Answered step by step

Verified Expert Solution

Question

1 Approved Answer

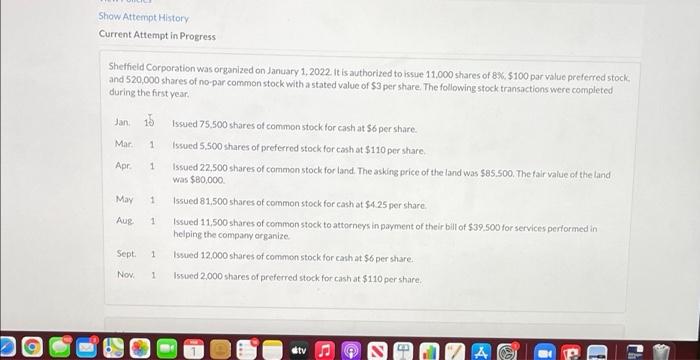

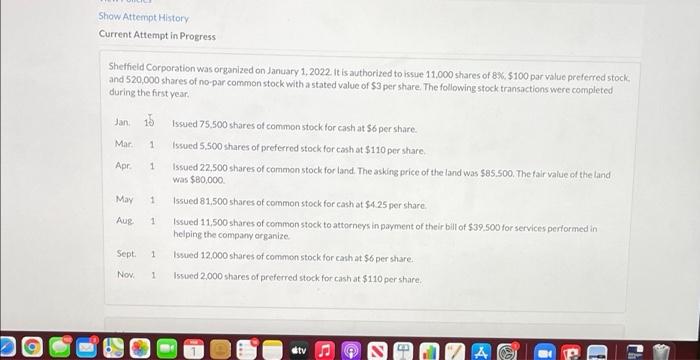

please help Show Attempt History Current Attempt in Progress Sheffield Corporation was organized on January 1, 2022. It is authorized to issue 11,000 shares of

please help

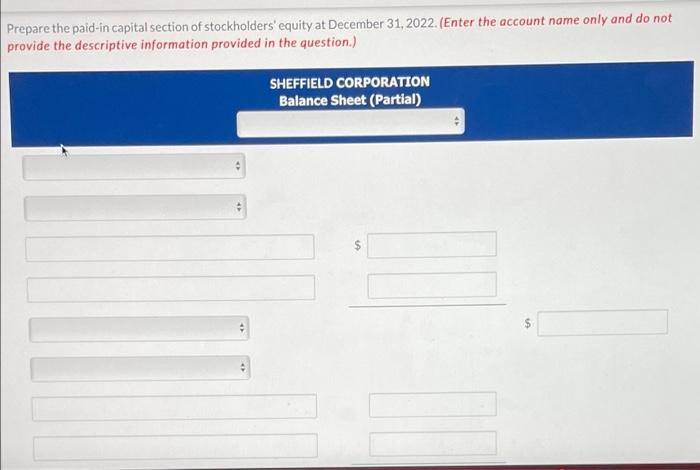

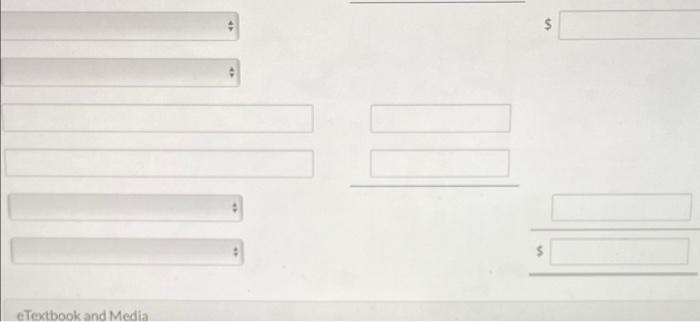

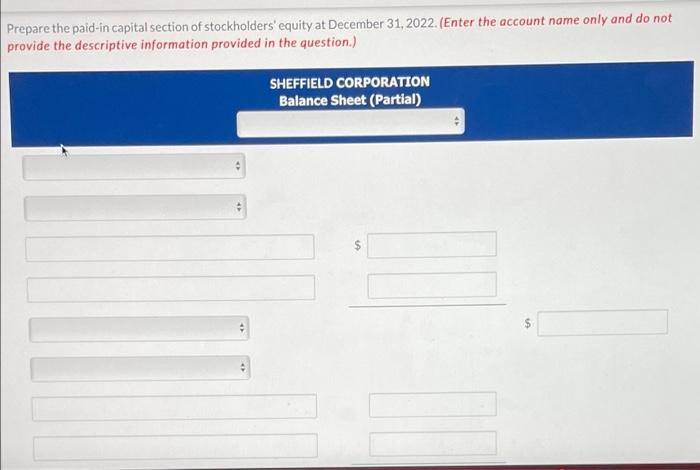

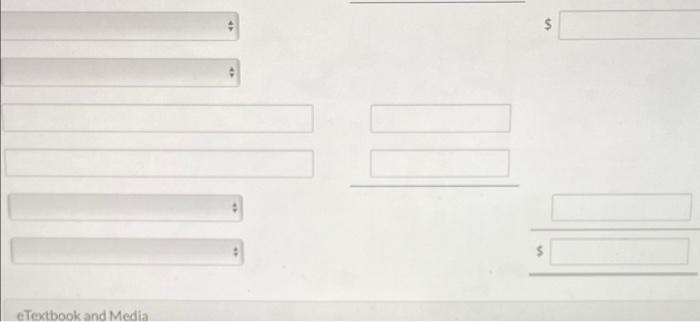

Show Attempt History Current Attempt in Progress Sheffield Corporation was organized on January 1, 2022. It is authorized to issue 11,000 shares of 8% $100 par value preferred stock and 520,000 shares of no-par common stock with a stated value of $3 per share. The following stock transactions were completed during the first year Jan 15 Mar 1 Apr 1 May 1 Issued 75,500 shares of common stock for cash at S per share Issued 5.500 shares of preferred stock for cash at $110 per share. Issued 22,500 shares of common stock for land. The asking price of the land was $85.00. The fair value of the land was $80,000 Issued 81,500 shares of common stock for cash at $4.25 per share Issued 11,500 shares of common stock to attorneys in payment of their bill of $39.500 for services performed in helping the company organize Issued 12,000 shares of common stock for cath at 56 per share Issued 2,000 shares of preferred stock for cash at $110 per share. Aug 1 Sept 1 NON 1 dtv A Prepare the paid-in capital section of stockholders' equity at December 31, 2022. (Enter the account name only and do not provide the descriptive information provided in the question.) SHEFFIELD CORPORATION Balance Sheet (Partial) $ $ $ e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started