please help- will give thumbs up!!

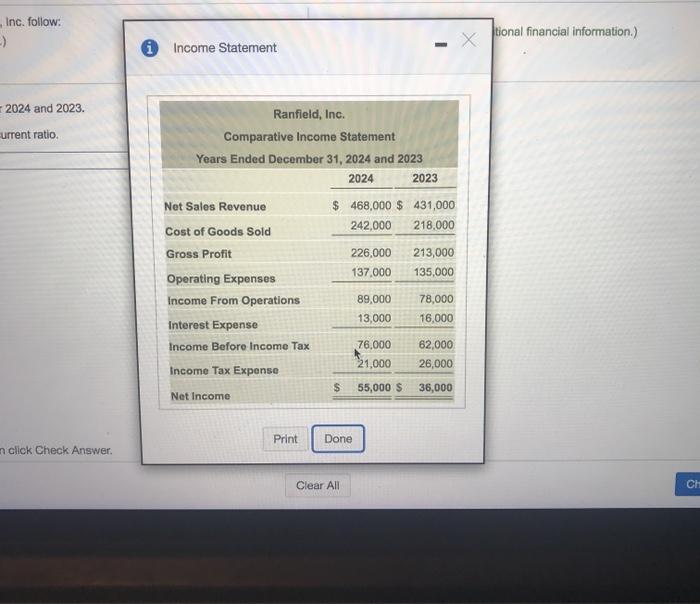

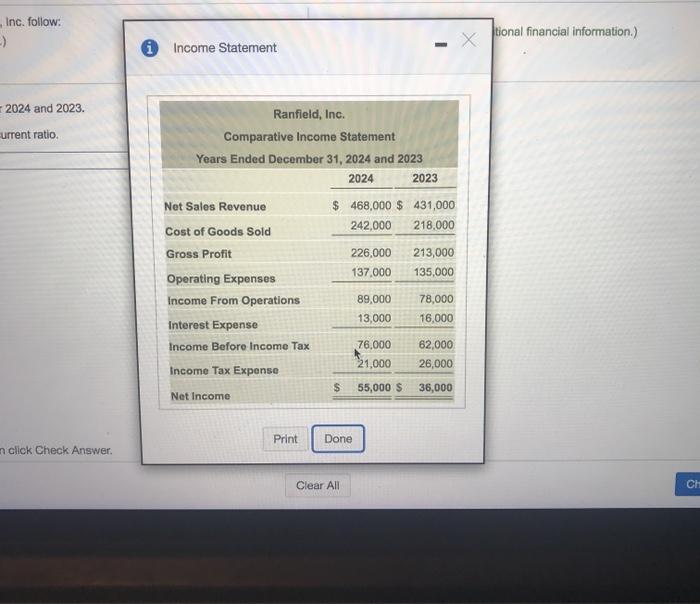

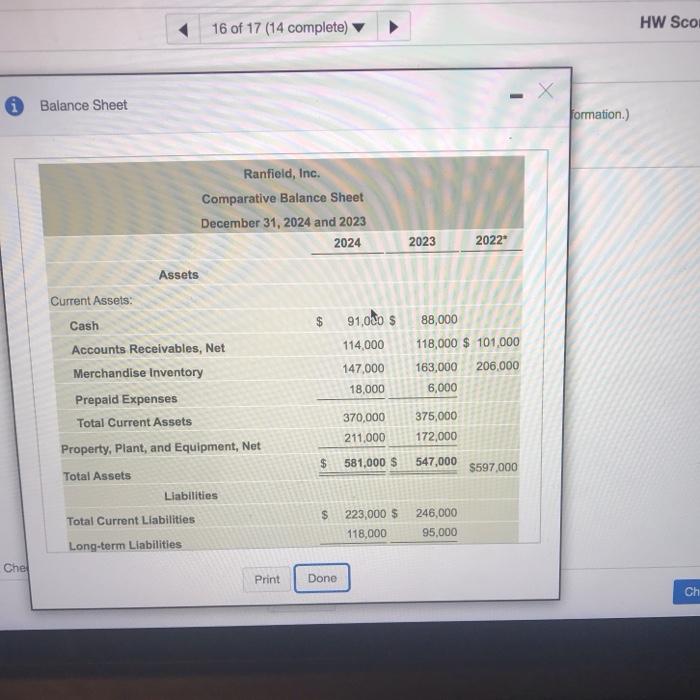

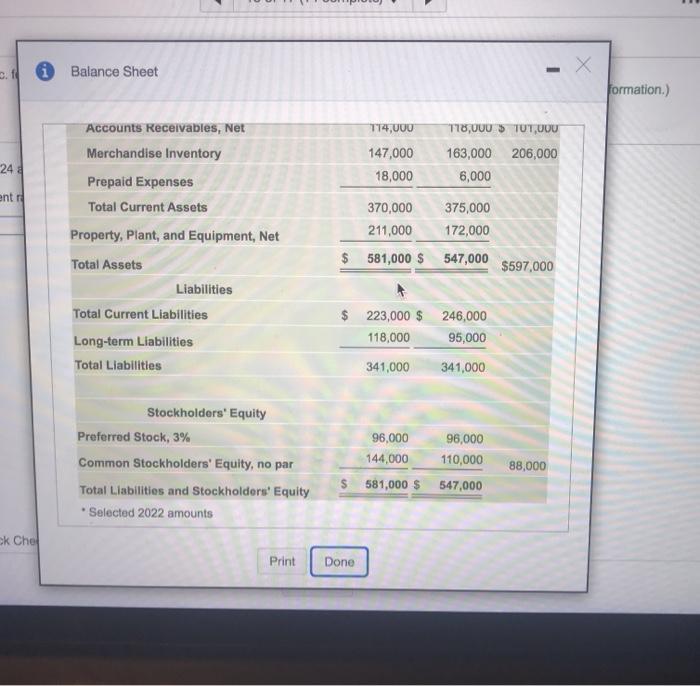

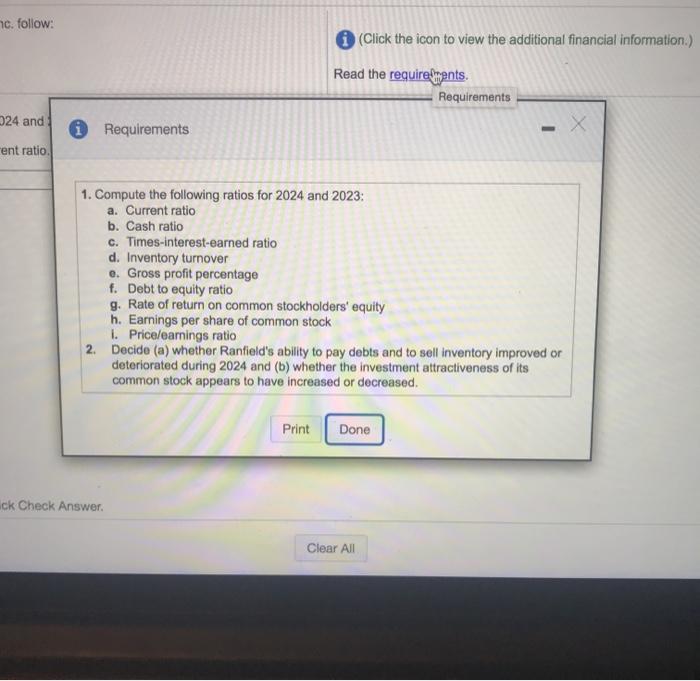

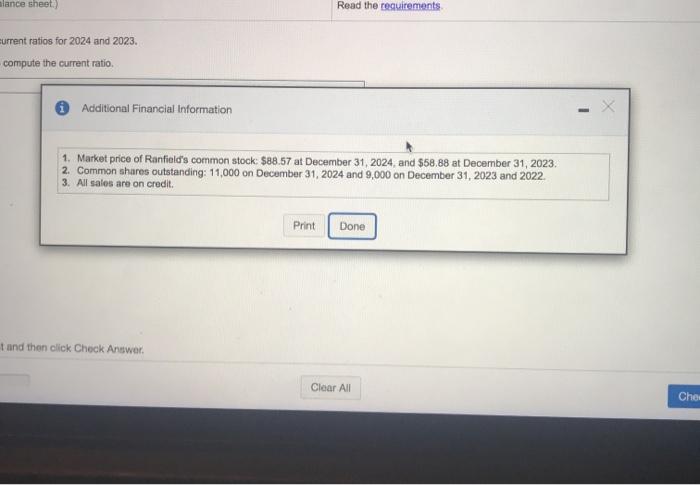

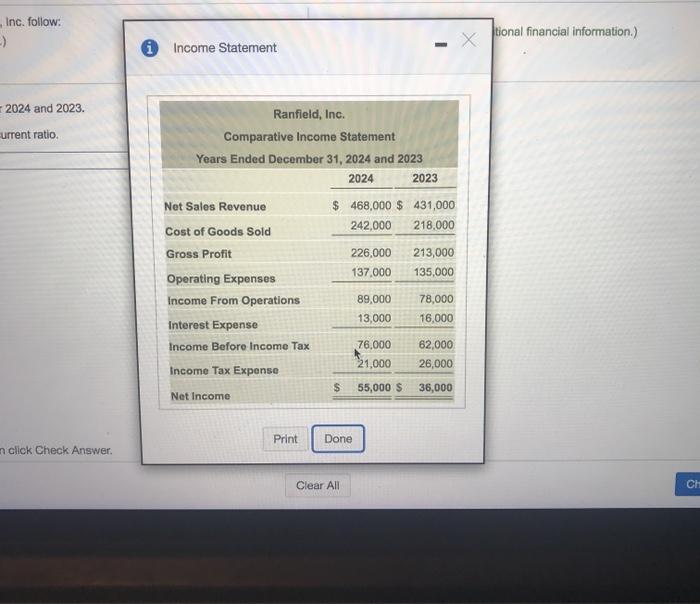

Inc. follow: -) i Income Statement tional financial information.) 2024 and 2023. urrent ratio Ranfield, Inc. Comparative Income Statement Years Ended December 31, 2024 and 2023 2024 2023 Net Sales Revenue $ 468,000 $ 431,000 Cost of Goods Sold 242,000 218,000 Gross Profit 226,000 213,000 Operating Expenses 137,000 135,000 Income From Operations 89,000 78,000 13,000 Interest Expense 16,000 Income Before Income Tax 76,000 62,000 21,000 Income Tax Expense $ 55,000 $ 36,000 Net Income 26,000 Print Done n click Check Answer. Clear All CH 16 of 17 (14 complete) HW Sco i Balance Sheet formation.) Ranfield, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 2022" Assets Current Assets: Cash $ 91,000 $ 114,000 88,000 118,000 $ 101,000 163,000 206,000 6,000 147,000 18,000 Accounts Receivables, Net Merchandise Inventory Prepaid Expenses Total Current Assets Property, Plant, and Equipment, Net 370,000 211.000 375,000 172,000 547,000 $ 581,000 $ $597,000 Total Assets Liabilities S Total Current Liabilities 223,000 $ 246,000 118,000 95,000 Long-term Liabilities Chel Print Done Ch 1 Balance Sheet formation.) T14,000 718,0UU TUTUUU Accounts Receivables, Net Merchandise Inventory 206,000 24 147,000 18,000 163,000 6,000 ent Prepaid Expenses Total Current Assets 370,000 375,000 211,000 172,000 $ 581,000 $ 547,000 $597,000 Property, Plant, and Equipment, Net Total Assets Liabilities Total Current Liabilities Long-term Liabilities Total Liabilities $ 223,000 $ 246,000 118,000 95,000 341,000 341,000 Stockholders' Equity Preferred Stock, 3% Common Stockholders' Equity, no par Total Liabilities and Stockholders' Equity Selected 2022 amounts 96.000 144,000 96,000 110,000 547,000 88,000 581,000 $ ck Chel Print Done c. follow: (Click the icon to view the additional financial information.) Read the requirements Requirements 24 and Requirements rent ratio 1. Compute the following ratios for 2024 and 2023 a. Current ratio b. Cash ratio c. Times-interest-earned ratio d. Inventory turnover e. Gross profit percentage f. Debt to equity ratio g. Rate of return on common stockholders' equity h. Earnings per share of common stock 1. Price/earings ratio 2. Decide (a) whether Ranfield's ability to pay debts and to sell inventory improved or deteriorated during 2024 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased. Print Done Ick Check Answer Clear All alance sheet.) Read the requirements current ratios for 2024 and 2023, compute the current ratio. Additional Financial Information 1. Market price of Ranfield's common stock: $88.57 at December 31, 2024, and $58.88 at December 31, 2023. 2. Common shares outstanding: 11,000 on December 31, 2024 and 9,000 on December 31, 2023 and 2022 3. All sales are on credit. Print Done and then click Check Answer Clear All Cher