Please help with B (1 and 2), WDA is below:

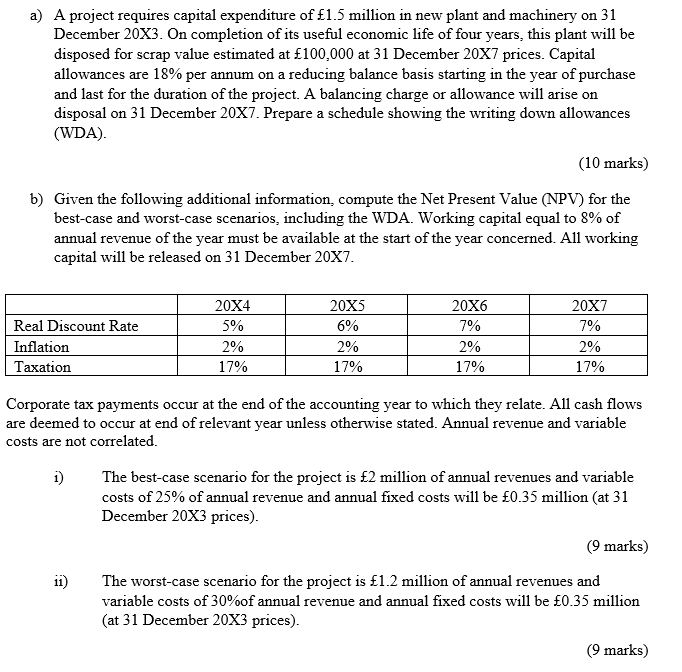

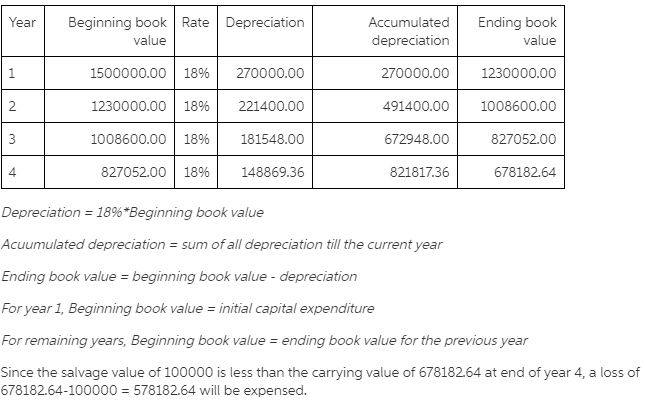

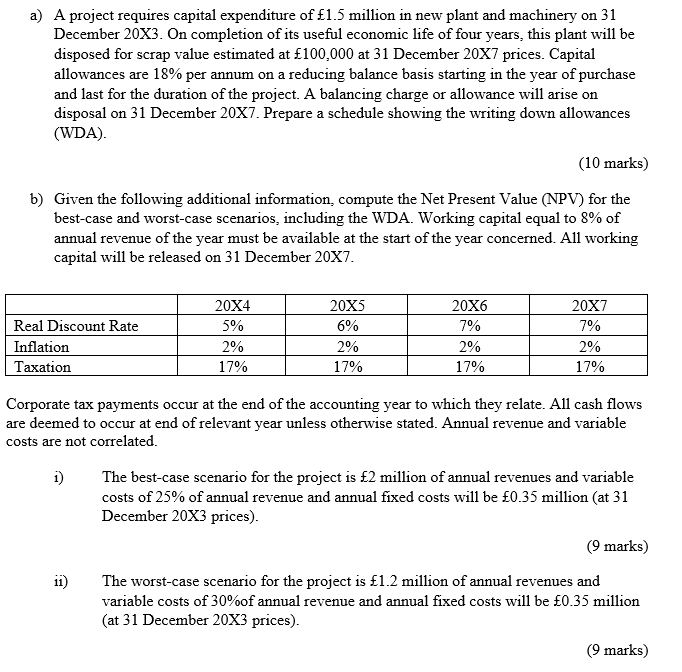

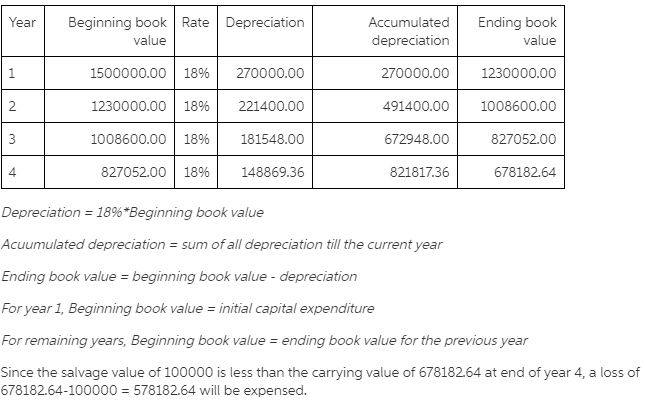

a) A project requires capital expenditure of 1.5 million in new plant and machinery on 31 December 20X3. On completion of its useful economic life of four years, this plant will be disposed for scrap value estimated at 100.000 at 31 December 20X7 prices. Capital allowances are 18% per annum on a reducing balance basis starting in the year of purchase and last for the duration of the project. A balancing charge or allowance will arise on disposal on 31 December 20X7. Prepare a schedule showing the writing down allowances (WDA). (10 marks) b) Given the following additional information, compute the Net Present Value (NPV) for the best-case and worst-case scenarios, including the WDA. Working capital equal to 8% of annual revenue of the year must be available at the start of the year concerned. All working capital will be released on 31 December 20X7. Real Discount Rate Inflation Taxation 20X4 5% 2% 17% 20X5 6% 2% 17% 20X6 7% 2% 17% 20X7 7% 2% 17% Corporate tax payments occur at the end of the accounting year to which they relate. All cash flows are deemed to occur at end of relevant year unless otherwise stated. Annual revenue and variable costs are not correlated. 1) The best-case scenario for the project is 2 million of annual revenues and variable costs of 25% of annual revenue and annual fixed costs will be 0.35 million (at 31 December 20X3 prices). (9 marks) The worst-case scenario for the project is 1.2 million of annual revenues and variable costs of 30%of annual revenue and annual fixed costs will be 0.35 million (at 31 December 20X3 prices). (9 marks) 11) Year Beginning book Rate Depreciation value Accumulated depreciation Ending book value 1 1500000.00 18% 270000.00 270000.00 1230000.00 2 1230000.00 18% 221400.00 491400.00 1008600.00 3 1008600.00 18% 181548.00 672948.00 827052.00 4 827052.00 18% 148869.36 821817.36 678182.64 Depreciation = 18%*Beginning book value Acuumulated depreciation = sum of all depreciation till the current year Ending book value = beginning book value - depreciation For year 1, Beginning book value = initial capital expenditure For remaining years, Beginning book value = ending book value for the previous year Since the salvage value of 100000 is less than the carrying value of 678182.64 at end of year 4, a loss of 678182.64-100000 = 578182.64 will be expenses