please help to make sure box's below are the correct numbers. I am having a hard time and need help. Tx & I will Rate! :)

Entries for Selected Corporate Transactions

Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises stockholders equity accounts, with balances on January 1, 20Y6, are as follows:

| Common Stock, $10 stated value (900,000 shares authorized, 600,000 shares issued) | $6,000,000 |

| Paid-In Capital in Excess of Stated Value-Common Stock | 1,150,000 |

| Retained Earnings | 13,620,000 |

| Treasury Stock (60,000 shares, at cost) | 840,000 |

The following selected transactions occurred during the year:

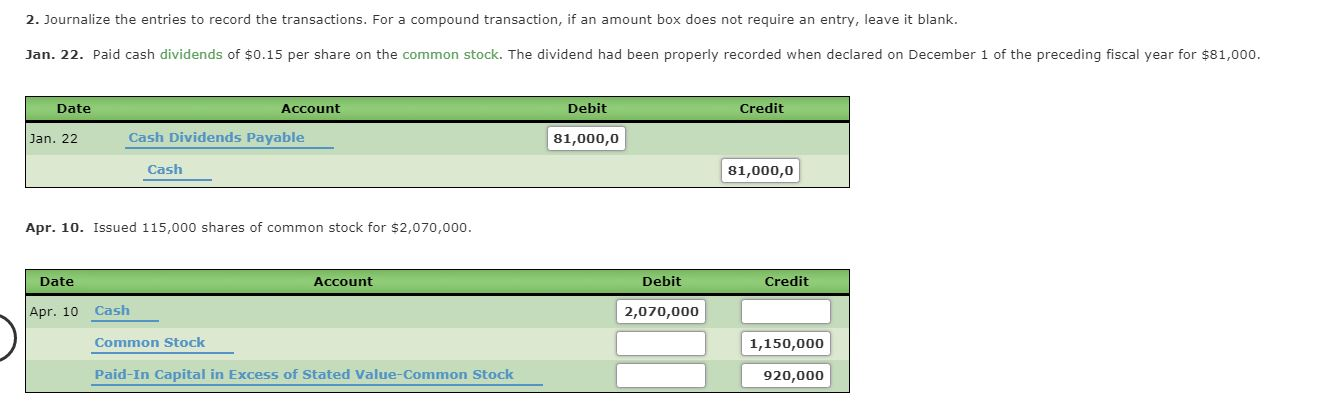

| Jan. 22. | Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $81,000. |

| Apr. 10. | Issued 115,000 shares of common stock for $2,070,000. |

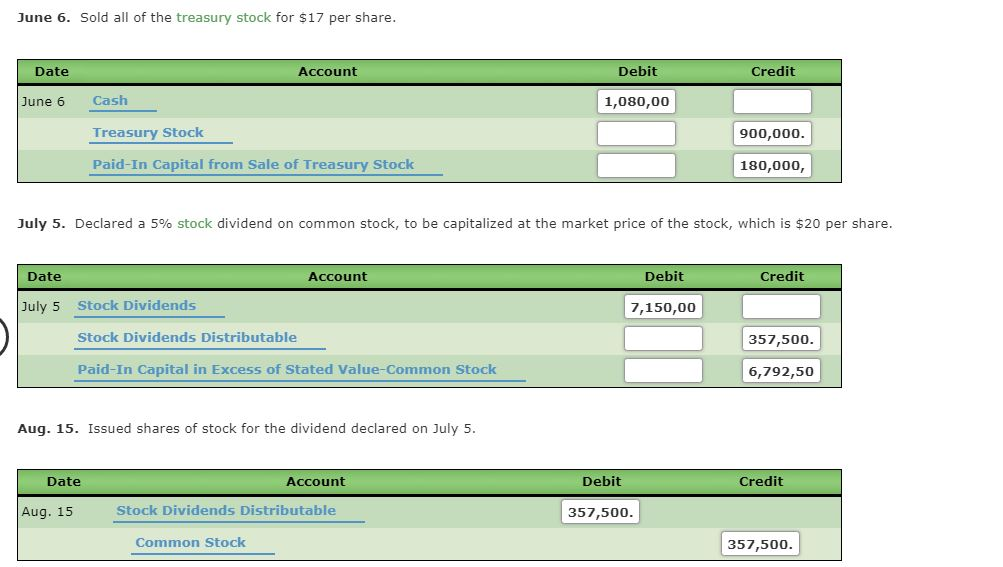

| June 6. | Sold all of the treasury stock for $17 per share. |

| July 5. | Declared a 5% Stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. |

| Aug. 15. | Issued shares of stock for the stock dividend declared on July 5. |

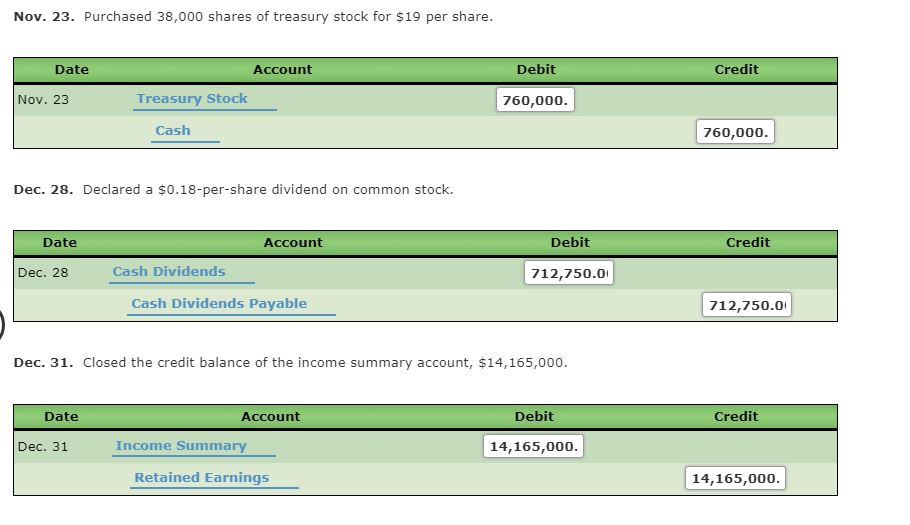

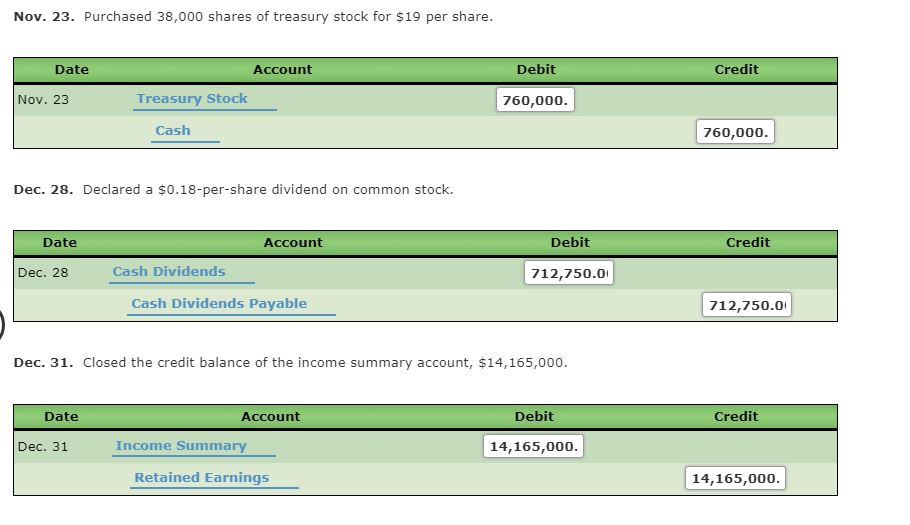

| Nov. 23. | Purchased 38,000 shares of treasury stock for $19 per share. |

| Dec. 28. | Declared a $0.18-per-share dividend on common stock. |

| 31. | Closed the credit balance of the income summary account, $14,165,000. |

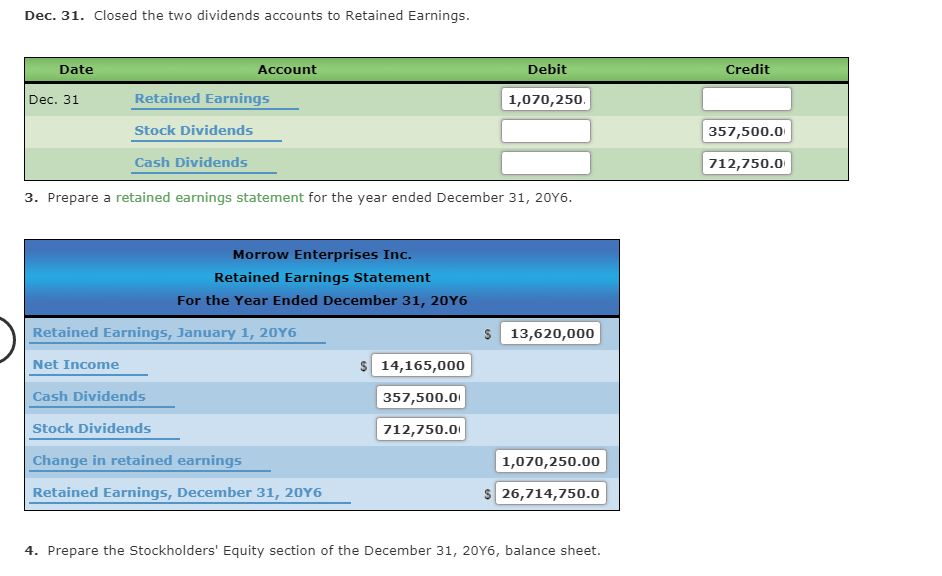

| 31. | Closed the two dividends accounts to Retained Earnings. |

Required:

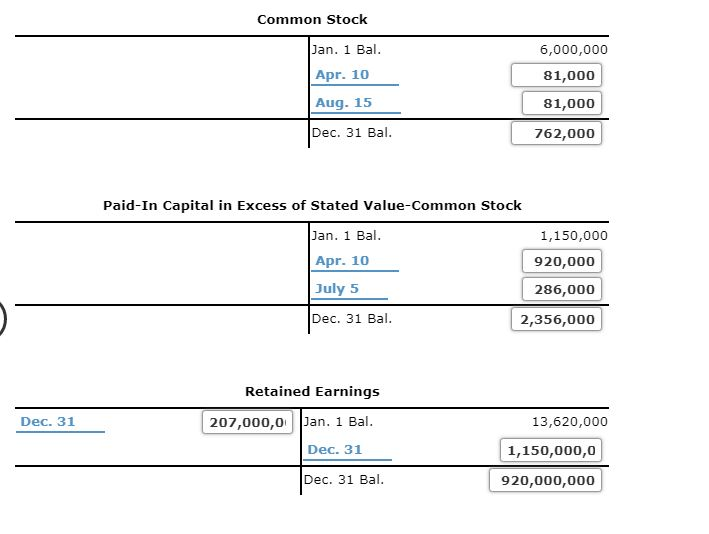

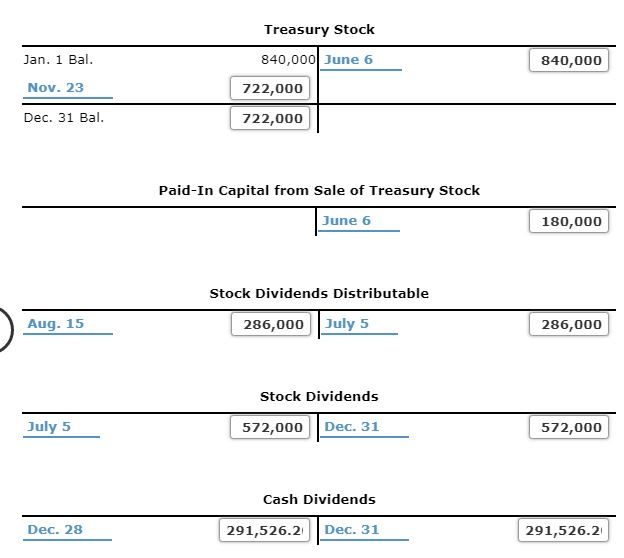

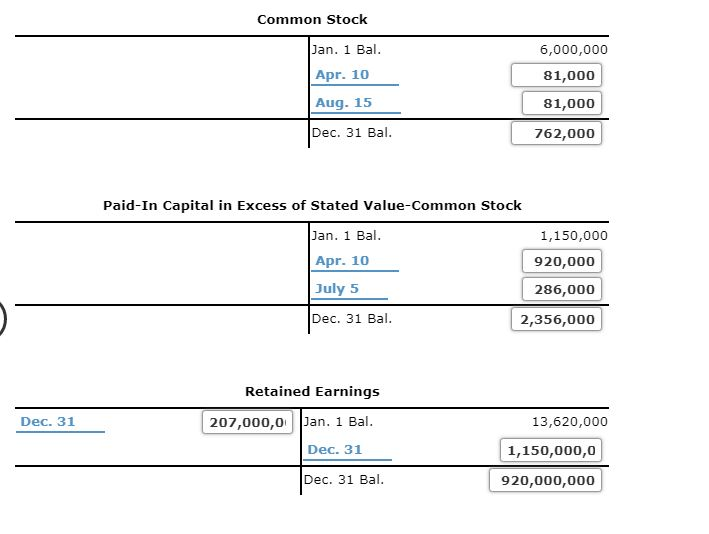

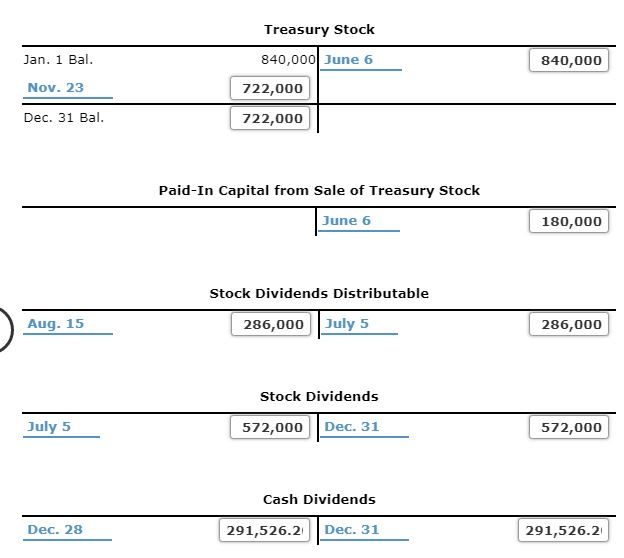

1. The January 1 balances have been entered in T accounts for the stockholders' equity accounts. Record the above transactions in the T accounts and provide the December 31 balance where appropriate. If required, round to one decimal place.

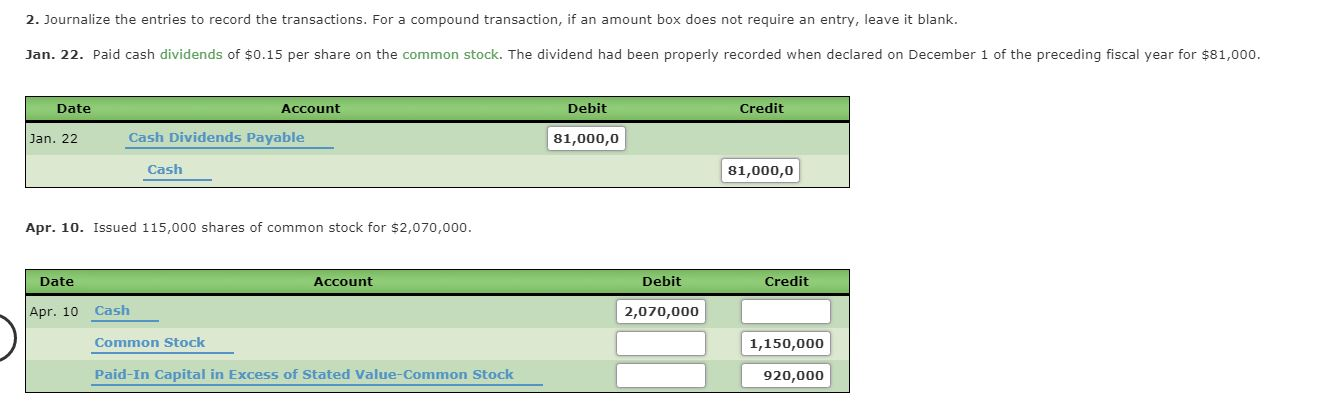

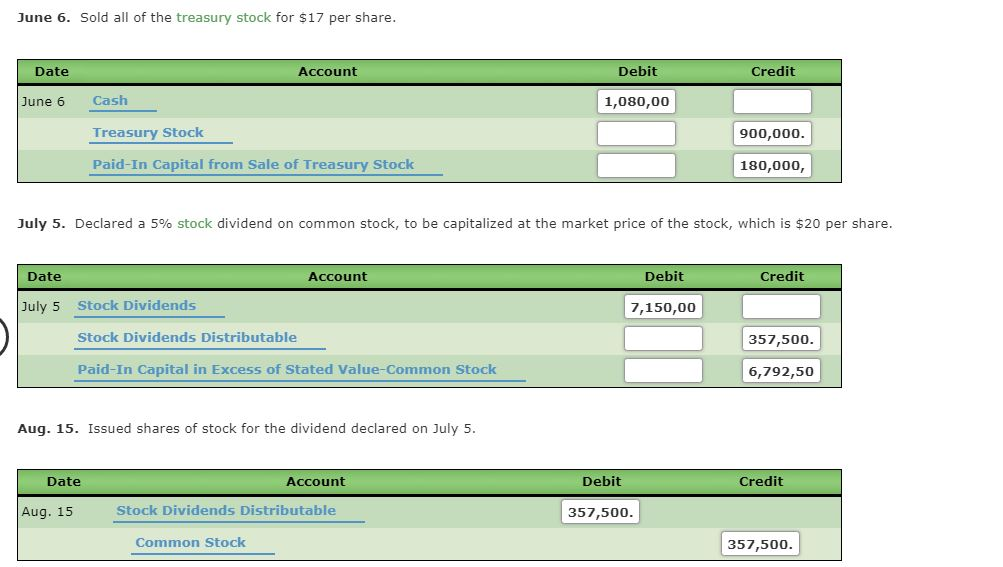

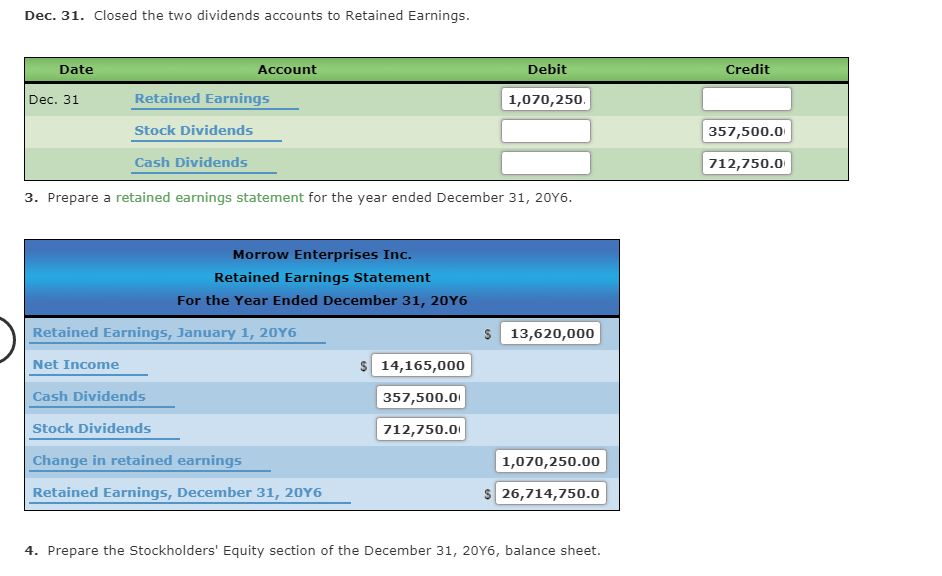

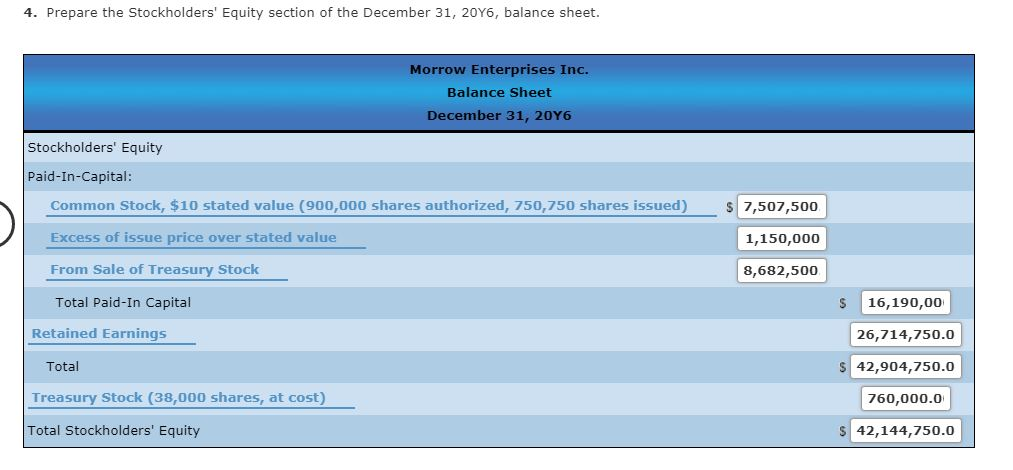

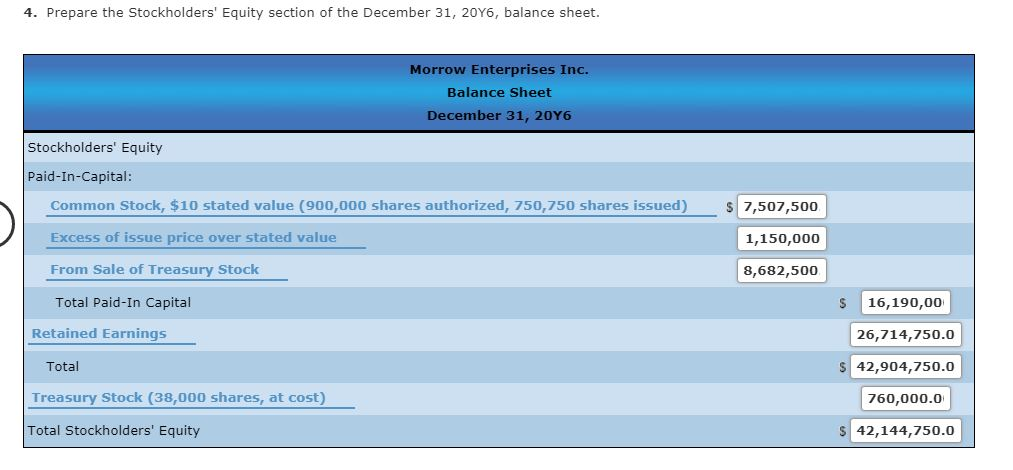

Common Stock Jan. 1 Bal. Apr. 10 Aug. 15 6,000,000 81,000 81,000 Dec. 31 Bal. 762,000 Paid-In Capital in Excess of Stated Value-Common Stock Jan. 1 Bal. 1,150,000 Apr. 10 920,000 July 5 286,000 Dec. 31 Bal. 2,356,000 Retained Earnings Dec. 31 207,000,01 Jan. 1 Bal. Dec. 31 13,620,000 1,150,000,0 920,000,000 Dec. 31 Bal. 2. Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. Jan. 22. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $81,000. Date Debit Credit Account Cash Dividends Payable Jan. 22 81,000,0 Cash 81,000,0 Apr. 10. Issued 115,000 shares of common stock for $2,070,000. Date Account Debit Credit Apr. 10 Cash 2,070,000 Common Stock 1,150,000 Paid-In Capital in Excess of Stated Value-Common Stock 920,000 June 6. Sold all of the treasury stock for $17 per share. Date Account Debit Credit June 6 Cash 1,080,00 Treasury Stock 900,000. Paid-In Capital from Sale of Treasury Stock 180,000, July 5. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. Account Debit Credit Date July 5 Stock Dividends 7,150,00 Stock Dividends Distributable 357,500. 6,792,50 Paid-In Capital in Excess of Stated Value-Common Stock Aug. 15. Issued shares of stock for the dividend declared on July 5. Date Debit Credit Account Stock Dividends Distributable Aug. 15 357,500. Common Stock 357,500. Nov. 23. Purchased 38,000 shares of treasury stock for $19 per share. Date Credit Account Treasury Stock Debit 760,000. Nov. 23 760,000. Cash 260,000. Dec. 28. Declared a $0.18-per-share dividend on common stock. Date Account Debit Credit Dec. 28 Cash Dividends 712,750.0 Cash Dividends Payable 712,750.0 Dec. 31. Closed the credit balance of the income summary account, $14,165,000. Account Credit Date Dec. 31 Debit 14,165,000. Income Summary Retained Earnings 14,165,000. Dec. 31. Closed the two dividends accounts to Retained Earnings. Debit Credit Date Dec. 31 Account Retained Earnings 1,070,250 Stock Dividends 357,500.0 Cash Dividends 712,750.0 3. Prepare a retained earnings statement for the year ended December 31, 2016. Morrow Enterprises Inc. Retained Earnings Statement For the Year Ended December 31, 2046 Retained Earnings, January 1, 2016 13,620,000 Net Income S 14,165,000 Cash Dividends 357,500.00 Stock Dividends 712,750.00 Change in retained earnings 1,070,250.00 Retained Earnings, December 31, 2016 $ 26,714,750.0 4. Prepare the Stockholders' Equity section of the December 31, 2016, balance sheet. 4. Prepare the Stockholders' Equity section of the December 31, 2016, balance sheet. Morrow Enterprises Inc. Balance Sheet December 31, 2016 Stockholders' Equity Paid-In-Capital: Common Stock, $10 stated value (900,000 shares authorized, 750,750 shares issued) $ 7,507,500 Excess of issue price over stated value 1,150,000 From Sale of Treasury Stock 8,682,500 Total Paid-In Capital Retained Earnings $ 16,190,00 26,714,750.0 S42,904,750.0 Total Treasury Stock (38,000 shares, at cost) 760,000.0 Total Stockholders' Equity S42,144,750.0