Answered step by step

Verified Expert Solution

Question

1 Approved Answer

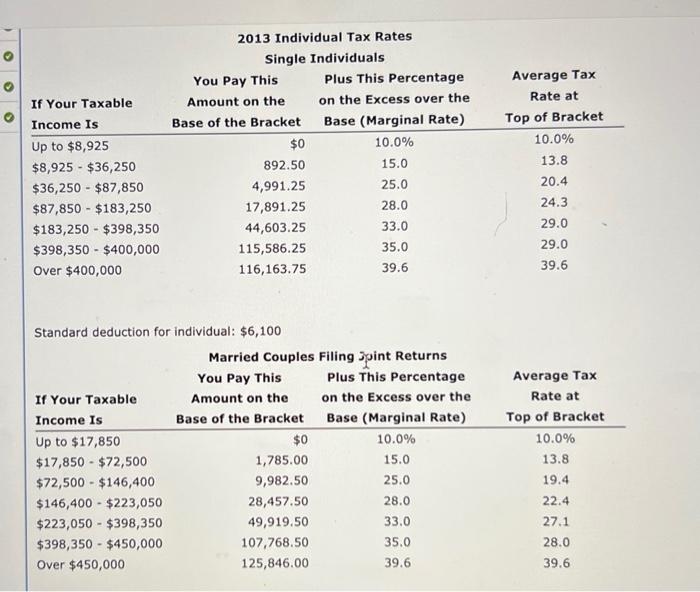

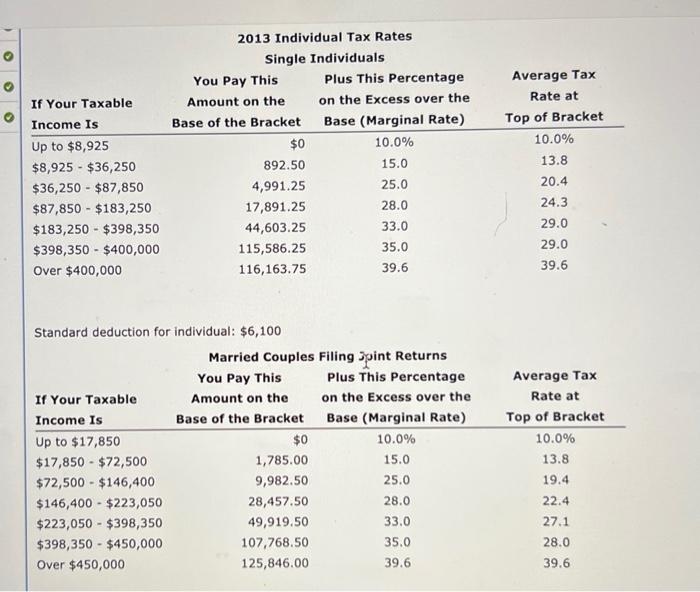

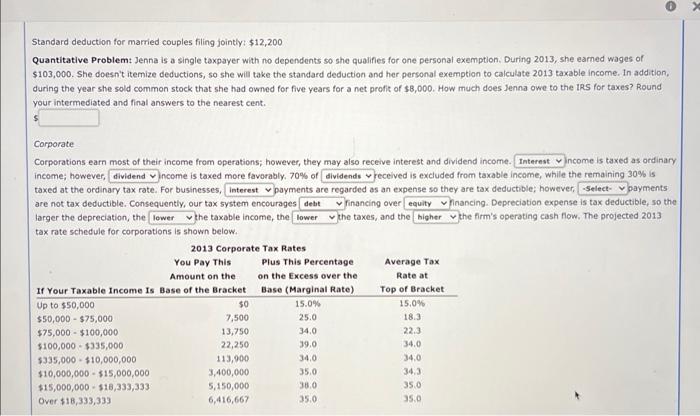

please help solve hw! ill leave a like! Standard deduction for individual: $6,100 Standard deduction for married couples filing jointly: $12,200 Quantitative Problem: Jenna is

please help solve hw! ill leave a like!

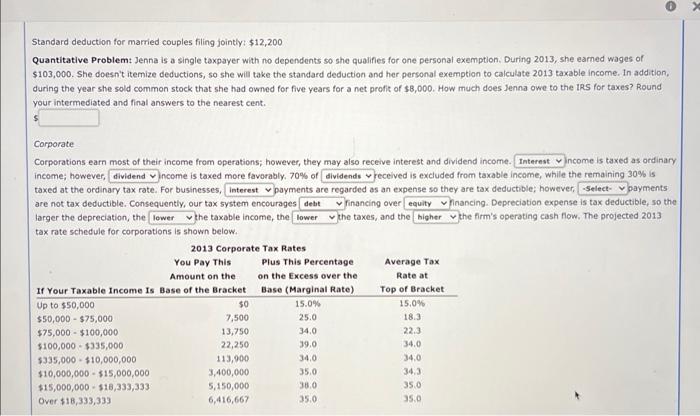

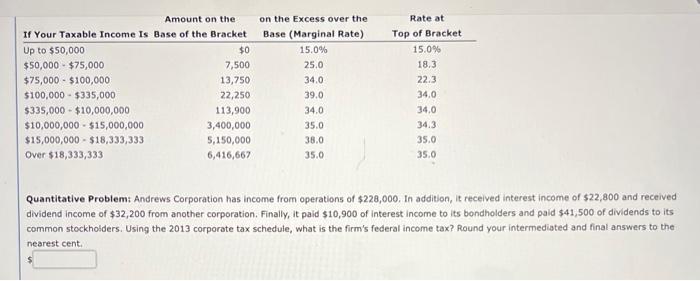

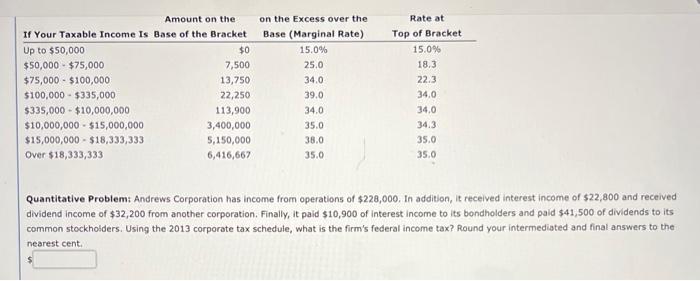

Standard deduction for individual: $6,100 Standard deduction for married couples filing jointly: $12,200 Quantitative Problem: Jenna is a single taxpayer with no dependents so she qualifies for one personal exemption. During 2013 , she eamed wages of $103,000. She doesn't itemize deductions, so she will take the standard deduction and her personal exemption to calculate 2013 taxable income. in addition, during the year she sold common stock that she had owned for five years for a net profit of $8,000. How much does lenna owe to the IRS for taxes? Round your intermediated and final answers to the nearest cent. 5 Corporate Corporations earn most of their income from operations; however, they may also receive interest and dividend income. income; however, ncome is taxed more favorably. 70% of eceived is excluded from taxable income, while the remaining 30% is taxed at the ordinary tax rate. For businesses, sayments are regarded as an expense so they are tax deductible; however, payments are not tax deductible. Consequently, our tax system encourages financing over inancing. Depreciation expense is tax deductible, so the larger the depreciation, the he taxable income, the - the firm's operating cash flow. The projected 2013 tax rate schedule for corporations is shown below. Quantitative Problem: Andrews Corporation has income from operations of $228,000, In addition, it received interest income of $22,800 and received dividend income of $32,200 from another corporation. Finally, it paid $10,900 of interest income to its bondholders and paid $41,500 of dividends to its common stockholders. Using the 2013 corporate tax schedule, what is the firm's federal income tax? Round your intermediated and final answers to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started