Answered step by step

Verified Expert Solution

Question

1 Approved Answer

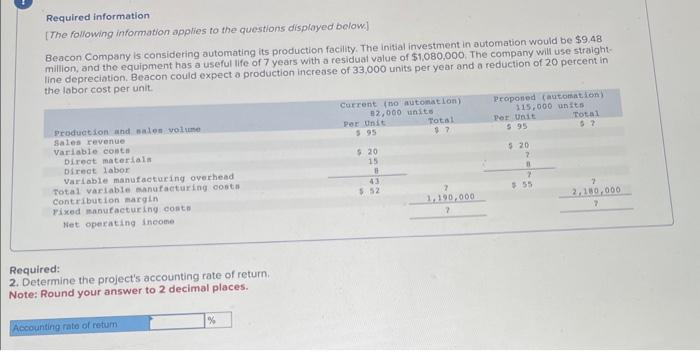

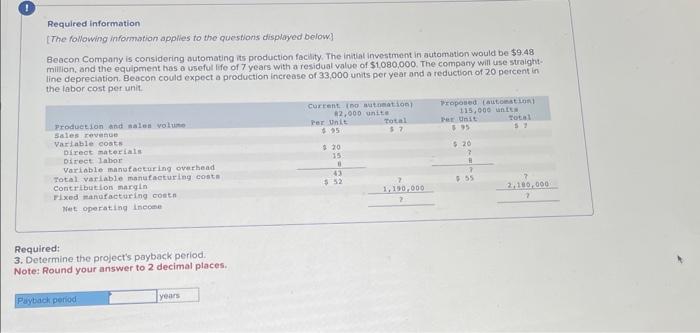

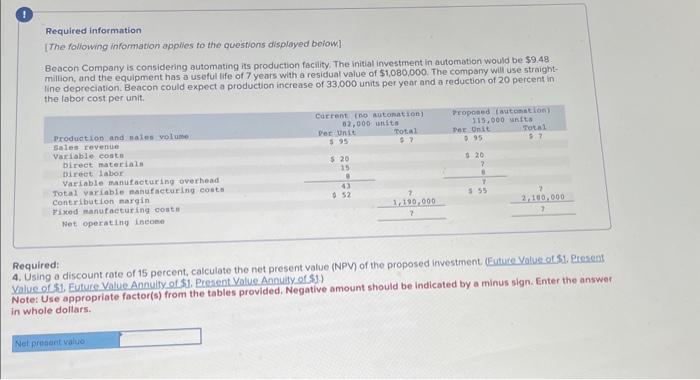

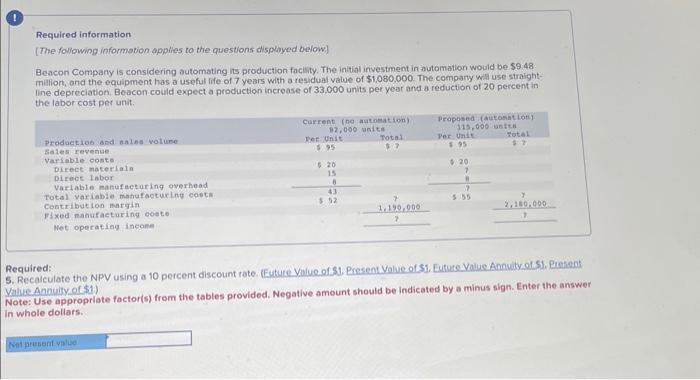

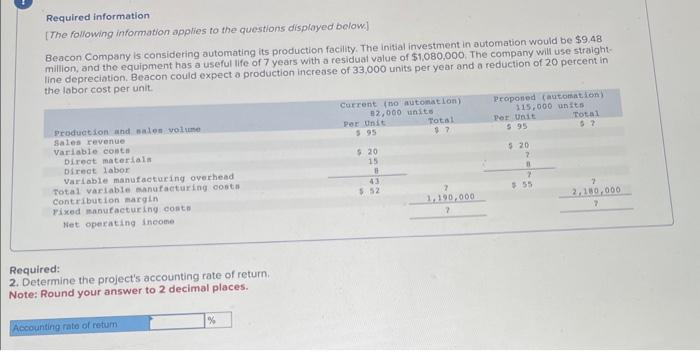

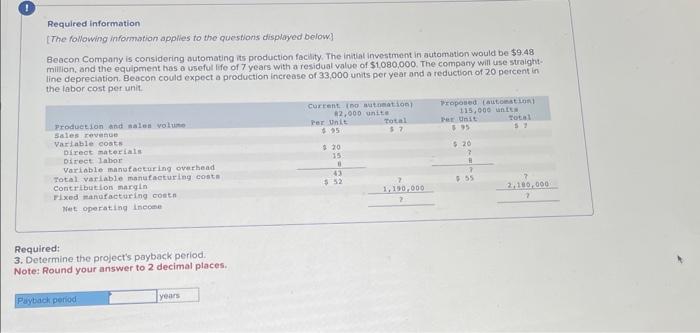

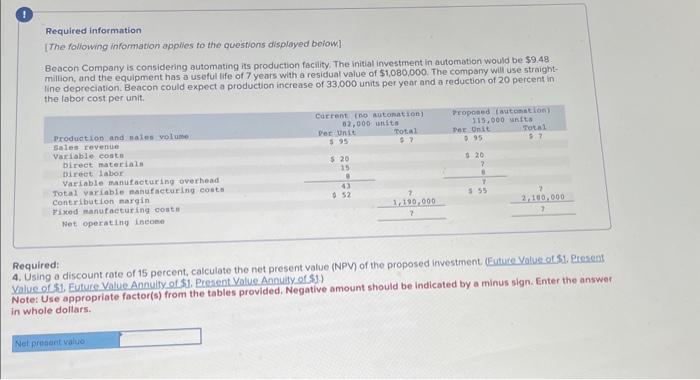

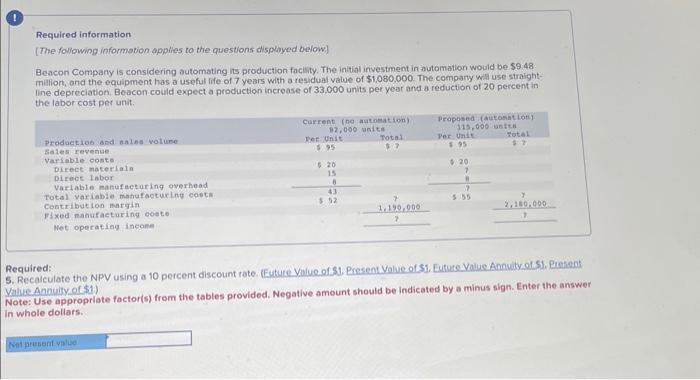

please help! Required information [The following information applies to the questions disployed below] Beacon Company is considering automating its production facility. The initial investment in

please help!

Required information [The following information applies to the questions disployed below] Beacon Company is considering automating its production facility. The initial investment in automation would be $9.48 line depreciation. Beacon could expect a production increase of 33,000 units per year and a reduction of 20 percent in the labor cost per unit. Required: 2. Determine the project's accounting rate of return. Note: Round your answer to 2 decimal places. Required information [The following information applies to the questions displayed below] Beacon Company is considering automating its production faclity. The invital investment in autamation would be $9.48 million, and the equipment has a useful life of 7 years with a residual value of $1.080.000. The company will use staightline depreciation. Beacon could expect a production increase of 33,000 units per year and a reduction of 20 percent in the labor cost per unit Required: 3. Determine the project's payback period. Note: Round your answer to 2 decimal places. Required information [The following information applies to the questions disployed beiow] Beacon Company is considering automating its production facility. The initial investment in automation would be $9.48 miltion, and the equipment has a useful life of 7 years with a residual value of $1,080,000. The company will use straight line depreciation. Beacon could expect a production increase of 33,000 units per year and a reduction of 20 percent in the labor cost per unit. Negative amount should be indicated by a minus sign. Enter the answet lote: Use appropriate factor(s) from the tables provided. Negati) Required information [The following information applies to the questions displayed below] Beacon Company is considering automating its production facility. The initial investment in automation would be $9.48 mlilion, and the equipment has a useful life of 7 years with a residual value of $1,080.000. The company wil use straightline depreciation. Beacon could expect a production increase of 33,000 units per year and a reduction of 20 percent in the labor cost per unit. Required: Note: Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer Aalue Annuity of $11) n whole dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started