please help really struggling to understand this question

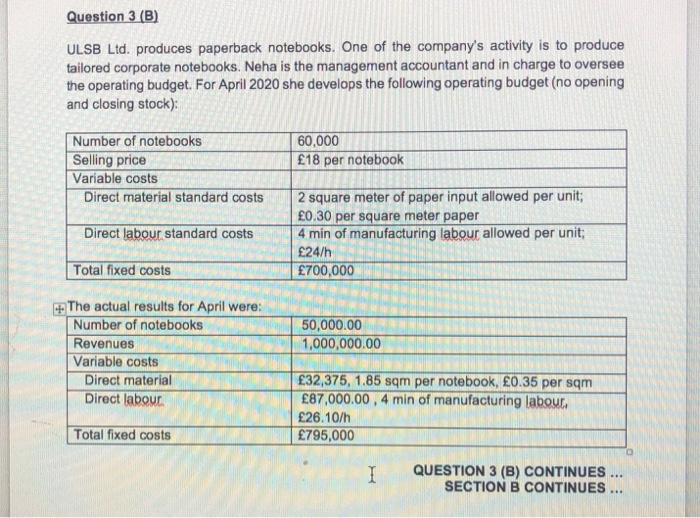

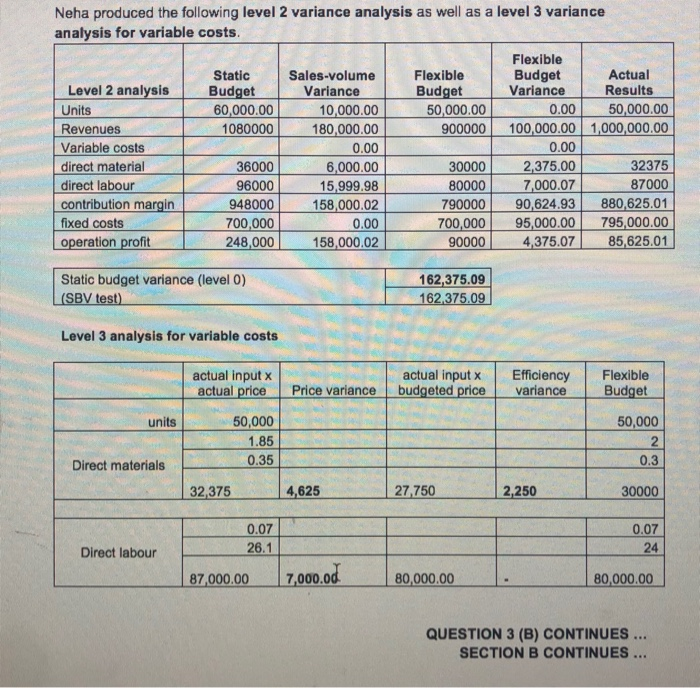

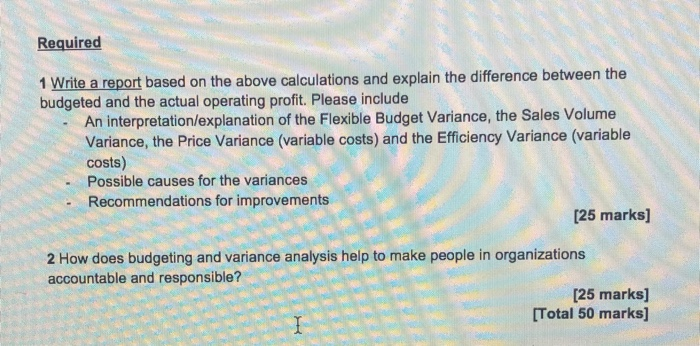

Question 3 (B) ULSB Ltd. produces paperback notebooks. One of the company's activity is to produce tailored corporate notebooks. Neha is the management accountant and in charge to oversee the operating budget. For April 2020 she develops the following operating budget (no opening and closing stock): 60,000 18 per notebook Number of notebooks Selling price Variable costs Direct material standard costs Direct labour standard costs 2 square meter of paper input allowed per unit; 0.30 per square meter paper 4 min of manufacturing labour allowed per unit; 24/h 700,000 Total fixed costs 50,000.00 1,000,000.00 The actual results for April were: Number of notebooks Revenues Variable costs Direct material Direct labour 32,375, 1.85 sqm per notebook, 0.35 per sqm 87,000.00, 4 min of manufacturing labour. 26.10/h 795,000 Total fixed costs I QUESTION 3 (B) CONTINUES. SECTION B CONTINUES ... Neha produced the following level 2 variance analysis as well as a level 3 variance analysis for variable costs. Static Budget 60,000.00 1080000 Flexible Budget 50,000.00 900000 Actual Results 50,000.00 1,000,000.00 Level 2 analysis Units Revenues Variable costs direct material direct labour contribution margin fixed costs operation profit Flexible Budget Variance 0.00 100,000.00 0.00 2,375. 00 7,000.07 90,624.93 95,000.00 4,375.07 Sales-volume Variance 10,000.00 180,000.00 0.00 6,000.00 15,999.98 158,000. 02 0.00 158,000. 02 36000 96000 948000 700,000 248,000 30000 80000 7 90000 700,000 9 0000 3 2375 87000 880,625.01 795,000.00 85,625.01 Static budget variance (level 0) (SBV test) 162,375.09 162.375.09 Level 3 analysis for variable costs actual input x actual price actual input x budgeted price Efficiency variance Flexible Budget Price variance units 50.000 50,000 1. 852 0.35 0.3 Direct materials 32,3754 ,625 2 7,750 2,250 30000 0.07 0.07 26.1 Direct labour 87,000.00 7,000.00 80,000.00 80,000.00 QUESTION 3 (B) CONTINUES ... SECTION B CONTINUES ... Required 1 Write a report based on the above calculations and explain the difference between the budgeted and the actual operating profit. Please include An interpretation/explanation of the Flexible Budget Variance, the Sales Volume Variance, the Price Variance (variable costs) and the Efficiency Variance (variable costs) Possible causes for the variances Recommendations for improvements [25 marks] 2 How does budgeting and variance analysis help to make people in organizations accountable and responsible? [25 marks] [Total 50 marks]