Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!!!! The 2nd picture is a hint for tbe first. Thanks!! ABC Corporation has hired you to evaluate a new FOUR year project for

Please help!!!! The 2nd picture is a hint for tbe first. Thanks!!

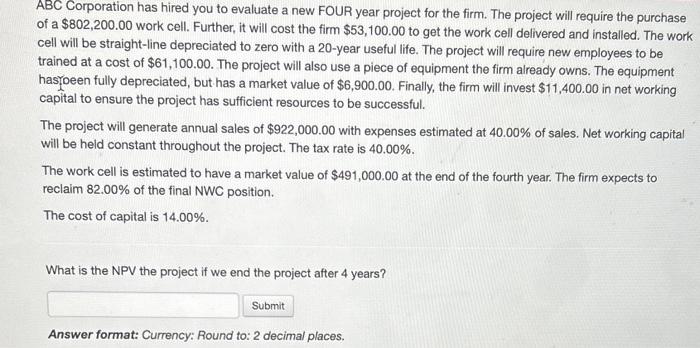

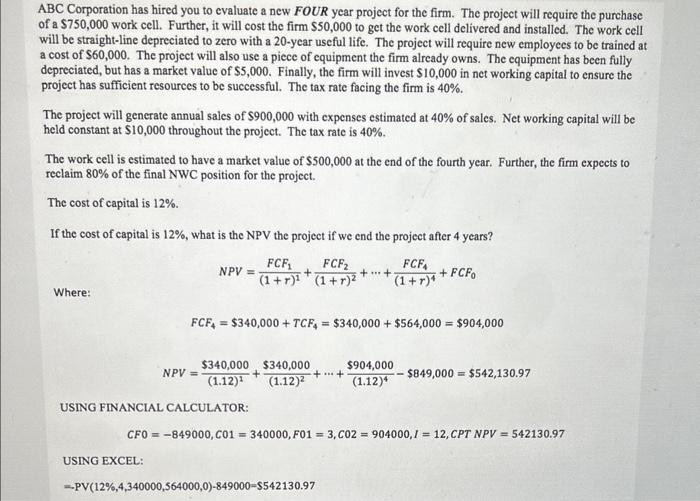

ABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $802,200.00 work cell. Further, it will cost the firm $53,100.00 to get the work cell delivered and installed. The work cell will be straight-line depreciated to zero with a 20 -year useful life. The project will require new employees to be trained at a cost of $61,100.00. The project will also use a piece of equipment the firm already owns. The equipment haoeen fully depreciated, but has a market value of $6,900.00. Finally, the firm will invest $11,400.00 in net working capital to ensure the project has sufficient resources to be successful. The project will generate annual sales of $922,000.00 with expenses estimated at 40.00% of sales. Net working capital will be held constant throughout the project. The tax rate is 40.00%. The work cell is estimated to have a market value of $491,000.00 at the end of the fourth year. The firm expects to reclaim 82.00% of the final NWC position. The cost of capital is 14.00%. What is the NPV the project if we end the project after 4 years? Answer format: Currency: Round to: 2 decimal places. ABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $750,000 work cell. Further, it will cost the firm $50,000 to get the work cell delivered and installed. The work cell will be straight-line depreciated to zero with a 20-year useful life. The project will require new employees to be trained at a cost of $60,000. The project will also use a piece of equipment the firm already owns. The equipment has been fully depreciated, but has a market value of $5,000. Finally, the firm will invest $10,000 in net working capital to ensure the project has sufficient resources to be successful. The tax rate facing the firm is 40%. The project will generate annual sales of $900,000 with expenses estimated at 40% of sales. Net working capital will be held constant at $10,000 throughout the project. The tax rate is 40%. The work cell is estimated to have a market value of $500,000 at the end of the fourth year. Further, the firm expects to reclaim 80% of the final NWC position for the project. The cost of capital is 12% If the cost of capital is 12%, what is the NPV the project if we end the project after 4 years? NPV=(1+r)1FCF1+(1+r)2FCF2++(1+r)4FCF4+FCF0 Where: FCF4=$340,000+TCF4=$340,000+$564,000=$904,000 NPV=(1.12)2$340,000+(1.12)2$340,000++(1.12)4$904,000$849,000=$542,130.97 USING FINANCIAL CALCULATOR: CF0=849000,C01=340000,F01=3,C02=904000,I=12,CPTNPV=542130.97 USING EXCEL: =PV(12%,4,340000,564000,0)849000=$542130.97 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started