Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Teresa drove a company car 15,000 personal kilometres in 2015. The total kilometres driven for the year were 25,000 kilometres. The actual operating

please help

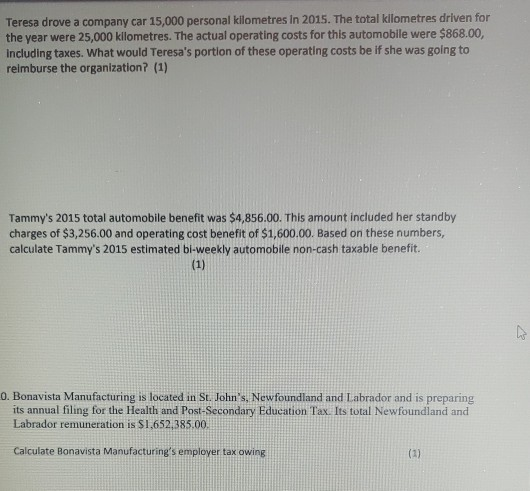

Teresa drove a company car 15,000 personal kilometres in 2015. The total kilometres driven for the year were 25,000 kilometres. The actual operating costs for this automobile were $868.00, including taxes. What would Teresa's portion of these operating costs be if she was going to reimburse the organization? (1) Tammy's 2015 total automobile benefit was $4,856.00. This amount included her standby charges of $3,256.00 and operating cost benefit of $1,600.00. Based on these numbers, calculate Tammy's 2015 estimated bi-weekly automobile non-cash taxable benefit. (1) 0. Bonavista Manufacturing is located in St. John's, Newfoundland and Labrador and is preparing its annual filing for the Health and Post-Secondary Education Tax. Its total Newfoundland and Labrador remuneration is $1,652,385.00 Calculate Bonavista Manufacturing's employer tax owing (2)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started