Please help with 3-12 (a, b, c), 3-13, and 3-14 (a, b, c). Our textbook doesn't have solutions so I have no way of checking my answers. We have a quiz tomorrow, so I want to make sure I'm doing this right. Sorry I can't post two pictures or I would show a picture of my work. Thanks!

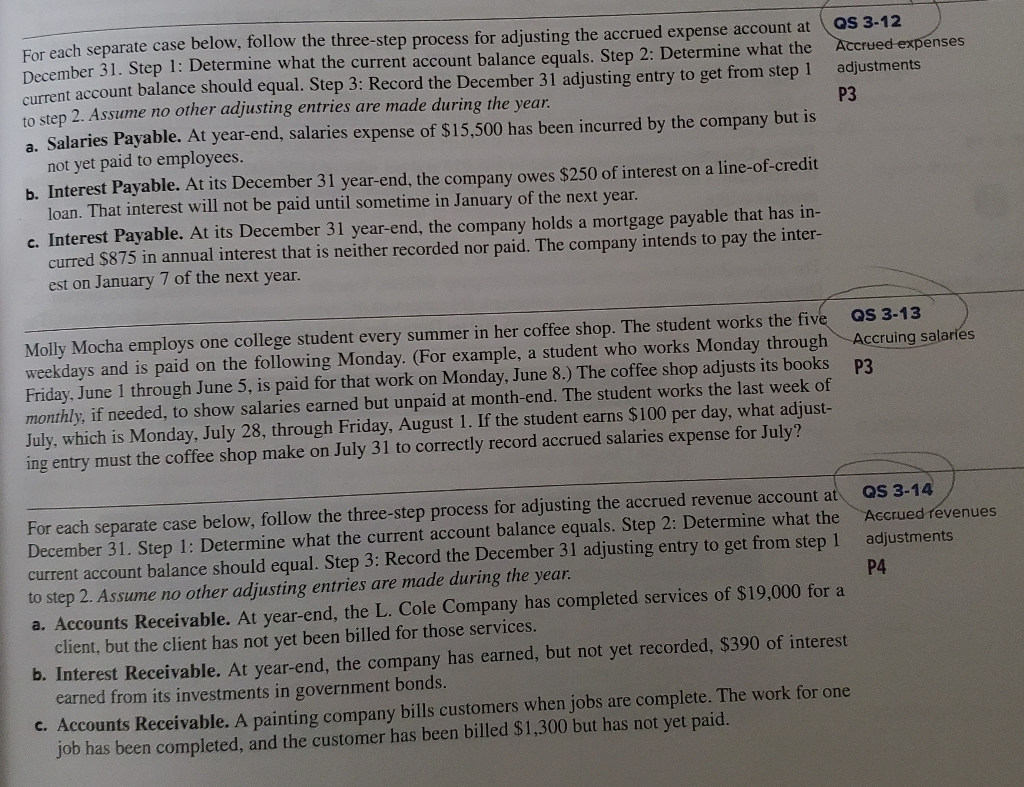

For each separate case below, follow the three-step process for adjusting the accrued expense account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year a. Salaries Payable. At year-end, salaries expense of $15,500 has been incurred by the company but is not yet paid to employees. b. Interest Payable. At its December 31 year-end, the company owes $250 of interest on a line-of-credit loan. That interest will not be paid until sometime in January of the next year. c. Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has in- curred $875 in annual interest that is neither recorded nor paid. The company intends to pay the inter- est on January 7 of the next year. QS 3-12 Accrued expenses adjustments P3 Molly Mocha employs one college student every summer in her coffee shop. The student works the five weekdays and is paid on the following Monday. (For example, a student who works Monday through Friday, June 1 through June 5, is paid for that work on Monday, June 8.) The coffee shop adjusts its books QS 3-13 Accruing salaries P3 monthly, if needed, to show salaries earned but unpaid at month-end. The student works the last week of July, which is Monday, July 28, through Friday, August 1. If the student earns $100 per day, what adjust- ing entry must the coffee shop make on July 31 to correctly record accrued salaries expense for July? For each separate case below, follow the three-step process for adjusting the accrued revenue account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $19,000 for a client, but the client has not yet been billed for those services. QS 3-14 Accrued revenues adjustments P4 b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $390 of interest earned from its investments in government bonds. C. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one Job has been completed, and the customer has been billed $1,300 but has not yet paid