Answered step by step

Verified Expert Solution

Question

1 Approved Answer

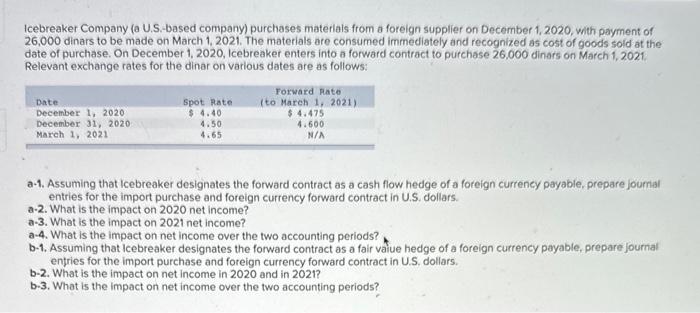

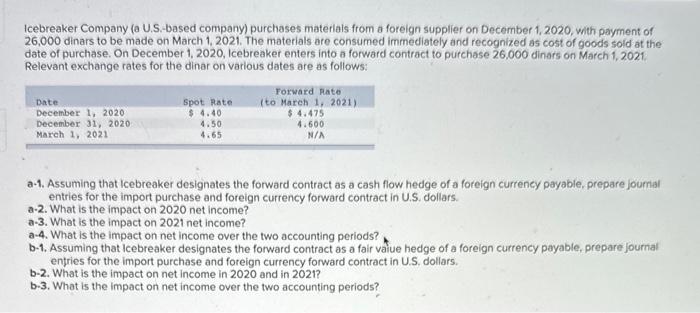

please help with all parts thank you! a clear image of the question Icebreaker Company (6 US. besed compeny purchoses materials from a foreign supplier

please help with all parts thank you!

a clear image of the question

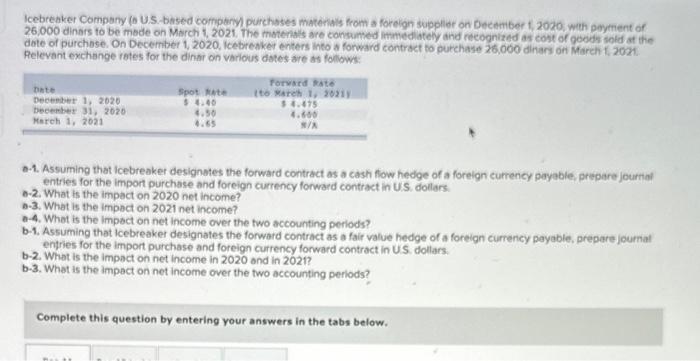

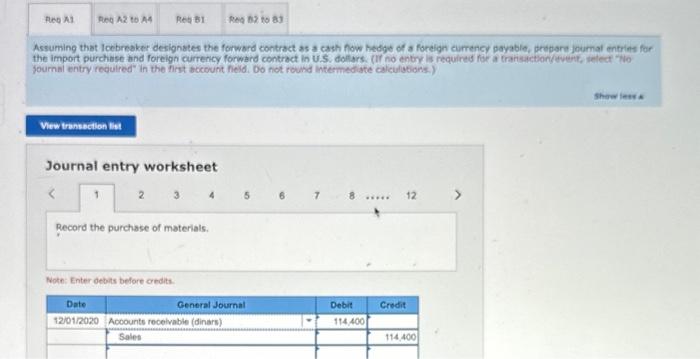

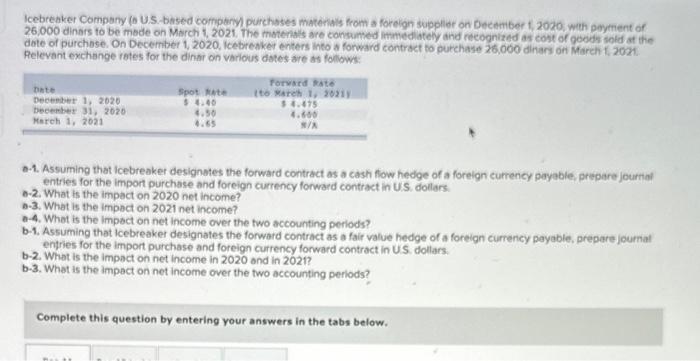

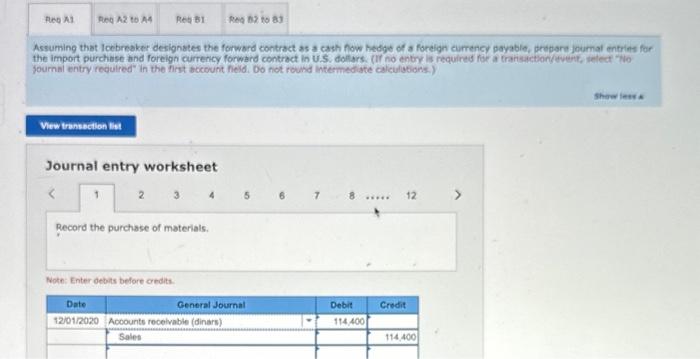

Icebreaker Company (6 US. besed compeny purchoses materials from a foreign supplier on December f, 2020, wth peythent of 26.000 dinars to be mode on March 1. 2021. The moterits are consumed immediately and recognized as cost of goods sold at the dote of purchose. On December 1, 2020, Icebresker enters into a forward contract to putchase 26,000 dinars on Mareh 1.2021. Relevant exchange retes for the dinar on various dates are as follows: a-1. Assuming that icebreaker designates the forward contract as a cash flow hedge of a foreign currency payable, prepare jourthal entries for the import purchase and foreign currency forward contract in US. dollars. 6-2. What is the impact on 2020 net income? b.3. What is the impact on 2021 net income? a-4. What is the impact on net income over the fwo accounting periods? b-1. Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for the import purchase and foreign currency forward contract in US. dollars. b-2. What is the impact on net income in 2020 and in 2021? b-3. What is the impact on net income over the fwo accounting periods? Complete this question by entering your answers in the tabs below. Assuming that locbreaker derignates the forword contract as a cash flow hedge of a forelgn currency payable, itedpare journal entrint for the import purchase and foreign currency forward contract in U.S. doflars. (If ho entor is requires for a frarisictionidyetr, select flo Sournal entry requlred" in the first bocount field. bo not round intermediste calicilstions.) Icebreaker Company (a U.S.-based company) purchases materlals from a foreign supplier on December 1,2020 , with payment of 26,000 dinars to be made on March 1, 2021. The materials are consumed immediately and recognized as cost of goods sold at the date of purchase. On December 1, 2020, Icebreaker enters into a forward contract to purchase 26,000 dinars on March 1, 2021. Relevant exchange rates for the dinar on various dates are as follows: a-1. Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency payable, prepare joumai entries for the import purchase and foreign currency forward contract in U.S. dollars. a-2. What is the impact on 2020 net income? a-3. What is the impact on 2021 net income? a-4. What is the impact on net income over the two accounting periods? b-1. Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal enfries for the import purchase and foreign currency forward contract in U.S. dollars. b-2. What is the impact on net income in 2020 and in 2021 ? b-3. What is the impact on net income over the two accounting periods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started