Answered step by step

Verified Expert Solution

Question

1 Approved Answer

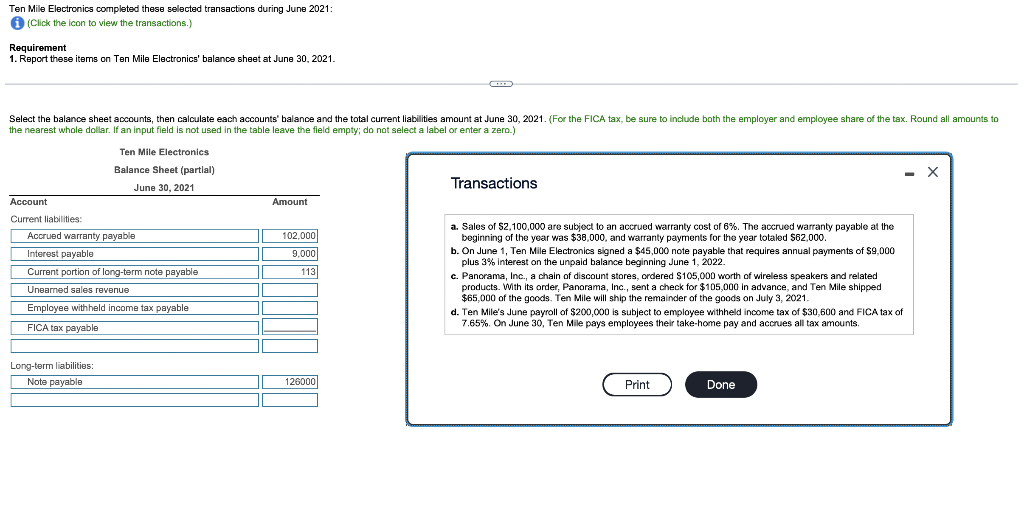

please help Ten Mile Electronics completed these selected transactions during June 2021: (Click the icon to view the transactions.) Requirement 1. Report these items on

please help

Ten Mile Electronics completed these selected transactions during June 2021: (Click the icon to view the transactions.) Requirement 1. Report these items on Ten Mile Electronics' balance sheet at June 30, 2021. the nearest whole dollar. If an input field is not used in the table leave the field empty; do not select a label or enter a zero.) Transactions a. Sales of $2,100,000 are subject to an accrued warranty cost of 6%. The accrued warranty payable at the beginning of the year was $38,000, and warranty payments for the year totaled $62,000. b. On June 1, Ten Mile Electronics signed a $45,000 note payable that plus 3% interest on the unpaid balance beginning June 1,2022 . plus 3% interest on the unpaid balance beginning June 1,2022 . c. Panorama, Inc., a chain of discount stores, ordered $105,000 worth of wireless speakers and related products. With its order, Panorama, Inc., sent a check for $105,000 in advance, and Ten Mile shipped $65,000 of the goods. Ten Mille will ship the remainder of the goods on July 3,2021 . d. Ten Mille's June payroll of $200,000 is subject to employee withheld income tax of $30,600 and FICA tax of 7.65%. On June 30, Ten Mile pays employees their take-home pay and accrues all tax amountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started