Answered step by step

Verified Expert Solution

Question

1 Approved Answer

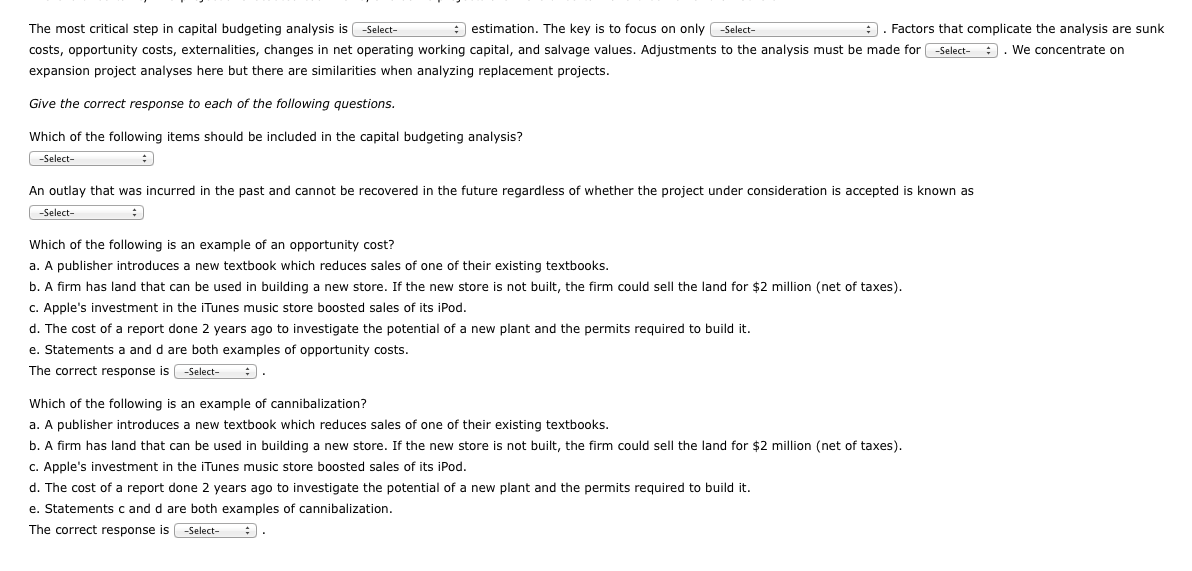

Please help with all drop drop boxes. The 1st gives the choices net income, cash flow, or accounting income. The 2nd gives the choices relevant

Please help with all drop drop boxes. The 1st gives the choices net income, cash flow, or accounting income. The 2nd gives the choices relevant net income, incremental accounting income, or incremental cash flows. The 3rd gives the choices of inflation, interest, or dividends. The 4th drop down box gives the choices of suck costs, interest payments, dividend payments, or oppornity costs. The 4th and 5th ones give the choices to pick from a,b,c,d,e. Thank-you for the help it is greatly needed.

Please help with all drop drop boxes. The 1st gives the choices net income, cash flow, or accounting income. The 2nd gives the choices relevant net income, incremental accounting income, or incremental cash flows. The 3rd gives the choices of inflation, interest, or dividends. The 4th drop down box gives the choices of suck costs, interest payments, dividend payments, or oppornity costs. The 4th and 5th ones give the choices to pick from a,b,c,d,e. Thank-you for the help it is greatly needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started