Answered step by step

Verified Expert Solution

Question

1 Approved Answer

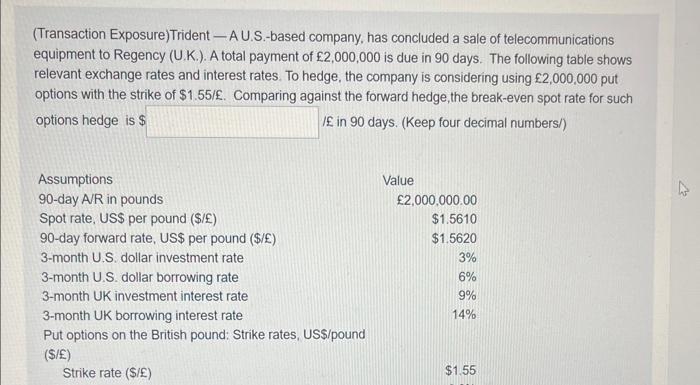

please help (Transaction Exposure)Trident - A U.S.-based company, has concluded a sale of telecommunications equipment to Regency (U.K.). A total payment of 2,000,000 is due

please help

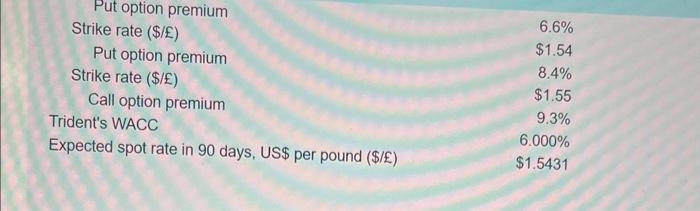

(Transaction Exposure)Trident - A U.S.-based company, has concluded a sale of telecommunications equipment to Regency (U.K.). A total payment of 2,000,000 is due in 90 days. The following table shows relevant exchange rates and interest rates. To hedge, the company is considering using 2,000,000 put options with the strike of $1.55/. Comparing aqainst the forward hedge,the break-even spot rate for such options hedge is I in 90 days. (Keep four decimal numbers/) Put option premium Strike rate ($/E) Put option premium Strike rate ($/) Call option premium Trident's WACC Expected spot rate in 90 days, US\$ per pound ($/) 6.6% $1.54 8.4% $1.55 9.3% 6.000% $1.5431

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started