Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP URGENT WILL LIKEEE 57 58 59 NO TIME WILL UPVOTE Unrelated diversification occurs through purchasing a portfolio of businesses which are capable of

PLEASE HELP URGENT WILL LIKEEE 57 58 59 NO TIME WILL UPVOTE

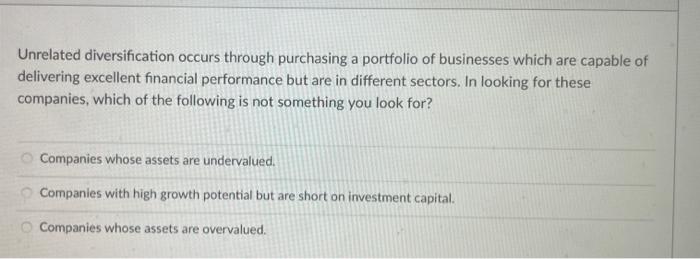

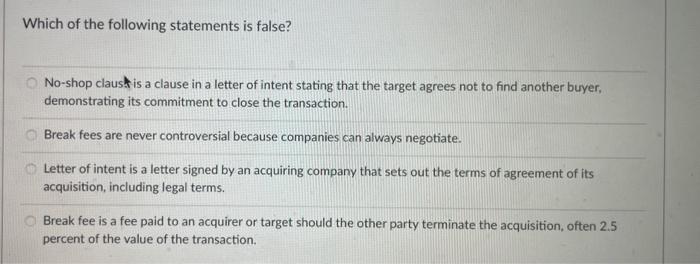

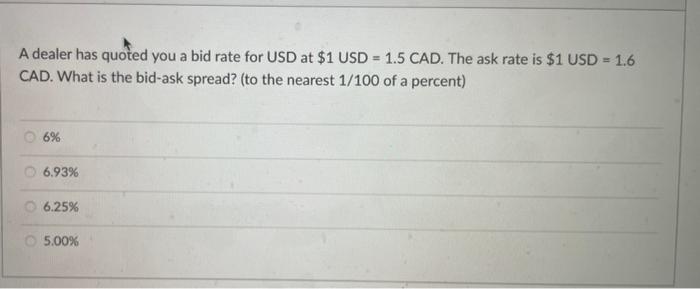

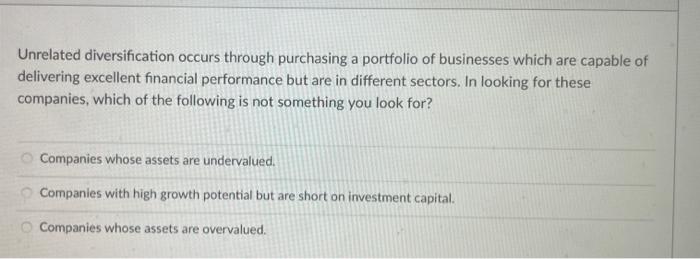

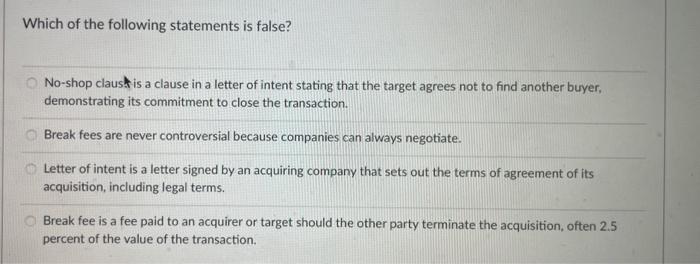

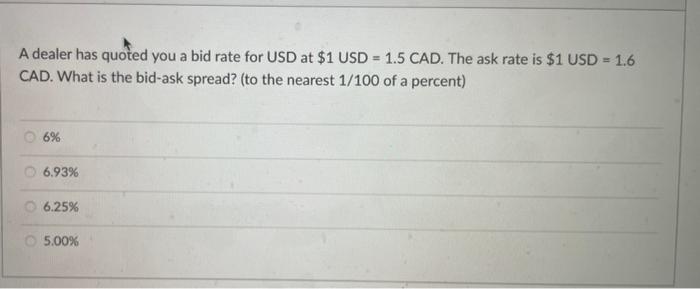

Unrelated diversification occurs through purchasing a portfolio of businesses which are capable of delivering excellent financial performance but are in different sectors. In looking for these companies, which of the following is not something you look for? Companies whose assets are undervalued. Companies with high growth potential but are short on investment capital. Companies whose assets are overvalued. Which of the following statements is false? No-shop claus is a clause in a letter of intent stating that the target agrees not to find another buyer, demonstrating its commitment to close the transaction. Break fees are never controversial because companies can always negotiate. Letter of intent is a letter signed by an acquiring company that sets out the terms of agreement of its acquisition, including legal terms. Break fee is a fee paid to an acquirer or target should the other party terminate the acquisition, often 2.5 percent of the value of the transaction. A dealer has quoted you a bid rate for USD at $1 USD = 1.5 CAD. The ask rate is $1 USD = 1.6 CAD. What is the bid-ask spread? (to the nearest 1/100 of a percent) 6% 6.93% 6.25% 5.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started