Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with c&d they are incorrect thank you Garrison holds a controlling interest in Robertson's outstanding stock. For the current year, the following information

please help with c&d they are incorrect thank you

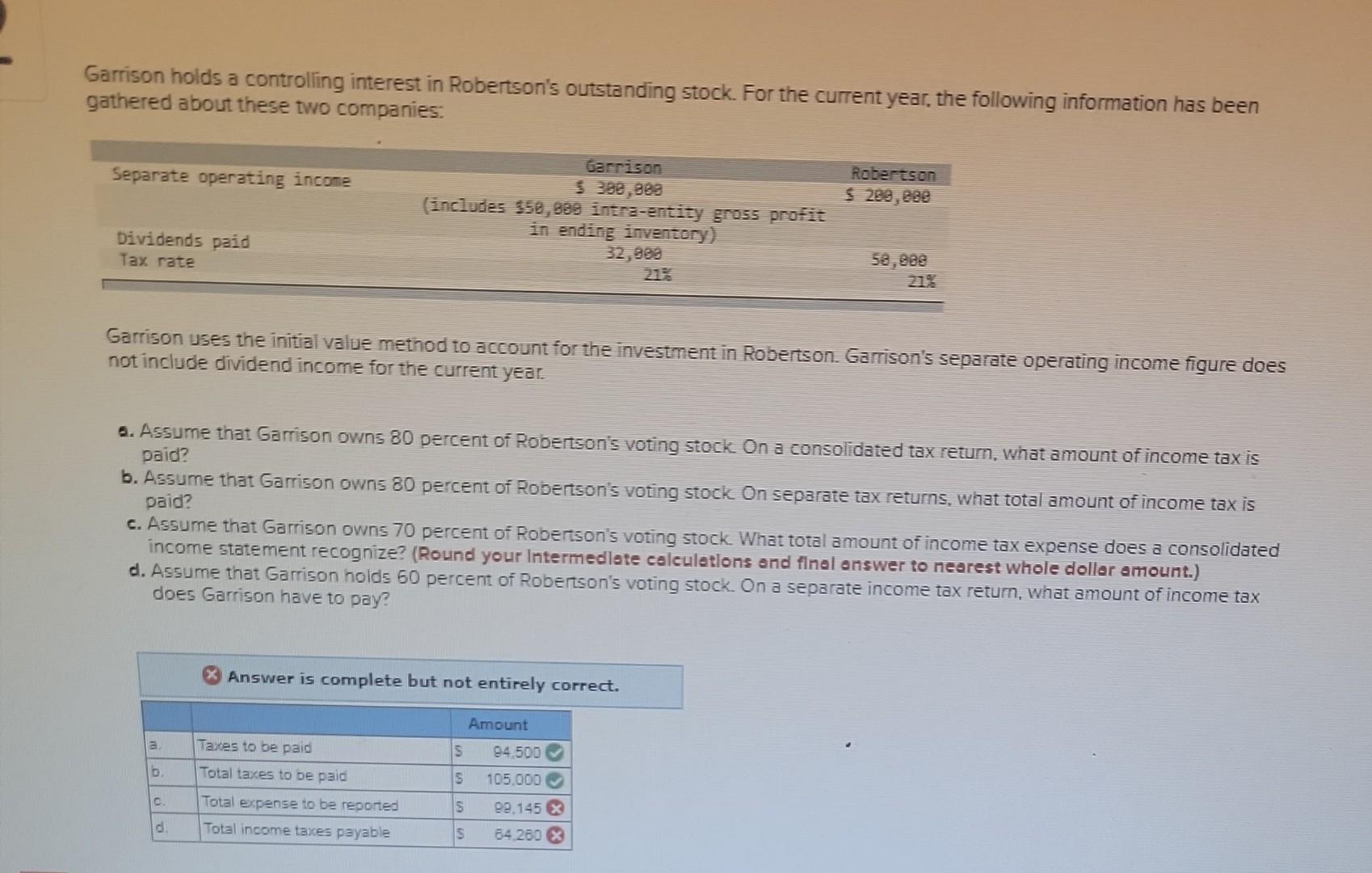

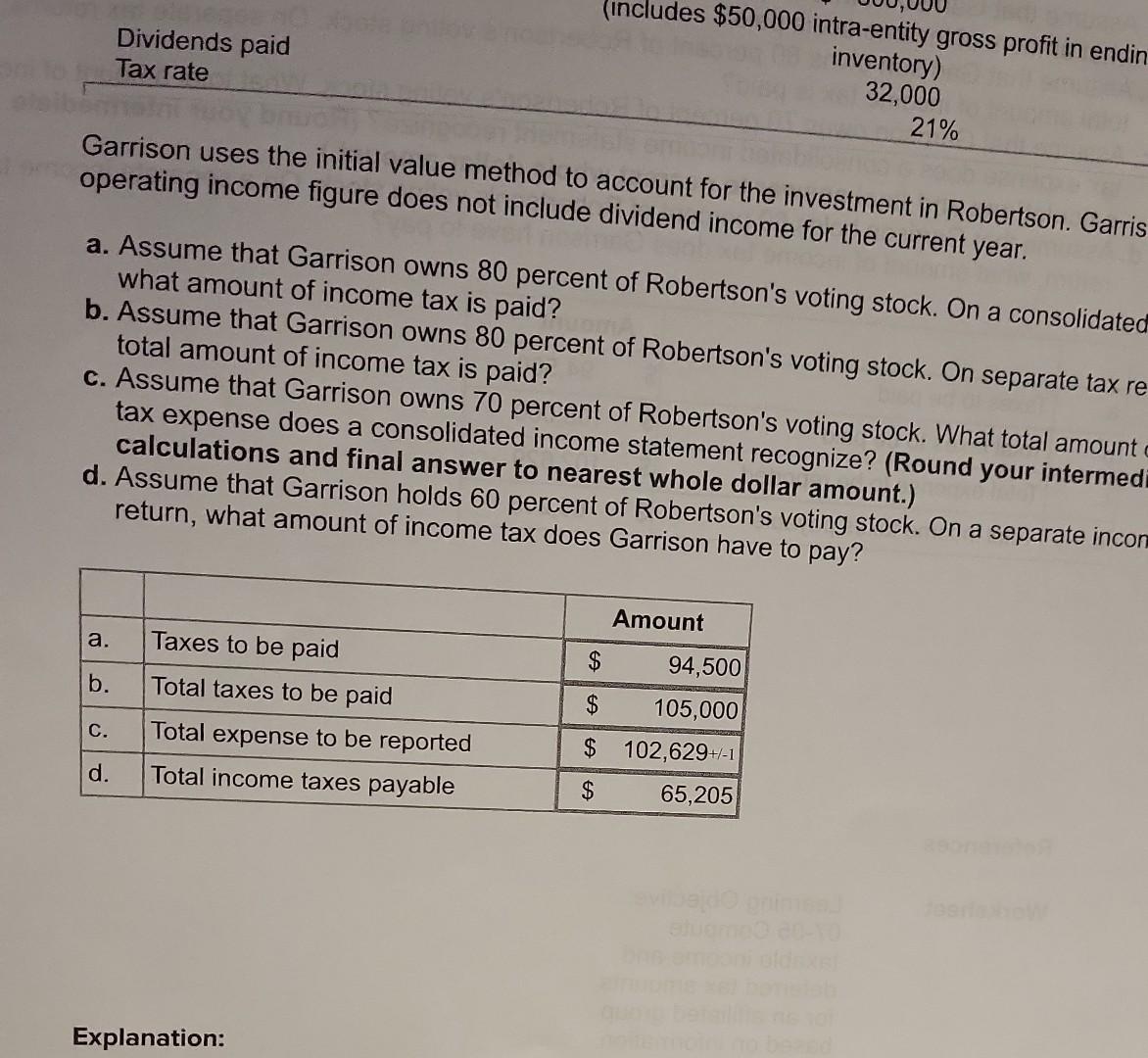

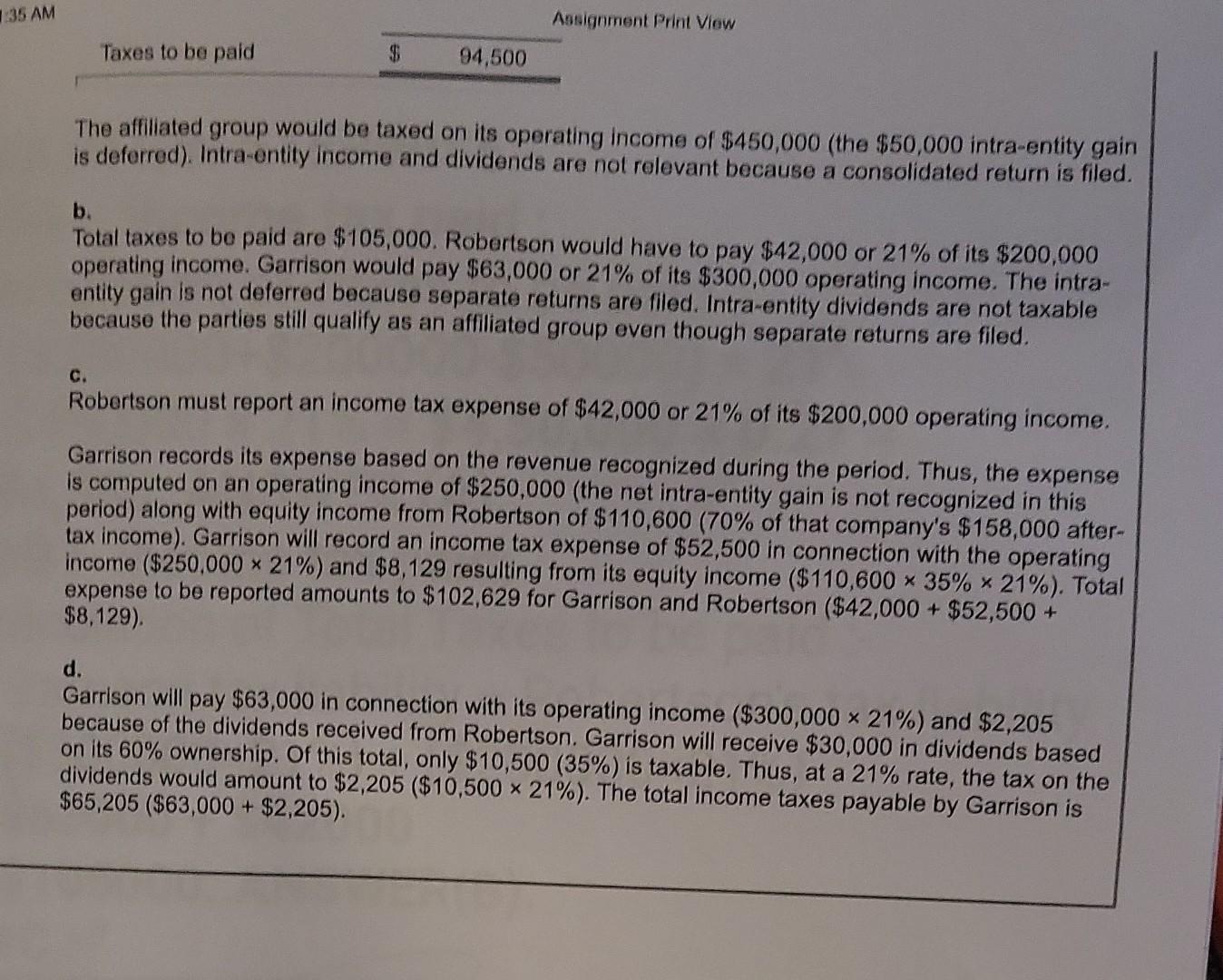

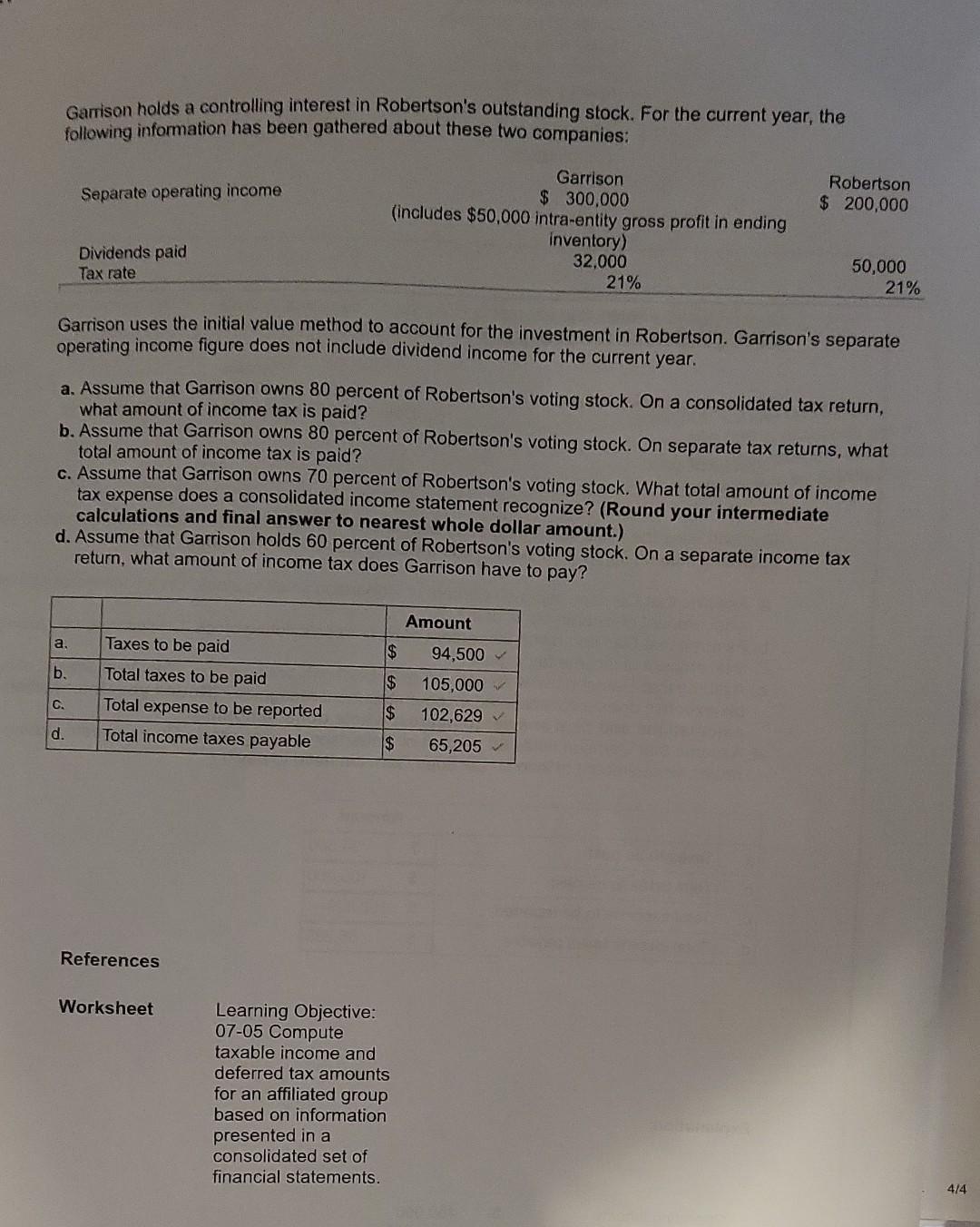

Garrison holds a controlling interest in Robertson's outstanding stock. For the current year, the following information has been gathered about these two companies: Garrison uses the initial value method to account for the investment in Robertson. Garrison's separate operating income figure does not include dividend income for the current year. 2. Assume that Garrison owns 80 percent of Robertson's voting stock. On a consolidated tax return, what amount of income tax is paid? b. Assume that Garrison owns 80 percent of Robertson's voting stock. On separate tax returns, what total amount of income tax is paid? c. Assume that Garrison owns 70 percent of Robertson's voting stock. What total amount of income tax expense does a consolidated income statement recognize? (Round your Intermedlate celculetlons and flinal enswer to nearest whole doller amount.) d. Assume that Garrison holds 60 percent of Roberson's voting stock. On a separate income tax return, what amount of income tax does Garrison have to pay? Answer is complete but not entirely correct. operating income figure does method to account for the investment in Robertson. Garris dividend income for the current year. what amount of income tax is percent of Robertson's voting stock. On a consolidated b. Assume that Garrison owns is paid? total amount of income tax 80 percent of Robertson's voting stock. On separate tax re c. Assume that Garrison owns is paid? tax expense does a consolidated incent of Robertson's voting stock. What total amount calculations and finatidated income statement recognize? (Round your intermed d. Assume that Garrison holdser to nearest whole dollar amount.) return, what amount of income 60 percent of Robertson's voting stock. On a separate incon The affiliated group would be taxed on its operating income of $450,000 (the $50,000 intra-entity gain is deferred). Intra-entity income and dividends are not relevant because a consolidated return is filed. b. Total taxes to be paid are $105,000. Robertson would have to pay $42,000 or 21% of its $200,000 operating income. Garrison would pay $63,000 or 21% of its $300,000 operating income. The intraentity gain is not deferred because separate returns are filed. Intra-entity dividends are not taxable because the parties still qualify as an affiliated group even though separate returns are filed. c. Robertson must report an income tax expense of $42,000 or 21% of its $200,000 operating income. Garrison records its expense based on the revenue recognized during the period. Thus, the expense is computed on an operating income of $250,000 (the net intra-entity gain is not recognized in this period) along with equity income from Robertson of $110,600(70% of that company's $158,000 aftertax income). Garrison will record an income tax expense of $52,500 in connection with the operating income ($250,00021%) and $8,129 resulting from its equity income ($110,60035%21%). Total expense to be reported amounts to $102,629 for Garrison and Robertson ($42,000+$52,500+ $8,129) d. Garrison will pay $63,000 in connection with its operating income ($300,00021%) and $2,205 because of the dividends received from Robertson. Garrison will receive $30,000 in dividends based on its 60% ownership. Of this total, only $10,500(35%) is taxable. Thus, at a 21% rate, the tax on the dividends would amount to $2,205($10,50021%). The total income taxes payable by Garrison is $65,205($63,000+$2,205) Garrison holds a controlling interest in Robertson's outstanding stock. For the current year, the following information has been gathered about these two companies: Garrison uses the initial value method to account for the investment in Robertson. Garrison's separate operating income figure does not include dividend income for the current year. a. Assume that Garrison owns 80 percent of Robertson's voting stock. On a consolidated tax return, what amount of income tax is paid? b. Assume that Garrison owns 80 percent of Robertson's voting stock. On separate tax returns, what total amount of income tax is paid? c. Assume that Garrison owns 70 percent of Robertson's voting stock. What total amount of income tax expense does a consolidated income statement recognize? (Round your intermediate calculations and final answer to nearest whole dollar amount.) d. Assume that Garrison holds 60 percent of Robertson's voting stock. On a separate income tax return, what amount of income tax does Garrison have to pay? References Worksheet Learning Objective: 07-05 Compute taxable income and deferred tax amounts for an affiliated group based on information presented in a consolidated set of financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started