Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with all parts of the question. Thank you! 15 On January 1, Revive Sales Company entered into a lease agreement to lease a

Please help with all parts of the question. Thank you!

15

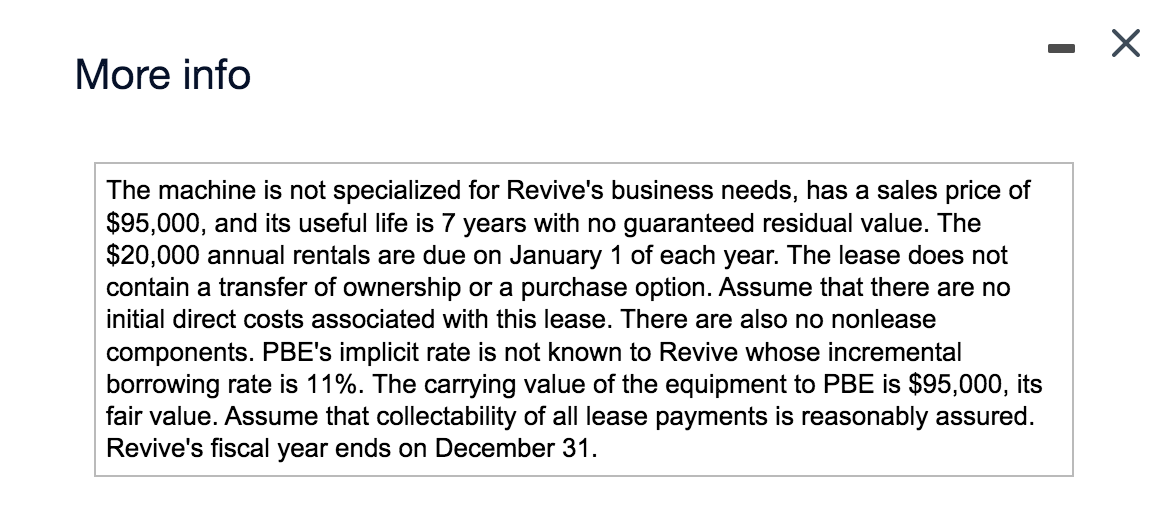

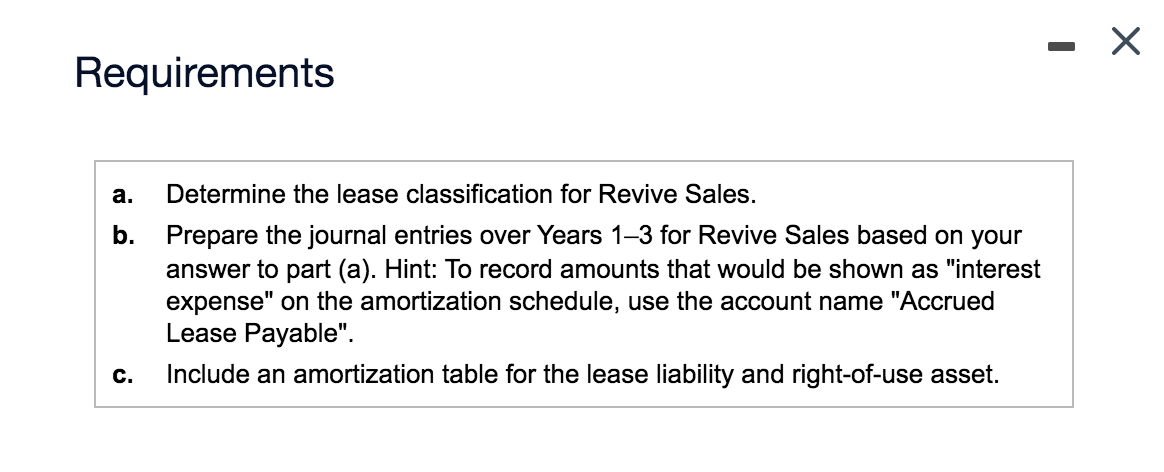

On January 1, Revive Sales Company entered into a lease agreement to lease a piece of machinery for a period of 5 years from Poor Boy Equipment (PBE). (Click the icon to view the Present Value of $1 table.) . (Click the icon to view the details of the lease.) (Click the icon to view the Future Value of $1 table.) (Click the icon to view the Read the requirements. (Click the icon to view the Requirement a. Determine the lease classification for Revive Sales. Begin by computing the present value of the lease payments. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculation. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answer to the nearest whole dollar.) The present value (PV) of the payments due under the lease is $ More info The machine is not specialized for Revive's business needs, has a sales price of $95,000, and its useful life is 7 years with no guaranteed residual value. The $20,000 annual rentals are due on January 1 of each year. The lease does not contain a transfer of ownership or a purchase option. Assume that there are no initial direct costs associated with this lease. There are also no nonlease components. PBE's implicit rate is not known to Revive whose incremental borrowing rate is 11%. The carrying value of the equipment to PBE is $95,000, its fair value. Assume that collectability of all lease payments is reasonably assured. Revive's fiscal year ends on December 31. Requirements a. Determine the lease classification for Revive Sales. b. Prepare the journal entries over Years 13 for Revive Sales based on your answer to part (a). Hint: To record amounts that would be shown as "interest expense" on the amortization schedule, use the account name "Accrued Lease Payable". Include an amortization table for the lease liability and right-of-use asset. CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started