Question

Please help with all of this I have numbered and made a list of the options given by each drop down box. I opened the

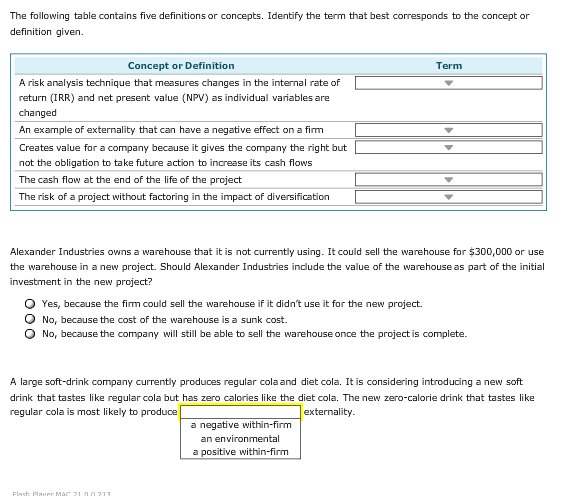

Please help with all of this I have numbered and made a list of the options given by each drop down box. I opened the very last drop down box in the picture. Please help with all questions. I have tryied 2 times and have only gotten 4 out of 7 and this is my last try.

1. possibility analysis, sensitivity analysis, pure-play analysis, or casino analysis

2. beta risk, exchange-rate risk, cannibalization, corporate risk

3. real option, expropriation, externalities, or opportunity cost

4. initial cash flow, terminal cash flow, incremental cash flow, or relevant cash flow

5. beta risk, stand-alone risk, corporate risk, or market risk

The following table contains five definitions or concepts. Identify the term that best corresponds to the concept or definition given. Concept or Definition Term A risk analysis technique that mesures changes in the internal rate of A risk analysis technique that measures changes in the internal rate of return (IRR) and net present value (NPV) as individual variables are changed An example of externality that can have a negative effect on a fim Creates value for a company because it gives the company the right but not the obligation to take future action to increase its cash flows The cash flow at the end of the life of the project The risk of a project without factoring in the impact of diversification Alexander Industries owns a warehouse that it is not currently using. It could sell the warehouse for $300,000 or use the warehouse in a new project. Should Alexander Industries include the value of the warehouse as part of the initial investment in the new project? O Yes, because the firm could sell the warehouse if it didn't use it for the new project O No, because the cost of the warehouse is a sunk cost. O No, because the company will still be able to sell the warehouse once the project is complete. A large soft-drink company currently produces regular cola and diet cola. It is considering introducing a new soft drink that tastes like regular cola but has zero calories like the diet cola. The new zero-calorie drink that tastes like regular cola is most likely to produce externality a negative within-firm an environmental a positive within-firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started