Answered step by step

Verified Expert Solution

Question

1 Approved Answer

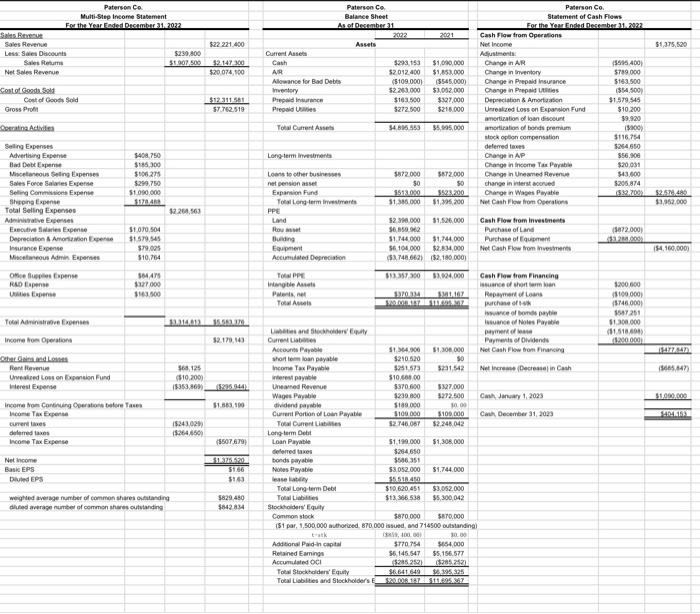

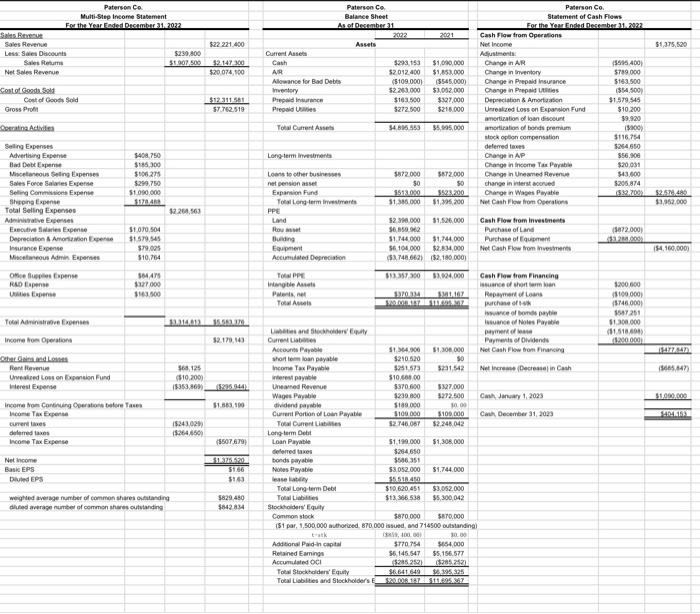

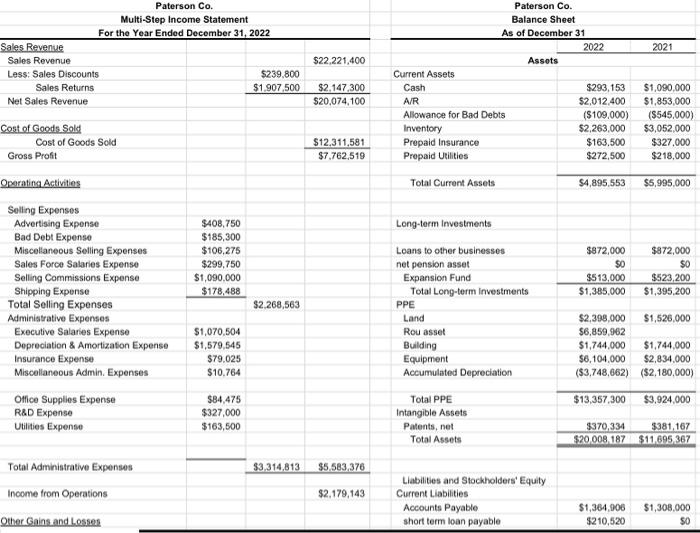

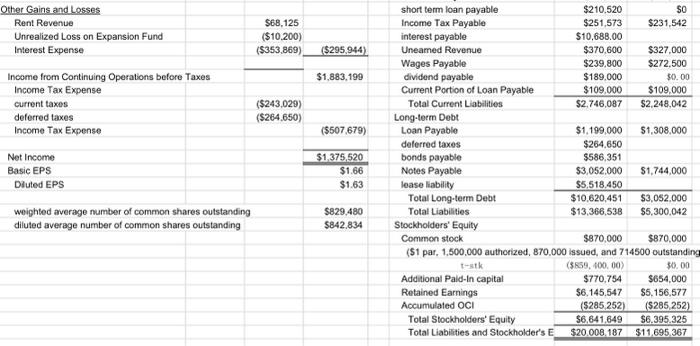

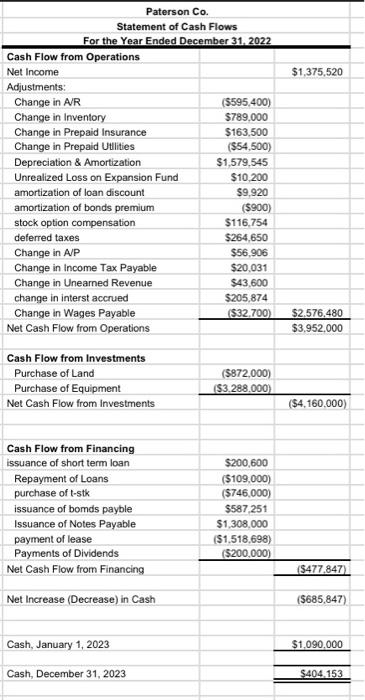

please help switch the cash flow statement from Indirect Method Statement of Cash Flows to a Direct Method Statement As a relatively new public corporation,

please help switch the cash flow statement from Indirect Method Statement of Cash Flows to a Direct Method Statement

As a relatively new public corporation, Paterson still has several large investors that hold seats on its Board and have significant control over the companys decisions. These investors have expressed concern with the companys new Indirect Method Statement of Cash Flows and have asked the management team to switch to a Direct Method Statement with the required Schedule to Reconcile Net Income to Cash Provided from Operations. Because of the influence of these investors, Patersons management team has no choice but to agree with their request (although, they arent thrilled with the extra work this change will cause). They have asked you to convert the current Statement of Cash Flows into a Direct Method version. The management team has decided to condense the line items used in the CFO section to include only seven (7) lines: Customers, Inventory, Selling Expenses, Administrative Expenses, Rent, Interest, and Taxes

3. As you start preparing the new Statement Cash Flows, keep in mind that not only will the Cash Flows from Investing and Cash Flows from Financing section stay exactly the same as they were in the last Paterson, but you already have all of the necessary adjustments calculated for the Cash Flows from Operating Activities section. Remember, it balances using the numbers from the last Paterson! All you need to do is match those adjustments up with the accrual numbers to get the cash flows numbers, using the worksheet for CFO we studied in Step 3 of creating the Statement of Cash Flows. Remember, use ALL of the adjustments listed in the last Paterson with their EXACT numbers and your new Direct Method Statement of Cash Flows will balance perfectly!

4. Cash Paid for Selling Expenses should be the sum of the cash flows for advertising, miscellaneous selling expenses, sales force salaries, selling commissions, and shipping. Cash Paid for Administrative Expenses should be the sum of the cash flows for executive salaries, pensions, insurance, miscellaneous administrative expenses, office supplies, R&D, and utilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started