Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!!! The following are independent situations. a. A new company is formed and sells 100 shares of $1 par value stock for $12 per

Please help!!!

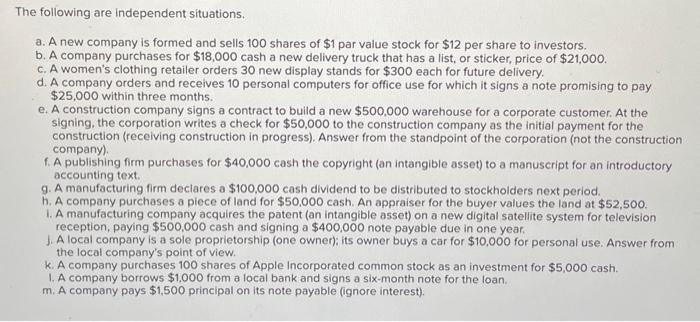

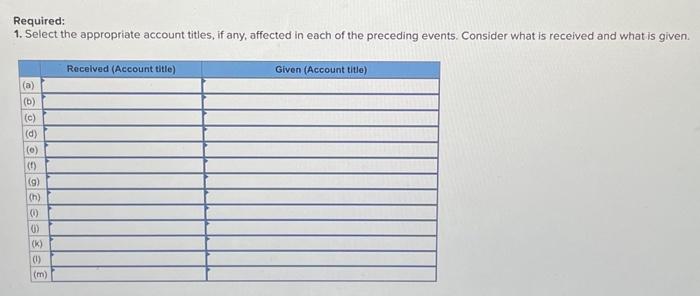

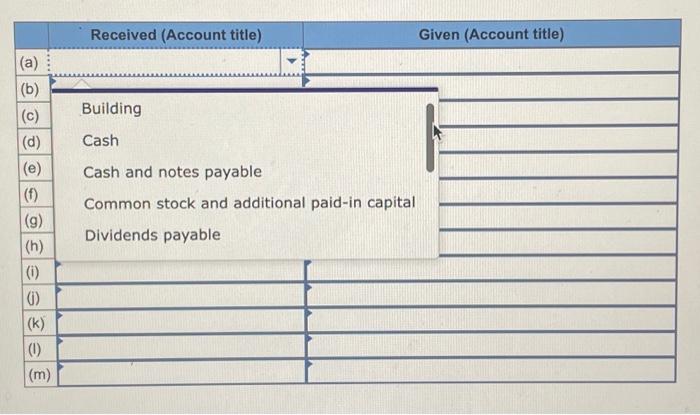

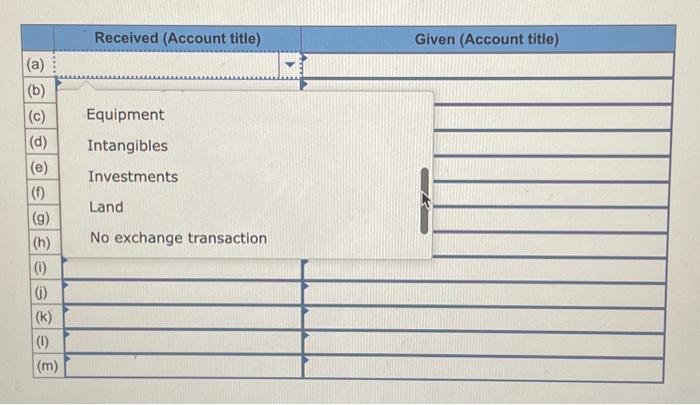

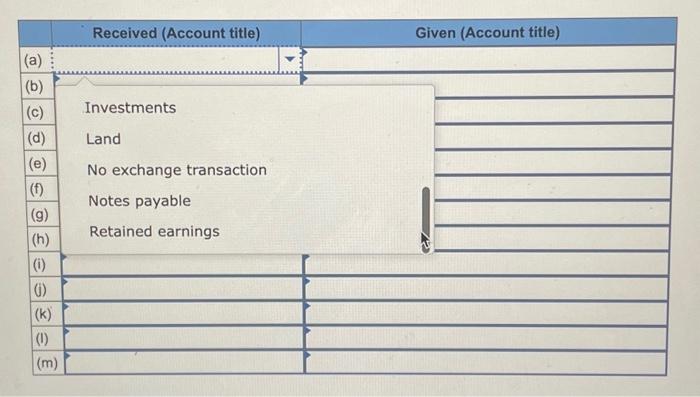

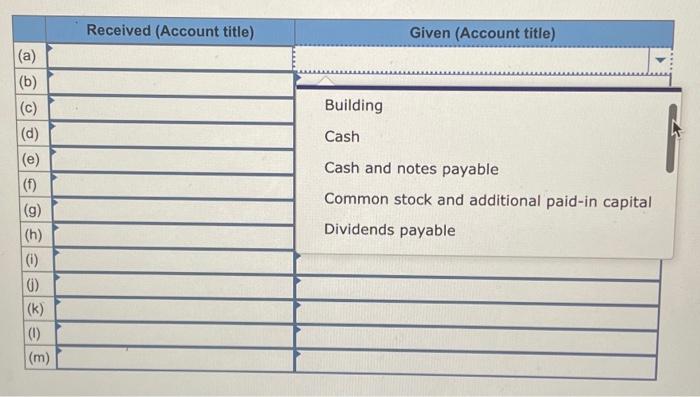

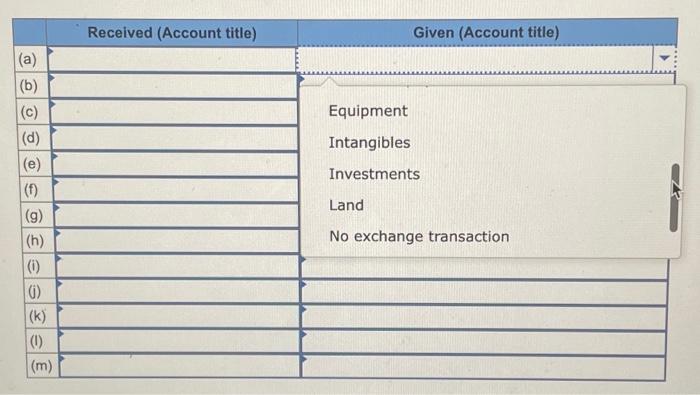

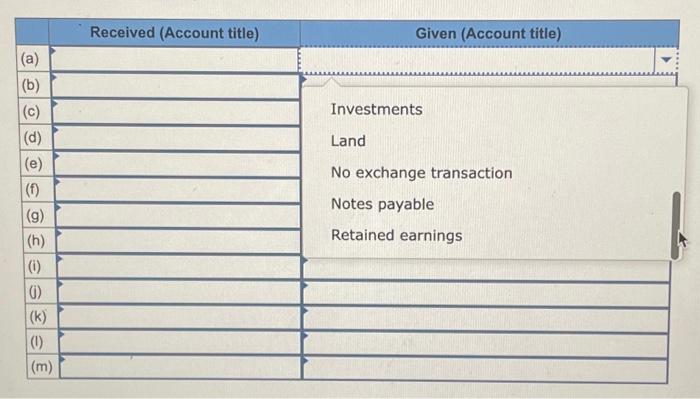

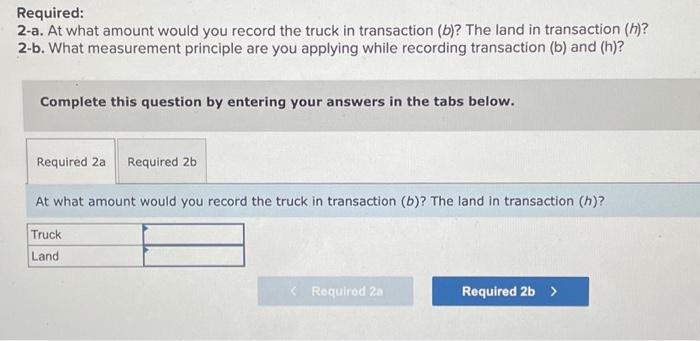

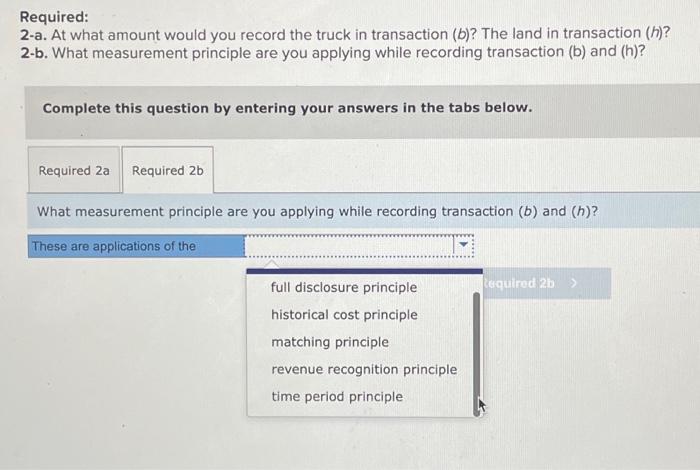

The following are independent situations. a. A new company is formed and sells 100 shares of $1 par value stock for $12 per share to investors. b. A company purchases for $18,000 cash a new delivery truck that has a list, or sticker, price of $21,000. c. A women's clothing retailer orders 30 new display stands for $300 each for future delivery. d. A company orders and receives 10 personal computers for office use for which it signs a note promising to pay $25,000 within three months. e. A construction company signs a contract to build a new $500,000 warehouse for a corporate customer. At the signing, the corporation writes a check for $50,000 to the construction company as the initial payment for the construction (receiving construction in progress). Answer from the standpoint of the corporation (not the construction company). f. A publishing firm purchases for $40,000 cash the copyright (an intangible asset) to a manuscript for an introductory accounting text. g. A manufacturing firm declares a $100,000 cash dividend to be distributed to stockholders next period. h. A company purchases a piece of land for $50,000 cash. An appraiser for the buyer values the land at $52,500. 1. A manufacturing company acquires the patent (an intangible asset) on a new digital satellite system for television reception, paying $500,000 cash and signing a $400,000 note payable due in one year. f. A local company is a sole proprietorship (one owner); its owner buys a car for $10,000 for personal use. Answer from the local company's point of view. k. A company purchases 100 shares of Apple Incorporated common stock as an investment for $5,000 cash. 1. A company borrows $1,000 from a local bank and signs a six-month note for the loan. m. A company pays $1,500 principal on its note payable (ignore interest). Required: 1. Select the appropriate account titles, if any, affected in each of the preceding events. Consider what is received and what is given. \begin{tabular}{|l|l|l|} \hline (a) & & Received (Account title) \\ \hline (b) & & Equipment \\ \hline (c) & Intangibles & Given (Account title) \\ \hline (e) & Investments & \\ \hline (f) & Land \\ \hline (g) & No exchange transaction \\ \hline (h) & No \\ \hline (i) & \\ \hline (j) & \\ \hline (k) & \\ \hline (l) & \\ \hline (m) & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline & Received (Account title) & Given (Account title) \\ \hline (a) & & \multirow{8}{*}{BuildingCashCashandnotespayableCommonstockandadditionalpaid-incapitalDividendspayable} \\ \hline (b) & & \\ \hline (c) & & \\ \hline (d) & & \\ \hline (e) & & \\ \hline (f) & & \\ \hline (g) & & \\ \hline (h) & & \\ \hline (i) & & \\ \hline (j) & & \\ \hline (k) & & \\ \hline (I) & & \\ \hline (m) & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline & Received (Account title) & Given (Accoun & \\ \hline (a) & & \multirow{8}{*}{EquipmentIntangiblesInvestmentsLandNoexchangetransaction} & \\ \hline \multicolumn{2}{|l|}{ (b) } & & \\ \hline \multicolumn{2}{|l|}{ (c) } & & \\ \hline \multicolumn{2}{|l|}{ (d) } & & \\ \hline \multicolumn{2}{|l|}{ (e) } & & \\ \hline \multicolumn{2}{|l|}{ (f) } & & . \\ \hline \multicolumn{2}{|l|}{ (g) } & & \\ \hline \multicolumn{2}{|l|}{ (h) } & & \\ \hline \multicolumn{4}{|l|}{ (i) } \\ \hline \multicolumn{4}{|l|}{ (j) } \\ \hline \multicolumn{4}{|l|}{ (k) } \\ \hline \multicolumn{4}{|l|}{ (I) } \\ \hline(m) & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline & Received (Account title) & Given (Accoun & \\ \hline (a) & & \multirow{8}{*}{InvestmentsLandNoexchangetransactionNotespayableRetainedearnings} & \\ \hline \multicolumn{2}{|l|}{ (b) } & & 4 \\ \hline \multicolumn{2}{|l|}{ (c) } & & \\ \hline \multicolumn{2}{|l|}{ (d) } & & \\ \hline \multicolumn{2}{|l|}{ (e) } & & \\ \hline \multicolumn{2}{|l|}{ (f) } & & \\ \hline \multicolumn{2}{|l|}{ (g) } & & \\ \hline \multicolumn{2}{|l|}{ (h) } & & \\ \hline \multicolumn{4}{|l|}{ (i) } \\ \hline \multicolumn{4}{|l|}{ (j) } \\ \hline \multicolumn{4}{|l|}{ (k) } \\ \hline \multicolumn{4}{|c|}{ (I) } \\ \hline (m) & & & \\ \hline \end{tabular} Required: 2-a. At what amount would you record the truck in transaction (b) ? The land in transaction (h) ? 2-b. What measurement principle are you applying while recording transaction (b) and (h)? Complete this question by entering your answers in the tabs below. At what amount would you record the truck in transaction (b) ? The land in transaction (h) ? Required: 2-a. At what amount would you record the truck in transaction (b)? The land in transaction (h) ? 2-b. What measurement principle are you applying while recording transaction (b) and (h)? Complete this question by entering your answers in the tabs below. What measurement principle are you applying while recording transaction (b) and (h) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started