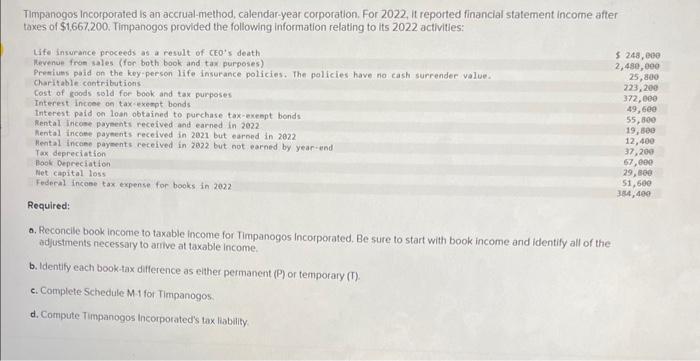

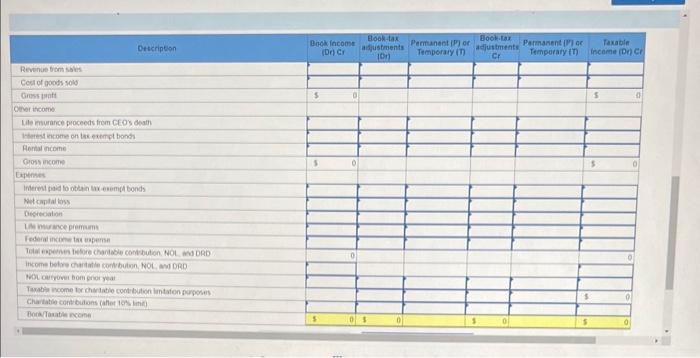

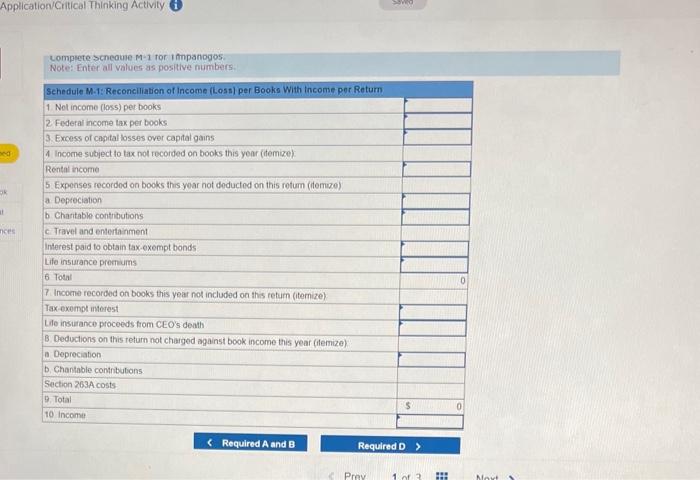

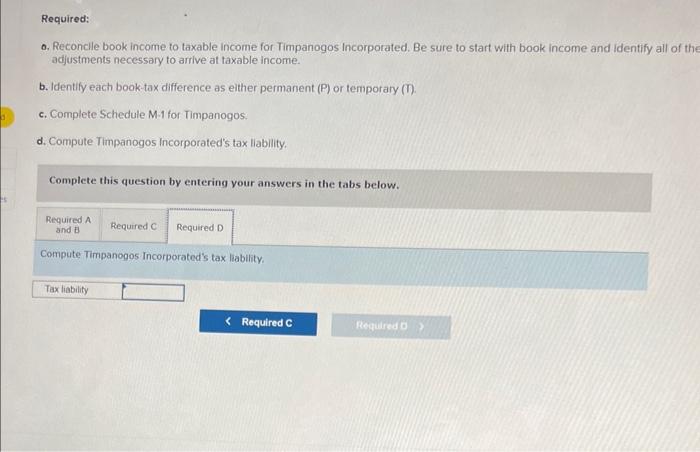

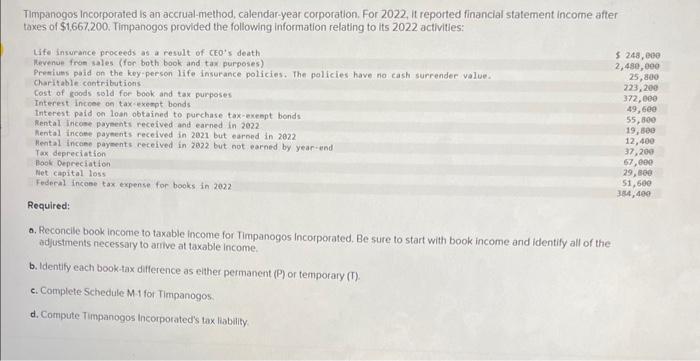

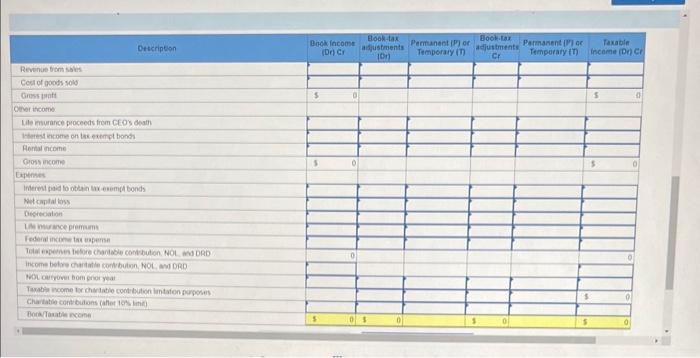

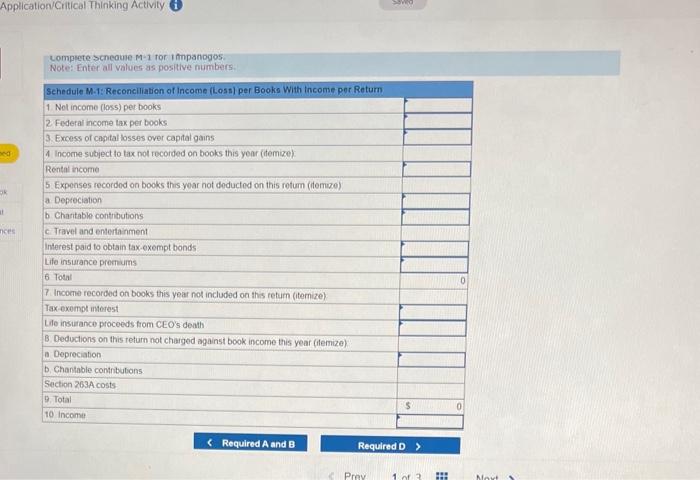

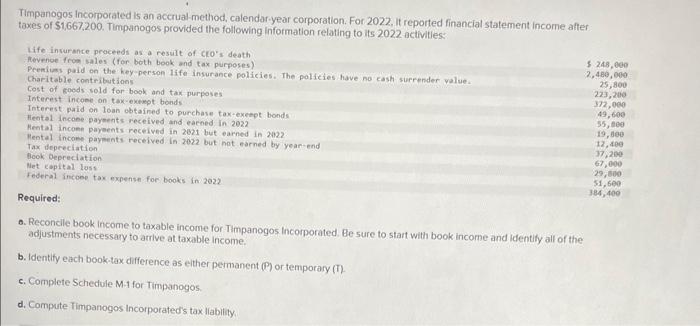

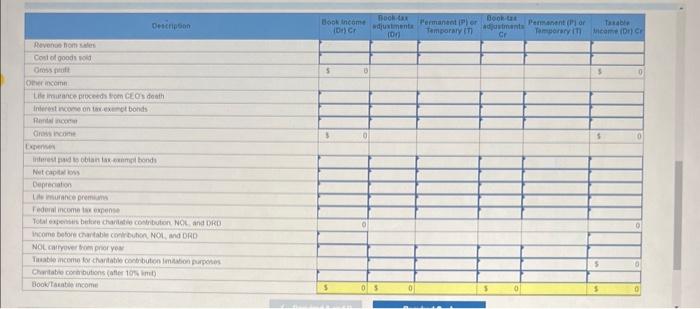

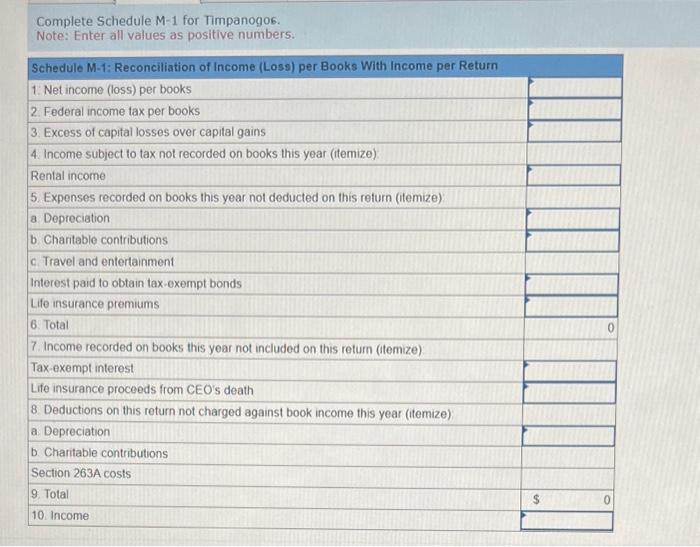

Timpanogos incorporated is an accrual-method, calendar-year corporation. For 2022, it reported financial statement income after taxes of $1,667.200. Timpanogos provided the following information relating to its 2022 activities: Lomplete >cneoue M-1 tor I finpanogos. o. Reconcle book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of adjustments necessary to arrive at taxable income. b. Identify each book-tax difference as either permanent (P) or temporary (T). c. Complete Schedule M-1 for Timpanogos. d. Compute Timpanogos Incorporated's tax liability. Complete this question by entering your answers in the tabs below. Compute Timpanogos Incorporated's tax liability. a. Reconcile book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of the adjustments necessary to atrive at taxable income. b. Identify each book-tax difference as elther permanent (P) or temporary (T) c. Complete Schedule M-1 for Timpanogos. d. Compute Timpanogos incorporated's tax llability Complete Schedule M-1 for Timpanogor. Compute Timpanogos Incorporated's tax liability. Timpanogos incorporated is an accrual-method, calendar-year corporation. For 2022, it reported financial statement income after taxes of $1,667.200. Timpanogos provided the following information relating to its 2022 activities: Lomplete >cneoue M-1 tor I finpanogos. o. Reconcle book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of adjustments necessary to arrive at taxable income. b. Identify each book-tax difference as either permanent (P) or temporary (T). c. Complete Schedule M-1 for Timpanogos. d. Compute Timpanogos Incorporated's tax liability. Complete this question by entering your answers in the tabs below. Compute Timpanogos Incorporated's tax liability. a. Reconcile book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of the adjustments necessary to atrive at taxable income. b. Identify each book-tax difference as elther permanent (P) or temporary (T) c. Complete Schedule M-1 for Timpanogos. d. Compute Timpanogos incorporated's tax llability Complete Schedule M-1 for Timpanogor. Compute Timpanogos Incorporated's tax liability