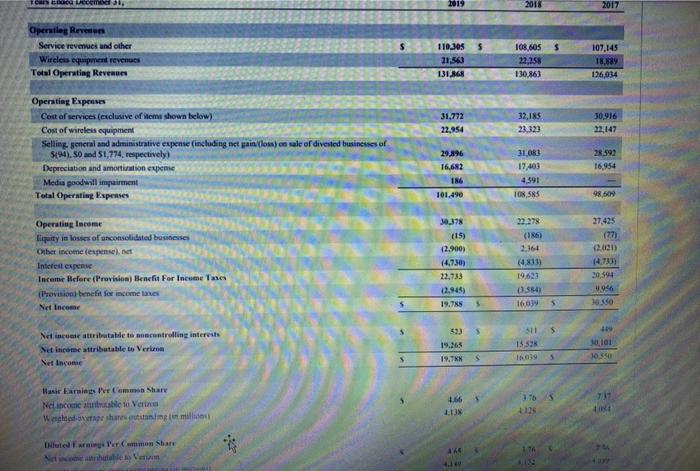

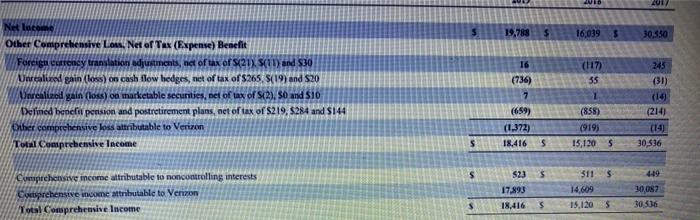

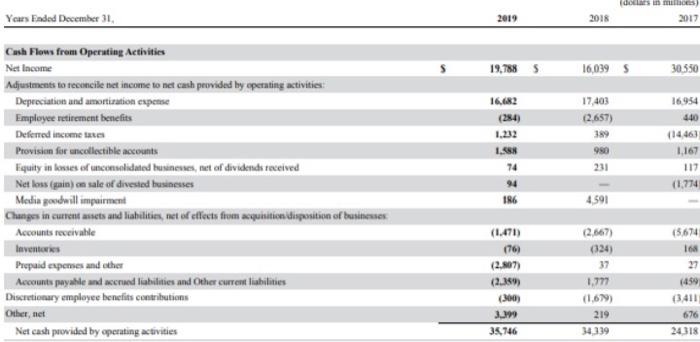

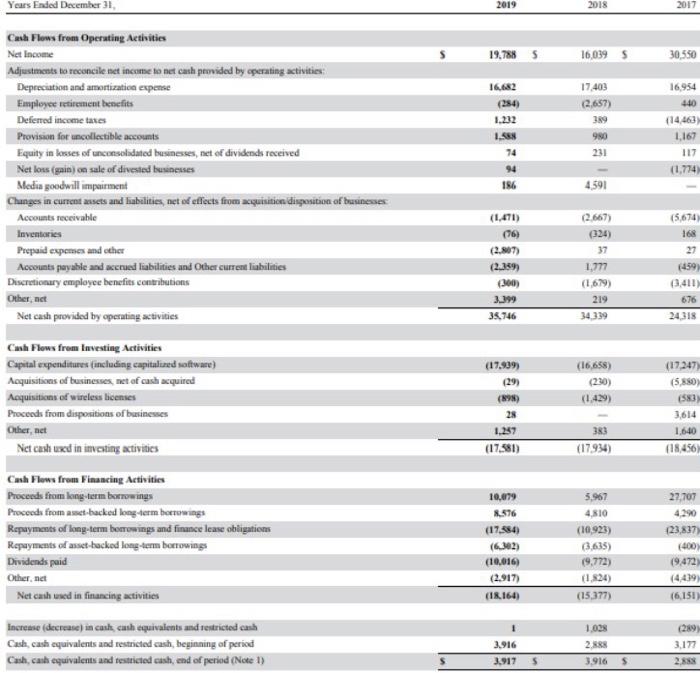

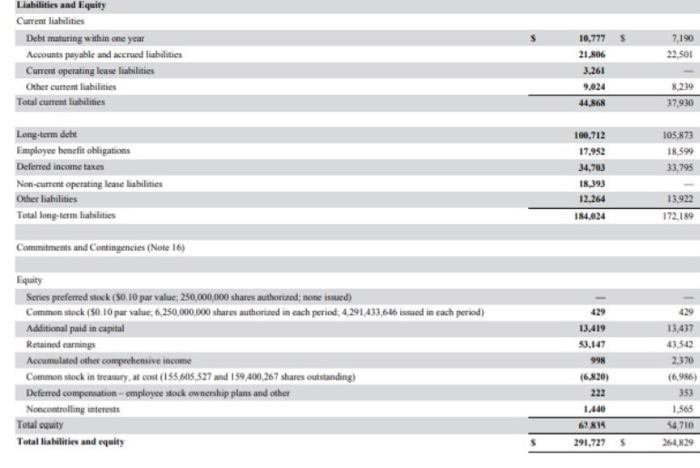

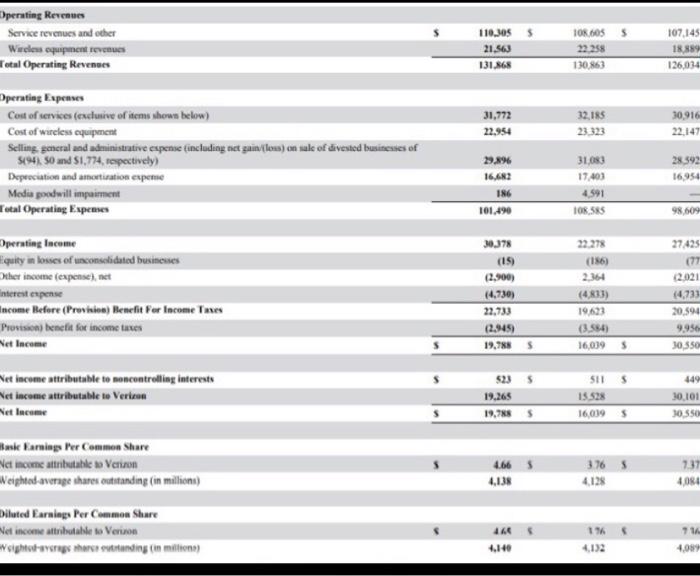

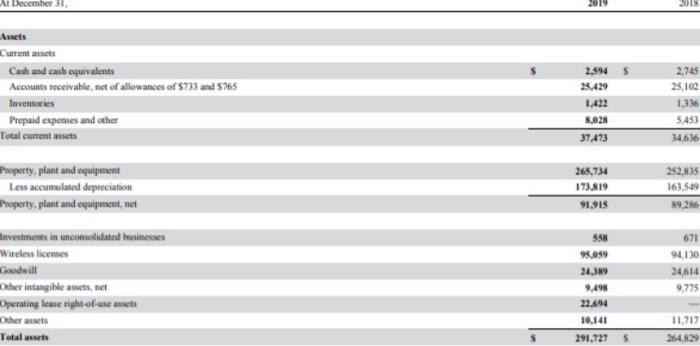

risk free rate: 1.75% expected rate of return for the market: 9.5% Beta of VZ: 1.1 VZ total debt, interest and shares issued can be found in VZ financial statements assume market value of all debt is 100% of face(par) value. tax rate is 20% VZ stock price: $60 initial investment: 4,500,000 . year 1 cash fld: 1.100,000 year 2 cash flow: 1.200.000 . year 3 cash flow: 1.350.000 year 4 cash flow: 1.550.000 Year 5 cash flow 150.000 Can En M2, 2019 2018 2017 S $ Operatieg Rerveen Service revenues and other Wireless equipment revenues Total Operating Revenues 110.305 21.563 131,368 108,05 22,258 130,863 107,145 18,689 126,034 31.772 22,954 32,185 23.323 30,916 22,147 Operating Express Cost of services (exclusive of items shown below) Cost of wireless equipment Selling general and administrative expense (including net painless) on sale of divented businesses of $94). 50 md 51 774, respectively) Depreciation and amortization expenie Media goodwill impairment Total Operating Expenses 28.592 16,954 29.896 16.62 186 101.490 31.0R3 17403 4.391 108,585 (186) Operating Income Equity in losses of unconsolidated businesses Other income espeelt Intereste Income Heere (Provision) Benefit For Income Taxes Provision benefit fe income taxes Net Income 30.37 (15) (2.900) (4.730) 22,733 (2.945) 19.75 27,425 (771 2,031 14.733 30.594 1956 (4801) 5 160 5 10:30 3 Net inse attributable to anacontrolling interests Net income attributable to Verizon Net Income 19.265 15325 16039 19.TR $ 1030 1.66 Wasir Erwings Per Share Nel con abbo Verin Wagame shares rutstanding in milli 125 4 Iluted in Permon Shar ** 12 doctors in mi Years Ended December 31, 2019 2018 2017 19,7885 16,0395 30.550 17,403 16954 440 (284) 1.232 1.68 74 94 186 389 930 231 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expetese Employee retirement benefits Deferred income taxes Provision for uncollectible accounts Fiquity in losses of uncomalidated businesses, met of dividends received Netloss (gain) on sale of divested businesses Media godwill impairment Changes in current assets and liabilities, net of effects from acquisitions disposition of businesses Accounts receivable Inventories Prepaid expenses and other Accounts payable and accrued liabilities and Other curren TO liabilities Discretionary employee benefits contributions Othernet Net cash powided by operating activities (1446) 1.167 117 (1.774 4,591 (1.471) (76) (2.807) (2.359) (2.667) (324) 37 1.777 (5674 16 27 (459 (3.411 676 24318 3299 35,746 219 34139 Years Ended December 31 2019 2018 2017 19,788 5 16,0395 30 550 16954 440 17.403 2,657) 389 980 (254) 1.232 1.588 74 94 186 (14463 1.167 117 (1.774 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization expense Employee retirement benefits Deferred income taxes Provision for uncollectible accounts Equity in losses of unconsolidated businesses, net of dividends received Net loss (gain) on sale of divested businesses Media goodwill impairment Changes in current assets and liabilities, net of effects from acquisition disposition of businesses Accounts receivable Inventories Prepaid expenses and other Accounts payable and accrued liabilities and Other current liabilities Discretionary employee benefits contributions Othernet Net cash provided by operating activities 231 4,591 (76) (2.667) (124) 37 1.777 (1.679) 219 34 339 (5.674 168 27 (459 (3,411) 676 (2.359) 3399 35.746 24318 (17.909) (230) (17,247 (5.880) (583 (893) 28 383 1.640 (18,456) (17.581) (17.934) Cash Flows from investing Activities Capital expenditures (including capitalized software) Acquisitions of businesses, net af cash acquired Acquisitions of wireless licenses Proceeds from dispositions of businesses Othernet Net cash used in investing activities Cash Flows from Financing Activities Proceeds from long term borrowings Proceeds from amet-backed long-term boererwings Repayments of long-term borrowings and finance lease obligations Repayments of asset backed long-term borrowings Dividends paid Othernet Net cash used in financing activities 10.079 R_576 (17884) 5,967 4.810 (10,923) (3,635) (9.772) 27,707 4.290 23,837) (400) (9.472) (4419) (6151) (10,016) (2.917) (18.164) (15.377) 1 increase (decrease) in cash cash equivalents and restricted cash Cash, cash equivalents and restricted cash, beginning of period Cash, cash equivalents and restricted cash and of period (Note 1) 3.916 3.917 1.008 2.888 3.916 29 3.177 2.888 S s Liabilities and Equity Current liabilities | Debt maturing within one yem Accounts payable and accrued liabilities Current operating lease liabilities Other current liabilities Tatal current limbilities 7.190 22501 10,777 21.06 3.261 9,024 8.2.19 44.86 37.930 105,873 18599 33,795 Long-term dele Employee benefit obligations Deferred income taxes Nan-cument operating lane liabilities Other liabilities Total long-term liabilities 100,712 17.952 34,703 18393 12,264 184,034 13922 172.189 Commitments and Contingencies (Note 16) 429 13,437 Equity Series preferred stock (50.10 par value: 250,000,000 shares authorized mene inued) Commen stock (50.10 par value: 6,250,000,000 shares authorised in each period: 4,291 433,646 issued in each period) Additional paid in capital Retained earnings Accumulated other comprehensive income Common stock in treasury, at cost (155.605 327 and 159,400,267 shares outstanding) Defierod compensation employee sock ownership plans and other Noncontrolling interests Total cquity Total liabilities and equity 429 13,419 53.147 99 43.542 2.370 (6,820) (696) 353 1.440 6835 291,727 1.565 54.710 264.829 5 Operating Revenues Service revenues and other Wireless oppment revues Hotel Operating Revenues 110.305 21,563 131.868 10.605 22 258 130,863 107.145 18.889 126,034 31,772 22.954 32,185 23.323 30,916 22,147 Operating Expenses Cost of services (exclusive of items shown below) Cost of warcles equipment Selling general and administrative expense (including niet zainles) on sake of divested businesses of 51942. 50 and 51,774, respectively) Depreciation and amortiration expene Media poodwill impaimen Total Operating Expenses 29.896 28.392 16954 31,683 17.403 4.591 IOR SRS 186 101,490 98 609 27,423 30.378 (159 Operating Income Equity in losses of unconsolidated businesses Other income (expense), et interest eapese Income Before (Provision) Benefit For Income Tones Provision) benefit for income taxes Net Income (4.730) 22,733 (2.9499 19,785 22.278 (186) 2.364 (4.833) 19633 (3.586) 16,0395 (2021 (473) 20.594 9,950 $ 30,350 511 449 et income attributable to non controlling interests Net income attributable to Verin Net Income 19.265 19,75 15.528 16,019 30.101 OSSO Raske Karnings Per Common Share Net income attributable to Venicon Weighted average shares outifanding (in millions) 4.665 4,138 3.76 5 4.128 7.31 4084 Diluted Earnings Per Common Share Net income attributable to Verion Weightorage share trending in millione) 466 11 4132 714 4,089 4.140 Ar December 2018 Assets Current assets Cash and cash equivalents Accounts receivable, net of allowances of 5733 and 5765 Inventories Prepaid expenses and other Total current sets 2.394 25.429 1.422 8.028 37.473 2.745 25,102 1,336 5,453 14,636 Property, plant and equipment less accumulated depreciation Property, plant and equipment, net 265,734 173,819 91915 25235 161,349 89286 Investments in unconsolidated businesses Wireless licenses 671 94,130 24,614 9775 24.389 9.49 22.694 Other intangible amets, net Operating Seuse right of us at ther assets Total acts 10,141 291,727 11,717 264,829