Please help with a-e. Thank you!

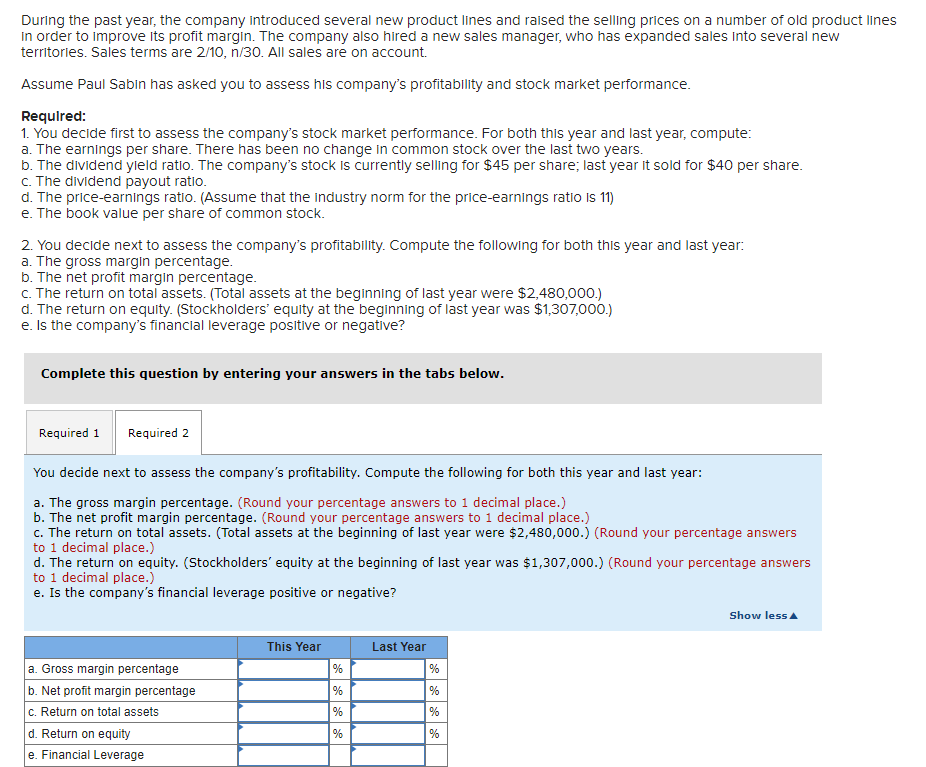

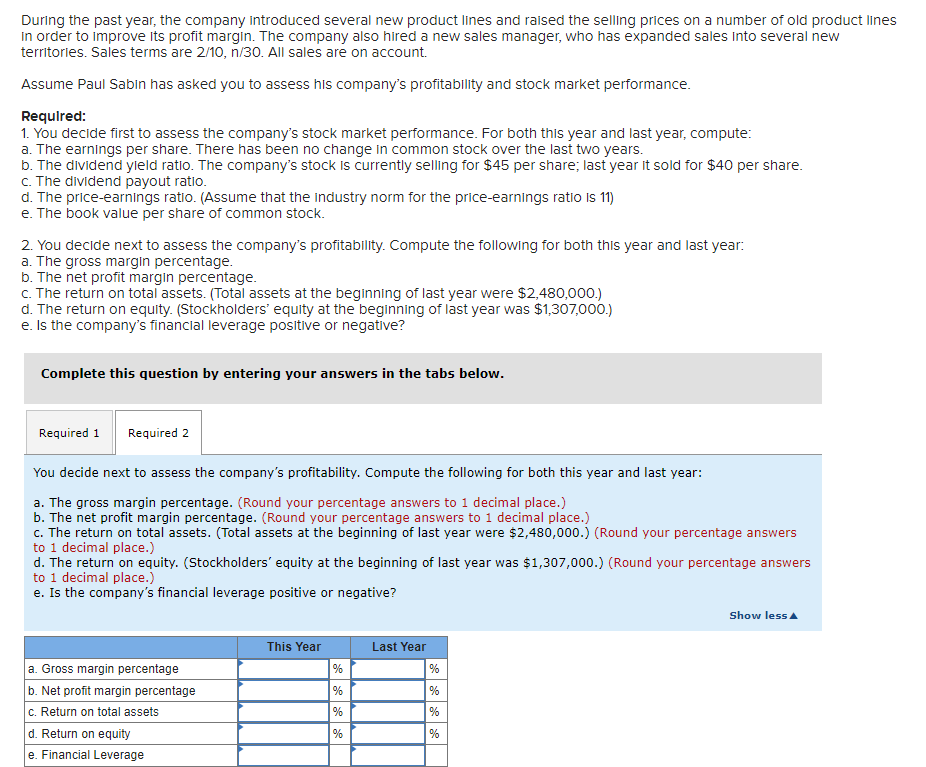

During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lin in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales Into several new territories. Sales terms are 2/10,n/30. All sales are on account. Assume Paul Sabin has asked you to assess his company's profitability and stock market performance. Requlred: 1. You decide first to assess the company's stock market performance. For both this year and last year, compute: a. The earnings per share. There has been no change in common stock over the last two years. b. The dividend yleld ratio. The company's stock is currently selling for $45 per share; last year it sold for $40 per share. c. The dividend payout ratio. d. The price-earnings ratio. (Assume that the industry norm for the price-earnings ratio is 11) e. The book value per share of common stock. 2. You decide next to assess the company's profitability. Compute the following for both this year and last year: a. The gross margin percentage. b. The net profit margin percentage. c. The return on total assets. (Total assets at the beginning of last year were $2,480,000.) d. The return on equity. (Stockholders' equity at the beginning of last year was $1,307,000.) e. Is the company's financial leverage positive or negative? Complete this question by entering your answers in the tabs below. You decide next to assess the company's profitability. Compute the following for both this year and last year: a. The gross margin percentage. (Round your percentage answers to 1 decimal place.) b. The net profit margin percentage. (Round your percentage answers to 1 decimal place.) c. The return on total assets. (Total assets at the beginning of last year were $2,480,000.) (Round your percentage answers to 1 decimal place.) d. The return on equity. (Stockholders' equity at the beginning of last year was $1,307,000.) (Round your percentage answers to 1 decimal place.) e. Is the company's financial leverage positive or negative? During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lin in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales Into several new territories. Sales terms are 2/10,n/30. All sales are on account. Assume Paul Sabin has asked you to assess his company's profitability and stock market performance. Requlred: 1. You decide first to assess the company's stock market performance. For both this year and last year, compute: a. The earnings per share. There has been no change in common stock over the last two years. b. The dividend yleld ratio. The company's stock is currently selling for $45 per share; last year it sold for $40 per share. c. The dividend payout ratio. d. The price-earnings ratio. (Assume that the industry norm for the price-earnings ratio is 11) e. The book value per share of common stock. 2. You decide next to assess the company's profitability. Compute the following for both this year and last year: a. The gross margin percentage. b. The net profit margin percentage. c. The return on total assets. (Total assets at the beginning of last year were $2,480,000.) d. The return on equity. (Stockholders' equity at the beginning of last year was $1,307,000.) e. Is the company's financial leverage positive or negative? Complete this question by entering your answers in the tabs below. You decide next to assess the company's profitability. Compute the following for both this year and last year: a. The gross margin percentage. (Round your percentage answers to 1 decimal place.) b. The net profit margin percentage. (Round your percentage answers to 1 decimal place.) c. The return on total assets. (Total assets at the beginning of last year were $2,480,000.) (Round your percentage answers to 1 decimal place.) d. The return on equity. (Stockholders' equity at the beginning of last year was $1,307,000.) (Round your percentage answers to 1 decimal place.) e. Is the company's financial leverage positive or negative