Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help. show work if possible please 2. PHB Company currently sells for $32.50 per share. In an attempt to determine whether PHB is fairly

Please help. show work if possible please

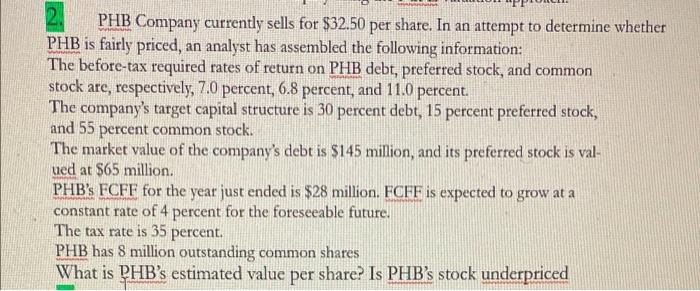

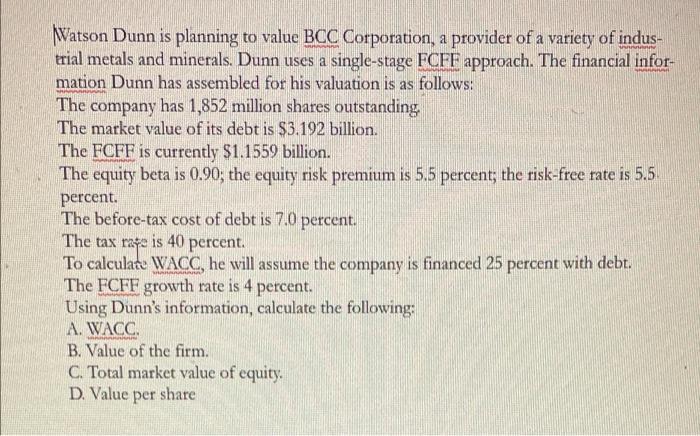

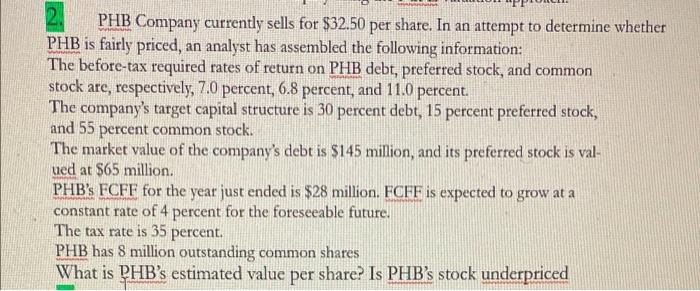

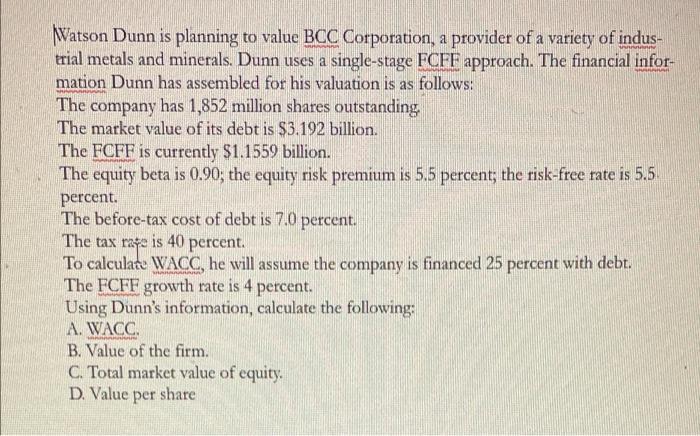

2. PHB Company currently sells for $32.50 per share. In an attempt to determine whether PHB is fairly priced, an analyst has assembled the following information: The before-tax required rates of return on PHB debt, preferred stock, and common stock are, respectively, 7.0 percent, 6.8 percent, and 11.0 percent. The company's target capital structure is 30 percent debt, 15 percent preferred stock, and 55 percent common stock. The market value of the company's debt is $145 million, and its preferred stock is valued at $65 million. PHB's FCFF for the year just ended is $28 million. FCFF is expected to grow at a constant rate of 4 percent for the foreseeable future. The tax rate is 35 percent. PHB has 8 million outstanding common shares What is PHB's estimated value per share? Is PHB's stock underpriced Watson Dunn is planning to value BCC Corporation, a provider of a variety of industrial metals and minerals. Dunn uses a single-stage FCFF approach. The financial information Dunn has assembled for his valuation is as follows: The company has 1,852 million shares outstanding The market value of its debt is $3.192 billion. The FCFF is currently $1.1559 billion. The equity beta is 0.90; the equity risk premium is 5.5 percent; the risk-free rate is 5.5. percent. The before-tax cost of debt is 7.0 percent. The tax mo is 40 percent. To calculat WACC, he will assume the company is financed 25 percent with debt. The FCFF growth rate is 4 percent. Using Dunn's information, calculate the following: A. WACC. B. Value of the firm. C. Total market value of equity. D. Value per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started