Answered step by step

Verified Expert Solution

Question

1 Approved Answer

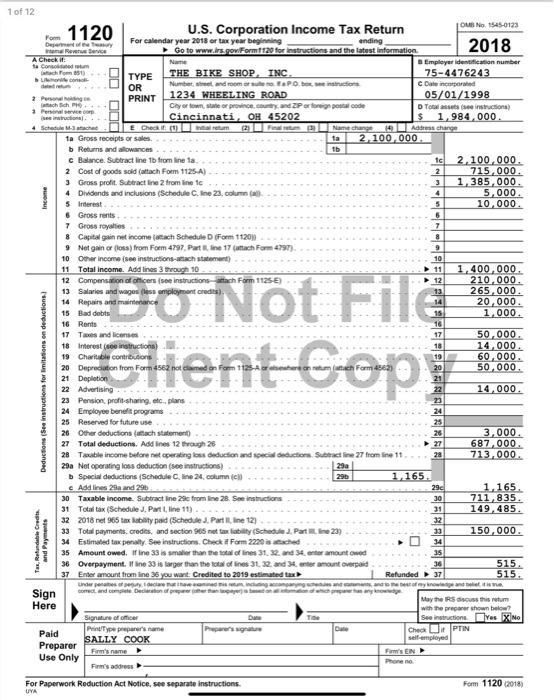

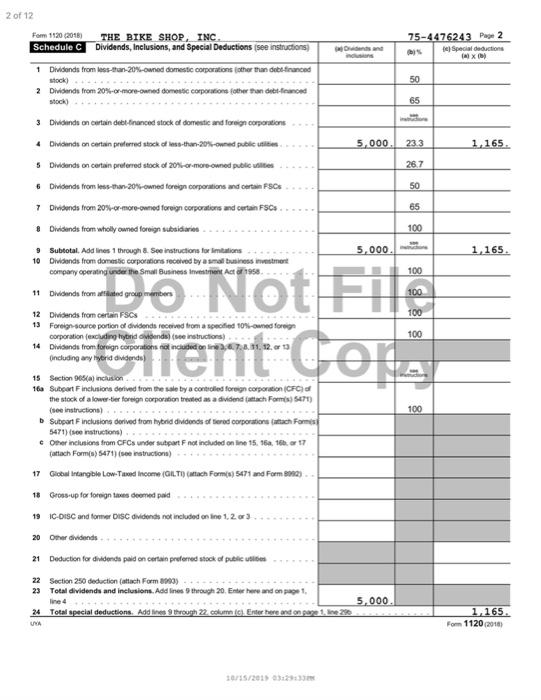

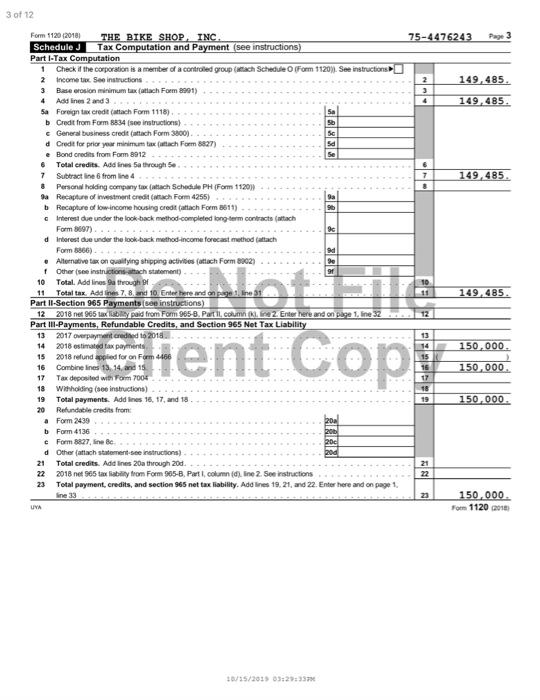

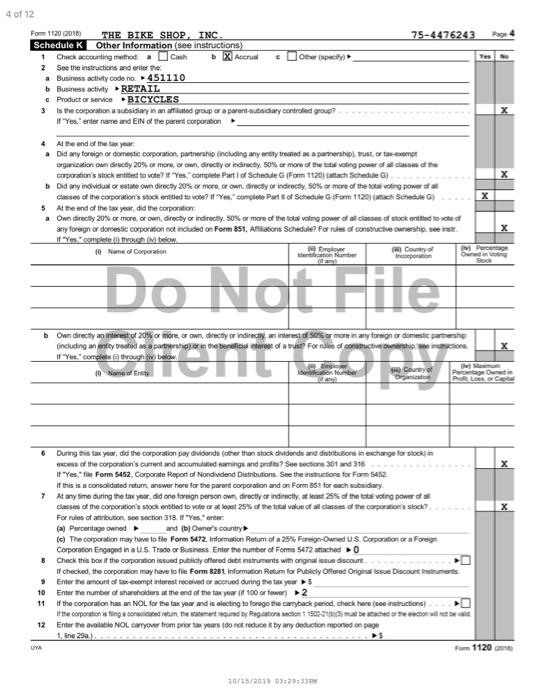

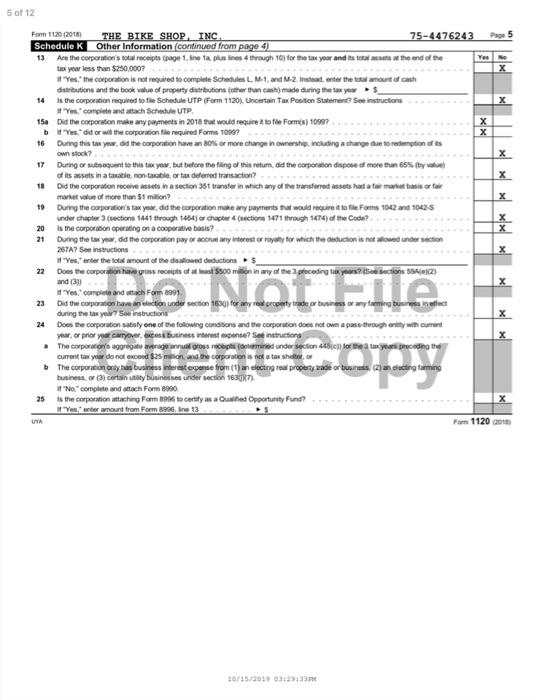

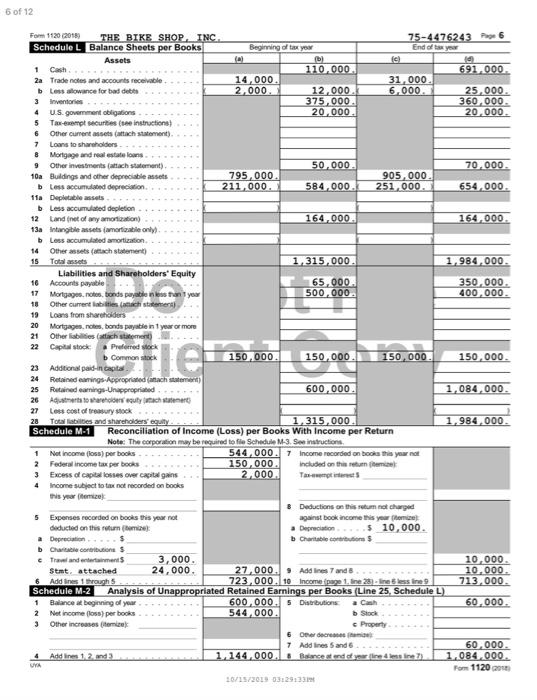

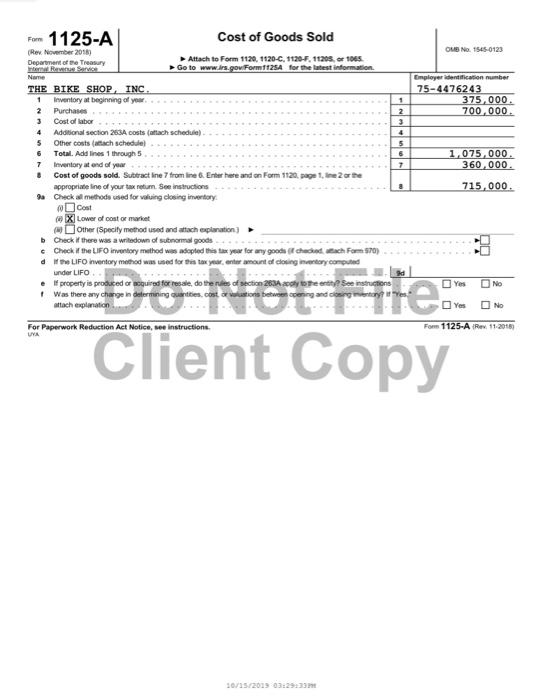

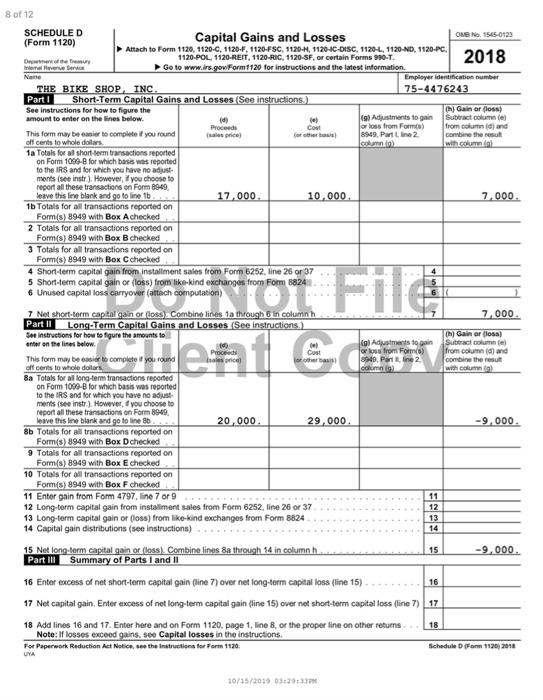

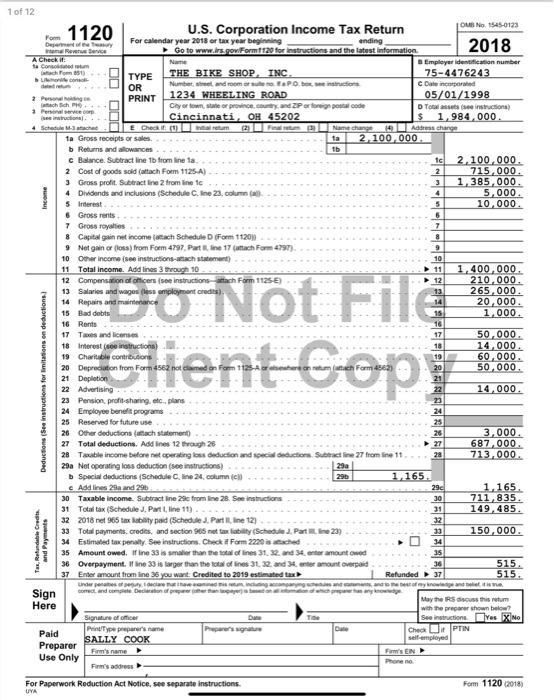

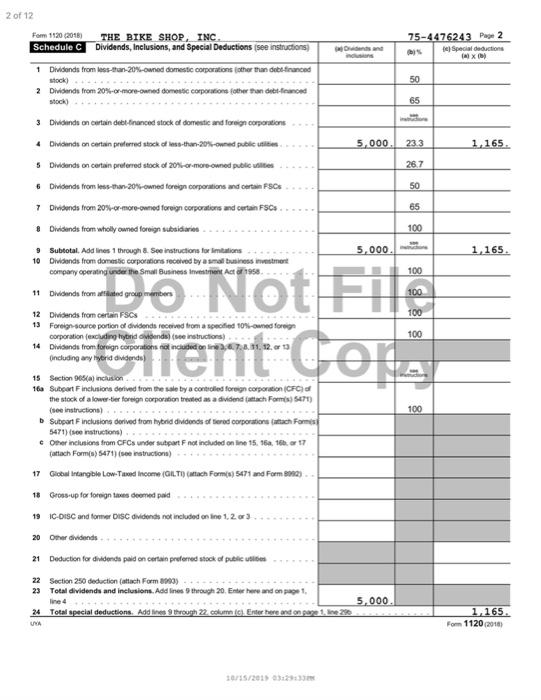

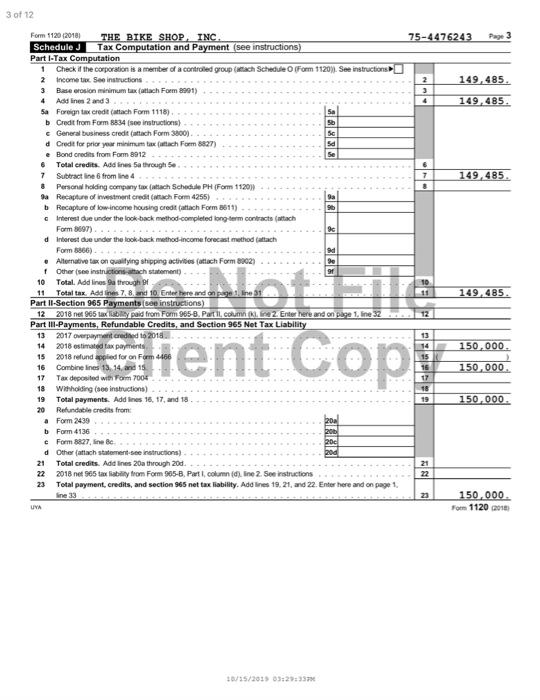

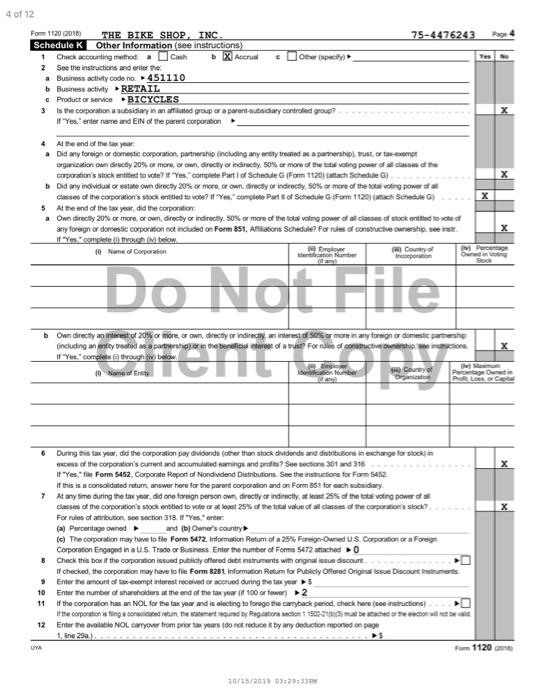

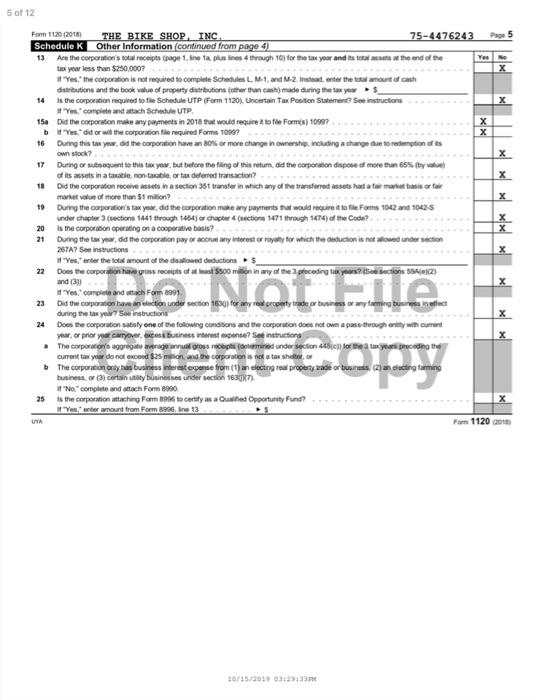

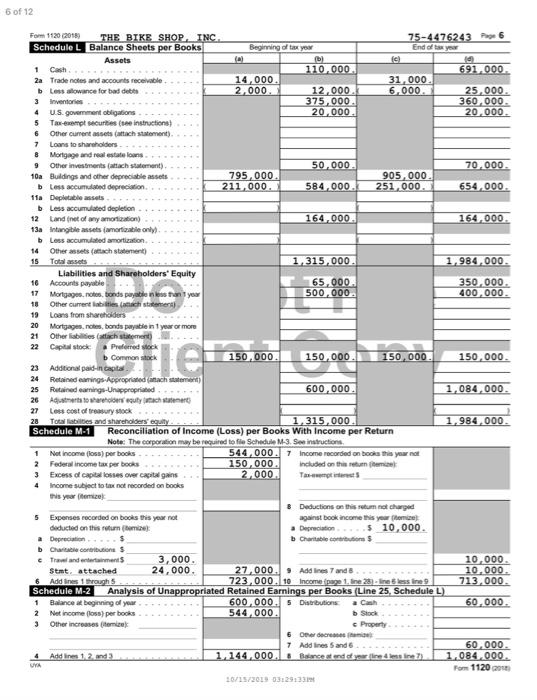

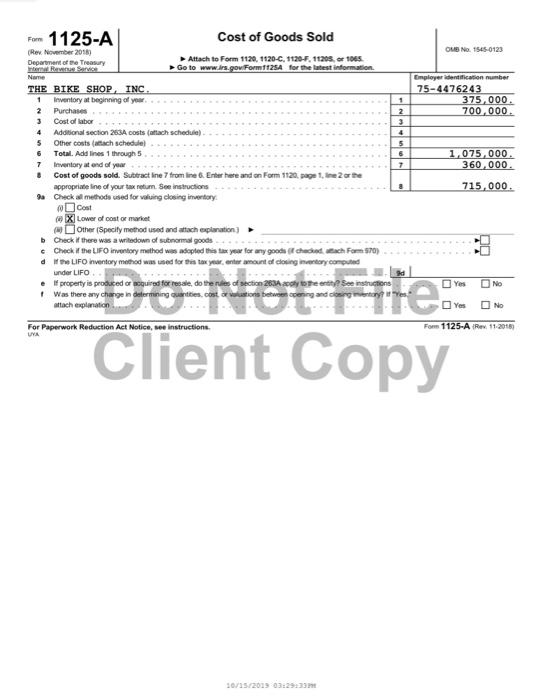

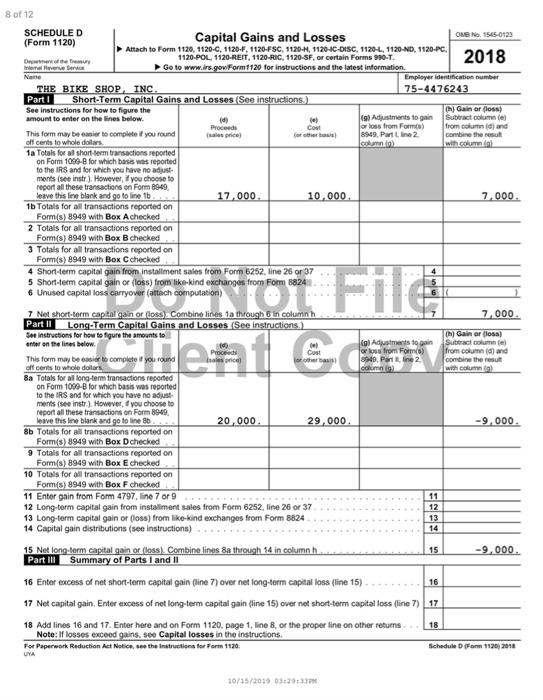

please help! Using the attached FAKE/ MADE UP corporate tax return, create a Trial Balance in Excel. It should have a Tax Balance column, a

please help!

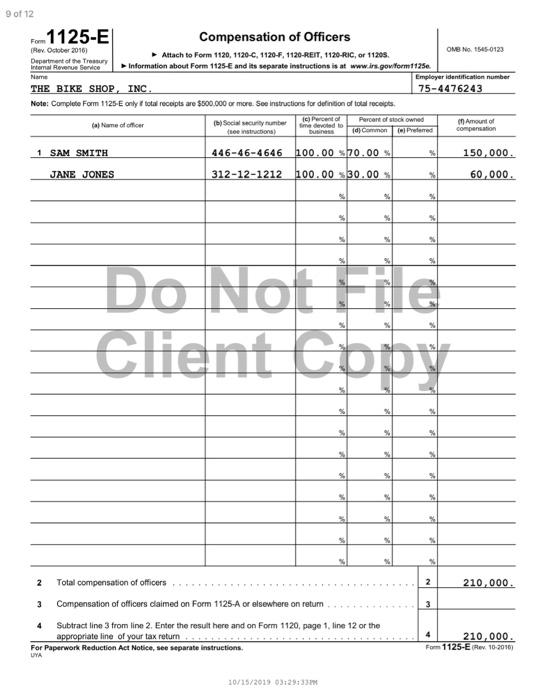

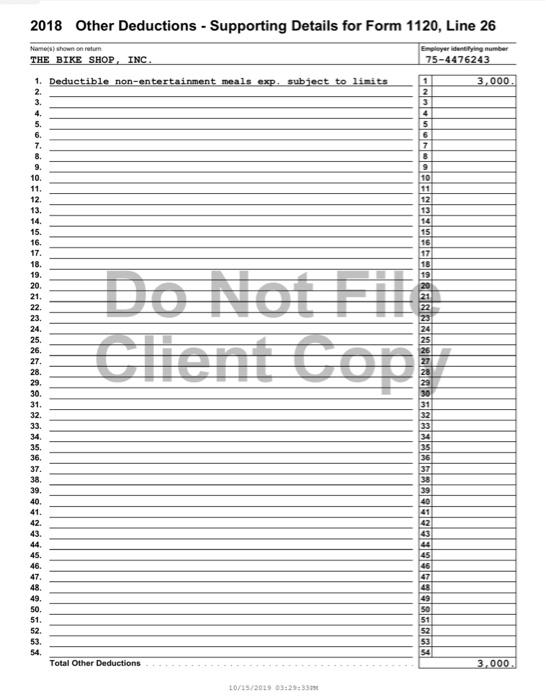

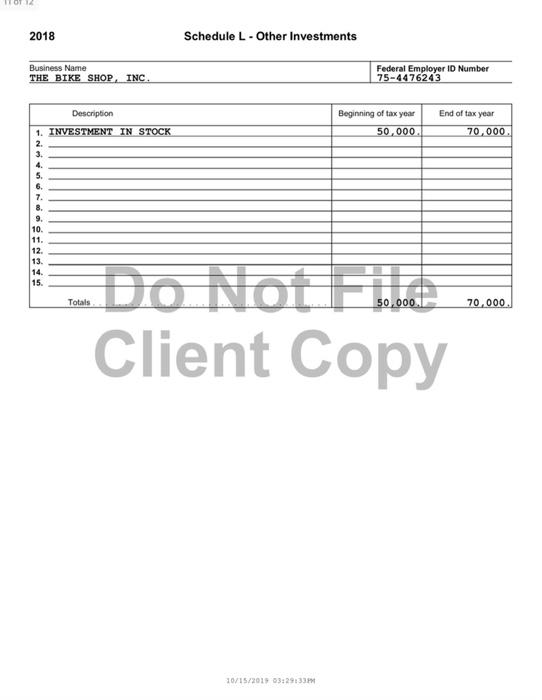

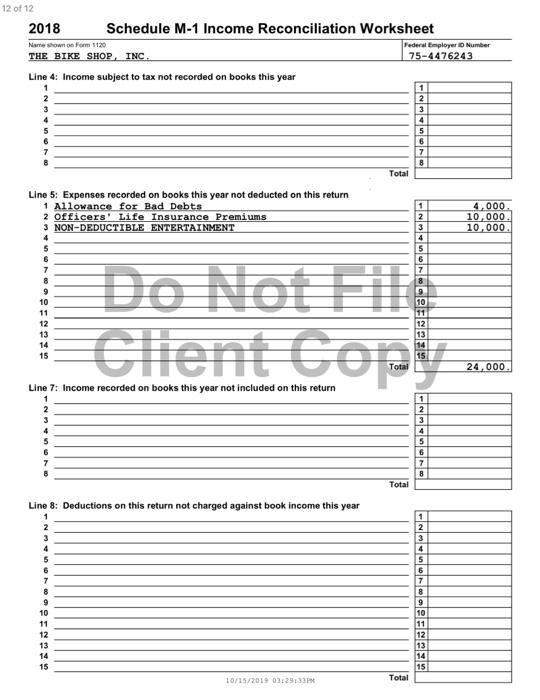

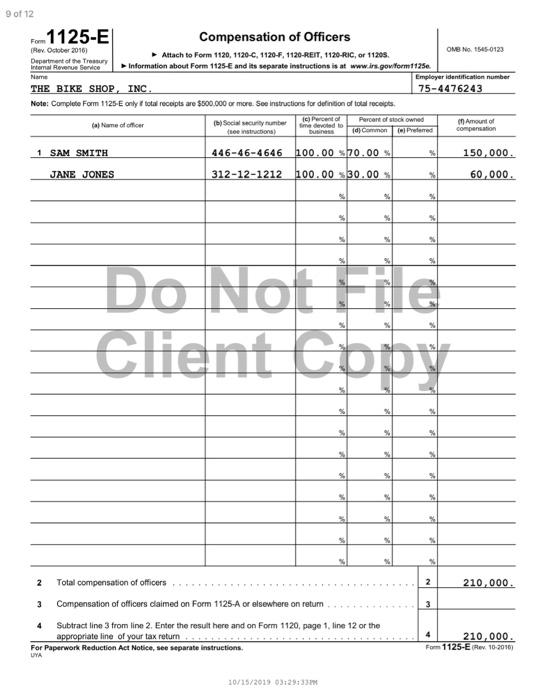

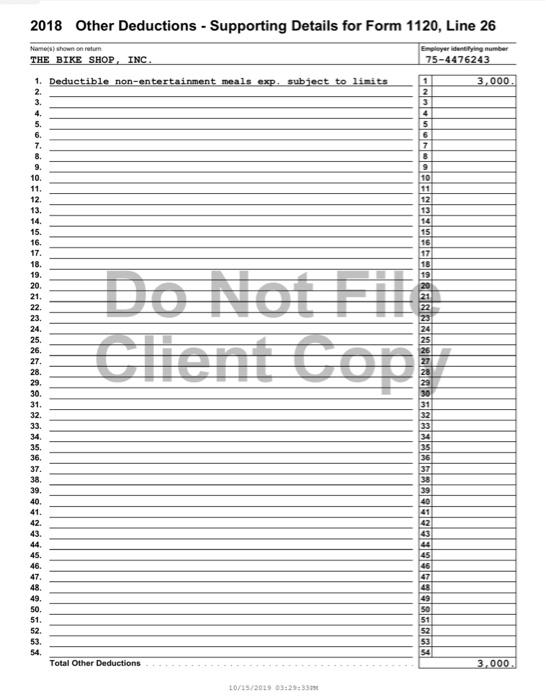

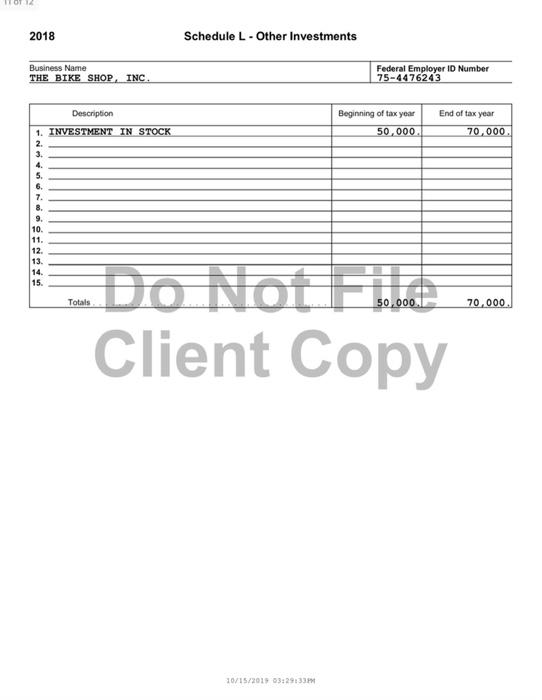

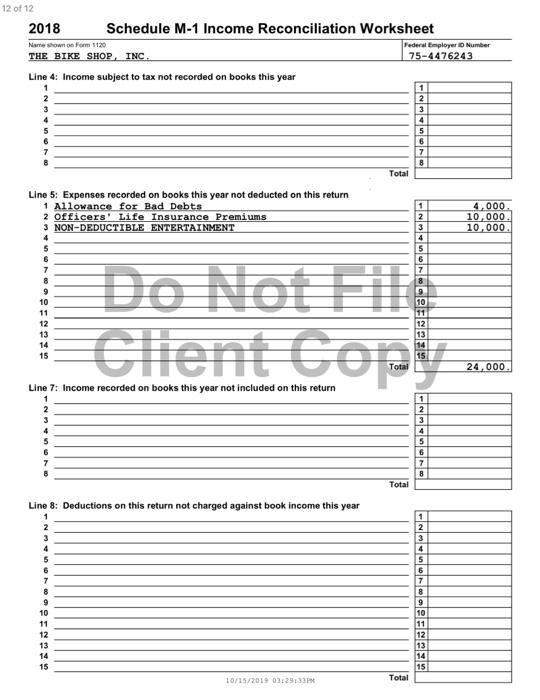

1 of 12 2 of 12 14.15/201) 0112i+1) 3 af 12 10.12/2013 0327=357x 4 of 12 6 During this tax yew, did the corporation pay divisends (other than stock dividends and dintibutions in ecchange for stockin excess of the coporation's currert and accumuleed eamings and profte? See sectors 301 and 316 It "Yes," lilie Form 5452, Corporate Report di Nondividend Distributions. See the instructions for Form 5452. If this is a consoliduted return, answer here for the parert corporwition and on Form 651 for each subsidary. 7 At any time during the tax year, did one forsign person own, directly ar indirectly, at hast 25% of the total voting power of at olasses of the corporation's stock entied to vote or at least 25% of tre total vidue of all clinses of the corporition's slock? For riles of atritution, see section 318 . If "Yes," erser: (a) Percentage owned b and (b) Owners country b Coppration Engaged in a U. S. Trade or Business. Enter the number of Forms 5472 atiached - 0 9 Enter te anount of tax-cempt interes receved or acetued during the tax year of 5 10. Enter the number of shareholders at the end of the tax year (if 100 or fewer) o2 11 If the corpontion has an NOL for the tax year and is olecting to lorego the carnyback penod, check here (tee instructions) 1, ine 29a.). Forn 1120 (204) 70/15/201903;29733FM 5 of 12 6 of 12 Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return 8 of 12 9 of 12 Note: Complete Form 1125-E only t total receipts are $800,000 or mure. See instructions for defintion of toela receipts. For Paperwork, Reducticn Act Notice, see separate instructichs, For 1125-E (Aex 10-2010) LTh 10/15/2019032913114 2018 Other Deductions - Supporting Details for Form 1120, Line 26 1. Deductible non-entertainment meals exp. subject to limits 2. 3. 4. 5. 6. 7. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21 21. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 36. 37. 38. 39. 40. 41. 42. 43. 44. 46. 47. 48. 49. 50. 51. 53. 54. Total Other Deductions 3,000 Schedule L - Other Investments 12 of 12 2018 Schedule M-1 Income Reconciliation Worksheet Line 5: Expenses recorded on books this year not deducted on this return Line 8: Deductions on this return not charged against book income this year 1 of 12 2 of 12 14.15/201) 0112i+1) 3 af 12 10.12/2013 0327=357x 4 of 12 6 During this tax yew, did the corporation pay divisends (other than stock dividends and dintibutions in ecchange for stockin excess of the coporation's currert and accumuleed eamings and profte? See sectors 301 and 316 It "Yes," lilie Form 5452, Corporate Report di Nondividend Distributions. See the instructions for Form 5452. If this is a consoliduted return, answer here for the parert corporwition and on Form 651 for each subsidary. 7 At any time during the tax year, did one forsign person own, directly ar indirectly, at hast 25% of the total voting power of at olasses of the corporation's stock entied to vote or at least 25% of tre total vidue of all clinses of the corporition's slock? For riles of atritution, see section 318 . If "Yes," erser: (a) Percentage owned b and (b) Owners country b Coppration Engaged in a U. S. Trade or Business. Enter the number of Forms 5472 atiached - 0 9 Enter te anount of tax-cempt interes receved or acetued during the tax year of 5 10. Enter the number of shareholders at the end of the tax year (if 100 or fewer) o2 11 If the corpontion has an NOL for the tax year and is olecting to lorego the carnyback penod, check here (tee instructions) 1, ine 29a.). Forn 1120 (204) 70/15/201903;29733FM 5 of 12 6 of 12 Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return 8 of 12 9 of 12 Note: Complete Form 1125-E only t total receipts are $800,000 or mure. See instructions for defintion of toela receipts. For Paperwork, Reducticn Act Notice, see separate instructichs, For 1125-E (Aex 10-2010) LTh 10/15/2019032913114 2018 Other Deductions - Supporting Details for Form 1120, Line 26 1. Deductible non-entertainment meals exp. subject to limits 2. 3. 4. 5. 6. 7. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21 21. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 36. 37. 38. 39. 40. 41. 42. 43. 44. 46. 47. 48. 49. 50. 51. 53. 54. Total Other Deductions 3,000 Schedule L - Other Investments 12 of 12 2018 Schedule M-1 Income Reconciliation Worksheet Line 5: Expenses recorded on books this year not deducted on this return Line 8: Deductions on this return not charged against book income this year Using the attached FAKE/ MADE UP corporate tax return, create a Trial Balance in Excel. It should have a Tax Balance column, a column for adjusting entries (with the AJE's listed at the bottom) and a Book Balance column. In other words, for this assignment, you are working backwards, going from the tax return to the Trial Balance. This will give you added familiarity with preparing the tax adjusting entries and the M-1 schedule. Ignore the fact that this is a 2018 tax return. The year doesn't matter, the process is the same. Be sure to pay attention to the additional schedules because they contain some of the details you will need.

thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started