Answered step by step

Verified Expert Solution

Question

1 Approved Answer

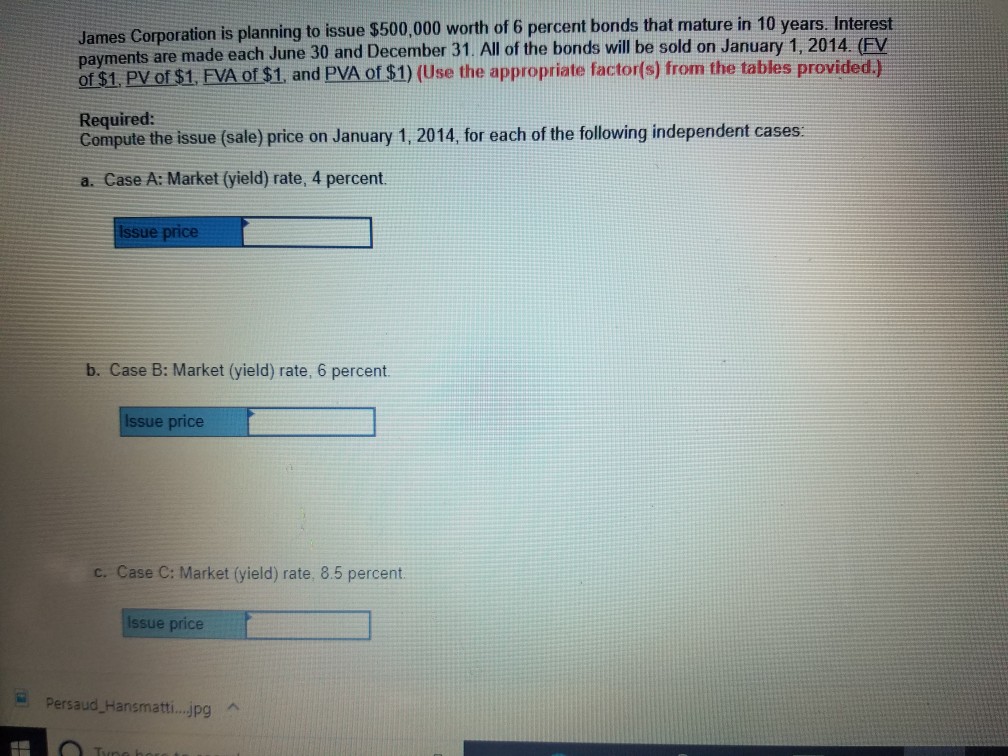

Please help solve part A. thanks orporation is planning to issue $500,000 worth of 6 percent bonds that mature in 10 years Interest payments are

Please help solve part A. thanks

orporation is planning to issue $500,000 worth of 6 percent bonds that mature in 10 years Interest payments are made each June 30 and December 31. All of the bonds will be sold on January 1, 2014. (FV of S1. PV of S1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Required: Compute the issue (sale) price on January 1, 2014 for each of he flowng indedent cases a. Case A: Market (yield) rate, 4 percent. b. Case B: Market (yield) rate, 6 percent. Issue price c. Case C: Market (yield) rate, 8.5 percent. sue price ?? Persaud-Hansmatti jpg ^

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started