Answered step by step

Verified Expert Solution

Question

1 Approved Answer

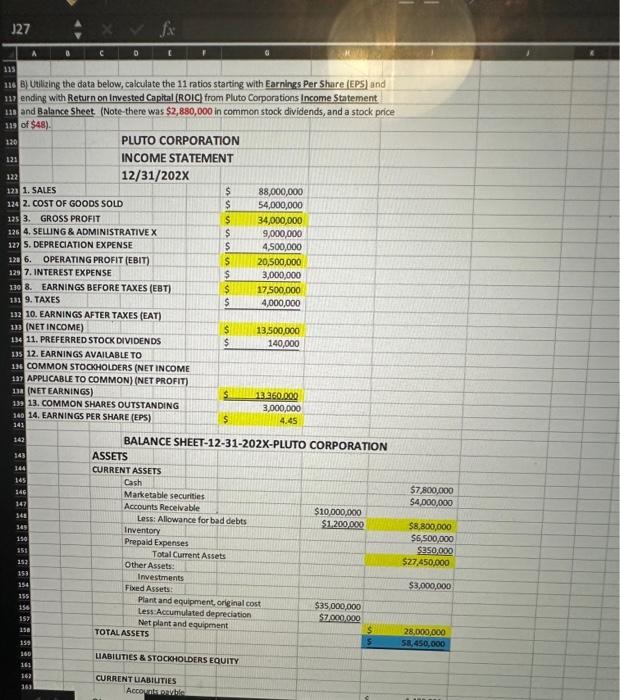

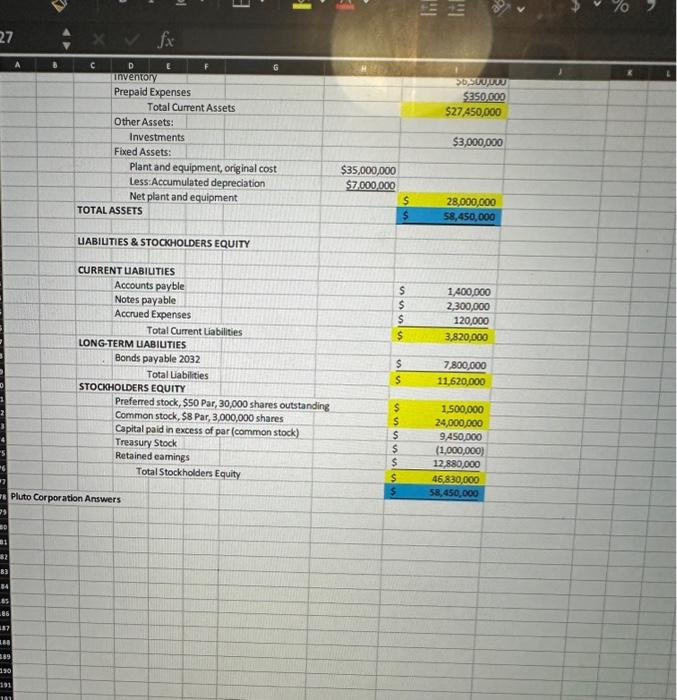

please help solve B) Uallizing the data below, calculate the 11 ratios starting with Earnings Per Share (EPS) and ending with Return on Imvested Capital

please help solve

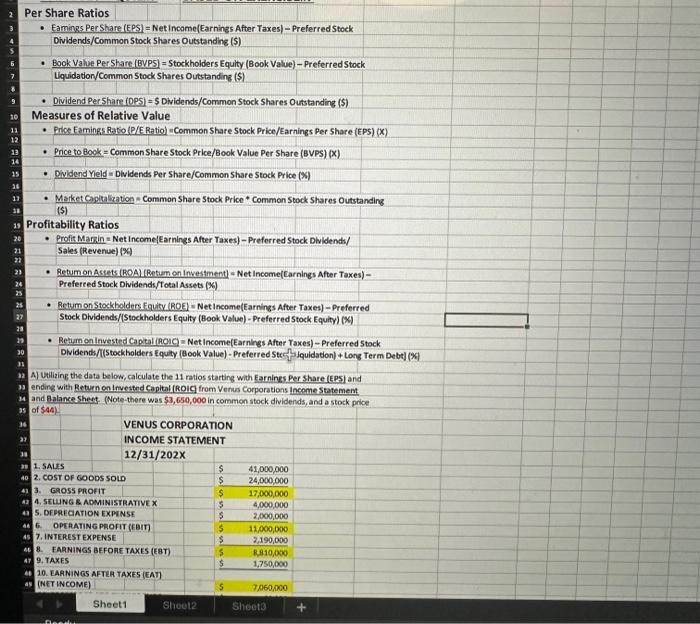

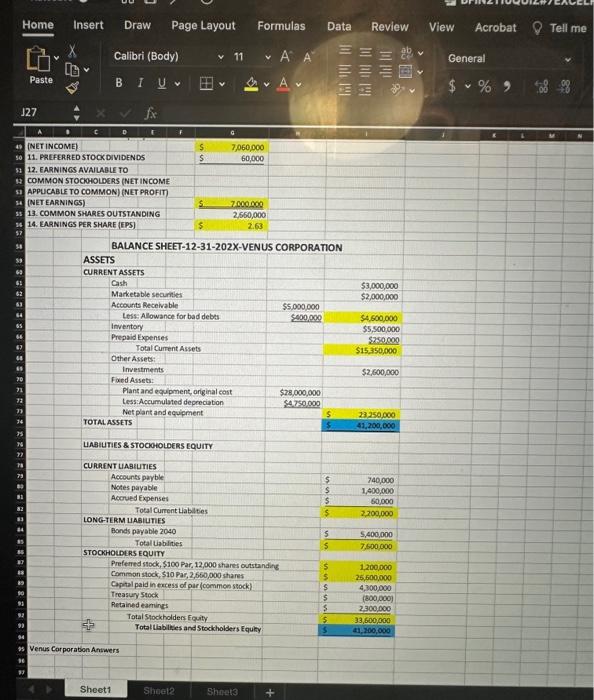

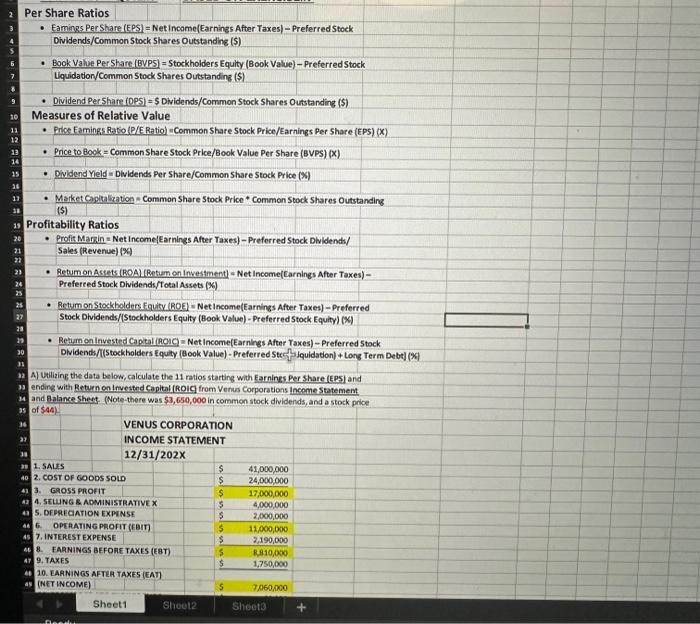

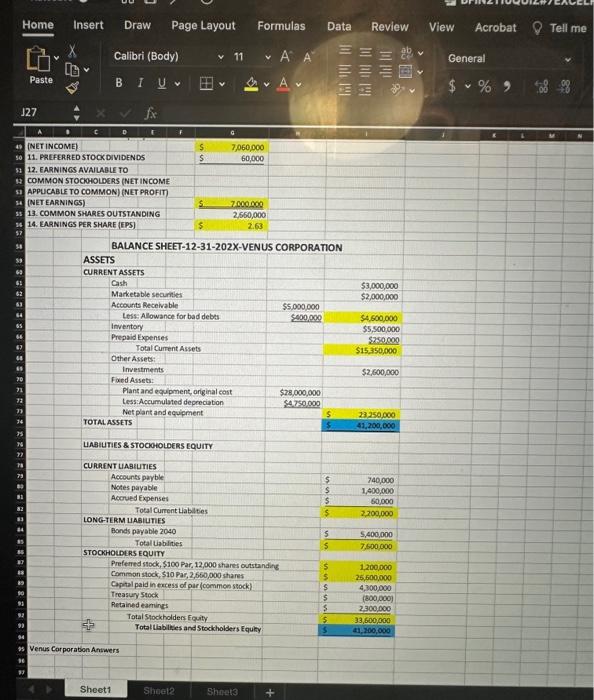

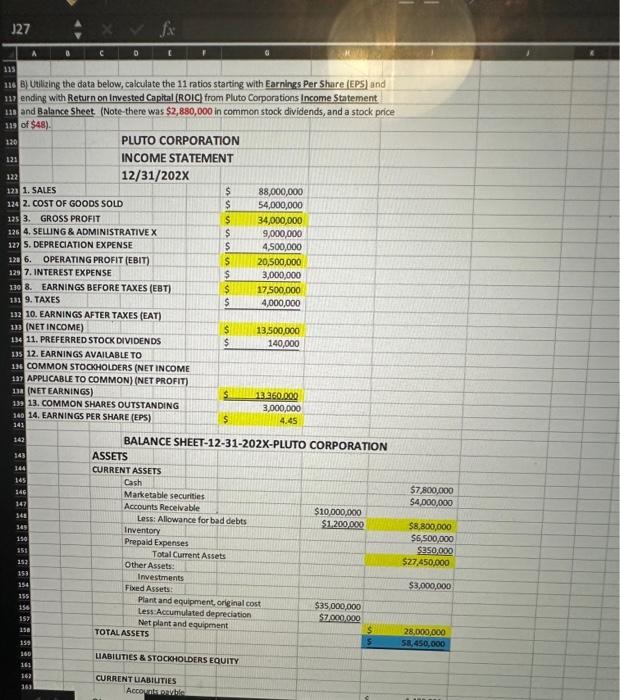

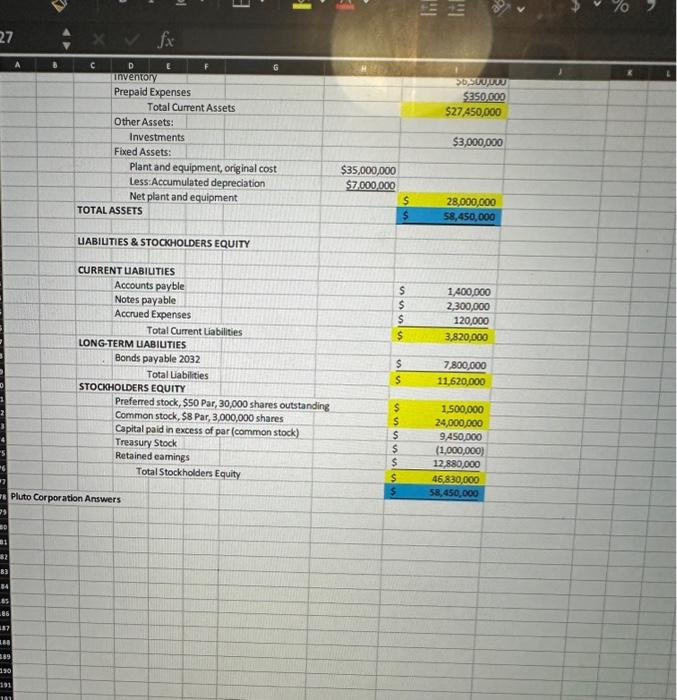

B) Uallizing the data below, calculate the 11 ratios starting with Earnings Per Share (EPS) and ending with Return on Imvested Capital (ROIC) from Pluto Corporations Income Statement. and Balance $ heet. (Note-there was $2,880,000 in common stock dividends, and a stock price Per Share Ratios - Eaminzs Per Share (EPS) = Net income(Earnings After Taxes) - Preferred Stock Dividends/Common Stock Shares Outstanding (\$) - Book Value PerSShare (BVPS) = Stockholders Equity (Book Value) - Preferred Stock Uquidation/Common Stock Shares Outstanding (\$) - Dividend Per Share (DPS) =\$ Dividends/Common Stock Shares Outstanding (\$) Measures of Relative Value - Proc Eamings Ratio (P/E Ratio) =Common Share Stock Price/Earnings Per Share (EPS) (X) - Price to Book = Common Share Stock Price/Book Value Per Share (BVPS) (X) - Dividend Yield = Dividends Per Share/Common Share Stock Price (X) - Market Capitalkation = Common Share Stock Price * Common Stock Shares Outstanding (\$) Profitability Ratios - Profit Marsin= Net Income[Earnings After Taxes)-Preferred Stock Dividends/ 21 Sales (Revenue) ( % ) 23 - Retumon Astets (ROA) (Retum en investment) = Net Income(Earnings After Taxes) - 2324 Preferred Stock Dhidends/Total Assets ( X ) - RetumonStockholdens Equity (ROE) = Net Income(Earnings After Taxes)-Preferred Stock Dhvidends/(Stockholders Equity (Book Value) - Preferred Stock Equity) (X) - Retimealinvested Capital (ROAC) = Net income(Earnings After Taxes) - Preferred 5 tock A) Utilizing the data below, calculate the 11 ratios starting with Earninss Per share (EPS) and 3 ending with Return on investend Capital (ROIC from Venus Corporations Inceme Statement. i4 and Balance Shest. (Note-there was $3,650,000 in common stock dhidends, and a stock price 35 of $44/2 40. COST OF COODS SOLD 41. 3. GaOss PROEIT 41 4. SEUNG \& ADMINISTRATIVE X 4. 5. DFBREGATION EXPINSE. 4. 6. OPERATING PROFIT (EBIT) 45 7. INTEREST EXPENSE 44 8. EAANINGS BEFOHE TAKES (EBT) 47 9. TAXES 4. 10. EARNINGS AFTEA TAXES [EAT] 4. (NET INCOME) VENUS CORPORATION INCOME STATEMENT 12/31/202X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started