Please help this is for a grade! Thank you!

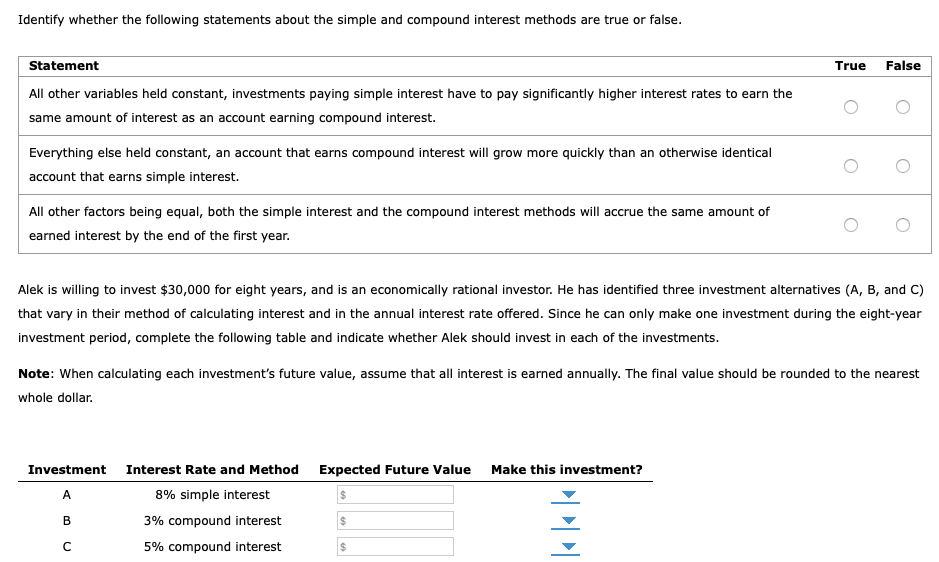

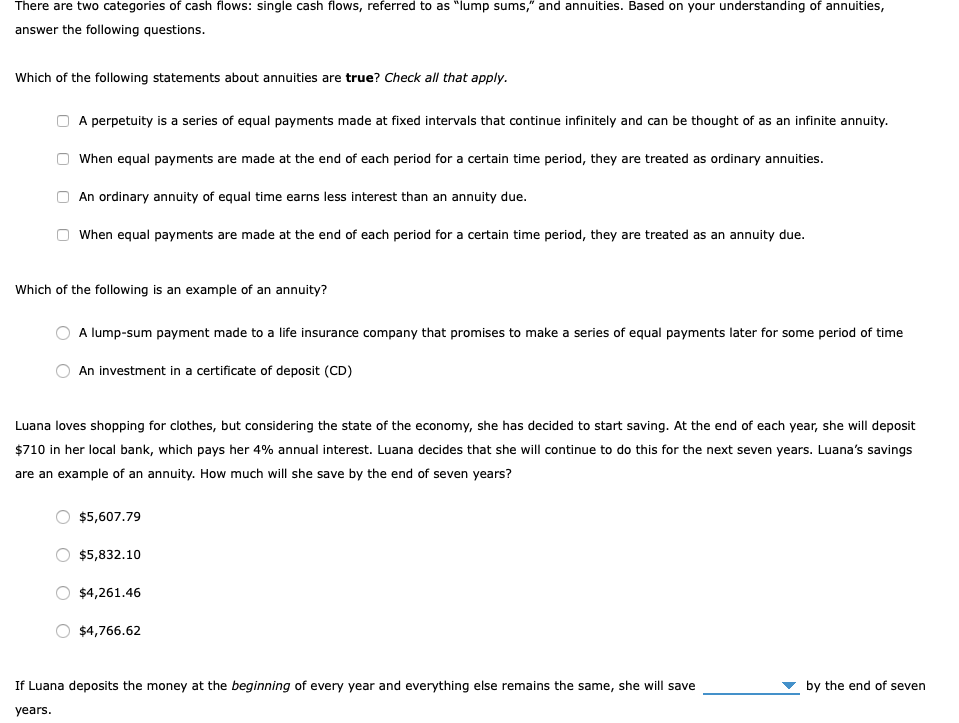

Identify whether the following statements about the simple and compound interest methods are true or false. False Statement True All other variables held constant, investments paying simple interest have to pay significantly higher interest rates to earn the same amount of interest as an account earning compound interest. Everything else held constant, an account that earns compound interest will grow more quickly than an otherwise identical account that earns simple interest. All other factors being equal, both the simple interest and the compound interest methods will accrue the same amount of earned interest by the end of the first year. Alek is willing to invest $30,000 for eight years, and is an economically rational investor. He has identified three investment alternatives (A, B, and C) that vary in their method of calculating interest and in the annual interest rate offered. Since he can only make one investment during the eight-year investment period, complete the following table and indicate whether Alek should invest in each of the investments. Note: When calculating each investment's future value, assume that all interest is earned annually. The final value should be rounded to the nearest whole dollar. Investment Interest Rate and Method Expected Future Value Make this investment? 8% simple interest %24 3% compound interest 5% compound interest %24 There are two categories of cash flows: single cash flows, referred to as "lump sums," and annuities. Based on your understanding of annuities, answer the following questions. Which of the following statements about annuities are true? Check all that apply. A perpetuity is a series of equal payments made at fixed intervals that continue infinitely and can be thought of as an infinite annuity. When equal payments are made at the end of each period for a certain time period, they are treated as ordinary annuities. An ordinary annuity of equal time earns less interest than an annuity due. When equal payments are made at the end of each period for a certain time period, they are treated as an annuity due. Which of the following is an example of an annuity? A lump-sum payment made to a life insurance company that promises to make a series of equal payments later for some period of time An investment in a certificate of deposit (CD) Luana loves shopping for clothes, but considering the state of the economy, she has decided to start saving. At the end of each year, she will deposit $710 in her local bank, which pays her 4% annual interest. Luana decides that she will continue to do this for the next seven years. Luana's savings are an example of an annuity. How much will she save by the end of seven years? $5,607.79 $5,832.10 $4,261.46 $4,766.62 If Luana deposits the money at the beginning of every year and everything else remains the same, she will save by the end of seven years