please help, will give thumbs up!

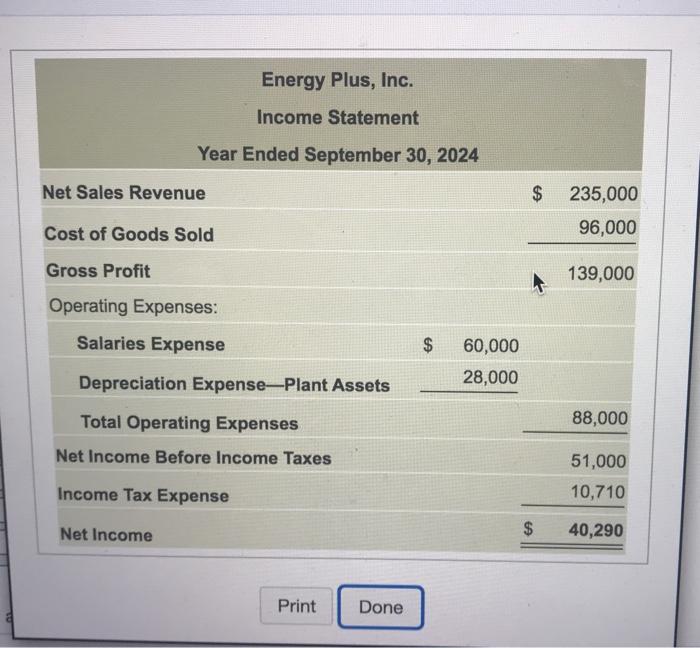

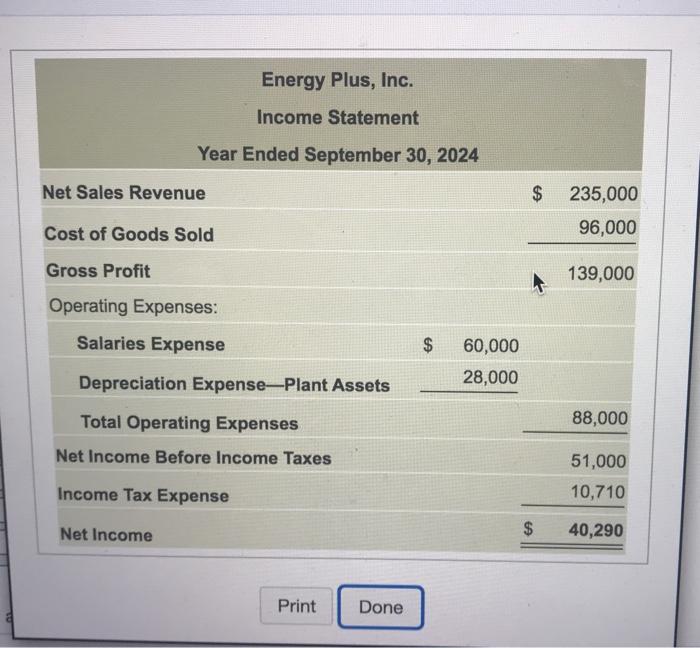

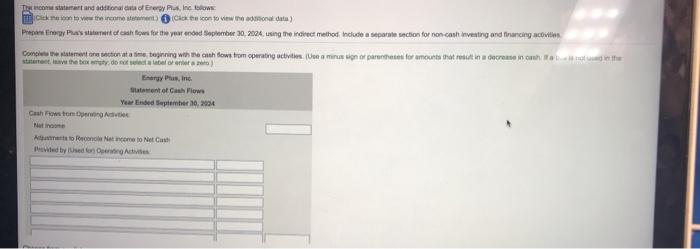

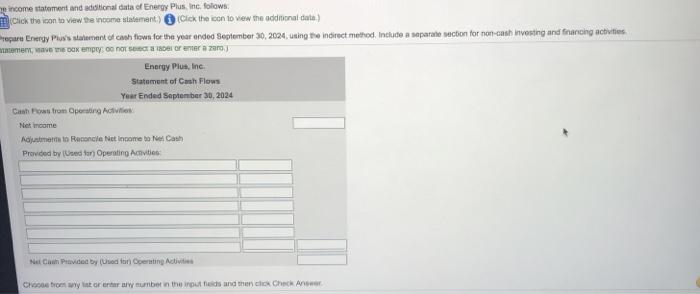

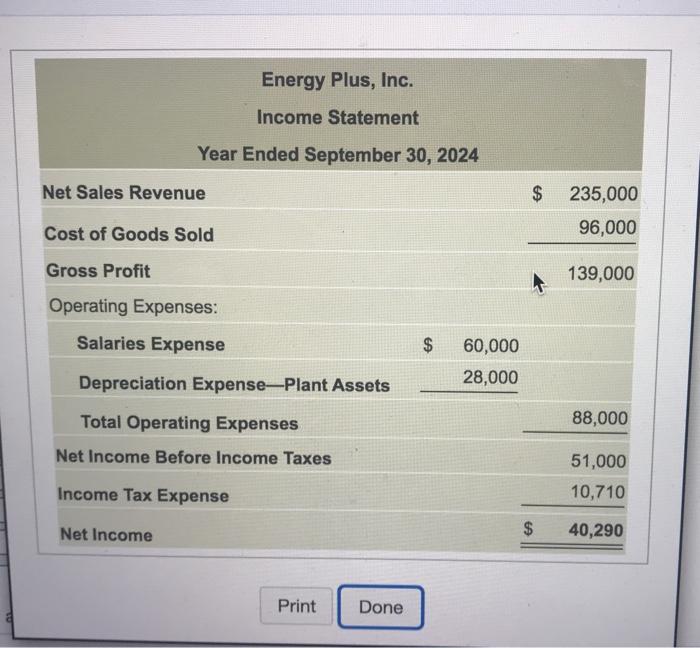

Energy Plus, Inc. Income Statement Year Ended September 30, 2024 Net Sales Revenue $ 235,000 Cost of Goods Sold 96,000 Gross Profit 139,000 Operating Expenses: Salaries Expense $ 60,000 Depreciation Expense-Plant Assets 28,000 Total Operating Expenses 88,000 Net Income Before Income Taxes 51,000 10,710 Income Tax Expense Net Income 40,290 Print Done That come start and additional Energy Plus, Inc Bow Click on the incoment) Cick the icon to view the one data) Phone new Paste for the year ended toplember 30, 2024. using the indirect method include a parte section for non-coth investing and financing activities Complete retornat a time, begin with a cun tows from operating them in ar parents amounts that result in a decrease in the the Energy Prus, Inc Statement of Cash Flow Year Ended September 30, 2004 Cash Flowstond A Netcome to Net ved by used e income statement and additional data of Energy Plus, Inc. folow Click the icon to view te income statement) Click the con to view the additional data) reparerergy Plus's statement of canh town for the year ended September 30, 2004 ning the indirect method. Include a separate section for non-cash investing and financing activities temerave me da empry: neorener zur Energy Plus, Inc Statement of Cash Flows Year Ended September 30, 2024 Cashow from Operating Active Nek income Adjustment Reconcile et income to Nel Cash Provided by used for Operating Activities NetCP.doc by Used on perting Activities Corom ny store al number in the routes and then the check Energy Plus, Inc. Income Statement Year Ended September 30, 2024 Net Sales Revenue $ 235,000 Cost of Goods Sold 96,000 Gross Profit 139,000 Operating Expenses: Salaries Expense $ 60,000 Depreciation Expense-Plant Assets 28,000 Total Operating Expenses 88,000 Net Income Before Income Taxes 51,000 10,710 Income Tax Expense Net Income 40,290 Print Done That come start and additional Energy Plus, Inc Bow Click on the incoment) Cick the icon to view the one data) Phone new Paste for the year ended toplember 30, 2024. using the indirect method include a parte section for non-coth investing and financing activities Complete retornat a time, begin with a cun tows from operating them in ar parents amounts that result in a decrease in the the Energy Prus, Inc Statement of Cash Flow Year Ended September 30, 2004 Cash Flowstond A Netcome to Net ved by used e income statement and additional data of Energy Plus, Inc. folow Click the icon to view te income statement) Click the con to view the additional data) reparerergy Plus's statement of canh town for the year ended September 30, 2004 ning the indirect method. Include a separate section for non-cash investing and financing activities temerave me da empry: neorener zur Energy Plus, Inc Statement of Cash Flows Year Ended September 30, 2024 Cashow from Operating Active Nek income Adjustment Reconcile et income to Nel Cash Provided by used for Operating Activities NetCP.doc by Used on perting Activities Corom ny store al number in the routes and then the check