Question

Please help to answer all (not some) of those questions, not in general, but what is actually been asked. Preferably, in the order of those

Please help to answer all (not some) of those questions, not in general, but what is actually been asked. Preferably, in the order of those questions or at least please indicate which answer is for which question. If possible provide the detailed (at least, somewhat) explanation if the question in its text demands that. The more details you would be able to provide the better it will help me learn, as I am looking first of all to understand this thing. For the purpose of these questions it should read 2016-2017 instead of 2012-2013.

Many thanks in advance

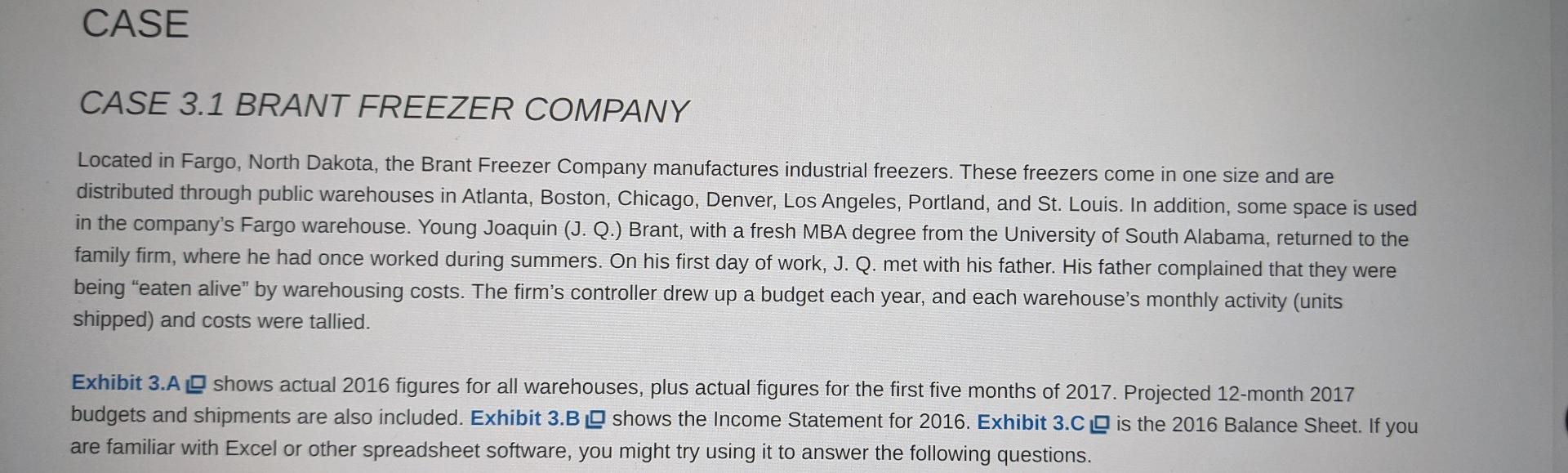

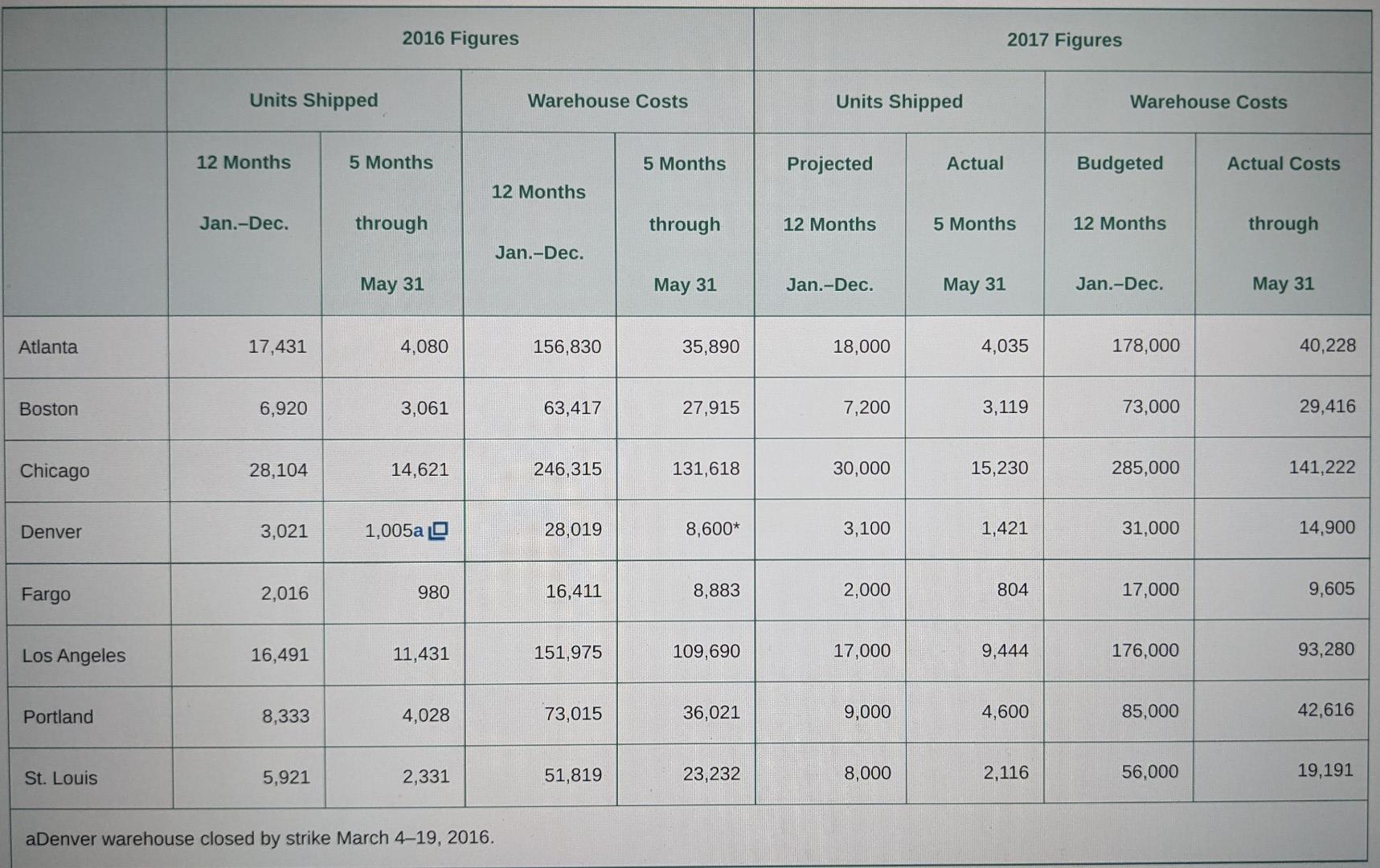

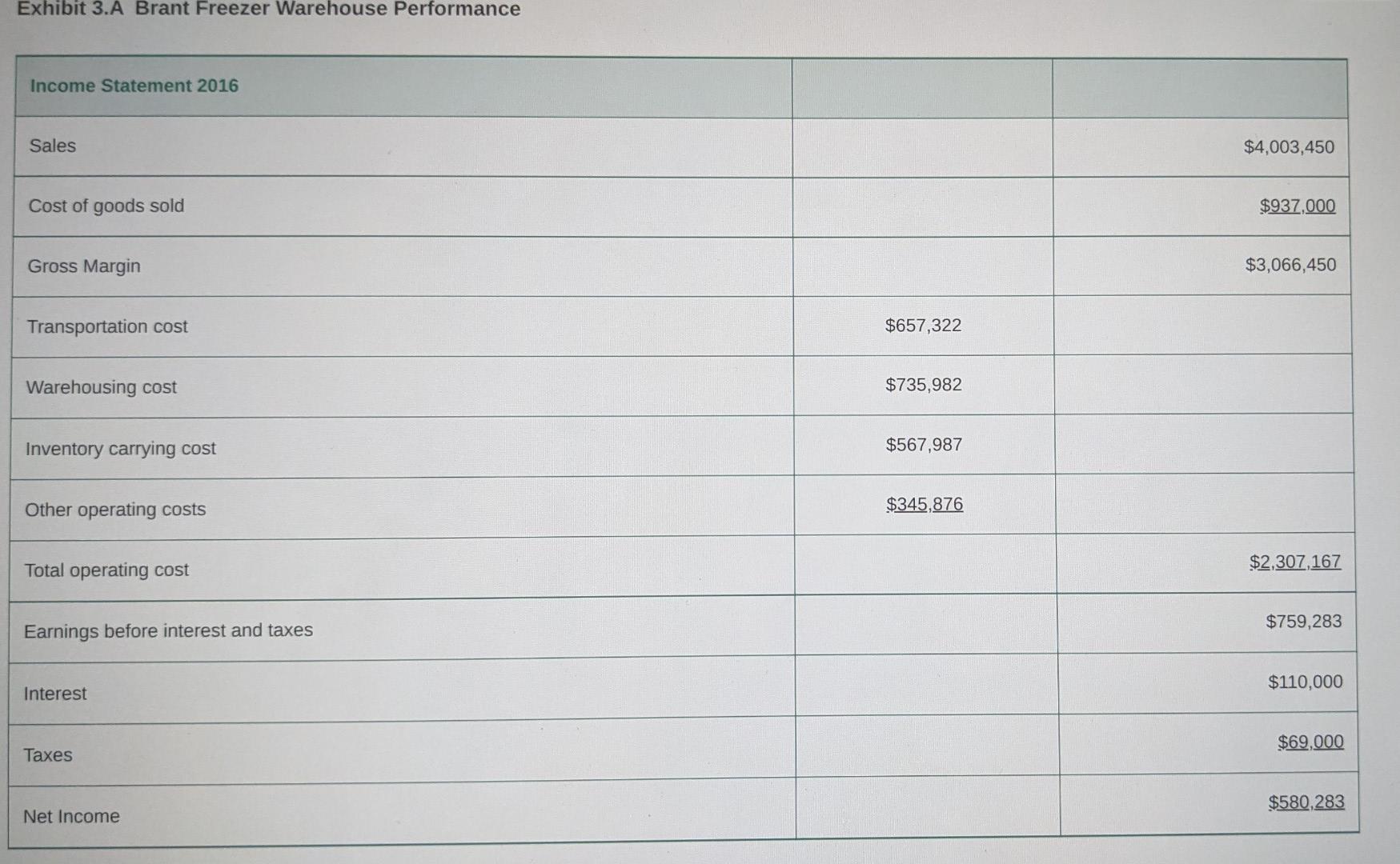

CASE CASE 3.1 BRANT FREEZER COMPANY Located in Fargo, North Dakota, the Brant Freezer Company manufactures industrial freezers. These freezers come in one size and are distributed through public warehouses in Atlanta, Boston, Chicago, Denver, Los Angeles, Portland, and St. Louis. In addition, some space is used in the company's Fargo warehouse. Young Joaquin (J. Q.) Brant, with a fresh MBA degree from the University of South Alabama, returned to the family firm, where he had once worked during summers. On his first day of work, J. Q. met with his father. His father complained that they were being "eaten alive" by warehousing costs. The firm's controller drew up a budget each year, and each warehouse's monthly activity (units shipped) and costs were tallied. Exhibit 3.A shows actual 2016 figures for all warehouses, plus actual figures for the first five months of 2017. Projected 12-month 2017 budgets and shipments are also included. Exhibit 3.B O shows the Income Statement for 2016. Exhibit 3.CO is the 2016 Balance Sheet. If you are familiar with Excel or other spreadsheet software, you might try using it to answer the following questions. 2016 Figures 2017 Figures Units Shipped Warehouse Costs Units Shipped Warehouse Costs 12 Months 5 Months 5 Months Projected Actual Budgeted Actual Costs 12 Months Jan.-Dec. through through 12 Months 5 Months 12 Months through Jan.-Dec. May 31 May 31 Jan.-Dec. May 31 Jan.-Dec. May 31 Atlanta 17,431 4,080 156,830 35,890 18,000 4,035 178,000 40,228 Boston 6,920 3,061 63,417 27,915 7,200 3,119 73,000 29,416 Chicago 28,104 14,621 246,315 131,618 30,000 15,230 285,000 141,222 Denver 3,021 1,005a 28,019 8,600* 3,100 1,421 31,000 14,900 Fargo 2,016 980 16,411 8,883 2,000 804 17,000 9,605 Los Angeles 16,491 11,431 151,975 109,690 17,000 9,444 176,000 93,280 Portland 8,333 4,028 73,015 36,021 9,000 4,600 85,000 42,616 St. Louis 5,921 2,331 51,819 23,232 8,000 2,116 56,000 19,191 aDenver warehouse closed by strike March 4-19, 2016. Exhibit 3.A Brant Freezer Warehouse Performance Income Statement 2016 Sales $4,003,450 Cost of goods sold $937,000 Gross Margin $3,066,450 Transportation cost $657,322 Warehousing cost $735,982 Inventory carrying cost $567,987 Other operating costs $345,876 $2,307,167 Total operating cost $759,283 Earnings before interest and taxes $110,000 Interest $69,000 Taxes $580,283 Net Income zoom Exhibit 3.B Brant Freezer Company Income Statement Balance Sheet 2016 Assets Cash $706,034 Accounts Receivable $355,450 Inventory $1,590,435 Total Current Assets $2,651,919 Net Fixed Assets $803,056 Total Assets $3,454,975 Liabilities Current Liabilities $1,678,589 Long-term Debt $398,060 Total Liabilities $2,076,649 Shareholders' Equity $1,378,326 Total Liabilities and Equity $3,454,975 1. In 2012, identify which two warehouses were the top performing and which two showed the poorest performance. Explain your answer. 2. Which of the warehouses, in your opinion, performs the best for the Brant Company? How did you come up with this and what could make the warehouses perform even better? 3. From the underperforming warehouses, which two would you recommend be considered to be replaced with another warehouse? How did you determine this and, out of the two, which would be your choice to replace and why? 4. Forecast what the firm will spend for warehousing from June - December. Show your work and explain the process. 5. Use the 2012 income statement and balance sheet to complete a strategic profit model for J.Q. 6. Holding all other information constant, what would be the effect on ROA for 2013 if warehousing costs declined 15 percent from 2012 levelsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started