please help with all questions and show explanation of calculations.

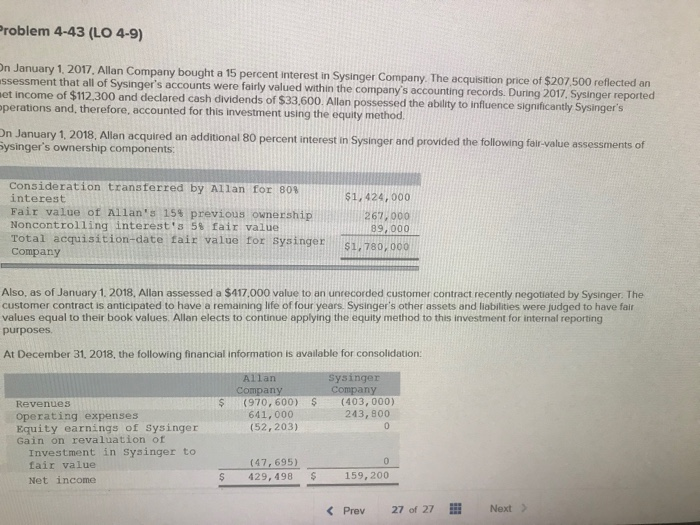

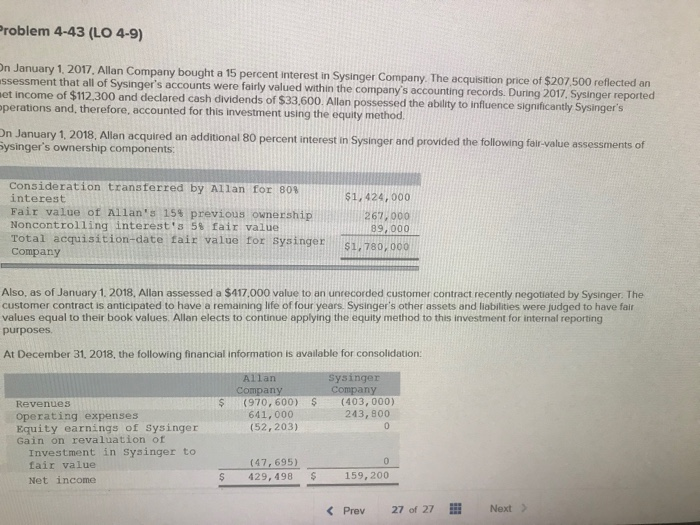

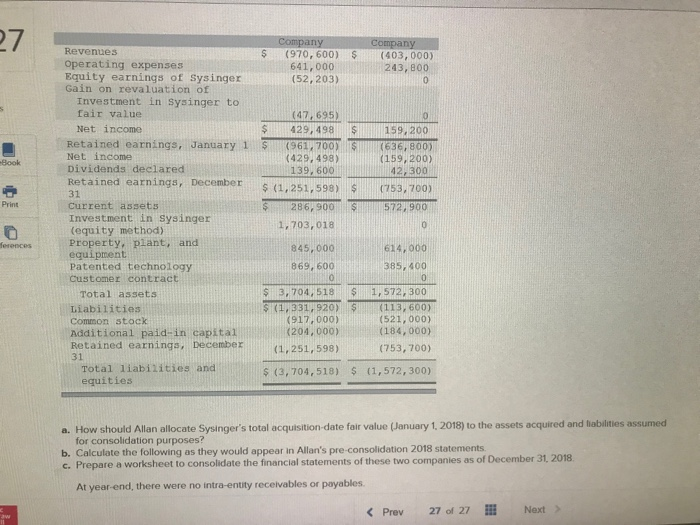

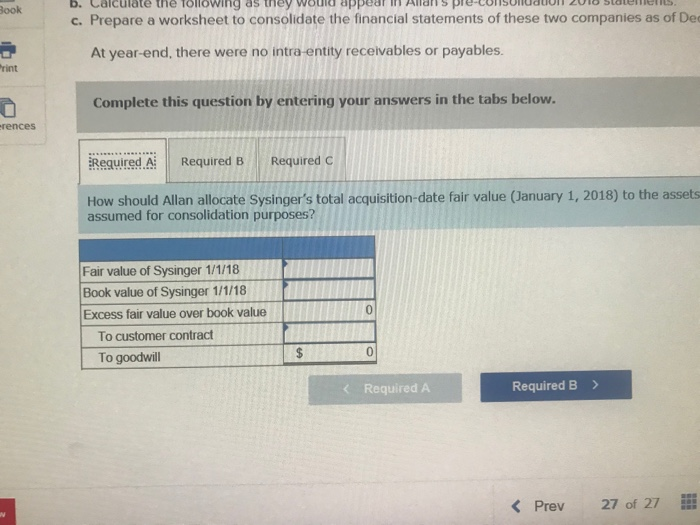

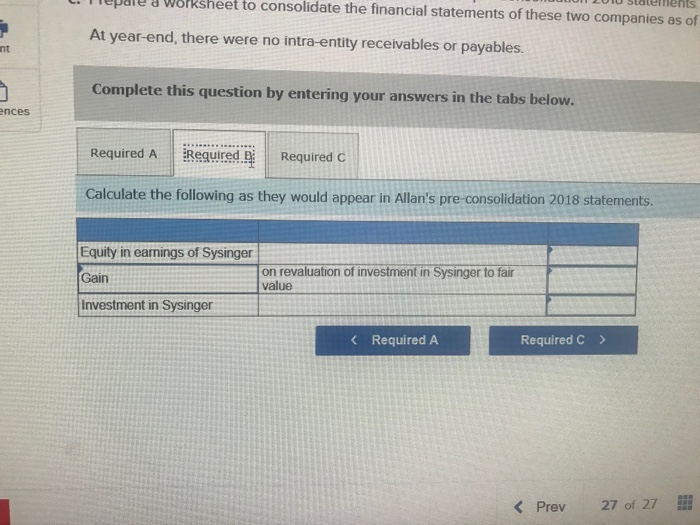

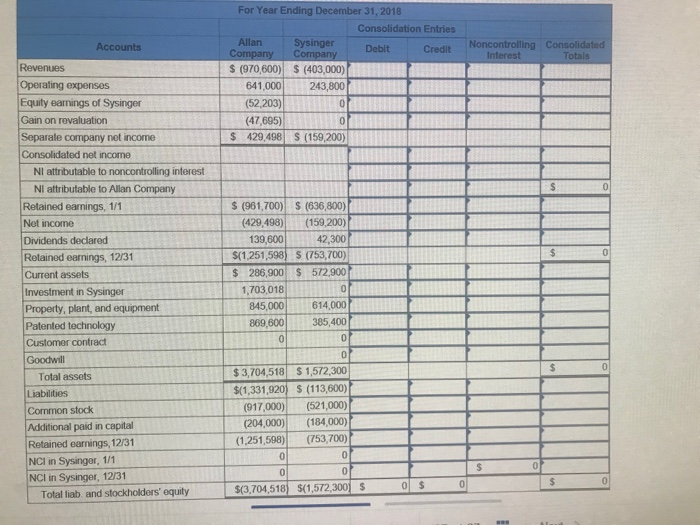

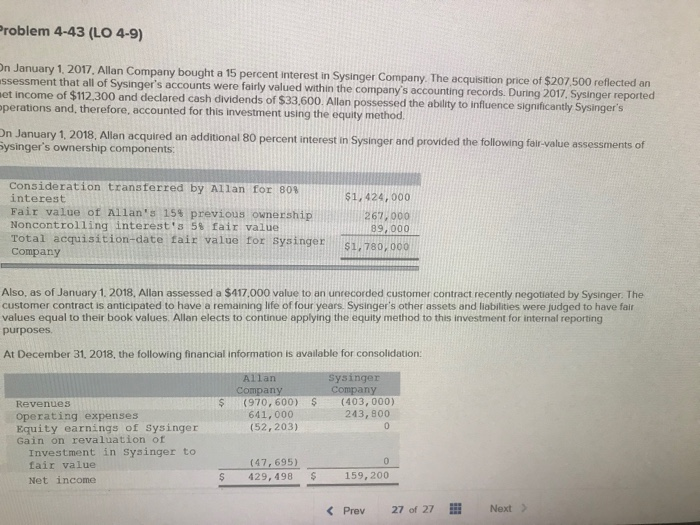

Problem 4-43 (LO 4-9) On January 1, 2017. Allan Company bought a 15 percent interest in Sysinger Company. The acquisition price of $207,500 reflected an assessment that all of Sysinger's accounts were fairly valued within the company's accounting records. During 2017. Sysinger reported net income of $112,300 and declared cash dividends of $33,600. Allan possessed the ability to influence significantly Sysinger's operations and therefore, accounted for this investment using the equity method. On January 1, 2018, Allan acquired an additional 80 percent interest in Sysinger and provided the following fair-value assessments of Sysinger's ownership components: Consideration transferred by Allan for 80% interest Fair value of Allan's 154 previous ownership Noncontrolling interest's 58 fair value Total acquisition-date fair value for Sysinger Company $1,424,000 267,000 89,000 S1,780 000 Also, as of January 1, 2018, Allon assessed a $417.000 value to an unrecorded customer contract recently negotiated by Sysinger. The customer contract is anticipated to have a remaining life of four years. Sysinger's other assets and liabilities were judged to have fair values equal to their book values. Allan elects to continue applying the equity method to this investment for internal reporting purposes At December 31, 2018, the following financial information is available for consolidation Allan Company (970, 600) 641,000 (52,203) $ Sysinger Company (403, 000) 243,800 $ Revenues Operating expenses Equity earnings of Sysinger Gain on revaluation of Investment in Syainger to fair value Net income (47,695) 429,498 $ $ 159, 200 $ S Company (970, 600) 641,000 (52,203) Company (403,000) 243,800 hooo Revenues Operating expenses Equity earnings of Sysinger Gain on revaluation of Investment in Sysinger to fair value Net income Retained earnings, January 1 Net income Dividends declared Retained earnings, December (47,695) 429,498 (961 700) (429, 498) 139.600 159, 200 (636, 800) (159, 200) 42300 31 (753, 700) 1,703, 018 614000 385,400 Current assets Investment in Sysinger (equity method) Property, plant, and equipment Patented technology Customer contract Total assets Liabilities Common stock Additional paid-in capital Retained earnings, December 845,000 869,600 HO 3, 704,518 1,331,920) (917,000) (204,000) $ 1,572,300 (113, 600) (521, 000) (184,000) (753, 700) 31 Total liabilities and equities $ (3,704,518) $ (1,572,300) a. How should Allan allocate Sysinger's total acquisition date fair value (January 1, 2018) to the assets acquired and liabilities assumed for consolidation purposes? b. Calculate the following as they would appear in Allan's pre-consolidation 2018 statements C. Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2018 At year-end, there were no intra-entity receivables or payables look U. Cucude u UNUWING as wley would appear And spre CONSUMUT ZU c. Prepare a worksheet to consolidate the financial statements of these two companies as of De At year-end, there were no intra-entity receivables or payables. int Complete this question by entering your answers in the tabs below. rences Required. A Required B Required How should Allan allocate Sysinger's total acquisition-date fair value (January 1, 2018) to the assets assumed for consolidation purposes? Fair value of Sysinger 1/1/18 Book value of Sysinger 1/1/18 Excess fair value over book value To customer contract To goodwill $ S Company (970, 600) 641,000 (52,203) Company (403,000) 243,800 hooo Revenues Operating expenses Equity earnings of Sysinger Gain on revaluation of Investment in Sysinger to fair value Net income Retained earnings, January 1 Net income Dividends declared Retained earnings, December (47,695) 429,498 (961 700) (429, 498) 139.600 159, 200 (636, 800) (159, 200) 42300 31 (753, 700) 1,703, 018 614000 385,400 Current assets Investment in Sysinger (equity method) Property, plant, and equipment Patented technology Customer contract Total assets Liabilities Common stock Additional paid-in capital Retained earnings, December 845,000 869,600 HO 3, 704,518 1,331,920) (917,000) (204,000) $ 1,572,300 (113, 600) (521, 000) (184,000) (753, 700) 31 Total liabilities and equities $ (3,704,518) $ (1,572,300) a. How should Allan allocate Sysinger's total acquisition date fair value (January 1, 2018) to the assets acquired and liabilities assumed for consolidation purposes? b. Calculate the following as they would appear in Allan's pre-consolidation 2018 statements C. Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2018 At year-end, there were no intra-entity receivables or payables look U. Cucude u UNUWING as wley would appear And spre CONSUMUT ZU c. Prepare a worksheet to consolidate the financial statements of these two companies as of De At year-end, there were no intra-entity receivables or payables. int Complete this question by entering your answers in the tabs below. rences Required. A Required B Required How should Allan allocate Sysinger's total acquisition-date fair value (January 1, 2018) to the assets assumed for consolidation purposes? Fair value of Sysinger 1/1/18 Book value of Sysinger 1/1/18 Excess fair value over book value To customer contract To goodwill